These six startups turned operationally profitable in FY18

After having spent a considerable time investing and building the business, a positive EBITDA is a strong boost for startups.

Cash burn is an important yardstick to measure the health of young and growing startups. While a low cash burn and higher growth is positive news for both investors and entrepreneurs, a higher cash burn with normal revenue gives out the wrong signals.

In this context, EBITDA (earnings before interest tax depreciation and amortisation) is an accurate indicator of the financial health of any company. For startups, becoming EBITDA positive (i.e. profitable at the operational level) has become a crucial milestone.

In fact, even the biggest, most-funded startups sometimes struggle to become operationally profitable. In fact, as per media reports, two poster boys of the Indian startup ecosystem – Flipkart and Paytm (through parent company One97 Communications) have shown an increase of 68 percent and 80 percent in losses, respectively for FY 2018.

YourStory put together a list of some startups that announced that they have achieved positive EBITDA this year. There may well be others that are operationally profitable but haven’t announced it yet or are yet to complete their regulatory filings that reflect this development.

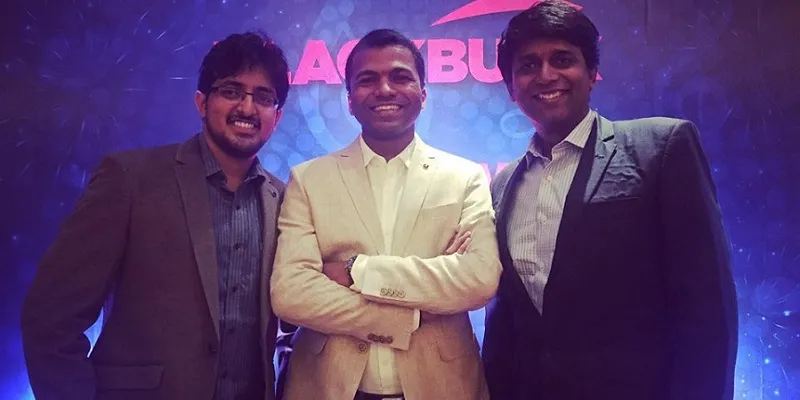

BlackBuck

The Tiger Global and Accel Partners-backed logistics startup recently told The Economic Times that it reached operational break-even in FY17. The company was founded by Chanakya Hridaya, Ramasubramaniam B and Rajesh Yabaji in April 2015.

While the company’s revenue grew 7x in FY 2017 to Rs 566 crore (vs Rs 81 crore in FY 2016), its losses widened to Rs 86 crore during the same period (vs Rs 16.5 crore in the previous fiscal). The operational breakeven was driven by strong unit economics and strong customer (shippers and carriers) confidence, the company said in a statement.

BlackBuck is able to leverage macroeconomic factors such as GST and its downstream effects in the logistics industry that is likely to show its impact on its revenue in FY18.

Zoomcar

Bengaluru-based self-drive vehicle rental company Zoomcar said in January this year that it had turned EBITDA-profitable in December 2017. The company was founded in 2013 by David Back and Greg Moran.

Zoomcar’s EBITDA profitability was primarily bolstered by rapid new vehicle supply growth through its ZAP (Zoomcar Associate Programme) marketplace. ZAP is a new subscription model, which allows users to subscribe to a car on a monthly basis.

Buoyed by its performance, the startup said it plans to enter new markets like Southeast Asia and Africa in the next two years. Zoomcar’s revenues grew over 40 percent in FY 2017 to Rs 121.2 crore, while its losses shrank marginally to Rs 100.4 crore. The revenue in the previous fiscal was Rs 89.82 crore and the loss for the same year was Rs 101.4 crore.

Zoomcar, in collaboration with Mahindra & Mahindra, also recently launched a fleet of electric vehicles. Co-founder and CEO Greg Moran had earlier told YourStory, “We entered the electric vehicles space because it was a better way for last-mile connectivity. Most electric cars are small and compact, they are easy to manoeuvre, operate and running costs are much cheaper.”

Ecom Express

This Delhi-based logistics startup had claimed it had become operationally profitable in FY 2018. The company also said it recorded 40 percent growth in revenues during the same period and expanded its delivery network by 50 percent that year (the company is yet to file its financial statements for FY18 with the Ministry of Corporate Affairs). Ecom Express had registered revenues of Rs 493 crore in FY17, while losses had fallen by 24 percent to Rs 72 crore that year. Ecom Express was founded in 2012 by TA Krishnan, Manju Dhawan, K Satyanarayana and Sanjeev Saxena.

Voonik

Online fashion platform Voonik, founded by Sujayath Ali and Navaneetha Krishnan in 2013, achieved EBITDA profitability on monthly sales earlier this year.

On January 3, 2018, Sujayath Ali, CEO of Voonik, tweeted: “Excited to share that Voonik has achieved EBITDA profitability at monthly level. No more Burn.”

The startup is also slowly expanding its brick and mortar presence. Voonik operates four ‘kurti’ stores in Bengaluru. The company clocked revenues of Rs 117 crore in FY17, up from Rs 17.8 crore the previous financial year. Its losses widened to Rs 130 crore in FY17 from Rs 84 crore in the previous fiscal.

FabAlley

FabAlley, an online fashion brand, completed FY18 with EBITDA-level profitability, riding on the back of its aggressive offline expansion.

The company said it had turned EBITDA-positive in the last three quarters of FY18 and expects to be operationally positive over the course of the next 12 months.

Noida-based High Street Essentials Pvt Ltd owns and operates two women’s fashion brands FabAlley and Indya, and has also begun opening physical stores.

The Delhi-based company is yet to file its annual financial statements for FY18 with the MCA. FabAlley was started in 2012 by Tanvi Malik and Shivani Poddar.

Zomato

Foodtech unicorn Zomato announced that it had become profitable in a blogpost on September 18, 2017. Deepinder Goyal, founder and CEO, wrote in the blog, “Yes, throughout the 24 countries where we operate, and across all our businesses, we are starting to make money. Our core advertising business in India, Southeast Asia, and the Middle East – the three key regions for us, is generating enough cash to cover for the millions of dollars of investments we are making into the rest of the regions, and our new businesses (like online food ordering, table reservations, Zomato Gold, Zomato Base, etc).”

Zomato saw its revenue increase by 80 percent in FY17 to $49 million. The company shut operations in nine countries in 2016, managing the markets from India, even as it tried to cut costs. Zomato posted a revenue of Rs 399 crore in the year ended March 31, 2017, even as its net loss fell to Rs 389 crore, down from Rs 590 crore in the previous year.

In a recent earnings call, InfoEdge’s CFO Chintan Thakkar had said, “The trend has been that Zomato has been burning less and less, so it has been on a growth trajectory.” InfoEdge India Ltd is an investor in Zomato. The home-grown startup also attained unicorn status in the last month of FY 2018 and also hit the $100 million revenue run rate mark. Zomato was founded in 2008 by Deepinder Goyal and Pankaj Chaddah.