Here’s a closer look at India’s top 10 funded non-Unicorns

We list down the top 10 funded non-Unicorns in India, the startups you must keep an eye on in the years to come.

Much of the noise around funding has focused on the top fund raisers — the Unicorns — like Flipkart, Ola and Paytm for good reason.

Flipkart alone has raised around $7 billion in the last 10 years. However, a bunch of other startups have also raised some impressive amounts of risk capital. The top 10 non-Unicorns have together raised around $2.3 billion.

This list does not include companies like Janalakshmi and Vini Cosmetics, which don’t fall in the tech-enabled startup category. We have also not included listed entities like MakeMyTrip.

An interesting mix of companies comprises our list (see the table below). The list includes five companies that work on an online marketplace/retail model. Four of the companies were founded in 2011 and two each in 2008, 2009 and 2013.

Why is it important to take a close look at these 10 companies? Most of the companies in this list are market leaders of their own niches, like OYO, BigBasket, Practo, Byju’s, CarTrade and Pepperfry. These have already shown fast scale-up. These companies are also proof of the depth that the Indian startup ecosystem has now. Many of the startups on this list are at the cusp of becoming billion-dollar-valued companies. These are the companies to watch out for in the coming years, the ones who will hopefully lead in terms of innovation. Some of the top startups in our ecosystem, like Swiggy, Freshworks and PolicyBazaar, did not make this list as this was purely on the basis of the funding raised.

Here’s a look at the 10 top funded non-Unicorns in India right now:

1. OYO

OYO’s initial claim to fame, at least in the media, was due to founder Ritesh Agarwal’s age. He was just 17 when he launched Oravel Travels, the original avatar of OYO. The growth the company has witnessed, along with the funding it has raised, has ensured that Ritesh’s age is not the only talking point anymore. OYO has, in six years, carved out a strong niche for itself, starting by partnering with primarily standalone small hotels, standardising rooms in these hotels and making this inventory available online.

OYO, however, faced challenges, especially regarding the quality of rooms on its platform. Since OYO did not own the hotel, there is only so much control it had. This is one of the reasons OYO launched Townhouse earlier this year. Under this, OYO leases out the property outright and runs the hotel completely, ensuring full control over the customer experience. OYO, at present, operates Townhouses in Bengaluru, Delhi-NCR, Mumbai, Hyderabad, Chennai, Pune and Kolkata.

The company aims to open Townhouses in 30 cities by the end of the calendar year. OYO has also opened a homestay category and operates 300 properties already under this vertical. In this category, OYO competes directly with the likes of Airbnb. Its other competitors include direct ones like Treebo and FabHotels, and aggregators like MakeMyTrip. While OYO is the top funded company in this category, others too have strong backers. MakeMyTrip is, of course, a listed entity and with the recent Ibibo acquisition the company is on a strong footing. Treebo recently raised $34 million in Series C round of funding, while FabHotels raised $25 million in a Series B round from Goldman Sachs and Accel Partners.

2. BigBasket

Online grocery is hot right now in India. Flipkart just launched its grocery category Supermart; Amazon has been focusing on scaling up this category the last few months. BigBasket, the market leader in the space with 50,000 orders a day, has been in the news with Alibaba and Paytm in final-stage funding talks with the Bengaluru-headquartered e-grocer. Alibaba has just sought Competition Commission of India approval to invest in BigBasket.

BigBasket ticks most of the boxes of what a startup should do. The founding team, most of whom were part of the founding team of India’s first online grocer FabMart, has strong experience in this industry. They went about setting up the supply chain and building up operations in a few cities before expanding to other locations.

BigBasket also has strong first mover advantage. When it started out, e-commerce was still nascent in India and Flipkart was focused on categories like electronics and later fashion. Even Amazon, when it launched in India, did not focus on grocery. So, BigBasket had the “luxury” to build up the business model and not worry about challenges like price wars that plagued other categories. A few hyperlocal delivery startups came up in the last three to four years, posing a semblance of challenge to BigBasket. Only Grofers remains as a strong competitor to BigBasket and even the former has changed its business model.

However, competition is set to increase with Flipkart and Amazon zeroing in on grocery as an important area of growth. With Alibaba as a backer, BigBasket will be able to breathe easy at least in terms of availability of capital. The company, which has a strong private label range in categories as varied as staples, bakery and green tea, is operationally profitable in Bengaluru and Hyderabad and is targeting to be profitable across all 10 Tier-1 cities it operates in by June 2018.

