The fault in our PoS: are we ready to go cashless?

With demonetisation upon us, there has never been a better time to check this hypothesis.

Prime Minister Narendra Modi’s move to demonetise Rs 500 and Rs 1,000 notes has put the country’s digital banking infrastructure under sudden pressure.

In a recent interaction with the media, Manju Agarwal, Deputy Managing Director, Corporate Strategy and New Business, SBI, stated that in the week after demonetisation, their Point of Sale (PoS) machines across the country witnessed over 10–12 lakh daily transactions as opposed to 3.5 lakh transactions before the announcement.

While this might seem to be ushering in a cashless economy, let’s not forget that we live in a country which has only 1.49 million PoS devices for the 730 million debit and 27 million credit cards the population holds.

According to the latest RBI bulletin showing data from July to September, of the total 243 million credit card transactions (worth Rs 75,200 crore) which took place during this period, 241 million were over a PoS machine (worth Rs 74,200 billion).

This seems normal, but here’s the true story.

Due to a high penetration of debit cards, of the total 2,636 million debit card transactions (worth a whopping Rs 7,12,200 crore) which took place between July and September, 2,251 million were to withdraw cash at ATMs. Further, Rs 6,60,800 crore was the amount of cash withdrawn from these ATMs. Only a small part — 385 million transactions — took place by swiping debit cards on PoS machines.

Hemant Jhajharia, Partner, PwC India, provides further context — there are 693 PoS machines per million people in India, a number which stands at 4,000 in China.

Further, 90 percent of merchant outlets have no avenues of accepting digital payment, stating a clear challenge.

But it’s not that the regulatory bodies aren’t taking any steps to move the needle. Specifically, they seem to be looking at bettering the low penetration of PoS infrastructure in the country:

April 2016 : The RBI states that it will be setting up the Acceptance Development Fund.

A corpus funded by the card issuers of the country is set up, with a percentage of their transaction revenue to be siphoned off and reinvested in expanding payment acceptance infrastructure.

November 8: The demonetisation announcement now creates a valid use case for individuals to subscribe to digital payment options.

November 28: Government removes excise duty on goods for manufacturing of PoS machines. PoS machines will now be exempted from 12.5 percent excise duty and 4 percent Special Additional Duty till March 31, 2017.

November 30: More retail outlets across the country have decided to dispense cash from their PoS machines. Big Bazaar and INOX seem to have kicked off a trend.

Banks are also rushing to procure more PoS machines for their network. While Canara Bank alone is looking to install 25,000 of these terminals, other players like State Bank of India, Union Bank of India, United Bank of India, Axis Bank, and RBL Bank all seem to be pushing for instalments on this front.

However, the on-ground reality continues to be a harsh one.

Stories from the ground

Speaking to multiple merchants over the past few weeks, YourStory found some glaring changes in the behaviour of accepting payments.

One pub owner on Brigade Road in Bengaluru claimed to be making people pay in advance because card payments are taking time to process. After a drink, customers are not willing to wait for payments to go through, blaming establishment owners for the same.

The cashier at Sanjay Dhaba, a popular eatery at New Airport Road in the city, claimed that the outlet insists on cash from customers.

Operating staff at fast food counters at malls state that customers are getting irritated by how slow the machines have become. Sometimes the wait is as long as 20 -30 minutes in which time tempers run high.

In a dipstick survey conducted by YourStory, 19 percent of the respondents agreed to card payments failing in the first two weeks of the announcement. However, the remaining four percent claimed that their card payments had failed more than twice.

And the industry seems to agree to the same.

Recently, looking at the surge in traffic, provider of middleware, network, and hardware (PoS) machines to merchants, Pine Labs commented that during peak hours, there was a slowing down of the approval process from most of the acquiring banks. However, the company was working closely with all acquiring banks to ensure that they facilitate an improved response time.

Looking through internal data, Hemant says that the first two weeks did see a rise in the failure of card payments. He adds,

A typical error rate for card payments failing in the country is roughly eight percent. Over the past few weeks, it has jumped to 23 percent, especially over the weekend after the demonetisation announcement and the reason for this could be that there are a lot of first-time users as well as a multitude of other factors.

With a large population now pulling out their debit cards for the first time, multiple challenges arise. An obvious one is the lack of education and practice to use digital payments among the new customers. This 'digital illiterate' customer can be seen putting in wrong pins or incorrect details into PoS machines and swiping inactive (expired) cards, among other things.

