[2 years of demonetisation] 5 trends that defined India’s digital payments industry since

In one stroke two years ago, PM Narendra Modi changed the fate of the digital payments industry of the country through demonetisation.

Two years ago, Prime Minister Narendra Modi put the entire nation in a frenzy. In one stroke, the government made Rs 500 and Rs 1,000 denomination notes invalid, leaving the country of 1.3 billion in a limbo.

As citizens queued up outside banks to deposit old currency notes in exchange for new ones, the digital payments ecosystem saw a huge opportunity open up. Right after the prime minister announced the ban on high-value currency notes, experts told YourStory that digital payments in the country will rise sharply and could easily double over the next couple of months.

And they did!

Two years later, the Reserve Bank of India (RBI) in its annual report said all payment and settlement systems - NEFT, IMPS, UPI, NACH, card payments, Electronic Clearing Systems as well as Forex and market clearing systems – have seen a 44.6 percent increase in volume in 2017-18 and an 11.9 percent increase in the value of funds transferred.

In the annual report, RBI also said that during the financial year 2016-17, the volume of transactions through digital payment systems witnessed a 56 percent increase, with the value of funds increasing by 24.8 percent.

Transactions across the digital retail payment infrastructure, which includes card payments, UPI and others increased to 92.6 percent in 2017-18, up from 88.9 percent in the previous year. [Report here]

The RBI also said the share of paper-based clearing instruments reduced from 11.1 percent in 2016-17 to 7.4 percent in 2017-18, showing a strong trend in favour of digital payments.

Growth of debit cards stalled after Demonetisation

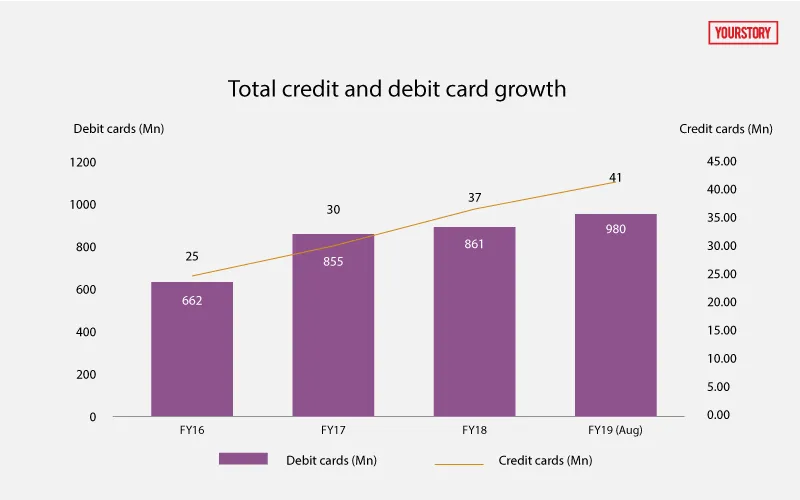

From FY16 to FY17, the total number of credit and debit cards grew by almost 29 percent, but this trend didn’t quite sustain in the next financial year. Card growth fell sharply in FY18, growing at 1.5 percent, with total physical cards in the country standing at almost 900 million.

This can be attributed to the slow growth of debit cards post demonetisation, which showed less than 1 percent growth between FY17 and FY18. Credit cards maintained an average 20 percent increase year-on-year.

Debit card growth in the country is now back on track, having grown 13.6 percent as of August this financial year. As of August 2018, there were a total of 1.02 billion credit and debit cards in the country.