3. Delhivery

One of the two e-commerce logistics companies in this list, Delhivery’s growth is directly linked to the growth of e-commerce in the country. One of the biggest challenges e-commerce firms faced in India was the lack of a strong logistics network. Flipkart also started its logistics arm in 2011, the same year Delhivery started up. Delhivery closed 2011 with six clients, operations in two cities and deliveries of 500 products a day. Now, the company has operations in 800 cities, works with 3,000 clients and delivers 3.2 lakh products a day.

Delhivery has also emerged as a full-stack logistics service provider. Within the core delivery vertical, the company offers last mile and freight services. It also offers specialised services like reverse logistics. The company has diversified into warehousing and has 13 fulfilment centres across India. Delhivery also offers business intelligence and analytics software solutions – the idea is its clients get a unified view of their customers.

While the growth in the e-commerce industry has helped Delhivery grow, the fact that Flipkart and Amazon use their own logistics networks poses a challenge. These two companies are responsible for large volumes in the e-commerce industry and both use third-party logistics providers only when they exhaust internal capacity or for pincodes they don’t directly service.

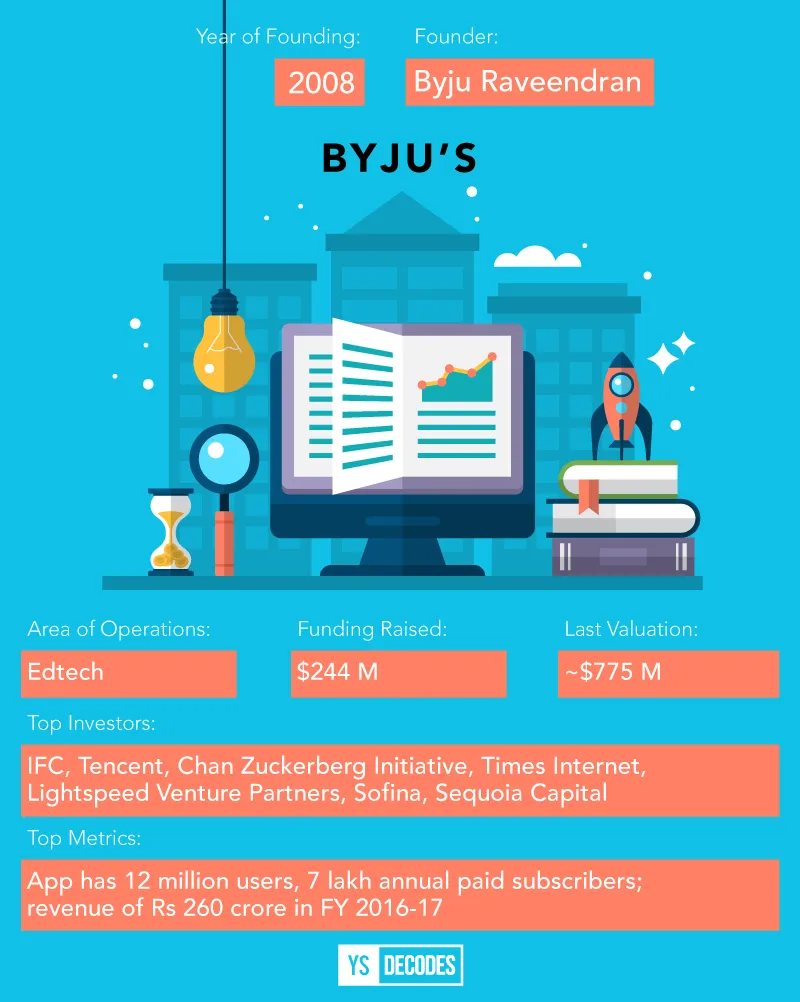

4. Byju's

Byju’s has had a dream run in recent months. Last year, the company raised three back-to-back rounds of funding, worth a combined $140 million, from marquee investors like Sofina and Chan-Zuckerberg Initiative. It later raised $15 million from IFC in December and followed that up with a $30 million fund raise from Verlinvest earlier this year. It is now the most funded edtech startup in India.

The company started out as an offline coaching venture with Founder Byju Raveendran’s classes being held even in massive stadiums. In 2015, Byju’s transitioned into a digital company when it launched its learning app. The app offers programmes that support classwork for students in classes 4 to 12 and for competitive exams like JEE, CAT and GMAT.

The company claims high engagement levels with students spending 51 minutes on the app each day. It also claims a high annual renewal rate at 90 percent.

While Byju’s maybe the largest in its space in India, it does face competition, especially from global peers like Coursera, Udemy and Khan Academy. Indian competition includes firms like Vedantu, Meritnation and Toppr.