But it’s not just the customers — even the payments networks have shown some friction.

According to Manish Patel, Founder and CEO of Mswipe, a company which provides mPoS hardware and network, the new surge in traffic is causing various parts of the network to fail with partner switches getting overloaded. He says,

Everyone is scrambling to meet loads with many card users coming onboard for the first time.

Also, the involvement of multiple players makes the process of fulfilling a payment fragmented — the failure of one network creates a domino effect.

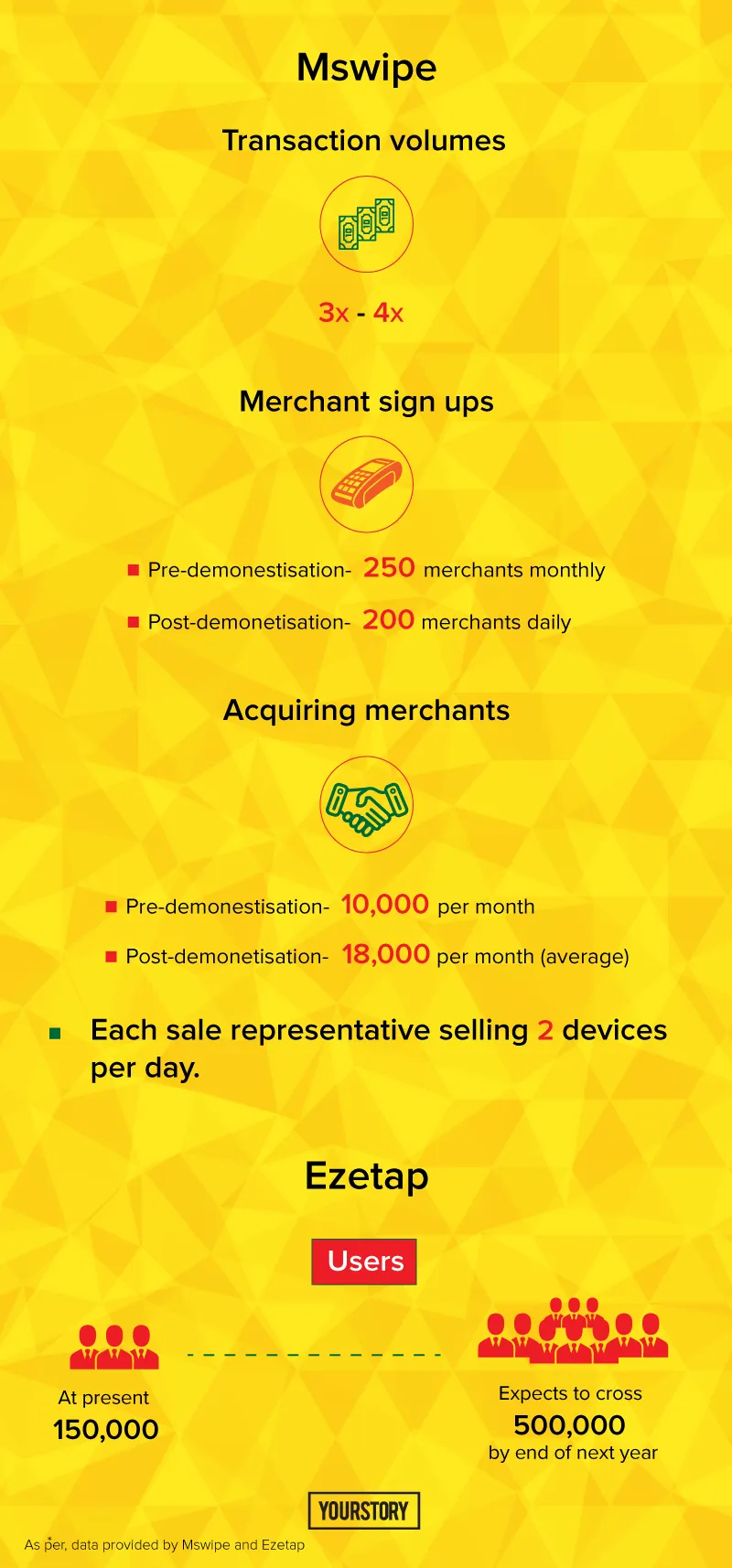

Although claiming to have a scalable infrastructure, Bhaktha Keshavachar, Founder and CTO of mPoS provider Ezetap, also accepts that there are people complaining, especially on Saturday evenings, when the traffic seems to be at its peak.

