How Shopclues narrowed its losses and boosted its revenues by 50 percent

In March 2017, Shopclues was set to close the financial year with a paltry 5 percent jump in revenue and surging losses that threatened to bleed it dry. Two years later, the story is remarkably different. So, how did it a pull off a turnaround?

India has always been more than happy to shop for clothes, utensils, household goods, and knick-knacks from small stores around the neighbourhood or in bustling bazaars. It was to bring the convenience of such shopping online that Radhika Ghai, Sanjay Sethi and Sandeep Aggarwal started Shopclues in 2011.

It had also clearly positioned itself differently from market leader Flipkart and later Amazon with a pure-play marketplace model and a focus on consumers who lived beyond the metros. Shopclues also had the backing of investors like Tiger Global Management and Helion Venture Partners, and in 2016, achieved ‘unicorn’ status with a valuation of $1.1 billion.

Sometime in 2017, ShopClues told YourStory that it was planning an IPO that year. 2017 was when Flipkart was staging a comeback and giving Amazon a run for its money, while SnapDeal had begun faltering. Shopclues - which had never directly competed with the two biggest players - seemed to have a real chance at success.

Shopclues Co-founders Sanjay Sethi and Radhika Ghai

As of March 2019, Shopclues remains a private limited company. Co-founder and Chief Business Officer Radhika Ghai candidly says,

“We spoke before our turn. There is a lot more we need to do before we hit IPO. It definitely is a continuous aim. But we want a strong business, and profitable assets before that.”

A slippery slope

There were differences between the three co-founders (Sandeep is no longer associated with the company), funding was drying up, cash flow was down to a trickle, and it reportedly nearly 20 percent of employees, including veteran executives at the top.

Not surprisingly, many had already written its obituary. After all, at a time when the ecommerce bigwigs were splashed over the multiple front pages of national dailies, Shopclues was nowhere to be seen. Rumours ranged from wondering if they had lost their ‘unicorn’ tag to wondering if they were going to shut shop.

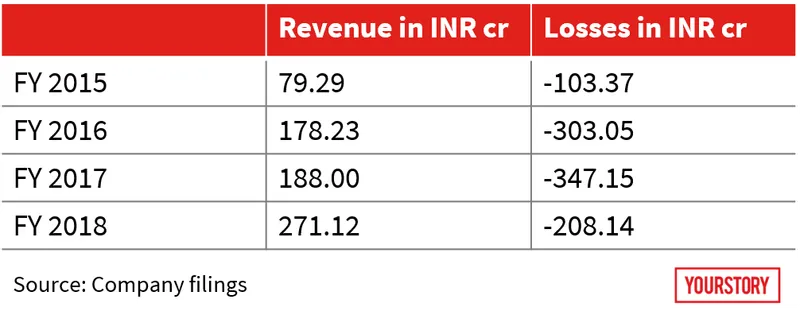

Over at Shopclues, meanwhile, the executive team decided to stay under the radar and go back to the basics. In a high-cash-burn sector like ecommerce, a turnaround is easier said than done. But take a look at its numbers for FY2017 and FY2018 and you’ll see the change.

So how did they effect the turnaround?

A close look in the mirror

Radhika says she clearly remembers the day in March 2017 when the team decided to take a step back and focus on profitability. It was time to make some tough decisions. The proverbial aha-moment came when they realised they didn’t necessarily need to sell products that would put ShopClues in direct competition with ecommerce heavyweights who were backed by deep-pocketed investors (Flipkart, for instance, raised over $4 billion in 2017.)

“We consciously walked away from categories that weren’t core to us - like branded smartphones, branded fashion, and large appliances,” recalls Radhika. And this at a time when Flipkart and Amazon were earning their spurs with exclusive tie-ups for exactly these categories.

What helped them walk away from that temptation was just one thing: focus on where they were headed. “The key of any business is to get to profitability,” points out Radhika, and that’s where the focus has been.

The same year, the company raised debt capital of $1 million led by InnoVen Capital, and later in August last year it raised $16 million from existing investors. The company’s valuation rose to $1.3 billion with the fundraise.

Also read: Find out why ShopClues is not worried about Amazon and Flipkart going to tier III towns

Laser sharp focus on the bottom line

The had team zeroed in on categories where they could work with merchants to optimise their margins, and in turn, their own. Currently, Shopclues’ category managers focus on four metrics - orders, revenue, contribution margins and EBITDA (earnings before interest, tax, depreciation and amortisation).

“When you’re surrounded by the likes of Amazon and Walmart, it is important that you keep honing on your key differentiator,” remarks Radhika.

For Shopclues, these differentiators provided to be women’s ethnic fashion, kitchenware, artificial jewellery, mobile and laptop accessories. The company also focussed on its exclusive labels - Homeberry (home furnishings), Meia (fashion) abd DigiMate (electronics label). It also recently launched Code Yellow - western fashion wear for women - and 29K, fashion accessories for men.

