The verdict is out — Ola or Uber?

“Capital infusion is what gives people the impression of better service quality. But it really isn't so,” said Bhavish Aggarwal, Co-founder and CEO, Ola, at the Carnegie Mellon Tech Summit in Bengaluru. Is he right? We decided to ask the customers.

Ola or Uber — investors and analysts have been asked that question many times, but as commuters you don’t really care about who’s valued at how much, or which fund is investing in which one, or when the next exit is. You use these services every day and all you care about is how convenient and safe they are.

A few days ago, we asked you some very basic questions on those parameters. Today, we collate those responses to tell your side of the story.

And the verdict is here

We received responses from 28 different cities. Apart from the usual large cities, tier-2 India is well represented via Thiruvananthapuram, Raipur, Ranchi, Jamshedpur, Indore, Coimbatore, Chandigarh, Udaipur, Kanpur, and Lucknow. And yes, a huge majority (84 percent) has used both services.

The verdict is quite clear. When it comes to quality of service, Uber wins hands down. Almost 65 percent of our respondents were of the opinion that Uber’s quality is better, while 12 percent voted for Ola.

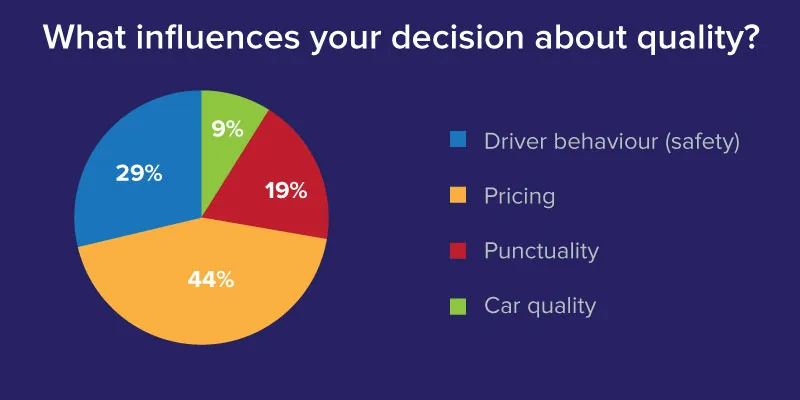

But what influenced this decision about quality? Was it what Bhavish said about capital infusion and the fact that Uber rides are 15 percent cheaper than Ola’s?

We discovered that a large number of people voting in favour of Uber’s service felt that their decision was influenced by pricing (44 percent), with safety being a distant second (29 percent). A little caveat here — the sample recorded only about 21 percent respondents as being female.

Punctuality, too, was a factor, trailing in with about 19 percent of respondents opting for it. However, not many were fussy about the quality of the vehicle, which goes to show that convenience provided a higher utility value than the optics of it.

What do the consumers say?

“The reason I choose a cab is convenience. With a click or swipe the car comes to my location and no questions asked. With Ola, the number of calls I need to make explaining my location is simply annoying,” says a 32-year-old marketing professional based out of Delhi.

It isn't just the number of calls the consumers dislike — it is also the fact that the driver behaviour just doesn't make the cut. From cancelling after discovering the drop location to downright rudeness, customers have seen it all from an Ola driver.

From the horse’s mouth

Many drivers have commented that in order to ensure a larger market share and more drivers, Ola’s onboarding threshold is lower. “Becoming a driver on Uber is more difficult because they have some stringent quality checks, but anybody can be a driver on Ola,” says a driver who is registered on both platforms.

Thus, the basic behavioural differences can be seen by the consumers. From following the GPS to no calls to being on their best behaviour, Uber guarantees more.

Autorickshaws falling out of favour?