Acceptance of digital infrastructure

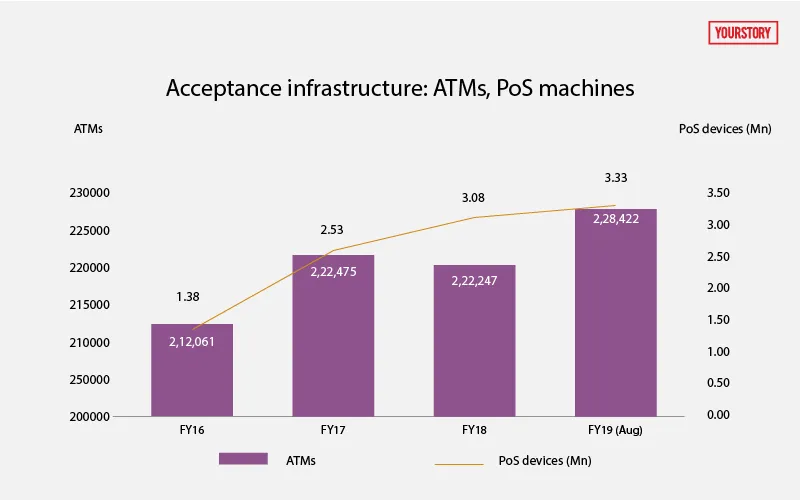

Acceptance of digital infrastructure has grown since demonetisation with the number of Point of Sale (POS) terminals increasing by 24 percent from 2.53 million in 2016-17 to 3.08 million in 2017-18, according to the RBI. During the same period, the number of ATMs deployed by banks witnessed a marginal decline from 222,475 to 222,247.

The digital infrastructure still needs to expand as currently, for a total 1.02 billion credit and debit cards in the country, there are only 3.3 million PoS devices and only 228,422 ATMs.

That means for every 309 million cards in the country there is one PoS machine available as an acceptance point.

UPI – the real winner

When it comes to digital payments, Unified Payments Interface has been the real winner.

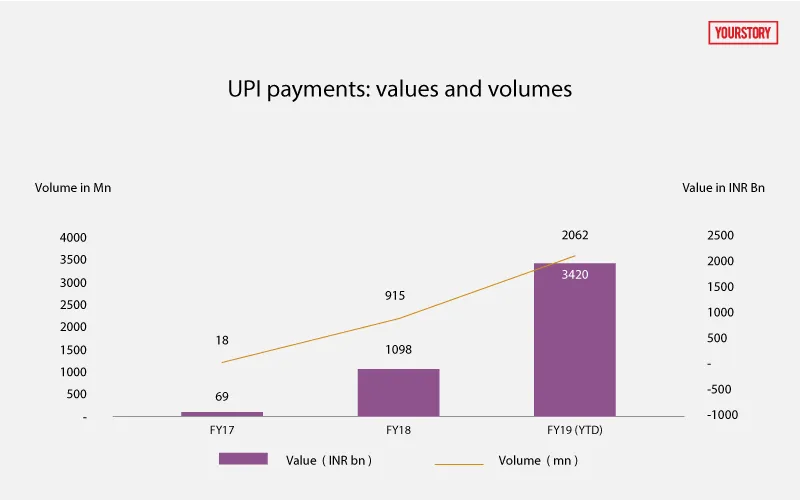

Despite Prime Minister Narendra Modi pushing digital payments app BHIM which runs on the UPI infrastructure, the total volume of UPI payments stood at 17.9 million in FY17. And the value of funds transferred for the same period, stood at Rs 6,900 crore, according to the RBI.

In 2017-18, after the adoption of UPI by private players like Google, Paytm and others, the total number of transactions skyrocketed by more than 5,000 percent. In FY18, the total number of UPI transactions stood at 915.2 million and total funds transferred on the service stood at Rs 1.09 lakh crore.

Within eight months of this year, according to data from National Payments Corporation of India (NPCI), UPI transactions in the country have already crossed the 2 billion mark with a total Rs 3.42 lakh crore being transferred.

