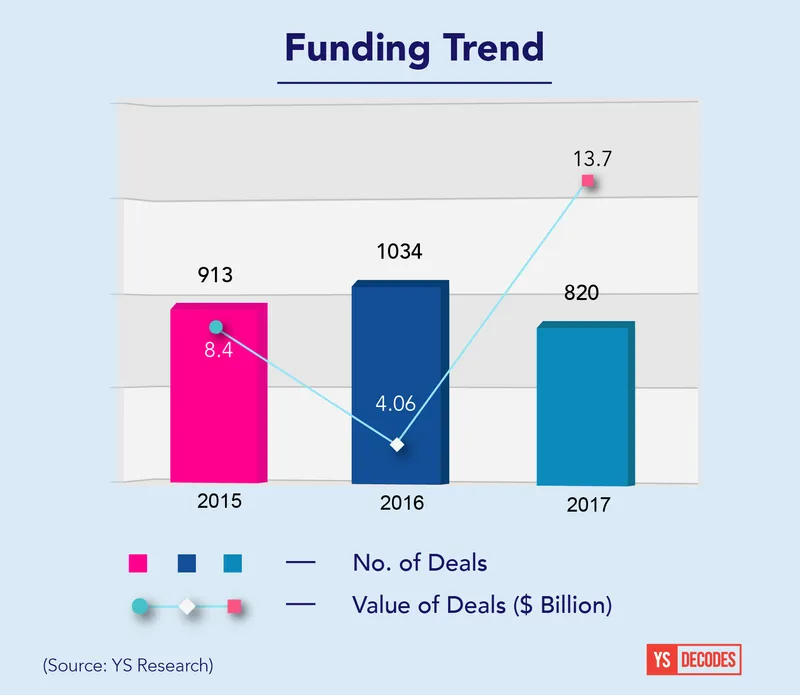

The YourStory 2017 Startup Funding Report – $13.7 billion invested across 820 deals

Late-stage deals take off, early stage under stress even as funding remains concentrated in top cities, mainly Bengaluru, Delhi-NCR and Mumbai.

The year has closed with a record $13.7 billion being invested into the Indian startup ecosystem across 820 deals.

The value of investments is significantly higher this year compared to 2016 and 2015, when funding was at $4.06 billion and $8.4 billion respectively. However, 2016 and 2015 saw a larger number of deals, at 1,034 and 913 respectively. The numbers represent all disclosed deals until December 10, 2017.

However, these overall numbers only reveal a part of the picture. Dive into the details and the data uncovers a more complex scenario. For, 10 companies cornered almost 70 percent of all the funding.

While companies like Flipkart, Ola and Paytm cannot be classified as startups anymore, they are still a very important part of the Indian startup ecosystem and so the funding these companies raised has been included in this report.

Early stage crisis?

