India’s appetite for erotic ecommerce grows, but sex toy market gets no love from investors

Players like Thatspersonal, IMBesharam, Lovetreats, and Kinkpin are leading the sex toy market, especially in Tier III and IV cities, but founders aren’t finding it easy to get funding despite the growing demand.

In the land of the Kama Sutra, it’s no surprise that sex is on plenty of minds. India is the sixth most sexually active country in the world, and – not so surprisingly - the market for sex toys is peaking.

Technavio predicts the sexual wellness market in India is expected to grow at an average rate of 34.8 percent per year from 2014 to 2019. It estimates that the current market size of the category in India is around $227.8 million as compared to the global $22 billion

Divya Chauhan, Founder of premium adult online store ItspleaZure, says the segment - mostly limited to underground markets and shady alleys – is showing change. “In recent times, more people are turning to the organised market due to the convenience of buying through ecommerce stores. This has led to growth of online stores,” she says.

According to a report by Thatspersonal, an ecommerce site for adult products, India contributes between 16-20 percent of the global English searches for topics like lotions, lubricants, erotic lingerie, and adult literature and games.

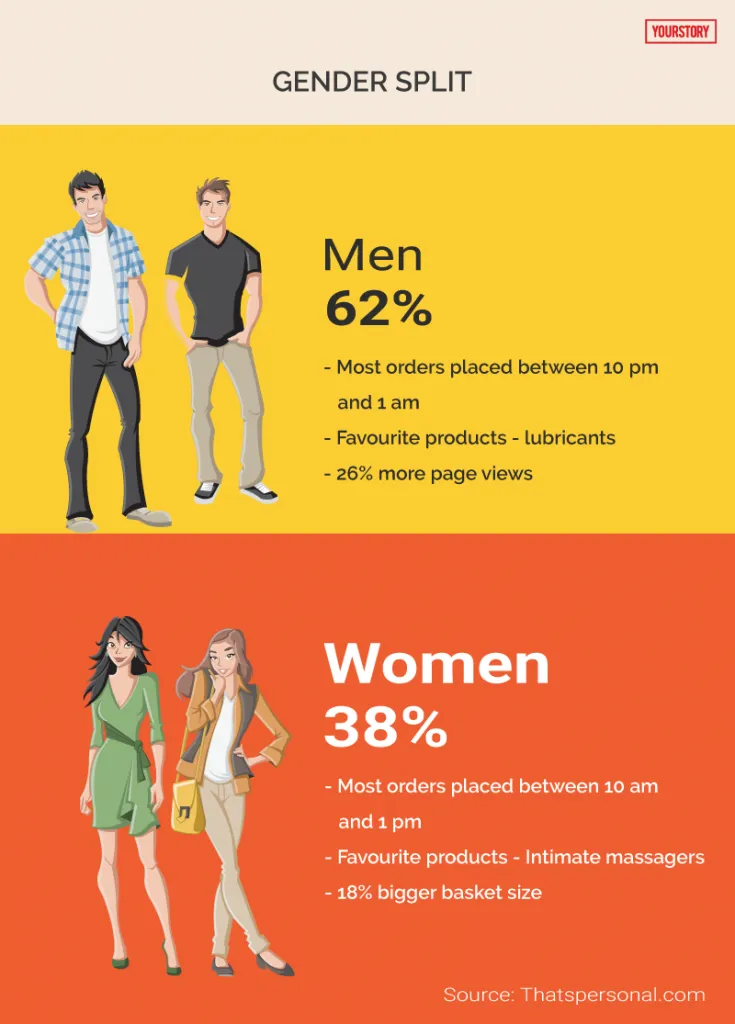

The highest sold sex products? Intimate massagers for women, and lubricants for men. Other sex products Indians put in their online carts include sexy lingerie, lotions, delay sprays, pleasure rings, and condoms.

The gender battle

The demand is high – and rising.

