Sell online, make profits! But remember – “conditions applied”

In today’s growing e-commerce space, marketplace and seller relationships are such that they are busy listing products to drive sales. But selling online is not just about listing products and waiting for orders. It’s about selling and making money – not just for the marketplace but also the seller. But the question here is, “Are the sellers really making money?”

Often we hear about seller frauds and scams in terms of SLA breaches, poor quality products, selling counterfeit merchandise, wrong product delivery, and many more such cases. However, how many times have we heard about marketplace fraud? By “fraud”, we mean terms or clauses that marketplaces generally hide from sellers, either intentionally or unintentionally.

To voice some of these issues faced by the brands selling online, Harsh Shah (Co-founder of Fynd) hosted a webinar on Fynd Voices. Joining us were Ishwar Seth (Business Head, Setu Etail), distributor of some of the largest brands in the country, Akhil Mevada (Growth Hacker, Fibre2Fashion), incubator of some of the youngest brands, and Prabhkiran Singh (Co-Founder, Bewakoof.com), one of the fastest growing online-only quirky fashion and lifestyle brands.

The intention behind picking up this topic was not to point fingers at anyone but to simply spread awareness and educate sellers about the best (and worst) practices so that they can take a more informed decision when selling online.

Over the last 10-15 years, online retail has grown exponentially in India. It is a great channel for anyone to start selling online and grow their business. However, there are certain hidden things that go unnoticed in this commotion of online retailing which need to be addressed.

As a part of any marketplace on-boarding process, a seller signs an agreement with the marketplace, lists the products, waits to get visibility, and in-turn generates sales. Pretty straightforward right? However, there are often things in the fine print sellers might miss. Wondering what they are?

Commission structure

Today one can sell online via various business models – SOR (sales or return), OR (outright), marketplace model, through distributors, sell directly, omni-channel, and many more ways. But the key is to understand various commission structures for each of these models as they are not very evident in the agreement.

In general, commissions vary from a marketplace to another, and so does their structure. There are two components in the commission – fixed fee and percentage of sales.

- Fixed fee components: These components include a fixed closing fee, listing fee, tech fee, packaging fee, cataloguing fee, delivery fee, etc., which a seller needs to pay over and above the commission, and most of these are non-negotiable. Ishwar Seth gives an example, “Amazon charges a fixed tech fee for the seller flex programme.”

- Percentage-of-sales component: These comprise of commission percentage, marketing cost, payment gateway charge, cash handling fee, etc. These components may or may not be negotiable but have a huge impact on the product costing. Akhil Mevada of Fibre2Fashion says, “Flipkart and Paytm charge 2.7 percent of the payment value while Amazon charges flat value starting from Rs 5-20, depending on the selling price of the product.”

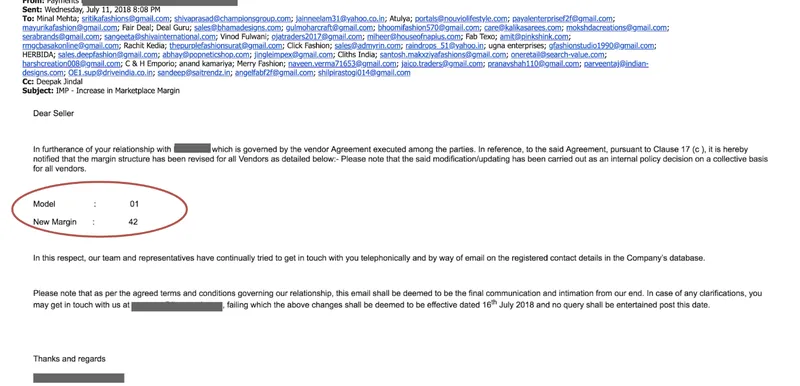

When these charges are added, the overall commission goes up to 40–42 percent. But wait! Returns, RTOs (Return to Origin), and penalty charges are not accounted for. RTO is the packed product which is not accepted.

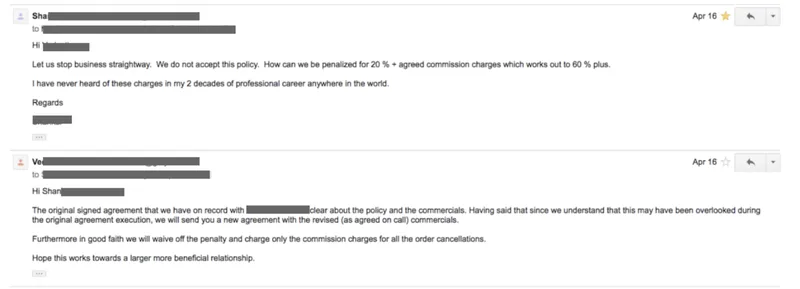

So in total, the commission charged can range from anywhere from 40 percent to as high as 60 percent. Hence, as a seller, it becomes important to consider these charges in their costing as per their ASP (Average Selling Price).

