Beyond Flipkart, acquisitions in 2018 favoured fintech and financial services startups

Walmart’s acquisition of Flipkart may have dominated headlines in 2018, but the fintech and financial services sectors took centre stage with 20 M&A deals between them. Read on for a list of some of the most notable deals of the year.

Deloitte's annual study of M&A activity may list technology acquisitions as the number one driver of M&As in the US in 2018, but fintech and financial services were the driving force of the Indian startup ecosystem. The number of deals touched 199 in 2018 up from 170 M&As in 2017, indicating a vibrant and healthy startup ecosystem. The top 10 M&A deals in 2018 were worth to $16.6 billion, up by 277 percent (and dominated by Flipkart), compared to $4.4 billion transacted in 2017.

While networking behemoth Cisco led the list of top 10 acquirers last year, the anchor this year was US-based retail giant Walmart, which acquired 77 percent stake in home-grown Flipkart for a whopping $16 billion.

A countermove from rival Amazon India came when it partnered with PE firm Samara Capital to acquire a majority stake in supermarket chain More, the fourth-largest supermarket chain in the country.

Amazon India also beefed up its digital payments push by acquiring all-in-one aggregator app Tapzo, reportedly for $30 million-$40 million.

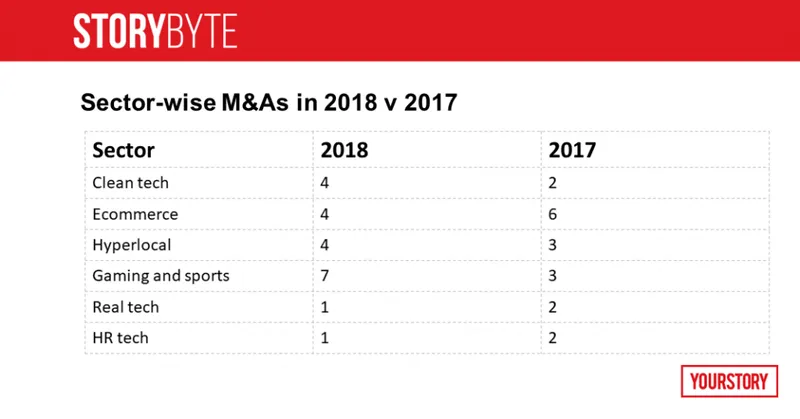

Sector-wise segregation of M&As in 2018

While M&A deals among startups spanned sectors, a good chunk of the deals were in the fintech, financial services, foodtech and healthtech sectors.

Fintech emerged as the sector of choice this year among investors. The sector saw 12 M&A deals in 2018 (vs 11 in 2017), including the likes of MobiKwik (acquired ClearFunds), Capital Float (acquired Walnut), Paytm (acquired Balance Tech, TicketNew, Cube 26), PhonePe (Zopper Retail) and others. Multi-bank payments app Chillr was acquired by the Sweden-based TrueCaller in June to begin lending operations.

The financial services sector saw eight deals in 2018, including Digital Insurance’s acquisition of ITI Reinsurance and Svatanra Microfinance’s acquisition of Micro Housing Finance Corporation Limited. In 2017, this segment saw only three deals.

Notable acquisitions in 2018

A major acquisition this year was of HR startup Mettl by global HR player Mercer. The deal closed at approximately Rs 300 crore, which is 7x the $4.2 million-$4.8 million (about Rs 33 crore, depending on what conversion rate you apply) that the startup raised in equity funding over the years. The exit is also one of the first successful ones for a SaaS business from India. For early investor Blume Ventures, the aggregated returns (seed and pro rata in the Series A round) is 7x the investment they made.

Foodtech gobbled plenty

Foodtech saw 11 M&A deals in 2018, the same as 2017. This year, the most high-profile ones included Tonguestun for $18 million to enter the B2B foodtech space. Later in the year, Zomato bet big on drone deliveries – still some way off given that India’s drone policy is yet to be finalised – and acquired Lucknow-based drone delivery startup TechEagle.

