Startup Deal Street 2018: who called the shots?

Walmart’s acquisition of Flipkart with a deal value of about $16 bn (for ~77percent) set the Indian unicorn valuation space on fire during 2018. The deal indeed received global attention as the world’s largest retailer valued India’s largest e-tailer with its massive valuation multiples crossing the north of ~4.5x revenue multiple! With consumerism sweeping through India, investors and corporates are keen to tap into its potential trajectory of growth. The Flipkart deal is the largest transaction of its kind and a contributing factor towards the surge in Indian M&A deals. Albeit, with technological advancements, companies are increasingly becoming aware of the need for new tech to boost operational efficiency, and are thus pushing acquisitions in the technology/ecommerce space.

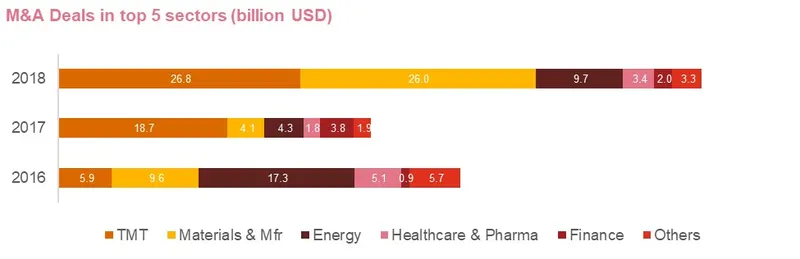

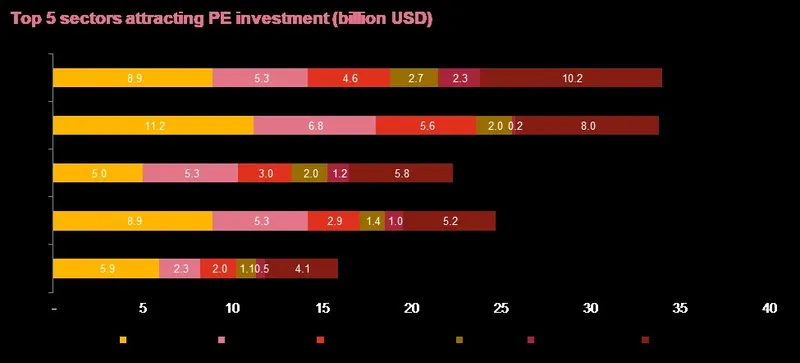

Digitisation, artificial intelligence (AI), cyber, data and analytics are some of the technology trends garnering significant interest from both corporates and funds. With larger corporations looking to adapt to technological advancements and revamp their business models, 2018 has seen a number of acquisitions in the new technology space. “Relevance” has become a key element for the survival of any business, and this has made technology advancements a requirement to achieve competitiveness in the world markets. The TMT space attracted investments worth over $35 billion in 2018 across PE and M&A together, a clear advancement over previous years.

Source: Venture Intelligence and PwC Analysis

Source: Venture Intelligence and PwC Analysis

Segments like ecommerce, fintech, automation, SaaS-based solutions, data and AI demonstrate the ability for mass adoption, exponential growth and global application. These sectors have attracted interest from global investors like Softbank, Temasek, Tencent and Sequoia. Marquee investments in these segments were deals with ecommerce platforms like Oyo ($1 bn), Gaana ($115 mn), Dream11 ($100 mn), Ola ($225 mn); deals with AI, SaaS and automation providers like Automation Anywhere ($300 mn), Freshdesk ($100 mn), ThinCI ($ 65 mn) and deals with fintech players like Paytm ($445 mn), Pine Labs ($125 mn) and Policybazaar ($236 mn).

Disruptive technologies like blockchain are still on the sidewalks of the deal street and will catch up no sooner with their application getting commercialised in an economic way. Global players like Oracle, IBM and Accenture continue to invest in this developing captive technology and it will take some time before the concept finds acceptance. Taking the consolidation bandwagon forward, larger IT players acquired companies in the data, digital, embedded security and cloud domains. Marquee deals in the segment include HCL’s acquisition of Actian (data management - $330 mn) and Telerx Marketing (AI - $60 mn) in the USA, Wipro’s acquisition of Alright HR (outsourcing - $117 mn) and Ensono Holdings (cloud - $55 mn).

The startup community over the world has acted as change agents for technology advancement and efficient business processes. A startup, in fact, is born with its unique knowledge and intellect capability. However, higher customer acquisition and running costs are leading to a burn-in cash flows and prolongated path to profitability impacting its scalability. On the other hand, big cats are looking for disruptive technologies to stay on top in the marketplace. A well-developed fundraising ecosystem in our country could be a win-win solution to the players in the chain. Conventional collateral-based funding are passé and Indian entrepreneurs have to, therefore, rely on the traditional ecosystem for funding business requirements. Novel means of credit assessment and financing by the new age fintech players, systemic fund-raising through specific equity exchanges for startups, etc., will play a critical role in the development of the ecosystem. There is a sizeable market of over 51 million SMEs in India, which is at a tipping point of digitisation waiting to scale-up at the next level of business. The policy environment is evolving; the government has announced various policies and new regulations like the Personal Data Protection Bill, 2018, Data Localisation Norms, National Ecommerce Policy, Guidelines for Online Pharmacies, etc. These regulations could potentially impact various sectors including ecommerce, fintech, online pharmacies, drones, shared mobility, etc.

There are concerns being voiced regarding the uncertainty looming over the issue of angel tax (i.e. tax levied on investments made by investors in a startup on the amount, which is considered as over and above the fair value of the startup). However, the recent announcement by the DIPP and CBDT to constitute a committee of members from IIT’s and IIM’s is eagerly looked upon by the fraternity with a lot of expectations to arrive at a permanent resolution. To give a boost to investment climate, à la AITC (Angel Investor Tax Credit) programme of Delaware, the Indian Government may consider granting tax exemptions/credits to the qualified investors and businesses of certain size and scale having operations in specified sectors.

To sum up, the recipe to success would be having a plug and play business environment encouraging enough to make an intellect professional into an entrepreneur. On investors’ front, there is an increasing interest in companies developing technologies related to language processing, sentiment analysis, chatbots, AIe, etc., which can lead them to exponential growth opportunities. Companies offering solutions for automating business processes, payments infrastructure, shared business services, banking and financing to SMEs could also witness M&A and interest from private equity investors at large.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)