Its private labels contribute to 10 percent of Shopclues’ overall business. The company has also tied up with around 150 Lucknow-based offline retailers who carry its labels Digimate and 29K.

“My top line is the orders and revenue. By revenue I mean the money we make. So if I make Rs 100 for selling a product that is costing me Rs 150 to ship out, that would a negative contribution margin. The operations team has checks and balances in place to ensure the negative contribution margins get narrowed,” explains Radhika.

Also read: The quiet and stupendous rise of Shopclues – India's online bazaar

A tight grip on expenses

Shopclues also tightened it belt when it came to expenses. In part, losses have fallen due to lower ad spends, a decline in employee benefits (given the attrition), and lower expenses.

“Once we brought in a laser focus on the categories, it was easier to bring in market efficiency. We focussed on areas where we get better returns and that’s where we’ve spent more money. As a result, if I am getting three orders for the same price as opposed to one order, it is okay, Radhika says.

She also points out that employee benefits have not been reduced. Rather, it is because they changed their staffing: “When we walked away from certain categories, it needed different talent and shuffling. We had around 830 employees as of December 2018.”

The Shopclues team

A close watch on what’s working

ShopClues also tapped the cross-border trade channel. Radhika says close to 30 percent of its orders are sourced from China. The marketplace also lists sellers from China on its platform.

Every six weeks, a team from Shopclues goes to China and meets the merchants there to understand what is selling on the platform and what isn’t. They provide the merchants with analytics and also partner with Chinese merchants and manufacturers. Remarks Vidya Shankar, Executive Director at Grant Thornton India,

“There is a growing need to decrease cart bounce rate, customize conversations, and get access to data and insights. By working with merchants closely, and giving an easy flow of data, you create a needed differentiator.”

And finally, the results…

Shopclues started making money at the contribution margin level in May 2018. In October last year, it broke even at the unit-economics level too.

“This happens with constant optimisation of category, market, and other monetisation capabilities,” says Radhika. What helped, she adds, was not measuring gross merchandise value (GMV) as it is a number that can be scaled and tweaked.

While Shopclues is still in the red, things are looking up. “When we make the next filing, you will see that we have reduced our burn to less than $6 million,” she promises.

The focus on value-for-money items remains sharp.

A SaaS-based cash cow in the works?

While Shopclues appears to have put its house in order in the B2C space, every consumer-facing ecommerce company needs a money-spinner. Amazon has AWS and Ocado has Ocado Tech. For Shopclues, it is SmartOps.

The SmartOps enterprise solution optimises operations in every aspect for ecommerce and is aimed at commoditising scale. The main components of SmartOps are shipping, cataloging operations, merchandising and marketing ops for brands to achieve scale at best ROIs, fulfilment ops and customer support.

“Many brands that sell on ecommerce platforms have their own website as well. For products sold on ecommerce websites, the operations and logistics are taken care of by the larger ecommerce players, but what about their own website? With SmartOps, we give brands the support they need to sell on their own website,” says Radhika.

Brands such as The Mom Co, The Man Company, Hangout Store, CyanKart, and Vplak outsource their key digital operational functions to ShopClues to achieve cost savings, process performance, customer satisfaction, use AI and ML in optimising digital operations, for end-to-end process management, and reporting dashboards to monitor key metrics.

Through SmartOps, the team claims to process over two million orders a month and is looking at an annualised revenue run rate of Rs 20 crore.

Vidya Shankar believes this is a strong differentiator. “There is a huge market to serve. The key for an enterprise tech solution to work is non-conflict. If they are able to maximise inventory and aggregate demand, this will work great. Most of these merchants and consumers are price-sensitive; a SaaS model works wonders for them,” he says.

What else is in the offing?

In a world ruled by low internet costs thanks to Reliance Jio, everyone is bullish about Tier II, III and IV markets. And that makes Shopclues upbeat about its growth curve this year.

It is working closely on building on voice tech and looking at more visual ways of representing details like address, checkout and others.

“There are ups when the industry is in fashion and down when nobody wants to touch it. Over the last seven years, one of the most important things I’ve learnt is - up or down, you need a steady ground to thrive and survive,” she says.

Shopclues believes it has built the foundation it needs, and the market is large enough. Says Vidya Shankar,

“People will continue to shop online and more so post the launch of Jio. There will be ecommerce platforms that will go beyond Flipkart and Amazon. For survival, they will need to innovate and focus deeper on categories and labels. There will also be a need to focus on what works for different platforms, and the use of cross-selling within categories.”

It is something that Radhika and her team have been working away at for the past two years. If things are on track, then Shopclues’ FY 2019 filings will make for some very interesting reading.