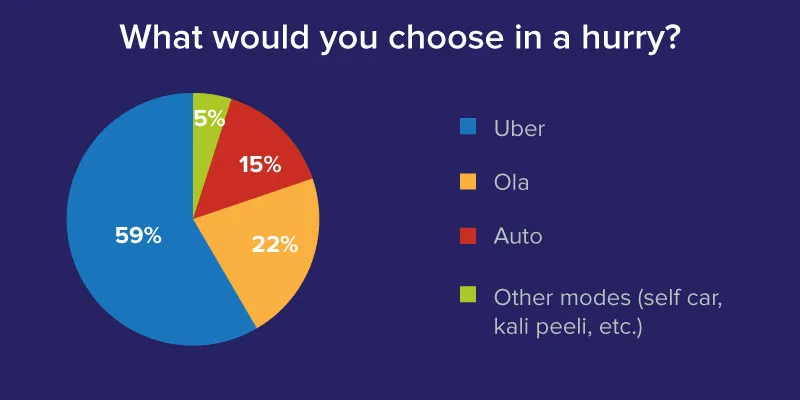

At this point, you would think that while this vote of confidence is well and good, when push really comes to shove, people would either take the good old autorickshaw or bring out their own cars. Well, wrong.

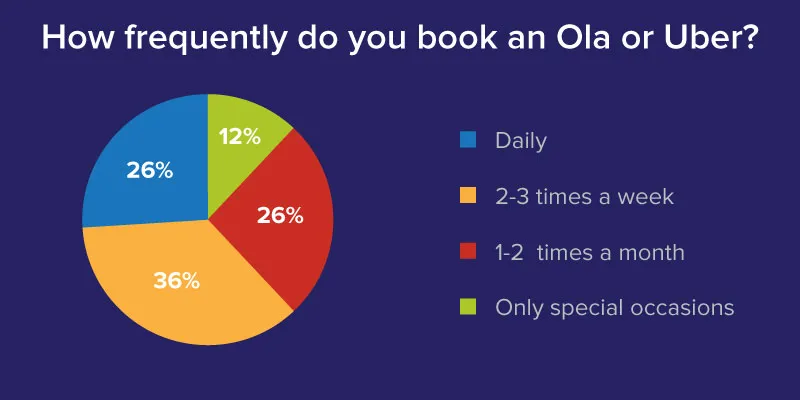

For one, more than 60 percent of our respondents use either an Ola or an Uber more than two to three times a week, and almost 60 percent have once again given a huge thumbs-up to Uber.

In fact, the combined dependence on the ubiquitous autorickshaw and their own cars or other taxis is only 20 percent — less than the 22 percent that voted for Ola as being their ride of choice in a hurry.

Of course, this response could be skewed because we are speaking to an audience that is already a very active user of cab aggregators. But brand-wise it is an important takeaway nonetheless because this is how the core target audience perceives matters.

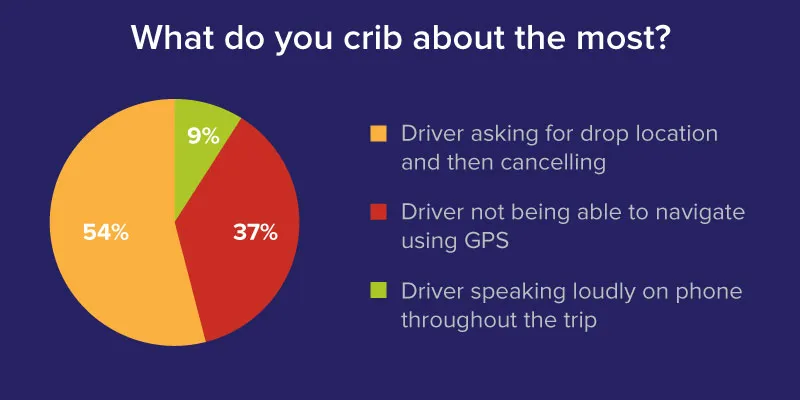

Moving on, no such survey is complete without asking respondents about some of their pet peeves. The top one (54 percent respondents voted for this) was something that most of us have faced one time or the other — drivers cancelling if the drop location doesn’t suit them. Drivers not being able to use the GPS navigator was a close second (37 percent).