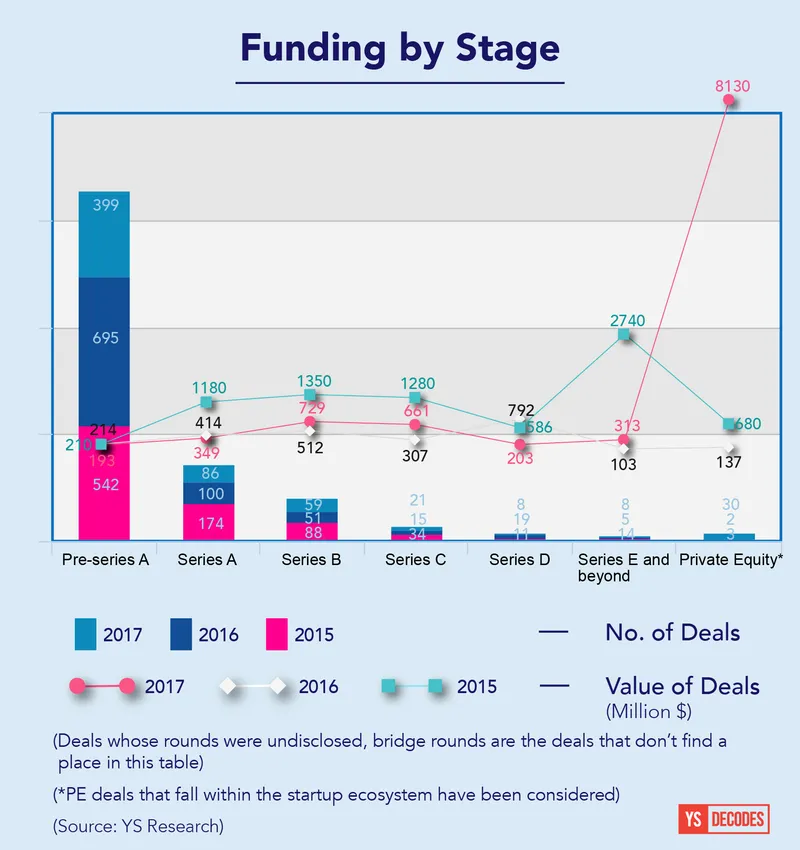

Only $4.22 billion has been invested in companies or startups that are not Top 10 fund raisers. Of course, only a fraction of this amount has gone to early stage companies as is the case each year. However, fewer early stage deals have happened this year, compared with the past two years.

Only 485 Series A and earlier deals took place in 2017 worth $542 million. In 2016, there were 795 early stage deals worth $628 million, while 2015 had 716 such deals worth an impressive $1.39 billion.

There has been an increase in Series C and D deals compared to 2015. However, they have not reached the 2015 levels. The drastic jump, as discussed, is in the PE stage (there is a difference between the PE funding amount and the value of funds raised by the Top 10 companies, as in the latter we have included debt financing).

Is there a reason to be concerned that early stage investments are down?

Padmaja Ruparel, Co-founder, Indian Angel Network, makes the following points:

- The market has given a strong signal in the year for entrepreneurs to create innovative propositions and not me-too products.

- Some government regulations like Section 56 of the IT Act have held back angel investment as investors. On the other hand, companies have shifted overseas (US/Singapore) to avoid the angel tax net.

- Investments of $1 million to $5 million or $6 million have been very difficult. Good companies have faltered for lack of funds/delayed at this stage. This has impeded growth for companies, and angel investors have become wary.

- However, the Government of India’s Fund of Fund startups is committed to several venture funds. This should bring more money into the startup ecosystem and encourage entrepreneurs to get started. This is exactly the reason that IAN has launched the IAN Fund as it will bring critical post-angel round money to startups, along with mentoring and market access.

Other investors, however, say that there is no cause for alarm.

It appears as a dip when compared to the exuberance of 2015-16. The current level of investment is a return to normalcy, as investors are deploying capital with greater caution and focus on evaluating long-term sustainability of businesses. At the same time, startup founders are also being more cautious and mature with their fund-raising effort which is great for our ecosystem,” says Vani Kola, Managing Director of Kalaari Capital.

While early stage deals may have been fewer this year, 2017 did see a few large deals in this category.

Acko General Insurance, founded by Coverfox Co-founder Varun Dua, raised a record $30 million in seed funding.