Rival FoodPanda, owned by Ola (ANI Technologies) took a different route and acquired the Mumbai-based Holachef, which had suspended operations for months, in a bid to enter the cloud kitchen space.

Foodtech heavyweight Swiggy, which raised the most amount of funding by any startup this year ($1.3 billion) spent $8 million to acquire Mumbai-based on-demand delivery firm Scootsy in an all-cash deal. Earlier in the year, it had acquired milk delivery startup SuprDaily, also based in Mumbai.

Health, Edtech, AI, IoT all raring to go

The somewhat broad sector involving Healthcare, Healthtech and Fitness also saw 11 deals, the same as in 2017. Three deals involved fitness-related startups, including Cure.fit’s acquisitions of Mumbai-based Fitness First.

Edtech did relatively well this year with seven M&A deals that included the likes of BYJU’s, Unacademy, and Ebix, as compared to five deals in 2017. The big deal was Reliance’s acquisition of Embibe for $180 million.

M&A deals also cut across pure tech sectors like AI and IoT. There were 12 deals in this space in 2018, compared to five last year. The prominent ones were Flipkart acquiring liv.ai and OYO acquiring Mumbai-based IoT startup AblePlus.

US-based enterprise cloud computing company Nutanix acquired Bengaluru-based Minjar, the maker of Botmetric, a service that makes the usage of public clouds more efficient and cost effective.

SaaS-based startups reported four deals this year as compared to three in 2017. Prominent among the M&As were Infibeam acquiring Unicommerce, an ecommerce management software provider for warehouse management and omni-channel services; and Noida-based online restaurant reservations startup Dineout acquiring Pune-based restaurant management solutions provider Torqus. Analytics-based startups saw four deals in 2018, compared to three last year.

In transportation, Ola acquired community and ticketing app Riddlr, reportedly to strengthen its tech.

Acquirers’ location

In terms of acquirers’ location, there were 29 US-based companies, including the likes of Walmart and Google that completed M&As with Indian startups this year, compared to 24 US-based companies that did M&As in India last year.

Geography-wise segregation of M&A deals

While there was only one Singapore-based company last year, this year there were four. There were five companies from the UK, Germany, and France this year as well as last year, and two from China in 2017 and 2018.

As far as domestic acquirers go, 42 NCR-based companies participated in M&A deals this year, compared to 38 NCR-based companies last year. These include big companies like Zomato (Tech Eagle), OYO (AblePlus), MobiKwik (ClearFunds), and Foodpanda (Holachef).

As many as 38 Bengaluru-based companies were part of deals this year, compared with 32 last year. In Mumbai, 36 companies participated in deals this year, compared to 32 last year. The figure was at 17 and six in Hyderabad and Chennai respectively, as compared to six and seven last year.

Acquirees’ location

The target zones were as varied as source zones. NCR topped the chart when it came to companies that were either acquired or merged with bigger rivals. A total of 50 (compared to 37 last year) companies from NCR participated in M&A deals this year. Bengaluru and Mumbai followed NCR, with 41 companies each involved in M&A deals this year. Last year, Bengaluru and Mumbai had 39 and 36 such startup companies, respectively.

Fifteen companies from Hyderabad were acquired this year, as compared to six last year. Chennai had 12 M&A deals this year, compared to 10 last year. Smaller towns like Ongole, Dehradun, Amritsar, and Dharwad also featured in this year’s list.

Indian startups going global

Indian startups acquired six US-based startups, but this number was relatively smaller, compared to last year when Indian companies acquired 11 US-based startups.

Expanding into newer territories

A rare but interesting case was of Mumbai-based gaming startup Nazara Games expanding into Kenya after it acquired a 70 percent stake in Kenyan gaming company NZ World. Nazara Games, in partnership with NZ World, has secured a betting licence from the Betting Control Board of Kenya to operate certain products under the licence.

Walmart-majority-owned Flipkart this year acquired Israel-based Upstream Commerce, a real-time pricing and product assortment optimisation solutions provider. Online travel agency Cleartrip acquired Saudi Arabian travel startup Flyin for an undisclosed amount.