AKS claims 3x growth from brand accelerator programme; what is Myntra planning next?

Nidhi Yadav, 30, was studying fashion merchandising in Italy when she did a six-month project on premium fashion brand Prada. Impressed by Prada's supply chain processes which get new styles to the market quickly, Nidhi wanted to replicate it in India.

Fast fashion was her choice, and AKS was born in May 2014, focusing on the ethnic wear category for women as there were few other brands in the category save a Biba or a W.

AKS, which means reflection, clicked with the customer, and became among the top 10 brands on fashion e-commerce portal Myntra.

Owing to its progress online, Myntra collaborated with Gurgaon-based AKS for its brand accelerator programme in June 2017. The Bengaluru-based company aims to help accelerate the growth of emerging domestic brands through technical know-how, analytics, and branding support from Myntra.

AKS and Chemistry were the first two brands to be selected for the programme, which was looking for local fashion brands that have a strong founding team and unique design sensibility.

The results were surprising, to say the least.

AKS had $6 million annual GMV in three years. With the accelerator programme, Myntra sought to grow AKS by 10X in the next three years. Since it joined the brand accelerator programme, AKS went from the top 10 to the top three brands in ethnic wear. It has achieved 30 percent more than its sales target.

Talking to YourStory, Nidhi spoke about expanding her business, “Since offline retailers are the biggest competition, we will expand in offline channel through retail chains like Shoppers Stop, and later open stand-alone stores also. We keep introducing new collections every month; but offline presence will give us a flavour of what the customer is asking for.”

AKS is now the poster boy of Myntra’s Brand Accelerator programme. Myntra claims that with preferential platform visibility, AKS has garnered a 2X increase in list views. Data-backed designing and pricing led by Myntra has helped AKS grow 3x since the start of the accelerator programme, much higher than the target of 1.3x, it says.

“The brands will be able to leverage our core strengths – largest mass premium customer base and data-driven insights on consumer, while also getting operational support. We are looking at creating about $1 billion incremental valuation for the Myntra Accelerator brands over the next three years,” Myntra CEO Ananth Narayanan had said at the launch of the programme last year.

The initiative is well connected to Myntra’s strategies for 2018. In a chat with YourStory, Ananya Tripathi, Head of Sports and International Brands business and Chief Strategy Officer at Myntra and Jabong, said that the Brand Accelerator programme aims to help brands scale up with inputs on building the catalogue, marketing processes, foreseeing the inventory which will be in demand etc.

“In China, local brands become national ones. We believe that the same will happen in India. Through our brands like Roadster and HRX, we have already seen it happening. We want to support who we think will be the next national brand. It is our duty to support local brands on how to get traffic, data, and assortment, so they can scale up. Hence, we give them price points to build their assortment, why returns are high and how to reduce them, and beating a lot of other brands,” she says.

Strategy for 2018

Ananya elaborated on Myntra’s focus points for 2018:

- Myntra had earlier announced that personal care segment will contribute 8 percent of its revenue in two years. “We are a bit behind the curve now. Nykaa is the leader; but Myntra and Jabong together have 20 million active monthly users. They are looking for personal care on our platform,” says Ananya. They aim to hit $100 million run rate target for FY 2019 in personal care.Myntra is considering launching a subscription model for certain types of personal care products like shampoos. “We have to figure out the tech for that,” Ananya adds. Amazon India is also reportedly launching its own set of beauty products to take on Myntra's efforts in this regard. According to Ananya, there will be a shift in focus from fashion to lifestyle too. Ananya explains: “Even headphones are becoming fashion accessories. India does not have access to global styles; we want to bring it to the country.”

- The bar for customer service is always high for retail. “Customer always wants faster delivery. So we will invest more in supply chain and better service by scaling up two-day guaranteed delivery and no questions asked returns through Myntra Logistics as well as third-party players. We will continue to scale the Try and Buy feature which is now available only in Bengaluru,” Ananya said.

- Artificial Intelligence is another area of investment for Myntra as the tech is at the core of the company. “Designer less fashion is our new area of interest. We will have AI-led designs soon. Machines find out what is popular from social media as well as Myntra and Jabong data. Our AI platform RAPID had started with $10 million; now we are doubling down on that. There is huge interest from global retailers for this technology. This technology is in Alpha stage now,” she says.

