This man went from building next-gen products at PayPal to driving financial inclusion with his startup

Line, founded by a former product head at PayPal, uses AI to drive financial inclusion. The Bay Area startup is backed by top names in fintech.

Akshay Krishnaiah’s career in the Bay Area has been dotted with many milestones.

The MIT and Stanford alumnus served as the Global Product Head – Research Labs at PayPal for three years, and Entrepreneur in Residence – Retail Labs at PayPal for two years before that. He also had a stint at eBay prior to its split with PayPal in 2015.

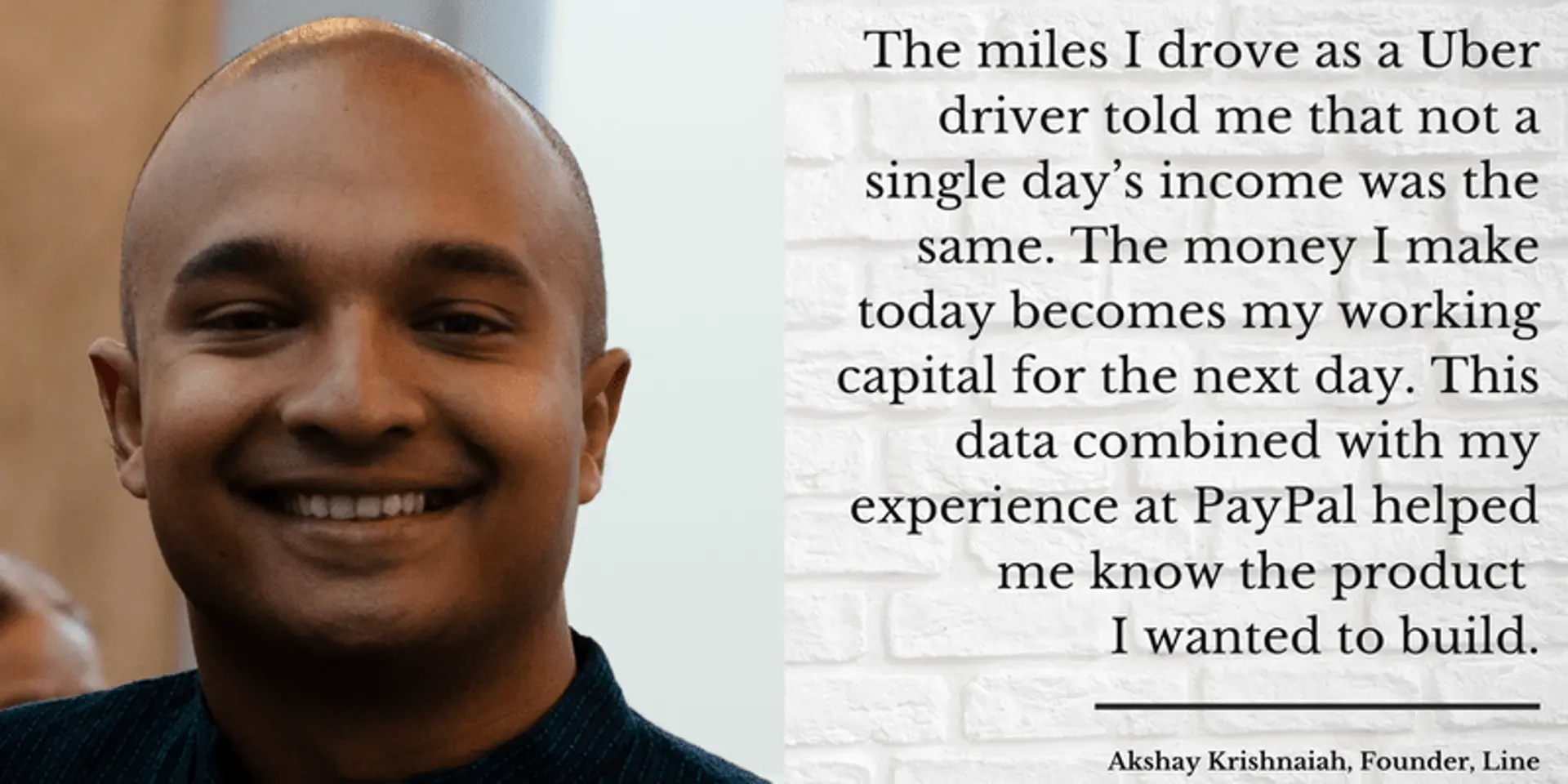

Akshay Krishnaiah, Founder and CEO, Line

What Akshay and his team of product geeks, inventors, and innovators built at PayPal, in many ways, laid the foundation for Line — an AI-led financial network offering instant credit access to the financially underserved, which he founded in 2019.

