From smart devices to AI and ML, technology is powering a hassle-free banking experience of the future

Till a few years ago, banking felt more like a chore than anything else. It was something we all partook in for the sake of getting things done. But today is the age of the customer, and they are calling all the shots.

Technology is transforming virtually every imaginable business landscape out there and the Indian banking sector is no exception. The once traditional, process-intensive, and not-so-customer-centric banking sector is undergoing rapid change through holistic transformation initiatives to retain their competitive edge by offering customers truly intuitive and personalized digital banking experiences. KPMG’s report on India Trends 2018 – Trends Shaping Digital India highlights mobile-first consumption as a key factor for digital payments going mainstream.

User journeys – augmented by smart consumers and smart devices

In the current scenario, two factors that are driving the latest wave of fintech innovation are well-informed tech-savvy consumers and smart devices. Both these factors have one agenda in common – simplified and convenient user journeys.

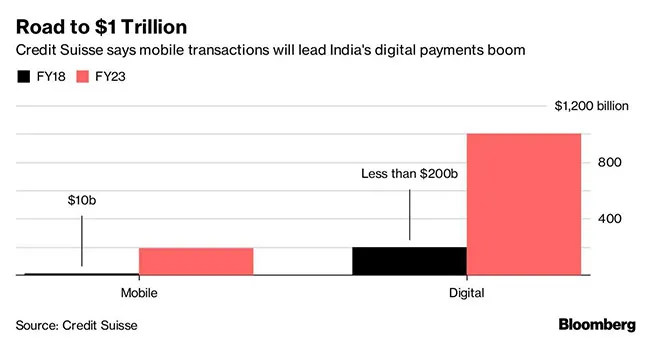

So, a bank can no longer expect its customers to come to them; instead, it must go to the customer, or else some other bank will. There is no dearth of competitors out there waiting to usurp the incumbents. Credit Suisse stated that by 2023, digital payments in India will reach $1 trillion, so the potential here is huge.

Today, it’s possible to do virtually every single banking operation right out of the palm of one’s hand from a smartphone/tablet, be it a fund transfer, raising a service request, interacting with a relationship manager, and so much more. Not just that – the advancements in digital technologies have made it possible to create omni-channel experiences that are seamless and unified across all touch points, much to the delight of both the customer and bank staff.

Digital technologies are transforming the very nature of banking

With banks aggressively adopting Artificial Intelligence (AI), Machine Learning (ML), blockchain technologies, and so much more, the banking experience is all set to change to one that is personalized, simplified, quick, and convenient for everyone. For instance, Canara Bank’s fully digital banking branch, CANDI, makes it possible for customers to open a new account in under seven minutes. When the customer walks out, they have a fully active account with mobile and Internet banking services activated and they even get a personalized debit card.

However, it’s not all highs without any troughs. Deep integration with digital technologies leaves behind a significant digital footprint. With trends like open banking/API-based banking and several third-party payment service providers bursting onto the scene, customer data is being handled and processed by several parties. So, it is of paramount importance that while banks extend the privileges of digital solutions to their customers, they should also make them aware of the risks. For example, incidents in India like the security breach that affected over 3.2 million debit card users in 2016 and 10,000 credit cards at PNB in 2018 are clear indicators that banks should ensure accountability for the security of data from their side and offer their customers biometric authentication (fingerprint, IRIS scan, voice recognition etc.),

OTPs, multi-level encryption, and other safety features are also constantly being upgraded to address the changing times.

In conclusion, the widespread proliferation of the latest technologies into the banking sector is inevitable. In the coming years, innovation will take place at a rate that would sweep us off our feet, and while this happens, it is absolutely critical that we stay grounded to the realities such as data security, fraud, and other imminent dangers that are lurking around.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)