In fact, the GPS problem has its roots in two very fundamental issues: (1) the application gives directions in English, which many drivers can’t follow, and (2) lack of proper training in taking visual cues from the application. There is a third, which isn’t in the cab aggregators’ or drivers’ control — patchy internet coverage in many areas.

“It’s simply frustrating when a driver calls me asking for directions. And even after giving the directions, they call back and ask what the drop location is and then ask you to cancel,” says a 29- year-old software professional based out of Bengaluru.

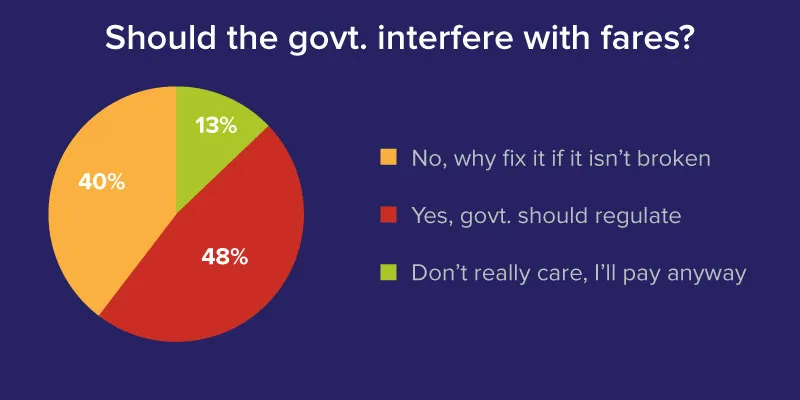

Since pricing was such an important consideration, we also asked our respondents for their opinion about the government intervening in fares. There was no real stand-out answer.

While 48 percent want the government to regulate tariff, a noteworthy 40 percent respondents said, “Why fix it if it isn’t broken?” The rest didn’t really care as long as they got their daily ride.

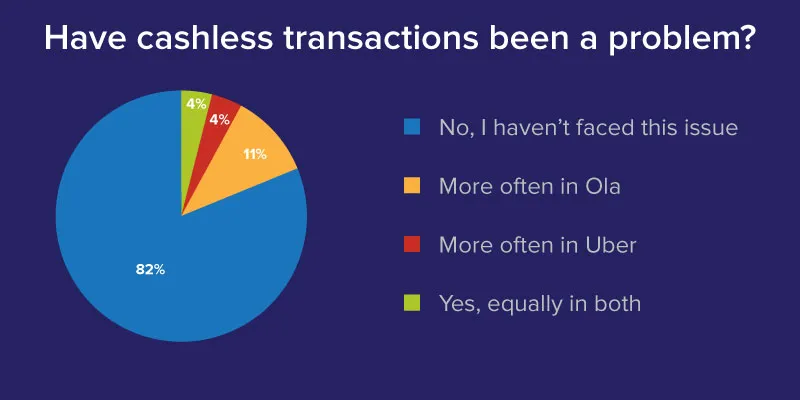

But when it came to handling the effects of demonetisation, both Ola and Uber were supported by most respondents. While there have been cases of refusals, almost 82 percent of respondents did not face any problems. Individually, though, Ola seems to have had a few more cases of refusals than Uber.

“I remember booking an Ola a couple of weeks ago. Once the driver reached the location, he called and asked me for the mode of payment. I said ‘Ola Money’ and he said, ‘Sorry sir. Please cancel. I don't believe in taking Ola Money, it just doesn’t reach us’,” says a 34-year-old entrepreneur.

To conclude

The war between Ola and Uber has always been a fierce one. By sheer volume of cars on the roads, Ola has a significant lead over Uber. Ola also has over 75 percent of market share, is spread over 100 cities, and has over nine different categories.

But quality-wise, Uber seems to be doing a better job in customer satisfaction. Of course, this survey is by no means exhaustive and on many counts scientifically rudimentary, but it certainly taps into the consumer sentiment.

With the emphasis now on better customer service and experience, the field is wide open for companies in the coming months. One thing is guaranteed — next year, customers will expect much better service.