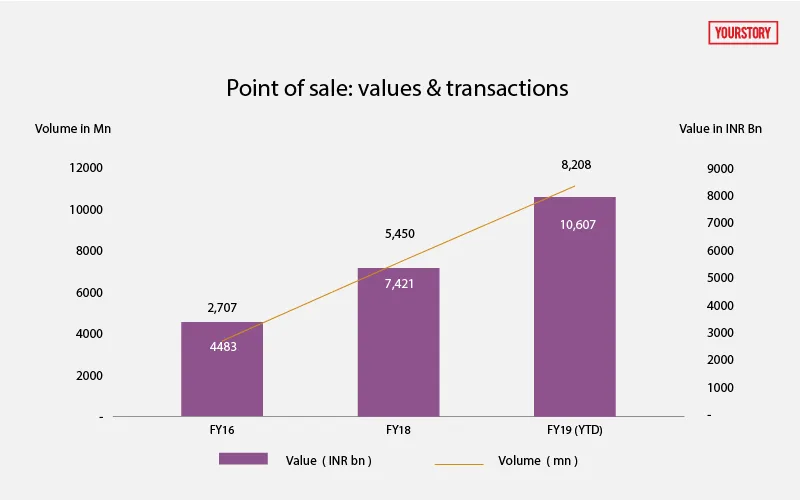

Purchases through physical cards

According to RBI data, credit and debit card transactions on PoS devices doubled between FY16 and FY17. The total number of card transactions in the country stood at 5.4 billion in FY17, up from 2.7 billion transactions in FY16.

This means that more people made purchases using their cards.

In FY18, however, this growth rate slowed down. Nonetheless, the upward trend continued as card payments on PoS devices were up by 50 percent, with total volume of transactions at 8.2 billion.

Further, even the average ticket size transacted on PoS devices has come down. Average transaction stood at Rs 1,361 for FY17 from Rs 1,666 in FY16. In FY18, the average ticket size of purchases made through PoS devices stood at Rs 1,292.

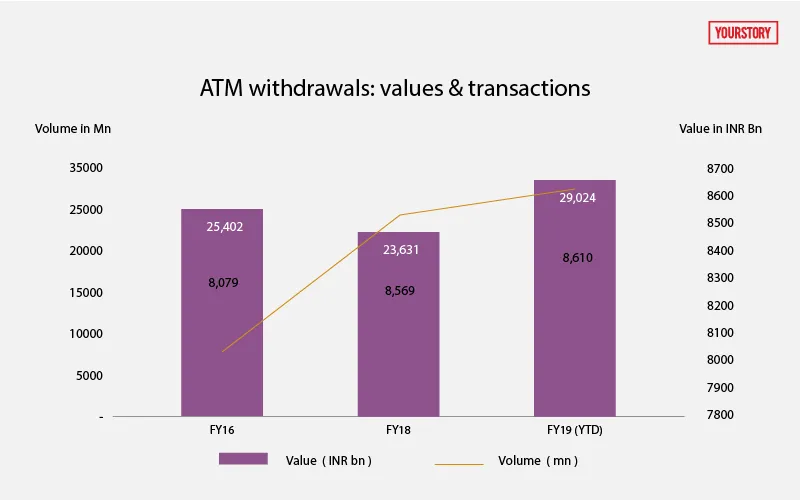

Curb on withdrawals does show in numbers

The Modi government’s decision to curb withdrawal to Rs 2,000 a day post demonetisation also reflected in the total value of cash withdrawn in FY17. The total value of cash withdrawn from ATMs stood at Rs 23.63 lakh crore in FY17, down 6 percent from Rs 25 lakh crore in FY16. Simultaneously, the total cash withdrawal transactions grew by 6 percent between FY16 and FY17.

As of FY18, there isn’t much change in the number of cash withdrawals when compared to the last fiscal. However, the value of cash withdrawn from ATMs has grown by 22 percent in FY18 when compared with the last fiscal last year, and stood at Rs 2.9 lakh crore for the year.

![[2 years of demonetisation] 5 trends that defined India’s digital payments industry since](https://images.yourstory.com/cs/wordpress/2017/11/Feature-Image-3.jpg?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)