At TechSparks 2017, Axis Bank prods startups to go for venture debt

The bank also asked startups to reach out to its branches if they are raising money from global markets.

In early 2014, a crack team of Axis Bank managers went to the board and requested them to study the startup ecosystem because funding was increasing in small companies. In a couple of years, after watching the growth of Flipkart and Snapdeal, Axis realised the importance of venture debt over equity.

The startups they were talking to told them that they did not want to dilute equity to investors and were fine with taking small loans to manage working capital and also to scale up their product. Axis Bank answered the call and, in May 2016, set up a venture debt team that has completed 17 deals in over 15 months, with an average ticket size of Rs 12 crore. The maximum ticket size is Rs 15 crore, which the bank is looking at increasing in the coming years.

The startups they were talking to told them that they did not want to dilute equity to investors and were fine with taking small loans to manage working capital and also to scale up their product. Axis Bank answered the call and, in May 2016, set up a venture debt team that has completed 17 deals in over 15 months, with an average ticket size of Rs 12 crore. The maximum ticket size is Rs 15 crore, which the bank is looking at increasing in the coming years.

Venture debt began in California when Silicon Valley Bank pioneered the concept in 1982. It had huge deposits from VCs, which it used to loan out to startups. What started as an experiment is today a loan book worth $20 billion.

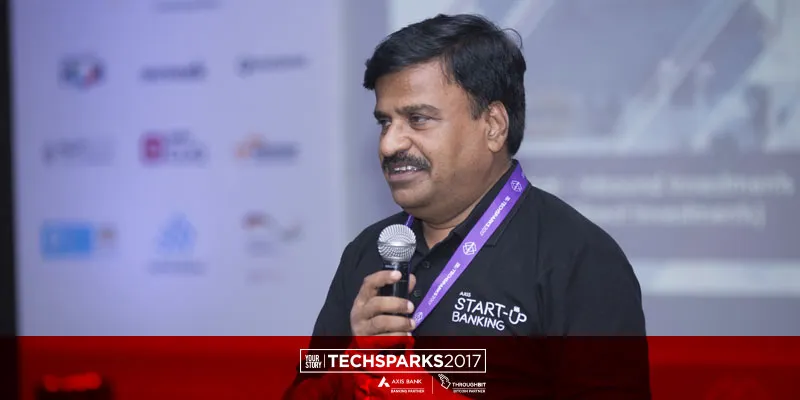

“Debt can be complementary to equity when you raise capital; you do not lose your equity and you can use the money to scale up product or manage working capital,” said Vivek Adhav, Deputy Vice President, Corporate Banking at Axis Bank.

According to him, in a total fund raise of $5 million, the startup can also go for venture debt of $1-4 million in equity. “The debt allows you to experiment on product and the founders can save their equity,” said Vivek. Axis provides venture to startups in pre-Series A going all the way up to Series B.

The company gives out venture debt after performing due diligence on founders’ backgrounds, current assets, and vendors. “We do not take any collateral from startups,” he said.

He added that they put in venture debt along with VC rounds too and the startup should have 12–15 months of runway of cash assets. The fixed assets and IP are key to any company wanting to raise venture debt. “We do not want personal guarantee. We want entrepreneurs that have skin in the game,” he said.

Axis case studies in venture debt are:

SaaS company example: The company was figuring out a market segment and had a revenue base, but could not burn its equity. So to double customer base the startup raised venture debt from Axis Bank, conserving its equity. The company achieved milestones and valuations to raise further equity.

Demand aggregation space: An SME supplies aggregator was initially paying off suppliers through equity, later collecting cash from SMEs. Now the venture debt freed the company from equity being burned and they used the working capital loan to manage payments from SMEs and paying suppliers.

The company’s venture debt portfolio is growing and it also expects its FDI practice to grow.

FDI in startups

In 2001, when Axis Bank spent time with 18 family businesses in Madurai, it realised these were young entrepreneurs looking to go abroad. At the time, there were restrictions in regulatory guidelines of foreign partnerships and forming LLP.

“Those days, NRIs could not invest in commercial property and all that changed subsequently and startups can raise money from HNIs,” said V Somasekhar, VP and Head – Trade and Forex, Axis Bank.

These 18 companies wanted to know how to go about it and Somasekhar said these are the few things a startup should remember while raising money in the form of an FDI from abroad:

- Who is the overseas remitter?

- Have an MOU with any entity agreed to between overseas investor and Indian company.

- MoU outlining various terms and conditions under which he is investing.

- How many years will the investor be putting in money in the startup?

- An email agreement is permissible as a contract.

- Conduct due diligence on the investor.

- KYC formalities of the investor from the money’s origin country.

- Ensure remitters are complying with the guidelines of the RBI.

- Overseas bank has to send a KYC report, for which the RBI provides the format.

However, certain sectors like agri and plantation, chit fund, real estate (allowed in townships), nuclear energy, and tobacco are prohibited from raising FDI.

“Now, FDI is easier to remit from abroad. Once the KYC is done, money can be remitted in a matter of a couple of months,” said Somasekhar. KYC will acknowledge a unique identification numbe,r which will automatically be sent to your number that you are allowed to raise money from abroad.

As an Indian entity, you must allot shares to the HNI or global investors within 180 days. All FDI transactions are reported to the RBI on the ‘ebiz platform’. Today, Forex is $400 billion in size, and Axis Bank wants to help startups from India raise money globally.

(Watch out for a bigger and better TechSparks 2018. Sign up for updates now.)