These small-town startups are gaining an edge by addressing the healthcare challenges in Tier-2 and 3 cities

Have you tried to arrange healthcare for your parents or relatives who live outside the top 10 cities? Have you ever fallen violently ill in India outside the top 20 cities? It’s not a smooth experience. There may be dozens of nursing homes and a handful of hospitals in each city, but the woes are many — few top-notch doctors, outdated diagnostic equipment, unavailability of key drugs, and below-par nursing staff. Even if facilities are present, there is no one place to access the information.

But don’t lose hope. There is a new breed of startups that has turned its focus towards solving this problem. Being from middle India, solving middle-Indian problems, they just might succeed.

Take the case of PurpleDocs in Vadodara. Founded by Pooja and Deepak Gupta, it had a rough start and although it took them a few months to convince doctors and hospitals, they are now present four cities across Gujarat.

Aren’t the big guys of Indian health-tech addressing this?

Small towns have their own set of problems, the biggest being the lack of awareness among the healthcare community on how technology can help them. A close second is an inertia to change. Thirdly, infrastructure and adequate human talent to bring out a tech revolution in healthcare are not readily available.

This is where PurpleDocs (Vadodara), LifCare (Jaipur), Dawailelo.com (Varanasi), and Health Potli (Raipur) are trying to make a difference. They could potentially be sitting on a big opportunity, given that 75 percent of healthcare startups in India focus on Delhi-NCR, Mumbai, and Bengaluru, as per a report from Craft Driven Market Research.

Pradeep K Jaisingh, Founder and Chairman of healthcare startups accelerator Healthstart, believes that the unavailability of proper infrastructure and inaccessibility of quality healthcare services triggered an opportunity for small-town startups to flourish because technology can play an enabling role in enhancing the access to quality healthcare.