On the other hand, Shailaz Nag, Co-founder and COO of payments firm PayU India, blames the failing of payments on the lack of education for first-time customers transacting digitally. He believes the government should educate individuals on the use and basic hygiene of digital payments.

But in spite of these factors, Hemant claims that there is a massive rise in digital volumes, with most payment gateways (PGs) typically showing a 100 percent increase, doubling their volumes.

The statistics

So what are these volumes industry experts speak about?

YourStory spoke to PoS deployers in the space to understand the volumes they have been registering post the demonetisation announcement.

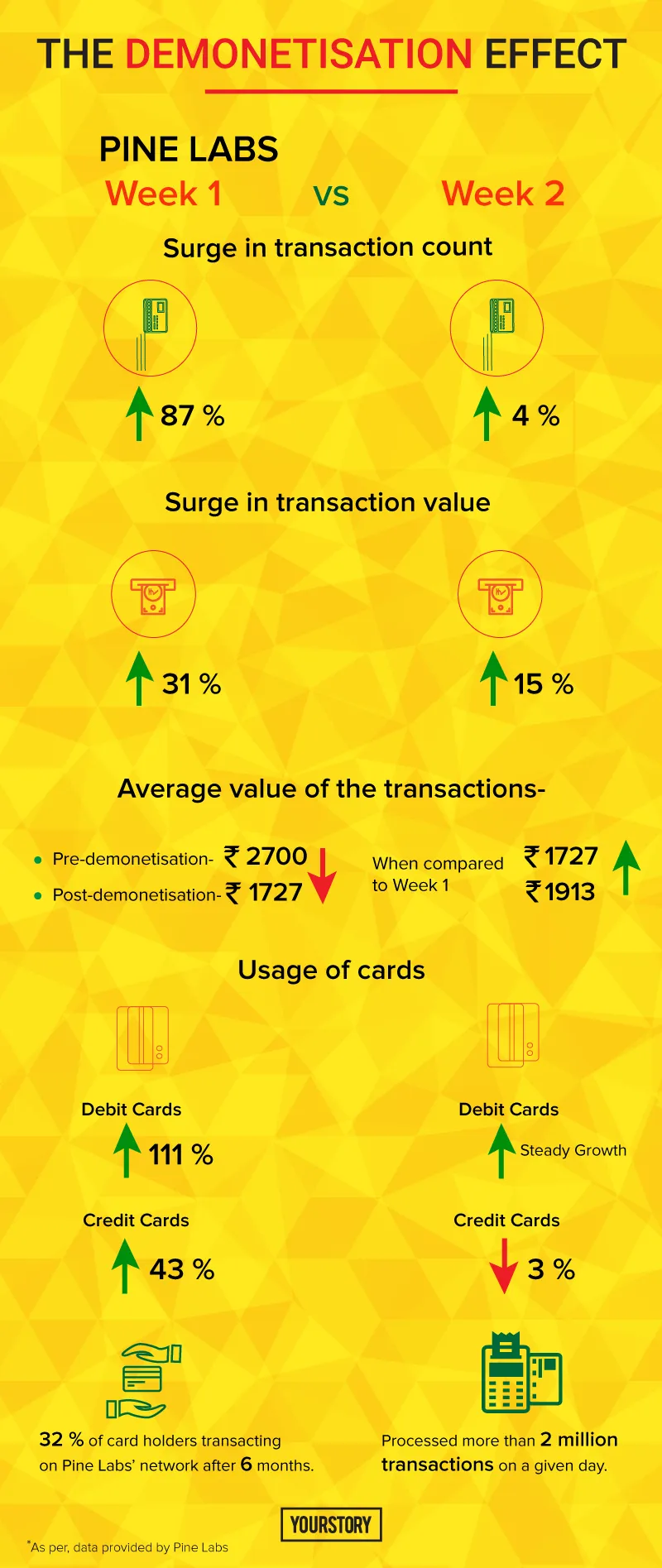

Pine Labs

Currently, the company is getting requests for PoS middleware from new categories of merchants such as canteens (colleges and government), coaching classes, neighbourhood grocery vendors, wholesalers, insurance companies, auto repair shops, chemists, and also from doctors and lawyers with private practices.

