5 ways to take control of your money

Are you one of those people who are constantly broke? Do you often wonder where your salary has disappeared to at the end of the month? You're not alone. Millennials today enjoy a luxurious lifestyle and have interests that require them to spend big bucks. While you shouldn't stop indulging in the activities you enjoy, you also need to plan your finances in a way that you don't end up surviving paycheck-to-paycheck. Make sure that if you earn Rs 10,000, you save at least Rs 4,000 every month. Don't lead a lifestyle where you earn Rs 10,000 but spend Rs 12,000. Here's how you can better manage your finances.

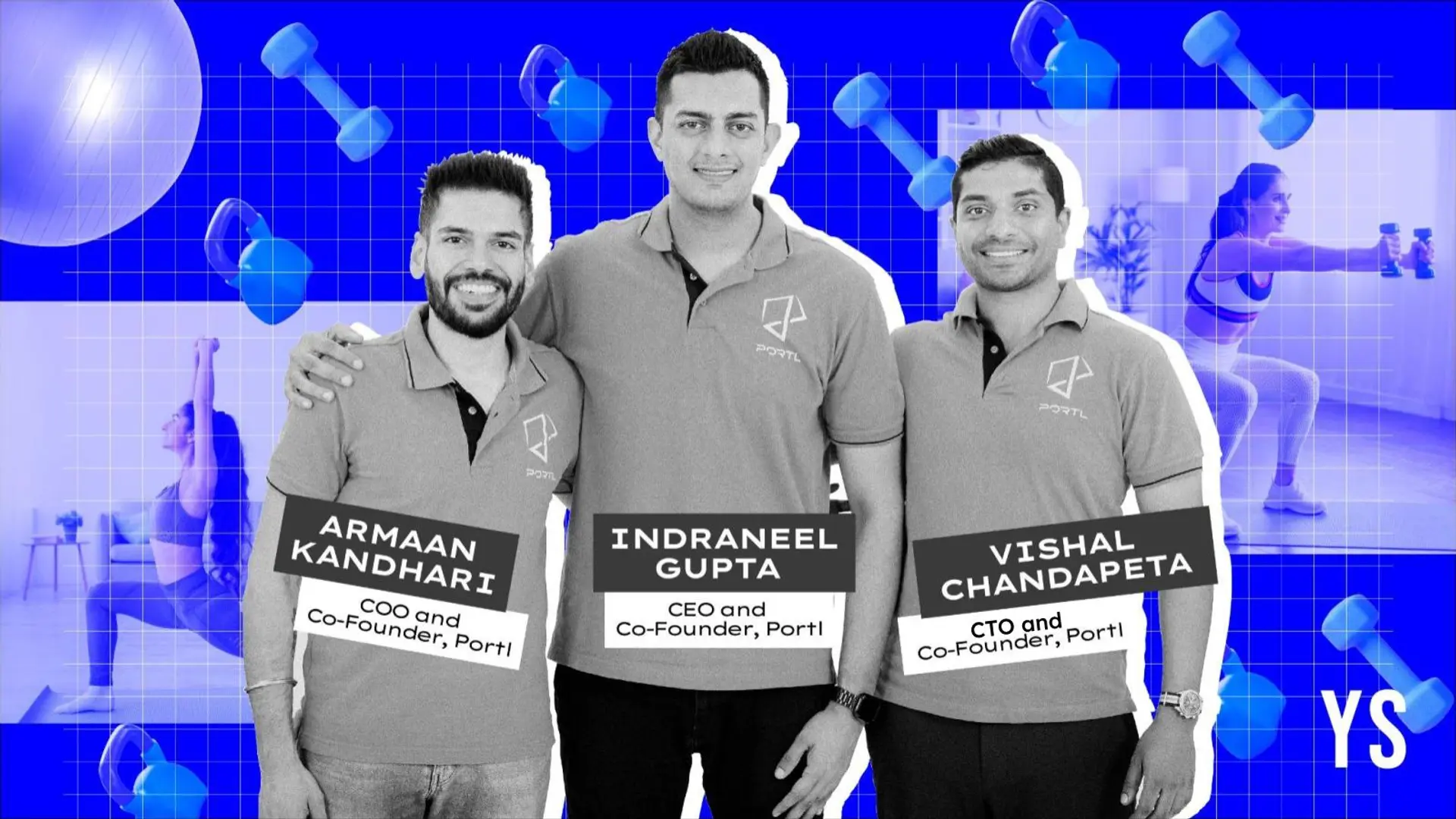

Image : shutterstock

Figure out where you are spending a bulk of your money

If you can't manage your money, you won't be able to measure it. Take a look at your bank and credit card statements for the last three months. While you can't track what you bought in cash, you can see the amount you withdrew and estimate, on the basis of that, how much you've spent in that time period. There are also applications that alert you by email or message if you have spent more than your set limit in a particular month.

Prioritise your spending

If you don't have money to buy groceries or pay your share of the rent till the end of the month, you need to prioritise your money starting today. The last thing you want is to default on your EMIs and lose your home or car.

See where you can curb expenses

Are you paying for subscriptions, services, and memberships you don't really need? If so, cut those expenses loose. Try to be more efficient with your electricity and your groceries. While it is okay to eat outside once or twice a week, try to cut back on eating out every day. You might not see the difference in your finances immediately, but it will help you in the long run.

Set an allowance for yourself

Once your basic expenses and savings needs are met, you can spend money on indulgences like expensive restaurants, branded clothes, and the latest cell phone. However, set a limit for spending on indulgences too. Just because you have disposable income, it doesn't mean you have to splurge it all. Give yourself an allowance and make sure you adhere to that allowance no matter what the temptation.

Invest wisely

Whether it is investing in mutual funds, fixed deposits, the share market or a retirement fund, investing your money not only ensures that you'll receive a sizeable amount at a later date, but also that your money is getting saved bit by bit. When you know you have to set a certain amount aside each month, you'll automatically cut back on your expenses.

The whole point is to make your future financially secure. Follow the above mentioned methods to help yourself handle your money better.