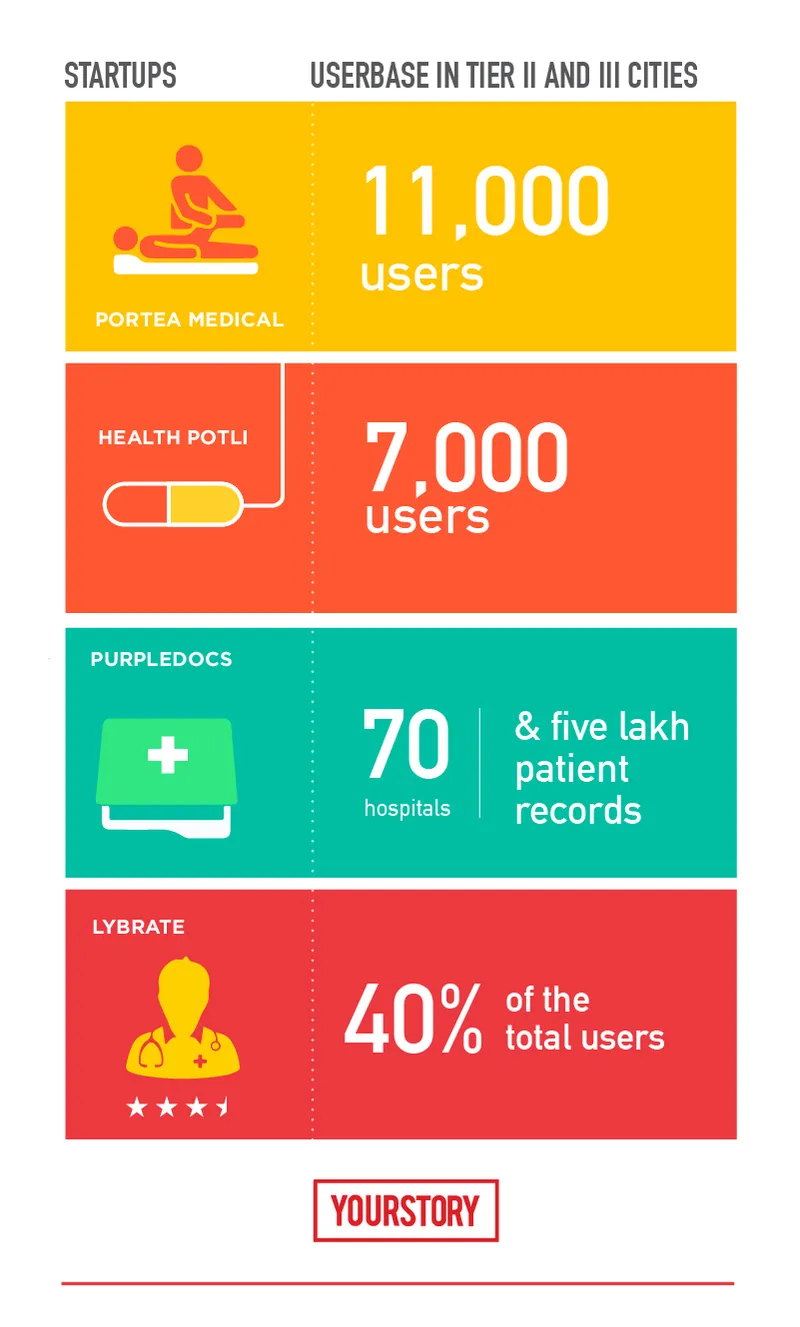

Healthcare platform Portea Medical, which offers home visits from doctors, nursing attendants, and physiotherapists, claims to have 11,000 customers from tier 2 and 3 cities.

Portea MD and CEO Meena Ganesh says,

“The bulk of our revenue contribution comes from cities like Delhi-NCR, Bengaluru, Kolkata, Chennai, Mumbai, and Hyderabad. However, markets such as Pune, Chandigarh, Jaipur, Ahmedabad, and Lucknow are also making key contributions.”

Lybrate, the online discovery platform for doctors and patients, also seems to be racing to reach out to non-metro cities. CEO and founder Saurabh Arora emphasised that Lybrate caters to more than 60 tier 2 and 3 cities, with 40 percent of the total users coming from these cities and the number growing at a rate of 5–10 percent per quarter.

So, how are they succeeding?

‘Free’ is a word that makes the best of them sit up and take notice, and it worked to PurpleDocs’ advantage, too. After a couple of months of persuasion and follow-ups, the couple was able to convince one hospital to try out the solution for free for an unlimited period. Happy with the service, the hospital converted into a paying customer within a few months.

Deepak says,

“We have been serving more than 70 hospitals and have processed more than five lakh patient records and two lakh diagnostic images. We are market leaders in Gujarat with our centres in Ahmedabad, Vadodara, Surat, and Rajkot.”

Raipur-based Health Potli may be an e-commerce platform for products like baby and mother care, personal care, health food and drinks, and medicines, but it too has its place in the healthcare narrative. It is making available a lot of health products that are not readily accessible in a small city. The startup is planning to expand to 30 cities across the country in the next three years.

“With 7,000 users, we are fulfilling around 70–90 orders every day. One percent of our existing user base orders on our app. We are growing by 10 percent week on week. We have shifted our revenue model into an inventory-based model and are now looking at gaining 30–35 percent revenue,” says, Manish Agarwal, Founder of Health Potli.

Jaipur-based LifCare has made the lives of the people of Jaipur easier with its subscription-based pharmacy model. Patients now can register with the platform with the medicine lists and prescriptions and get personalised packs delivered to the doorsteps. Again, Varanasi-based Dawailelo delivers medicines to the doorstep of customers and also lists doctors’ details and connects customers to pathology labs to get samples collected and reports delivered to their homes.

Bigger players in metro cities with deep pockets are also eyeing a share of the tier-2-and-3 cities pie. Portea Medical will continue to focus on offering 360-degree comprehensive care across all the cities backed by diagnostics, medical equipment, and pharmacy support. The services are even extended to handling post-operative care, elder care, chronic care, and primary care for people of all ages.

Lybrate chose to insert language options on its platform in a bid to enable patients to communicate with doctors in regional languages, thereby minimising the language barrier in tier 2 and 3 cities.

Pradeep says just hard work isn’t enough — entrepreneurship in small cities requires a sustained effort.

He further advises startups in small towns not to replicate the models of tier 1 city startups but to focus on developing appropriate technology. Startups have to create a balance between the kind of investment they make and optimising the business. Addressing larger numbers of patients with affordable healthcare solutions should be the key theme for tier 2 and 3 cities.