For a brand with high ASP, these fixed costs may not have an impact, but for a mass market brand which is competitively priced, it is difficult to incorporate marketplace commission in their pricing. This is one of the reasons brands like Zara and H&M do not sell on any other channel apart from their own website. Everywhere else, it becomes more expensive and less profitable for them to sell.

As Prabhkiran Singh puts it, “At Bewakoof, we have consciously made the decision to not sell on other marketplaces so that we can provide maximum price benefit to the customer.”

Penalties

Penalties are other costs that are not highlighted by the marketplaces during the time of on-boarding. Sellers start noticing these charges once they start selling. Some of these charges that the panellists highlighted were SLA (service-level agreement) breach, RTO (Return to Origin), cancellation charges, and marketing recovery charges. SLA and RTO charges are the most biased of all.

SLA (service-level agreement) breach

Since marketplaces have to maintain a basic hygiene with regards to delivery timelines, a brand is charged a flat cost when a seller does not confirm, pack, or ship a product in a given timeline. These timelines vary from portal to portal, but in general, it is 12-24 hrs. This is completely fine when an adherence needs to be maintained. The disconnect happens in cases when a product is confirmed and packed on time by the seller, but there is a delay in delivery pickup by the marketplace. Even if the product is picked on time, the logistic partners do not update the status on their system immediately, which hampers the timeline.

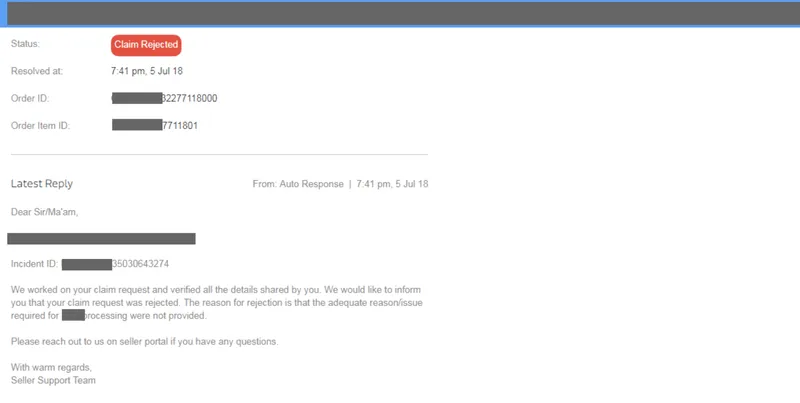

It is still considered as an SLA breach at the seller’s end and a penalty is charged. In such cases, a seller needs to have a solid proof of these instances to claim refunds. But again, the claim may or may not be approved by the marketplace.

RTO (Return to Origin)

RTO is a return state when a customer has not even opened the packaging and refused to accept the order. This event arises due to non-genuine customers acquired by the marketplace. Ideally, sellers should not be charged for an RTO as they have no control over the customers. Yet, marketplaces grant a fancy term to RTO and charge the seller. These account for 50 percent and penalties are charged ranging from the entire marketing fees, or reverse logistics ranging to 1.25x the forward shipping.

Accounting and settlement

Sellers receive multiple reports from various portals which include sales report, settlement reports, and commission invoice report. But most of the time the reports shared are not consistent.

For example, in a 7–10 days settlement cycle, if a product is delivered towards the end of the month, then the payment is not made in the same month but moves to the next month. This is because the payment is done on order delivered status. Hence, for orders that were delivered in the last week of a month, the payment would come in the next month’s cycle. So the invoicing is done on the dispatch date and settlement is done on the delivered date. Hence, tallying payments for an “order-id” against the “transaction-id” is very challenging.

It then takes a lot of time and effort for sellers to tally the sales against the settlement for multiple marketplaces. This is mostly because of lack of clarity in understanding what is being delivered to the customer and what is being returned. Brands then have to invest heavily in accounting software and processes, which is an additional cost to them.

As and when there is a mismatch in the accounting, they need to raise tickets. But the resolution takes a lot of time which, in turn, is a costly affair.

Akhil Mevada adds, “There are companies who are earning money through their reconciliation services only. This is a huge business now.”

Tax filing

Mismatch in invoice date and settlement date makes tax filing very difficult as the new GST regulation states that both seller’s and marketplace’s GST filing should match up to two decimal points. A key question that arises here for a seller is, “Should they be filing taxes on ‘dispatch date’ or the ‘delivery date’”? In the case of Setu Etail, to avoid any mismatch in the GST date and TDS date, they file the taxes based on what is filed by the marketplace, which is essentially on the “delivered date” of the order.

