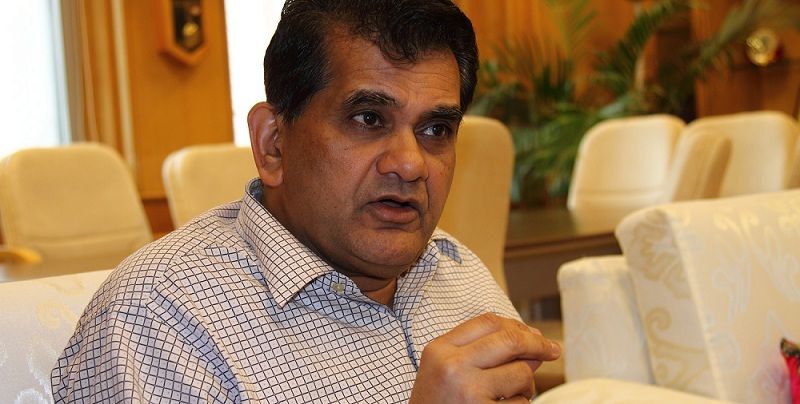

Fintech market in India to touch $31B in 2020: Niti Aayog CEO

Niti Aayog CEO Amitabh Kant also added that the government of India has played a key role in building fintech startups in the country.

The fintech market in India is likely to expand to $31 billion in 2020, Niti Aayog CEO Amitabh Kant said on Thursday.

He further added that India is one of the fastest growing fintech markets globally. Kant said that India is the only country in the world with over a billion mobile connections and biometrics, providing enough scope for penetration of fintech technology.

He added,

"The Indian fintech ecosystem is the third largest in the globe. $6 billion investments have already happened in fintech market in the country in the last three to four years.

Amitabh Kant, CEO NITI Aayog

"Fintech market in India is likely to expand to USD 31 billion in 2020," Kant said at the event organised by industry body Assocham and added that the government has played a key role in building fintech startups in the country.

Noting that unlike China where all data is owned by Alibaba, and the US where data is owned by Google and Facebook, Kant said, data in India is owned by the government.

Recently, the Reserve Bank of India (RBI), put out its vision document for the payment and settlement systems in India outlining the roadmap for 2019-2021.

With concerted efforts and involvement of all stakeholders, the four goal-posts of Vision 2021 has 36 specific action points over the 36-month timeframe will have 12 specific outcomes.

In the document, RBI stated that it expects payment infrastructure like UPI and IMPS to register average annualised growth of over 100 percent and NEFT at 40 percent over the vision period.

The apex bank expects the number of digital transactions to increase more than four times from 2,069 crore in December 2018 to 8,707 crore in December 2021.

Just yesterday, RBI announced that that banks can use Aadhaar for KYC verification with the customer's consent. It also specified that Know Your Customer (KYC) norms can be followed by banks and other entities regulated by it for tasks including various customer services, including for opening bank accounts.