Founder Byju is extremely ambitious about the company’s growth prospects. In an earlier conversation with YourStory, he said, “We are looking at the 270 million-plus student population in K-12 in India. So you see, we haven’t even scratched the surface.”

5. CarTrade

CarTrade leads the pack in the online auto classifieds space with about 15 million users a month and listings of over two lakh used cars. It faces strong competition from other auto marketplaces like Sequoia-backed CarDekho and Droom, which is backed by investors like Lightbox, Beenext and digital Garage, and from multi-category classifieds platforms like Quikr and OLX.

CarTrade’s acquisition of rival CarWale in 2015 ensured it was able to consolidate its leadership position. Both sites still operate as separate entities. CarTrade and CarWale help consumers buy and sell new and used cars by offering features such as used car price information and condition check. New car buyers can make use of features like reviews, on-road prices, car comparisons and latest news.

More than the new car market, it is the used car segment that most online players focus on as it is still a highly unorganised market with many car owners trying to sell their vehicles on their own. India’s used car market is pegged at 3.3 million units, which is worth Rs 96,000 crore, and is expected to grow to Rs 2.50 lakh crore or 6.6 million units by 2021.

CarTrade is backed by deep-pocketed investors like Temasek, March Capital, Warburg Pincus and Tiger Global. It raised $55 million in February this year. Apart from acquisitions, the company is using the funding to expand into new areas like auto finance. At the time of the funding, Founder Vinay Sanghi said: “The funds raised will be used to drive growth through continued focus on strengthening our dealer and customer services and evaluating potential acquisitions. CarTrade is aggressively looking at the market for used car finance with less than 8 percent of used cars sold being financed through an organised financier. To address this opportunity, CarTrade Finance was recently launched with the aim of financing the inventory for car dealers and to consumers who wish to buy used cars.”

6. Grofers

The “other” online grocery e-tailer in this list, Grofers is among the few that survived the hyperlocal bloodbath of late-2015 and 2016. The company that started up in 2013 and was the most funded hyperlocal company in 2015 has changed its business model. The Gurugram-based startup started out by delivering groceries procured from local stores within two hours of customers placing an order. Now, the company has moved completely to a scheduled next day (or even later) delivery model through its own warehouses – a model similar to competitor BigBasket. A The Economic Times article in August says about 95 percent of items shipped by the company is from its warehouses.

The company also shut down operations in nine cities in 2016 when it started re-working its business model. It has since re-started operations in some of these locations and today operates in 18 cities. Grofers claims to have found success with this model and was at an annualised sales run rate of $120 million, according to The Economic Times article quoted earlier.

Grofers also plans to start its own private label, like BigBasket has done, and has also got the government’s nod to start directly retailing food products. However, like BigBasket Grofers too will face greater competition now that Flipkart and Amazon are scaling up their operations in this category. There are reports of a potential acquisition by Amazon, which was earlier in acquisition talks with BigBasket. The latter opted for an investment by Alibaba as it was not open to an outright sale.

