Demonetisation – Impact on savings and investments

On the evening of the 8th of November, when people were eagerly awaiting the US presidential election results, due in less than a day’s time, they were suddenly hit by a hurricane in the form of an unscheduled announcement at 20:15 IST. The Prime Minister, addressing the public, stated that 500 and 1,000-rupee notes would cease to be legal tenure post midnight, sparking the saga of demonetisation.

You can easily imagine the impact of this announcement. Almost all of us left our comfortable couches and started counting these invalid notes in our bedrooms, a task that might have taken quite a toll on many. This ‘surgical’ and ‘disruptive’ move was made by the Government in an effort to stop the use of counterfeit bank notes, allegedly used to fund criminal activities like terrorism, drugs and human trafficking, as well as to put an end to the black money parallel economy in the country. With many economists backing this move, let’s see how it will impact our savings and investments.

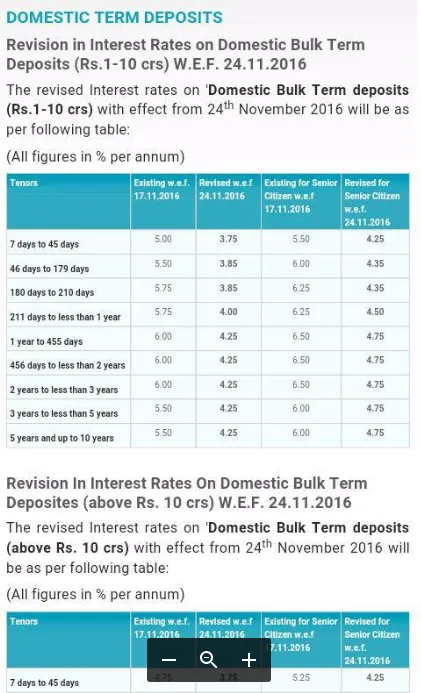

Savings in Fixed Deposits

We all know that banks are getting loads of deposits post the demonetisation, and this will definitely impact their deposit rates. Why will any bank pay high interest rates when money is available so easily? Following the SBI’s lead, many banks have already started reducing their fixed deposit rates, with the rates in some cases even falling below the savings account rates offered by some banks. Putting your investments in fixed deposits at this point of time is equivalent to putting your money under your pillow, as the returns will surely not even beat inflation.

Savings in Real Estate

This sector is one of the most unorganised, and investment in it was already going through a dull phase. Demonetisation will certainly put a stop to the hoards of black money being pumped into the real estate space. At the same time, this is a very good moment for prospective first-time buyers to buy their first homes. With banks offering lower interest rates on home loans, these buyers are sure to benefit from the demonetisation.

As per research reports by PropEquity, housing prices in 42 major cities could drop by 30 percent over the next 6-12 months, wiping out over Rs 8 lakh crore worth of market value for the sold and unsold residential properties of developers since 2008. One can essentially categorise real estate into four main segments.

Primary Market: Investors who buy in this space take out home loans, and all their money is poured in from legal channels, i.e. people with no black money having salaried income and buying property for the first time. This segment will be least affected in the large cities as most of the dealings here are done legally via the banking channel. But the story may be different in Tier II and Tier III cities, as the business model in these cities includes accepting a cash component for primary residential sales.

Secondary Market: This market deals with the resale of property, and it is certainly going to be impacted. As per a research report by PropEquity, for every five buyers in this segment, only one is willing to pay entirely through cheque. And sellers mostly want to take 20-30 percent of the amount in cash, which will surely not be possible for a while.

Land Transactions: Again, in this segment, most of the dealings were done in cash. Most of these deals involve a cash component of around 20-40 percent. And due to demonetisation, the closing cycle of the deals will be longer, which will lead to a cash crunch and hence lower land prices.

High-End Transactions: Also to be considered is the luxury segment in real estate. This segment will also see a downturn due to demonetisation, as most of the deals involve cash transactions. There will be a slash in prices to the tune of 25-30 percent as sellers struggle to offload properties to generate liquidity.

Savings in Gold

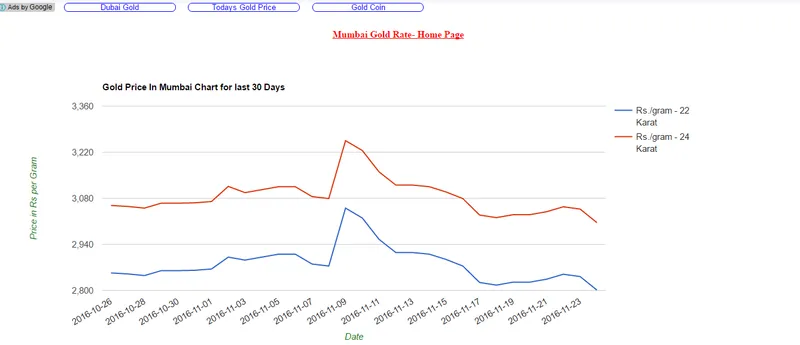

You would have read stories about the sudden rush at the jeweller’s shop on 8th Nov to convert black money to gold. When everything is said and done, the demonetisation has instilled the faith of the people in gold. People have an emotional connect with gold, and rightly so, as it is a safe haven that provides a hedge against uncertain times. As per GFMS Thomson Reuters estimates, India’s gross official gold import was worth $1.5 billion as of November 14, 2016. Of this, as much as $900 million worth of gold was imported post demonetisation.

It should be noted, however, that gold is a very unpredictable asset, and should be in the portfolio in a limited quantity. You can easily see, in the chart below, that the prices of the commodity shot up after the demonetisation announcement, only to have fallen again.

Savings in Equity

Indian stock markets reacted negatively to this news, but recovered later. These jitters and the volatility in the markets caused thanks to uncertainty are nothing but buying opportunities. There might be a negative impact on the equities for coming quarters, but in the long run, it will be positive as ours is a consumption economy. And with most of the money moving to banks, banks have started reducing their deposit rates. The decrease in deposit rates will make people look for alternative asset classes to beat inflation and get higher returns. To hedge their savings against inflation, people need to keep on adding exposure towards equities in a systematic manner.

About Sinhasi Consultants:

Sinhasi Consultants are personalised investment advisers, providing end-to-end financial advisory and planning services, and distribution services. We at Sinhasi focus on planned returns through tailor-made customised holistic financial plans. Planning equity-related investments is a core strength of Sinhasi.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)