It claims to have been getting queries from a lot more emerging cities like Nagpur, Indore, Surat, Kanpur, Calicut, and Madurai. Queries are also coming in from remote places like Sindhudurg, Beed, Tiruchirapalli, and Bokaro.

Mswipe

While Mswipe’s sales team was previously acquiring 10,000 merchants a month, the number is now predicted to go as high as 18,000, with each salesperson selling at least two devices every day.

However, Manish is still wary of the change. He states,

My worry here is that it is merchant-influenced. So, once the option (of cash) is restored, merchants might say that they accept cash again, because the customers never wanted to pay by card. So the baseline of card-based transactions will not change drastically once the dust settles. The larger question here is how sustainable these digital transactions are going to be in the long run.

Since cash is a difficult drug to stay off, he feels people might be using cards just to get through a rough period.

Nonetheless, owing to the quarter’s worth of inventory it carries, Mswipe at least claims to be dealing well with the sudden rise in demand.

Hemant adds,

10 percent of India will be under digital payments soon, due to the demonetisation announcement. However, what remains to be seen is the stickiness towards digital payments. In the next two to three weeks, digital payments in the country will be at its peak and the base line of digital payments will push up. But as currency settles down, it will have some plateau impact in the next 6–12 months.

The fault in our PoS

So what is it that’s really keeping this infrastructure from growing?

According to Hemant, there are two major roadblocks — the first being the transaction interchange fee for small-scale merchants and the other being setting up of KYC.

However, it is taken care for RuPay cards, with NPCI waiving off switching fee on RuPay PoS and e-commerce transactions.

For acceptance infrastructure to improve and the number of transactions in the ecosystem to increase, transaction fees for merchants have to go down.

Therefore, he doesn’t deny a pricing play when it comes to payment interchange fees. He adds,

Digital payments might become cheaper as banks start to increase digital transactions. Further, banks seem to be making efforts to increase the span of digital transactions, while pushing for it at the same time.

Another pain point is the network infrastructure — he says that while the cost of PoS machines is largely coming down, connectivity issues remain. In reality, as we go deeper into India, we have infrastructural and data connectivity issues which lead to frustration from payments not going through.

Manish sheds light on even bigger loopholes. He says that while acquiring merchants, businesses make very little money.

Further, for PoS, business’ capital expenditure (CAPEX) isn’t an issue. This can be seen in the case of natural acquirers like banks for whom capital isn’t much of an issue.

But the real deal remains that it isn’t an acquirer-friendly business since the operation costs are higher. What does he mean by that?

According to Manish, there is nothing left to innovate. The cost of plastic and hardware can’t be reduced beyond a certain point. And if one needs to make money, you need to be profitable at per-transaction and per-terminal basis.

Rationalising it in September 2012, the Merchant Discount Rate (MDR) for debit cards transactions has been capped at 0.75 percent for transaction values up to Rs 2,000 and at 1 percent for transaction values above Rs 2,000.

Further, Manish claims that there isn’t much left after cost of processing a transaction and CAPEX are deployed. Therefore, one hits a glass ceiling where not making enough money on transactions per machine may act as a deterrent to deploy further terminals or PoS machines.

What is sought to be implied here is that with the cap issued on transactions, there wouldn’t be much play for PoS deployers, with businesses hitting a plateau because there isn’t much to be made on a per-terminal basis.

Moreover, on June 22 last year, the National Democratic Alliance government proposed income benefits for making payments through credit or debit cards while doing away with transaction charges on purchase of petrol, gas, and rail tickets with plastic money.

The draft reportedly proposed that an appropriate tax rebate could be extended to a merchant if at least 50 percent value of the transactions for merchants is through electronic means. Further, a 1–2 percent reduction in value added tax (VAT) could also be considered on all electronic transactions by merchants.

Hence, considering the need of acceptance infrastructure for digital payments in the country, now seems an apt time for the government to revisit these suggestions.

It is also a proven fact that a tax break by the South Korean government to promote electronic payments for both shoppers and merchants on card transactions, led to a rise in their GDP.

This tax break is also one of the suggestions by the Niti Aayog to the government in the wake of demonetisation.

However, with 4,000 terminals being added by acquirers every day in this current phase, it seems practically possible for the country to add a million new terminals by next year.

Till then, the onus is on the regulators as well as the banks to educate their customers about the use of various digital methods in the country.