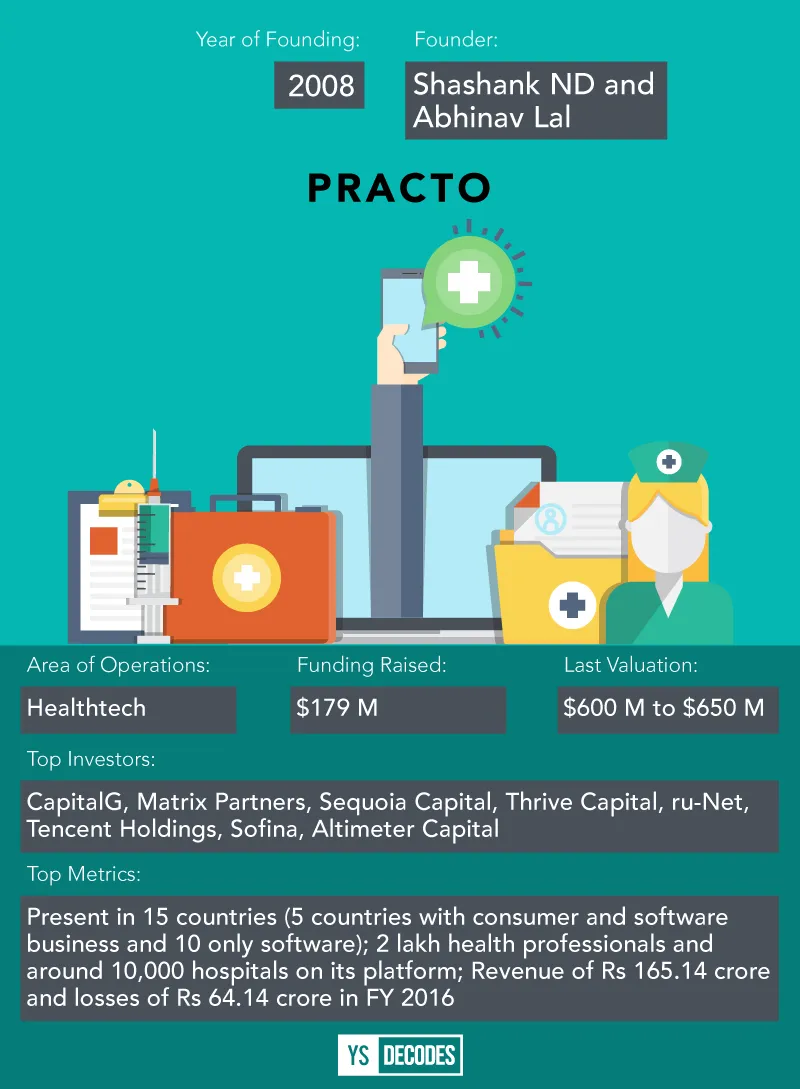

7. Practo

Along with restaurant discovery and food delivery portal Zomato, Practo is among the few Indian B2C startups with a significant global presence. The company started out as a provider of patient management software to doctors. Today a consumer can discover doctors or diagnostic centres, book appointments and tests, store medical records, chat with a doctor and even order medicine on Practo’s site and app. On the healthcare provider side, Practo offers solutions ranging from booking management to hospital management software.

Apart from India, Practo has consumer-facing operations in Singapore, Philippines, Indonesia and Brazil.

In an interaction with YourStory in April, Co-founder and CEO Shashank ND had claimed that 2016 saw a 60 percent increase in bookings internationally and that over 20 percent of revenues for the company come from outside India. HE also said software solutions are the revenue drivers.

The company has gone the inorganic path to expand into new areas. Acquisitions include hospital information management solution provider Insta Health Solutions and hospital appointment scheduling solutions provider Qikwell Technologies. Practo competes with different companies across different verticals. Competitors include Sequoia-backed 1mg, Tiger-backed Lybrate, Netmets, Matrix-backed Myra and Bessemer-backed PharmEasy.

8. Ecom Express

Like Delhivery, Ecom Express’ growth has mirrored that of the e-commerce industry. Ecom Express started operations in 2013 with a presence in 35 cities. The company now covers around 1,000 cities and towns across the length and breadth of the country.

The company, like Delhivery, saw fast scaleup soon after launch. E-commerce in India was growing by leaps and bounds and none of the logistics providers had enough built-up capacity to cater to the orders being generated. In the beginning of 2014, Ecom Express was delivering to 60 cities and before Diwali that year, just after raising Rs 80 crore from Peepul Capital, the company had expanded its reach to 200 cities. Soon after, Ecom Express also set up its long-haul road transport network to reduce reliance on air cargo.

Earlier this year, the company opened up its own warehouses that offer fulfilment services to e-commerce firms. The plan is to have seven large warehouses and 20 smaller ones.

The challenge for Ecom Express, and for Delhivery, is the slower growth that the e-commerce industry is experiencing. After growing at 180 percent in 2015, the industry grew at only 12 percent last year, and is projected to grow at 20 percent this year, according to research and advisory firm RedSeer Consulting. The other challenge is Flipkart and Amazon increasingly relying on their own long-haul and last-mile networks for most of the country. Considering these two firms account for the most volumes, third-party logistics providers will end up depending on smaller players with less predictable volumes for a bulk of their orders.