Bala TV, Co-founder, Lovetreats, says: “When we started, due to our Tier I presence and outreach, the ratio of female buyers to male buyers was 80:20. Over the last two years with an increase in our popularity across the country, we now see an equal number of men and women (give or take a percent or two) buying sex toys every month.”

The numbers and the current market scenario suggest that 2018-2019 will be a turning point for the industry due to the emergence of new players, international brands, and a more mature consumer market.

Pleasure preferences

Bala says there aren’t any regional favourites as they deliver across all corners of India.

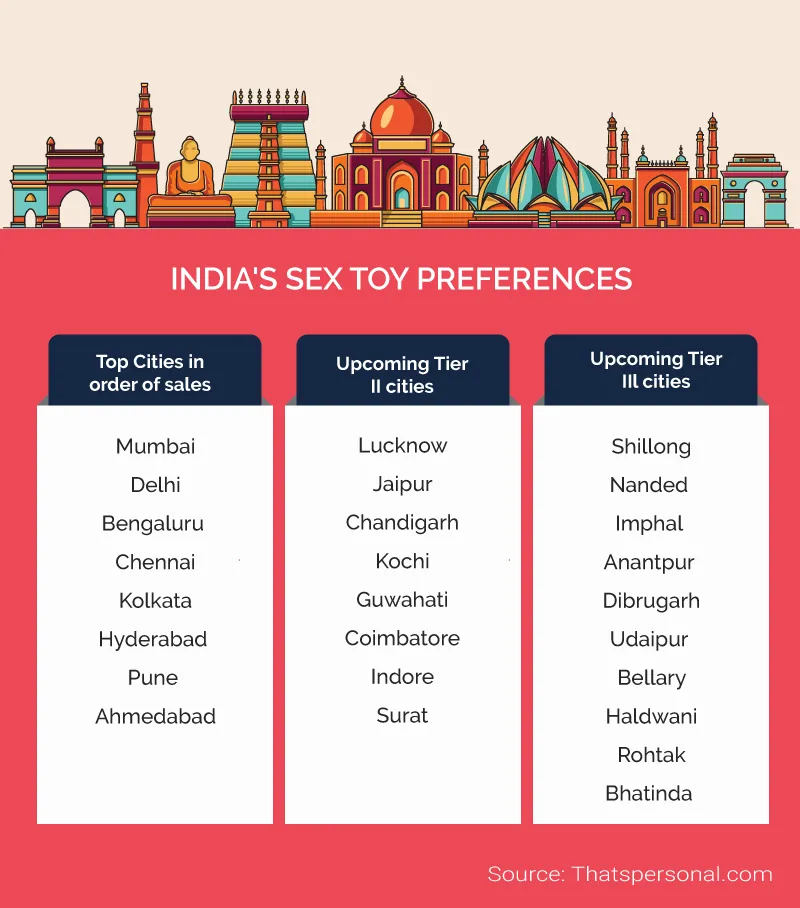

“When we started, Bengaluru, Mumbai, Chennai, Delhi, and Hyderabad were our top markets since we had two-day delivery time. Now after extending fast delivery service to most of India, more markets are opening.” He adds that they now have 40 percent customers from Tier III and IV towns.

It’s fascinating how, across India, different Indians have similar pleasure preferences.

“Buyer behaviour changes depending on whether they are from Tier I and II cities or from Tier III and IV cities. Tier I and Tier II women buy sex toys for themselves. In Tier III and IV cities, the men buy sex toys for women. Tier III and IV cities have a sex toy cart size that is roughly three times bigger than Tier I and II. Tier III and IV cities make up for about a quarter of our buyer bases,” Bala says.

A report by Thatspersonal reveals that the sale of sex toys in Tier II cities increased by 25 percent, last year. Most of these companies source the products from abroad; they tie up with foreign brands who make these products, source, and ship them out to India.