Barriers to growth

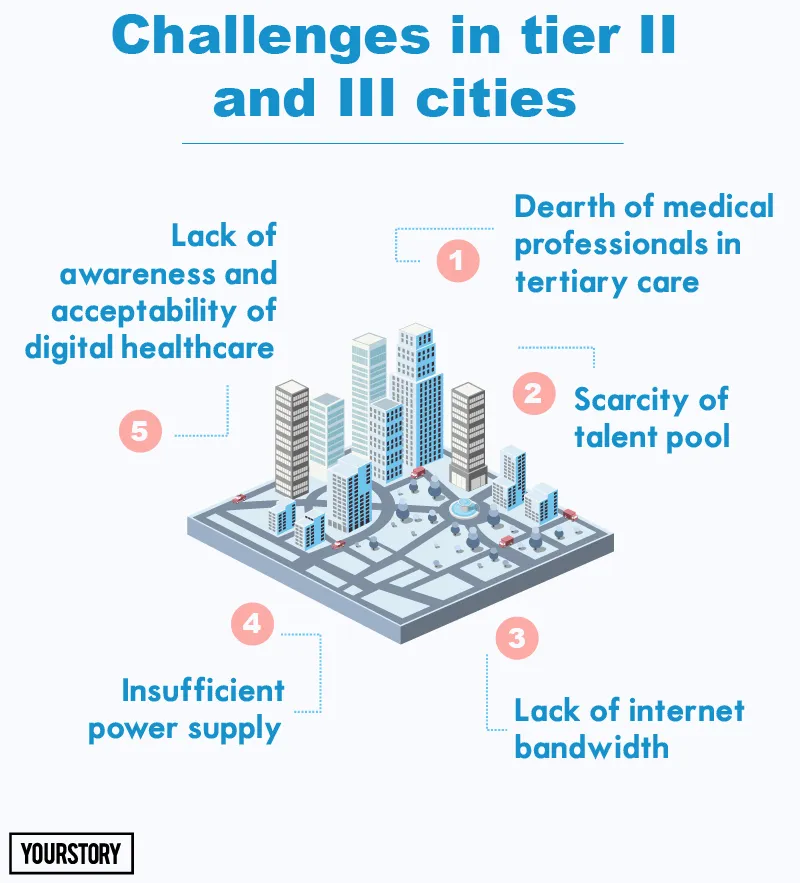

Currently, the quality of healthcare delivery in small towns is largely impacted by the lack of three things — medical professionals in tertiary care, awareness, and acceptability of digital healthcare. Pradeep says that doctors do not want to be located in small cities owing to non-lucrative career opportunities.

The adoption of digital healthcare is hindered by doctors’ and administrators’ lack of awareness regarding how technology can solve some of their pain points and improve productivity by simplifying processes on their ends.

Deepak recalls that while most doctors were excited to see PurpleDocs’ prototype, no one wanted to be the first to try it out.

And the few doctors who are willing to leverage the potential of technologies face myriad challenges in handling the remote patient monitoring owing to poor infrastructure comprising insufficient power supply, internet bandwidth, and inability to hire trained staff.

Meena Ganesh is of the view that innovation is still being driven by the US and devices are getting manufactured in developed markets; adjusting costs to the local environment is still a factor.

“It’s time for the government to shift attention towards the potential of small-town startups and come up with the policies and initiatives. However, the state government intervention is slowly taking place in terms of fostering entrepreneurship. T-Hub in Telangana sets an example for it,” says Pradeep.

However, a few healthtech startups from small towns did manage to lure the investors’ attention this year. PurpleDocs raised an undisclosed amount of funding from Kelly Gamma, Lead Angels, and a few HNIs in September. LifCare raised seed capital from a group of investors including Rishi Mandawat (Bain Capital), Dheeraj Jain (Partner — Redcliffe Capital, London), and Kunal Shah (CEO, FreeCharge).

The show must go on

Healthtech in India has reached new heights in the past decade, with the market (currently valued at $1 billion) expected to grow 1.5 times by 2020. The overall Indian healthcare market is expected to grow to $280 billion by 2020, growing at a CAGR of 22.9 percent.

Since PurpleDocs offered most of its best products and solutions for free during the initial days, it got customers by word of mouth and referrals. Pooja said now that they have no dearth of money, they spend more on conducting seminars and sponsoring healthcare events to educate customers about the potential of digital healthcare. They even attended Vibrant Gujarat twice to demonstrate their products. And Pooja today also boasts of having the right talent pool as they conducted campus recruitments in various colleges in Gujarat.

And so did Manish from Health Potli who recruited a few people from IIM and IIT in Raipur and filled the gap of talent in his organisation. To create awareness, he prefers regional languages as the mode of communication, especially when it comes to distributing pamphlets and putting up advertisements.

The ecosystem in small towns, unlike metro cities, is yet to mature owing to limited infrastructure, talent and lack of digital literacy. Developing products and solutions that are highly localised is more conducive towards attaining sustainability for startups based out of remote locations.

![[Startup Bharat] Y Combinator-backed BeWell Digital is enabling the digital transformation of radiologists](https://images.yourstory.com/cs/2/40d66ae0f37111eb854989d40ab39087/ImagesFrames31-1648033042143.png)