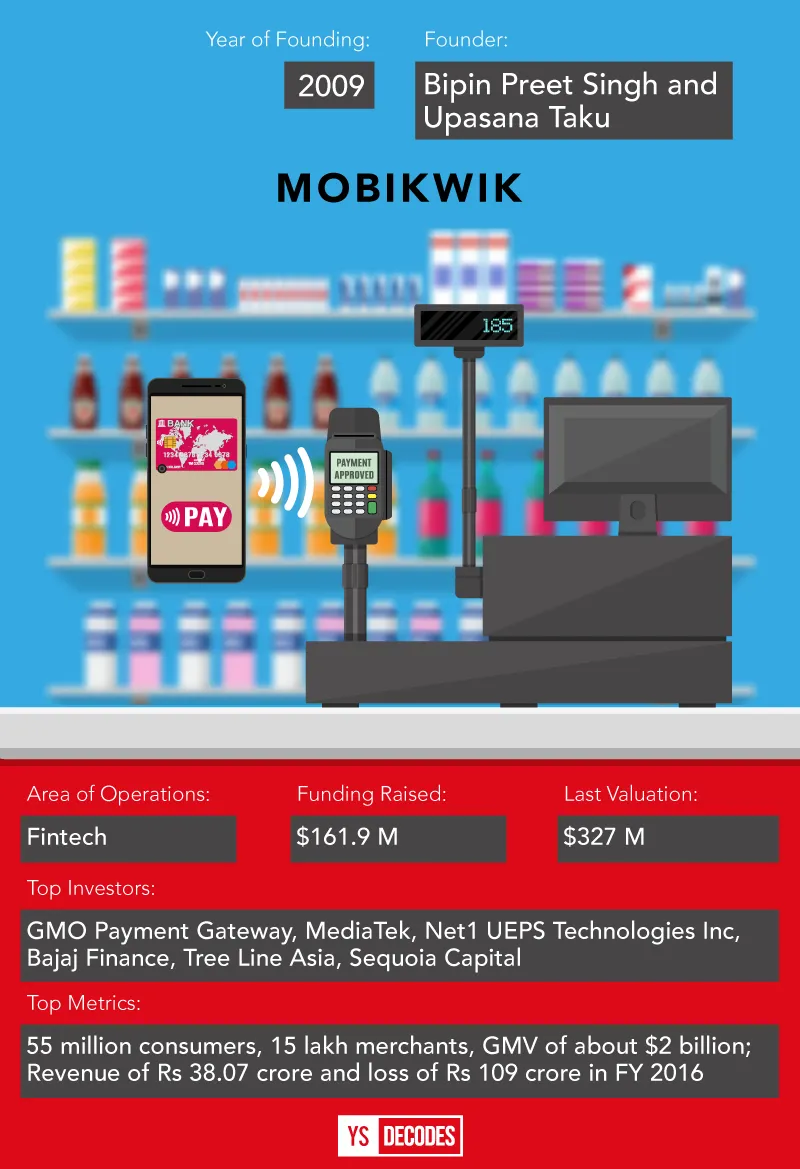

9. Mobikwik

Paytm may be the heavyweight in the digital payments industry, but Mobikwik has made a space for itself in the sector that turned red hot after last year’s demonetisation.

With pure digital payments becoming increasingly crowded, with the likes of Paytm, Bhim, PhonePe and a slew of wallets being launched by banks and even telecom operators, Mobikwik is betting on “smart money application”. The company is partnering with banks to give credit lines to its 55 million wallet users, offer personal loans, sell insurance to shopkeepers and get into verticals like auto insurance and cashless mediclaim. While there are multiple fintech startups that offer similar services, Mobikwik isn’t becoming a comparison marketplace. It will act like a service provider and not a distributor.

One of the key challenges is the fact that the fintech sector is under the hawk eye of India’s Reserve Bank of India, which changes regulations now and then keeping the best interests of the individual user in mind. Recently, the RBI announced stricter KYC requirements for prepaid instruments like wallets. Mobikwik has announced that it will spend Rs 400 crore in the next five years just for the KYC process. Competition is also extremely strong in this industry. Paytm is the 800-pound gorilla in the sector, but a whole host of fintech startups in areas ranging from wealth management to insurance are fighting for market share.

10. Pepperfry

Flipkart is looking to make use of its $4-billion war chest and Pepperfry is reportedly one of its investment targets. That’s because the latter has grown to be the market leader in the niche online furniture category in the last six years.

Here are some numbers: 10,500 sellers, 50 manufacturers, over 2,500 orders a day, over 60 percent market share and 23 physical studios (stores). The most impressive number – an average order value of Rs 18,000. Furniture is a high value and high touch category. Hence it is not an easy segment to crack. Pepperfry has done this by opting for a hybrid model, where some of its products come from sellers; for others, it partners with manufacturers to produce. Margins are also high, at about 55 percent.

However, online makes up only a fraction of the furniture market in India. Revenues are expected to cross $1 billion this year. While portals like Urban Ladder and LivSpace compete directly with Pepperfry, the biggest competition is from the offline industry that is still mostly unorganised. An investment from Flipkart will give Pepperfry access to a much larger online user base.

(Let us know in the comments section which company you think will break into the Unicorn Club first?)