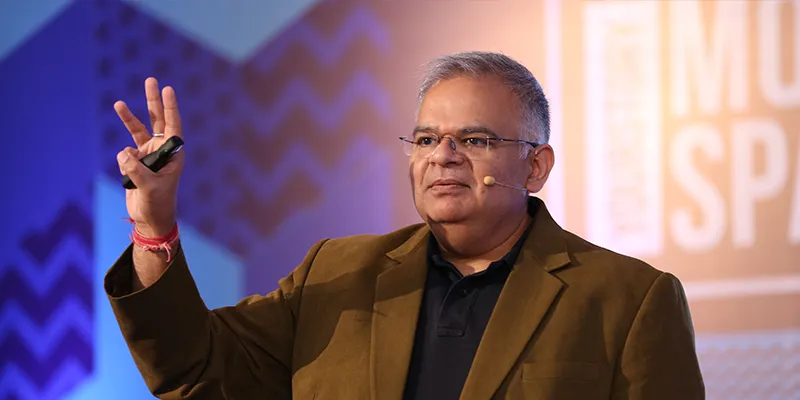

Intuit Circles wants to help the Indian startup ecosystem prosper: Sanket Atal, MD, Intuit India

In conversation with YourStory, Sanket Atal, Managing Director of Intuit India, talks about why financial literacy is integral to startup success and why every entrepreneur should be a part of Intuit Circles.

Keen to help the Indian startup ecosystem grow, Intuit announced Intuit Circles, a new programme to enable entrepreneurial success by enhancing financial literacy and developer partnerships for startups across India.

Intuit will bring together various stakeholders such as investors, co-working spaces, incubators, accountants, and more to help startups and entrepreneurs get ahead. It aims to do this in a two-pronged manner – by helping startups with financial management and using startup innovations to solve customer problems. The business and financial software company will also provide an introduction to QuickBooks ProAdvisors, and connect startups with an accountant to keep them on track.

Sanket Atal, Managing Director of Intuit India, believes financial literacy skills are integral to entrepreneurial success. “Without proper guidance or support, startups may find it challenging to make the right decisions to fuel their own success. To alleviate this, we are pleased to collaborate with various stakeholders in the ecosystem to bring us one step further in our efforts to make a positive impact on the Indian startup community.”

Startups that fit the profile will learn about their financial standing and get insights through live events and training sessions. They will get a free nine-month subscription of QuickBooks Online (QBO) and receive a 50 percent discount on the subscription of QBO for the next year. Intuit is partnering with several other companies for this programme.

In a conversation with YourStory, Sanket Atal talks about the importance of financial literacy for the success of a startup. Edited excerpts of the interview:

YourStory: You have worked with MakeMyTrip, a startup, and Oracle, a corporate. How was the experience?

Sanket Atal: I was with Oracle from 1997 to 2010 and then moved to another corporate, CN Technologies, before joining MakeMyTrip in 2012. The MMT experience was great. It was tough to call it a startup at that point in time; it was already public and worth more than a billion dollars. The task of being a CTO and guiding it through the basic architecture of technology, to be able to scale heights was an amazing experience. It was two years of no sleep. But working with people in five countries was great. I had to leave them since I needed to move back to Bengaluru.

YS: From Oracle to Intuit, tell us about the journey.

SA: I spent a long time with Oracle and it had a hard-core engineering system. Intuit is driven by its mission. It has a set of values and truly lives by them; that's something that aligns with my personal values. I never found a single person who was negative about Intuit and that's when I thought that they must be doing something interesting.

People said my personal culture would gel really well with Intuit, which is all about respect, value, and doing the right thing.

YS: What is Intuit Circles all about? How would you convince an entrepreneur to use Intuit Circles?

SA: I have been dealing with startups for quite some time now - three to four years. I have done a lot of research and have personally interviewed more than a thousand startups. Majority of startups fail within the first three to four years; most failures are due to financial mismanagement - for not doing what needs to be done. Many don’t keep track of financial records, of money coming in and going out. So when they go for a loan, they might not have all the details; similarly, when they think they have money, they might not.

The term Circles came from friend circles. We want to be there for startups, to help them be prosperous. Circles will introduce the basics of financial literacy to startups. We provide them with our financial management system, QBO, for nine months. We will also connect them with an accountant, who can guide the startups towards financial stability.

The second problem most startups face is that after building the product, they can't sell it. QuickBooks has millions of customers worldwide; we also have a platform that is very easy to use and lets one develop an application on the top of the financial management system.

Startups need to come up with a product that can be on the platform. The app and the millions of people on the platform give startups a good opportunity to sell their products. The combination of these two approaches, in connection with the advisor accountants, is Intuit Circles.

YS: Do you think startups would be willing to share confidential details with these accountants?

SA: We never look into our client's data. Companies are already dealing with accountants. More than security, startups are concerned with the right thing to do with their financial data and maintaining for easy accessibility and analysis.

We do a lot of market research; we observe these startups, their functioning, and speak to them. They don't have issues sharing details. At the end of the month, they hand over a stack of invoices to the accountant.

YS: What do you mean by financial literacy and how do you plan to financially educate startups?

SA: Our goal is not to make them accountants; it is to teach them the basics in a few hours so they can practice the right principles to manage their finances. The training will be in different formats - we will personally talk to them, recorded snippets will be available, there will be online tutorials and webinars, and they can ask questions that we will answer.

YS: What is your revenue model going to be like?

SA: Our focus is not revenue; it is the prosperity of startups. It’s important that startups follow the right path to have higher probability for business success. Then, when they look at this behaviour, they should consider us for their financial prosperity. Intuit Circles is not about revenue; we want to do something for the ecosystem.