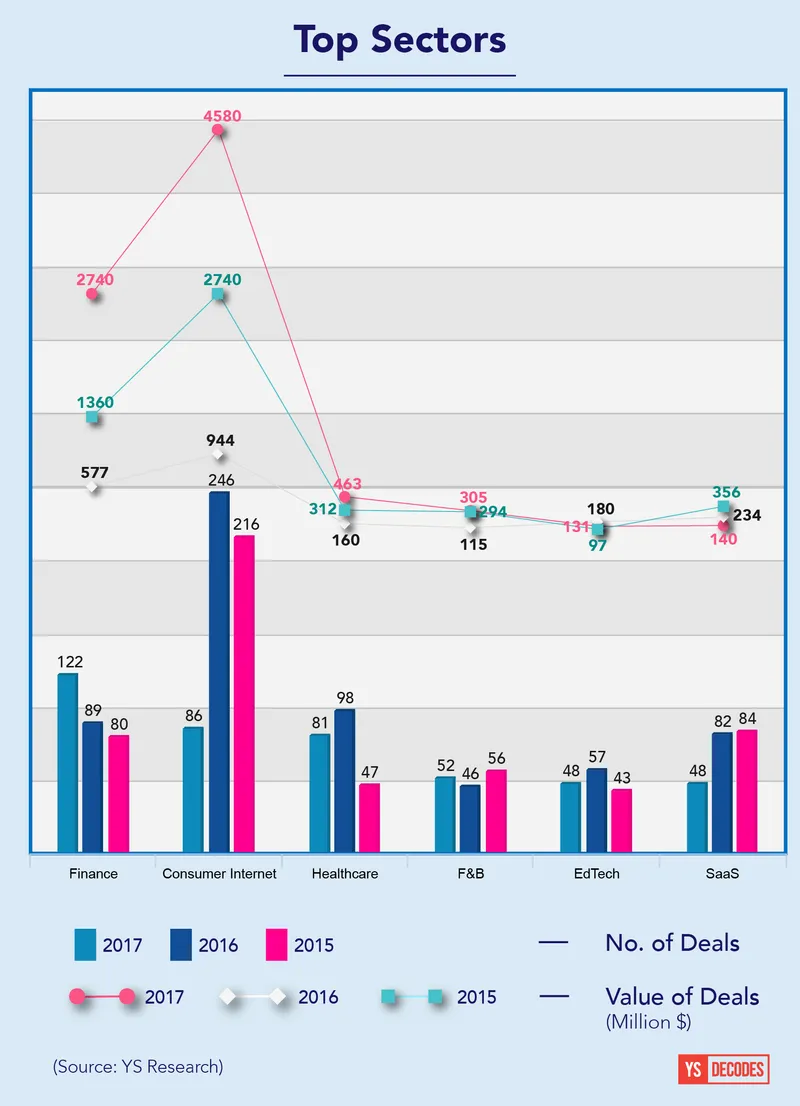

Finance rules

Not surprisingly, Finance took top spot in terms of number of deals, but Consumer Internet topped the chart in terms of value of investments. What stands out about Finance, especially FinTech, is the spread of deals across early and later stages.

The many early stage deals in Fintech (about 60 deals) shows how the field is still wide open, despite the presence of a Goliath like Paytm. Also, the companies are quite diverse, with lending platforms, tech-enabled investment advisory and money management startups all raising early stage funding.

The Fintech space also saw a healthy number of later stage deals with companies like lending startup Capital Float, mobile payments service provider Mswipe, and digital payments venture MobiKwik all finding backers.

Similarly, Consumer Internet has seen heavy segmentation with multiple players emerging in sub-categories like subscription services, men’s grooming, reselling, rural products, used furniture and many more.

While these six categories captured the most number of deals, it is interesting to note that some of the tech segments have also seen strong fund flow. About 20 Artificial Intelligence startups raised funding. Almost all of them are early stage startups like AI enterprise tech platform Artivatic.

Agritech (17 deals), Analytics (14 deals), CleanTech (14 deals), IoT (16 deals) and Gaming (12 deals) were areas that saw reasonable deal flow.

This year saw an uptick in investments into coworking space providers like Awfis, 91springboard and BHIVE Workspace. This category saw a total of nine deals.

Top heavy

As already mentioned, 10 companies have cornered about 70 percent of the deal value this year with Flipkart taking the biggest chunk.

Investor Softbank deserves a special mention here as it is an investor in four of these 10 top companies. Softbank has become the biggest late stage investor in India with the investments it has done this year. China’s Tencent too is making its presence felt by backing two companies in the top 10—Flipkart and Ola .

There is now a hope and expectation that the large fund raisers—Flipkart, Ola and Paytm—will in turn become strong investors and acquirers in the Indian startup ecosystem. All three companies have made multiple investments and acquisitions in the past—Ola’s Foodpanda acquisition being the most recent.

But, there is an expectation for the investments and acquisitions done by these three to ramp up significantly.

Sudhir Sethi, Founder and Chairman of IDG Ventures India, says:

We do expect Scaled Tech Companies to acquire young emerging companies; this is healthy for the ecosystem.”

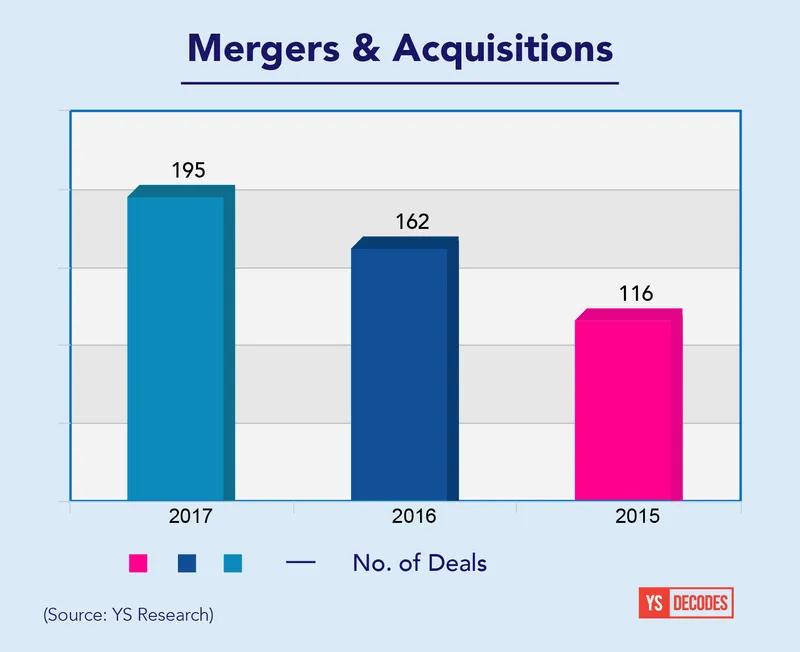

M&A rises. Slightly

Acquisitions have seen an increase. But exits are still a cause for concern.