Visibility and marketing costs

Apart from the above-mentioned commission and fixed costs, sellers also need to keep a marketing budget to get some visibility on a portal. Marketplaces offer various properties on their portal such as banner, collection page, feed page, notifications, social media push, etc. But each of these properties comes with a huge cost which many sellers cannot afford due to their thin margins.

Now, the catch here is that marketplaces will provide the option to choose from these properties, but will never give a sales commitment. Once a seller chooses a plan, they straight away deduct the marketing amount from the payment. Later, nothing is in the seller’s control, even if sales are not achieved as per the portal’s “verbal” commitment. In fact, in all likelihood, a seller makes a loss when such costs are factored in.

Hence, as a brand, it is important to understand the purpose of the campaign, and whether you are looking at a short-term spike or a long-term brand building activity. For a short-term plan, one needs to look at the boost in sales, and for the latter, they need to back-calculate the visibility, impression, and ROI before spending money on marketing.

Akhil Mevada says, “As a new brand, one must not expect immediate results or positive ROI for at least the initial six months on any portal for any marketing spend.”

Discount

Running discounts on marketplaces is a perennial phenomenon and is going to stay forever due to the nature of discount-seeking online customers and cash-rich competing e-commerce companies in India. Unfortunately, even for sellers, this is the best way to liquidate stock or gain customers. But to stay competitive, sellers have to sacrifice on their margin in order to build in all the penalties, commissions, marketing costs, fixed costs, etc. in their costing and then offer a great discount.

Harsh Shah from Fynd asks, “So essentially, if a seller is paying for the discount, logistics, marketing, penalties, returns, RTOs, and what not, then what are the marketplaces doing?” Ishwar Seth of Setu Etail has a reply, “That is true but online portals are just helping us to liquidate stock which brands were not able to sell on full price.”

However, for many brands and aggregators like Fibre2Fashion, discounting is a great tool to merchandise their products at the right price to maximise sales. Brands who do not wish to spend much on marketing can use psychological pricing strategy by keeping price points at “499” and “999”. Not only this, “999” works as a magic number to take the GST slab benefits for certain categories, i.e, goods below Rs 1,000 fall under 5 percent GST slab and ones priced above that fall into 12 percent slab.

Customer data intelligence

Having visibility to customer data is very important especially for retail brands and growing brands. Intelligence such as best performing region, customers that resonate best with the brand, age group, etc. helps them take a strategic decision in order to open up new physical stores or close existing stores.

Sellers receive the geographical data of the customer only in the marketplace model, where they raise the shipment challan. But in case of OR and SOR models, a seller hardly gets any visibility on customer data. Marketplaces do not share customer profiles directly but one can definitely seek inputs regarding designs, colours, sizes, and styles that are selling well for their new range of development. Hence, this becomes a crucial factor when deciding to work on a marketplace or SOR/OR model.

Key takeaways for sellers

Considering the various challenges faced by sellers, a few things that can help them take a more informed decision and sell effectively are:

- Read the agreement thoroughly. It is important for the sellers to read the fine print when it comes to association with marketplaces. Fees go unnoticed unless they are charged. Often, out of lack of understanding or lack of communication, the sellers feel that the marketplaces are charging hidden costs which were not conveyed before.

- Understand the tax calculation well. Often the sellers are unaware of GST tax percentages – like, if it is 5 percent or 18 percent accountable on the marketplace commission – and panic when they receive less payout.

- Be aware of the various fees charged by the marketplaces such as fixed fees, SLA charges, shipping fees, penalties, business support fees, closing fees, packaging fees, etc.

- Build all types of charges in the product costing.

- File taxes consciously considering the dates which have been filed by the marketplace.

- Invest time and effort in reconciliation as the data shared by marketplaces might not be accurate.

- While investing in marketing campaigns, keep the goals and ROI in mind.

- Decide on the online business model depending upon your customer data requirement, and seek any data that you may need from the marketplace.

- Strategically price products to gain maximum traction.

Key takeaways for market places

- Create a right ecosystem by educating the sellers about various areas of online selling.

- Extend support in understanding right warehousing practices, which includes conducting QCs and handling shipments within the stipulated SLAs.

- Improve TAT (turnaround time) for resolving seller queries with regards to listing, reimbursement, settlement, returns, etc.

- Be more transparent and stop looking at penalties as an additional source of revenue.

It’s important to remember, ultimately, that marketplaces and sellers cannot exist in isolation. Both need to be transparent and ethical while doing business in order to grow in this volatile market.

Harsh Shah is Co-founder of Fynd, India’s largest fashion O2O company.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)