- Ananya added that Myntra is also investing in Cerebrum, which is an AI-led planning platform that shows what is selling and what is not. “This is purely data led, with no human intervention at all. It can even predict trends according to seasonality: say, GMV contribution of x percent will come in Winter. Machines can count 100 factors and tell us what will sell on a particular day in a particular geography,” she claims. (On a side note, Chinese e-commerce giant Alibaba also provides its technology for offline fashion retail stores to understand consumer behaviour better and stocking up the right inventory.)

Myntra says it is still in a growth phase, so wants both new and old customers. “Across Myntra and Jabong, there are 11 million yearly buyers out of 60 million online shoppers. The first online purchase is for sports shoes as they know the size and quality,” Ananya tells YourStory. But trust and touch-and-feel is still the biggest barrier.“So we invest in easier returns. We also get size information through user profiles, which has resulted in reduction in returns by 150-200 basis points,” she adds.

- After claiming success with the offline retail store of their private label Roadster in Bengaluru, Myntra is planning more stores for the same label as well as other private labels. This Omnichannel strategy will enable customers to pick up and return at stores. Ananya says they are planning experiments with brands to do store pick up and returns too. (Myntra already runs franchise partnership with brands like Mango, catering to their online and offline needs. Chemistry is also in their Brand Accelerator programme.)“We have seen uptake in online sales for it too. If the customer wants the delivery in two hours, they won’t mind picking up at the nearest store rather than getting it delivered. Same happens with returns,” she says.

Branded fashion to grow

According to BCG-CGI Digital Influence Study of 2016, brand fashion will rule 60-70 percent of online fashion market. Myntra is also strategising with the idea that emerging, domestic brands will lead the way, not just international ones. “Indian consumer is becoming more price conscious; so we will continue to focus on growing local brands. Brand accelerator currently gives 4 percent of GMV; by FY2019 it will be 10 percent,” Ananya says, adding that by March end, Myntra will break even and reach its GMV target of $1.2 billion.

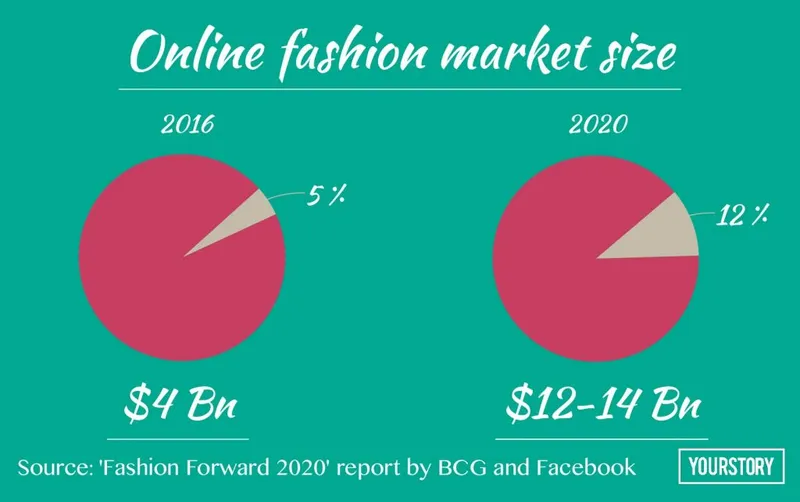

India will have 135 million online fashion shoppers by 2020, from the current 60 million, as per ‘Fashion Forward 2020’ report by BCG and Facebook. It states that by 2020, a very high share of business will be on women’s ethnic wear. Myntra’s ethnic wear and western wear categories are already neck-to-neck. With ethnic wear becoming more popular in online shopping, and brand accelerator programme showing positive results, local brands like AKS may pave the way for Myntra’s profitability dreams.

![[YS Exclusive] RevX Capital launches second fund; aims for Rs 750 Cr corpus](https://images.yourstory.com/cs/2/a1c35720cce711efabacb7b767fb7698/CopyofCopyofNewPPTTemplates-1736763309419.png?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)