While a few IPOs have happened from the startup tech space, like Tejas Networks, most exits are still through M&A. The fact is many of these M&As are distress sales or acquihires, like the case of Axis Bank buying Freecharge or Ola acquiring Foodpanda.

There is increasing talk of resetting expectations. India is still a much smaller actual market than China or US.

At a panel discussion on exits during YourStory’s TechSparks 2017, Bharati Jacob, Founding Partner at Seedfund, had this to say:

If you look at the venture capital market in India it has been present for close to 10 years but comparing that to an ecosystem that is six decades older doesn’t make sense. India needs to be compared according to the dynamics of an India market.”

During the same panel discussion, Rajat Agarwal, Vice President at Matrix Partners, made a more positive observation:

When companies start scaling, and profitable business models get established and the macro-economic dynamics begin to shift, exits will shift too. To be honest, it is just a function of time. Secondly, secondary markets need to exist in India. IPOs are hard to get in India, especially for tech companies that haven’t seen profitability in a long while.”

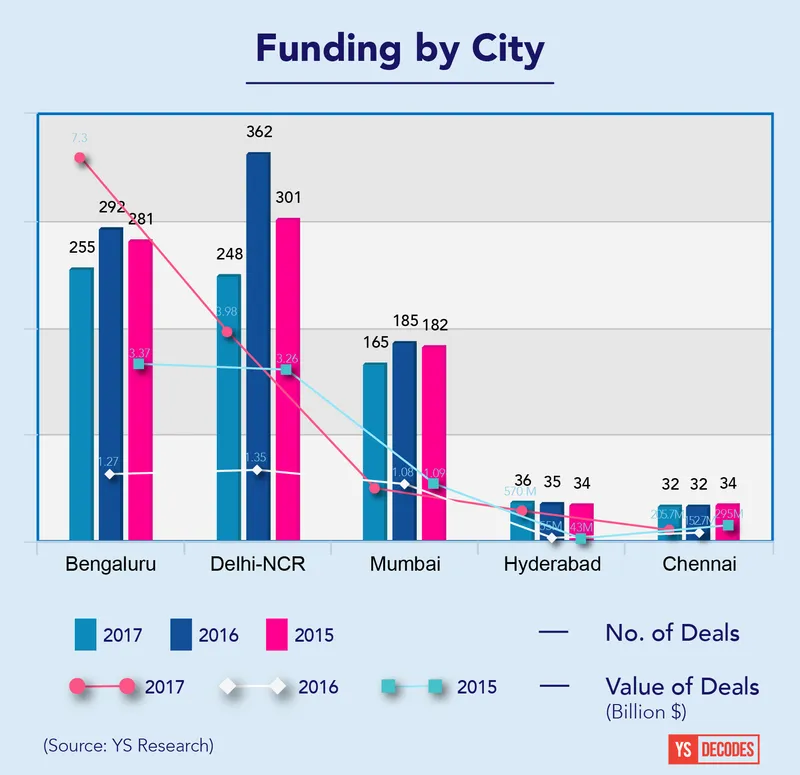

Bengaluru wrests top slot

Bengaluru captured the most investments this year with 255 deals and $7.3 billion in funding. Delhi-NCR had held the top spot in 2015 and 2016 in terms of number of deals.

When we remove the $4.12 billion raised by Flipkart and $1.77 billion raised by Ola, other Bengaluru-based companies got $1.14 billion. Similarly, if we remove the $1.4 billion raised by Paytm and the $740 million raised by ReNew Power, other Delhi-NCR based companies got $1.84 billion in funding.

The chart below begs the question of whether a distributed startup ecosystem, which is what various state governments are trying to achieve, is good for entrepreneurs. Yes, deals have happened in smaller cities like Surat, Bhubaneswar, Jaipur (which actually saw 7 deals) and Hubli. But it is clear from the chart below that funding is still concentrated in the top cities, mainly Bengaluru, Delhi-NCR and Mumbai.