Innovation and the market

The numbers keep growing every year. As of now, there are several companies, including IMBesharam, Thatspersonal, Lovetreats, Kinkpin, Shycart, Privy Pleasures and many others, servicing the market.

Innovation is making its way to the sex toy market as well.

Kiiroo, billed as a revolutionary product in the adult sex toys category, allows couples to feel each other from anywhere in the world. It comes in nondescript packaging and can easily pass off as a compact music speaker. There are two components -- Onyx for the man and Pearl for the woman -- each Bluetooth-enabled. They can communicate directly when connected to the Kiiroo video chat app.

“You can give and receive pleasure from a partnered toy,” the product description says.

As of last year, IMbesharam.com had sold 130 units. The entire set of Kiiroo costs upwards of Rs 50,000.

There are other WiFi-enabled sex toys manufactured in Europe and the US that seem to be the next big thing in the love industry.

Lovetreats’ two most popular products across markets are the Angelo (made by Fun Factory, Germany) and glow-in-the-dark condoms. Angelo’s is an interesting story. The seven-speed sex toy was being discontinued by Fun Factory, but is now manufactured only for the Indian market because the customer base keeps asking for more.

Also read: India readies for IoT in sex

Dearth of funding

But despite the numerous players in the space, funding amounts haven’t been significant. Most investments in the space have been undisclosed and smaller seed amounts. Also, larger investment firms and fund houses seem to be shying away from placing their bets in the space.

“Due to the cultural taboo factor and ambiguous legal issues, investors in India hesitate to enter into this industry. This is despite dynamics such as 100 percent year-on-year growth and operating margins of over 35 percent. The dearth of funding also makes it difficult to sustain and grow a business in such a restricted market,” Divya says. Her ItspleasZure is winding down operations soon; Divya only cites personal reasons for the decision.

The lack of sex-positive education and awareness is one of the biggest challenges sexual wellness companies face in the Indian market. Divya says the industry looks really lucrative in India but there are lot of challenges.

The taboo factor

There is demand is there, supply can be arranged, but certain legal restrictions on distribution, marketing, and sales of these products hinder the growth. The three key challenges startups in this space face are legal restrictions, constraints on sales and marketing channels, and the “taboo” factor. These restrictions make it difficult to mass market these products and to reach offline consumers, thus restricting market growth.

There are two main regulatory laws for this industry. Section 292 prohibits promotion or display of anything that can be considered obscene – making it very objective and putting things in a grey area.

Samir Saraiya, Founder, Thatspersonal, seems to agree. Thatspersonal, started in 2013, is one of the few early-stage companies in the space. “When I first started, I consulted my friend, who also is the Co-founder and a legal expert, Lekhesh Dholakia. All our products come from the right sources and means. We have every single certification in place, to ensure there are no legalities or issues around that,” Samir says.

Understanding the market

He adds that the word obscenity has no clear definition. “What is obscene for one person may not be obscene for another,” he says. The law against the unnatural representation of women also comes in, and Samir says that nowhere on their website or in their communications do they depict women in obscene way.

Section 377, which pertains to unnatural sex, can be interpreted differently by authorities and can lead to lot of challenges for businesses.

Bala says: “We are often asked even by our customers if sex toys are legal in India. All products we sell are 100 percent legal; we get each and every product approved and cleared by an experienced legal team before we place orders with our suppliers in Europe. India has certain laws governing ‘obscenity’ so as a premium retailer in India, we have to be naturally aware of the culture we are living in and be respectful of it.”

He states his firm is careful about two things: “Ensuring that our products do not look obscene and making sure we don't present and sell the products in any kind of exploitative or offensive manner.”

Raj Armani, an NRI Businessman and the founder of one of India’s premier ecommerce sites for adult products, IMbesharam, has shared a customs hassle earlier with YourStory.

Clearly, across the world, sex toys may have come out of the closet - at least from whispers to a conversation - but in India, we still tend to be puritanical and prudish. The market for sexual wellness clearly exists, but when will the tide turn for startups in the space?