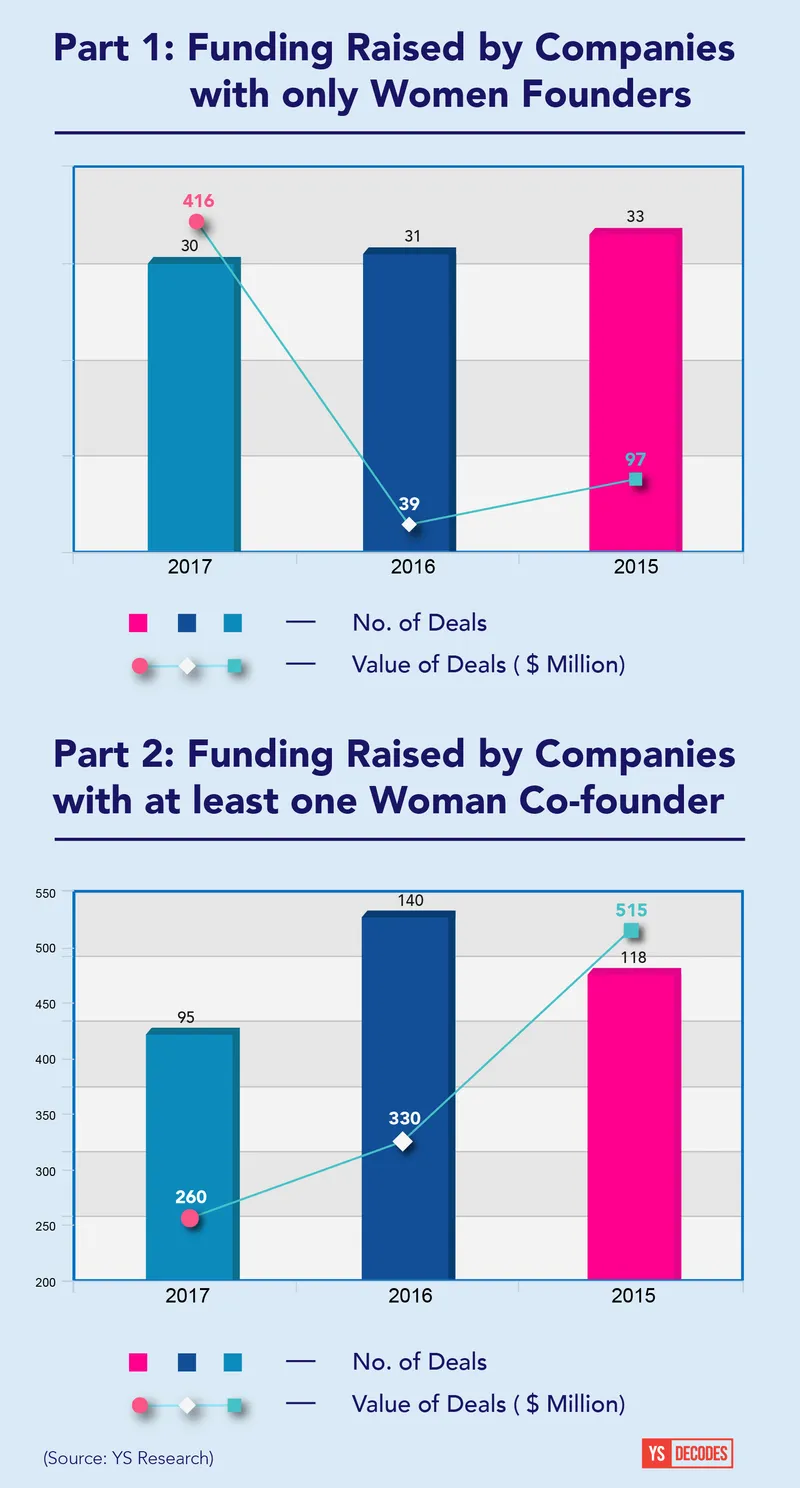

Women founders don’t hold up half the funding sky

Just 30 deals involved companies with only women founders. Ninety-five deals involved companies with at least one woman co-founder. These represent a fraction of the overall funding raised by startups in India.

The ecosystem players need to ask some tough questions to themselves—are they okay with so few women-founded startups raising funds?

In fact, the value of funding raised by startups led by only women is at over $400 million because of the $332 million in equity and debt financing raised by Padmaja Reddy’s microfinance venture Spandana Sphoorty. This can be seen as a positive—that a woman-led company features in the Top 10 fundraisers of the year.

Also read: Only 2 pc of all equity funding raised in 2017 went to startups with a woman founder