Line recently entered the & Western Union Accelerator, a programme aimed at building better financial tools and services that can drive financial inclusion globally. It piloted its AI-led instant credit ‘line’ offering with Western Union’s large client-base in the US, and is readying for a wider rollout in a few weeks.

PayPal to Line; finding the problem statement

At PayPal Research Labs, Akshay was building next-gen fintech products. “We worked on futuristic things like how to enable Tesla car keys to make payments, or how to move payments from individuals to services without revealing identities,” he tells YourStory.

At PayPal Retail Labs prior to that, Akshay had led a team that built omnichannel retail payment solutions to make retail checkouts entirely cardless.

He shares, “The problem statement was, ‘How do we make people use PayPal twice a day instead of once a quarter?’ To do that, we needed to make it available to the underbanked in the US. PayPal CTO James Barrese [who would later become an angel investor in Line] offered us $250,000 in seed money and said ‘you crack it in three months’. We did it in eight-and-a-half weeks.”

Image Source: ShutterStock

All the customer data and transaction history collected by PayPal brought Akshay closer to ground realities, and made him realise that “no matter how innovative large companies are, the realities of the everyday man never coincide with them.”

Hence, before launching Line, he cut his teeth in those ground realities. From clocking 36,000 miles as an and Lyft driver in San Francisco to listing his apartment on Airbnb, Akshay got face-to-face with swathes of people with volatile incomes. “We called them people with non-standard work arrangements and wanted to understand the financial products they needed,” he says.

These people ranged from freelancers, dance instructors to construction workers, travelling nurses, and so on. “Whenever folks at my Airbnb would ask what I was working on, I’d tell them, and they would go, ‘Hey, that’s me!’,” Akshay reveals.

“The miles I drove as a Uber driver told me that not a single day’s income was the same. The money I make today becomes my working capital for the next day. This data combined with my experience at PayPal helped me know the product I wanted to build,” he says.

How Line drives ‘finclusion’ with AI

The app-based platform delivers users lines of credit for online and in-store purchases of essentials like food and medicines. Shoppers have to simply click on the ‘use line’ option at the retail checkout. Line also offers them interest-free funds for money transfers, utility bill payments, student debt clearance, and EMIs.

Line is available on iOS and Android, and users can get its services for a monthly subscription fee of $5. They can avail credit of up to 10 percent of their cash flow. The startup uses a proprietary AI-based neural engine to assess the customer’s risk profile and delivers credit “in under a minute”.

“There is no application waiting [to be processed] for weeks. We are taking the risk on behalf of the merchant, and in return, we’re asking them for more time for payments to come from users,” the founder explains.

Line app

The Line app also comes with an automated budgeting tool that analyses tax statements, predicts income, and account fluctuations, and aligns the user’s finances based on that.

Financial access is the startup’s ‘North Star’ as it aims to close the credit gap and improve standards of living in a post-pandemic world. Line will also provide all its active subscribers up to $100 for the COVID-19 vaccine when it is available.

Line CTO Chandan Raj tells YourStory,

“Users sign up with existing bank accounts as compared to emails or phone numbers, and from the moment they start interacting with Line, our cutting-edge AI stack goes to work, learning about them, assessing their risk, potential for chargebacks, account takeovers, and more. The AI stack is also able to pull in anonymised data for the individual and their footprint across 36,000+ apps, retailers, merchants, services before qualifying the user.”

Photo: Line | Facebook

Line’s algorithms have been “battle-tested” against 300 million anonymised financial records to reach its ability to underwrite credit risk and funds.

The startup doesn’t hold any personally identifiable information (PII) data as privacy is deeply embedded in its infrastructure.

Chandan adds, “Our technology stack allows merchants to integrate with Line at 1/10th the time compared with traditional players, eliminate 100 percent of transaction fees, increase conversion by 31 percent, and checkout speeds by 400X. Like Apple or Nike, we look to vertically integrate across the value chain."

Funding and growth plans

Line has raised $650,000 from TechStars-Western Union, and serial fintech entrepreneurs and executives “who continue to shape this ecosystem”.

These include James Barrese (ex-PayPal CTO), Amrish Rau (CEO of Pine Labs; ex-Citrus Pay, PayU), Michal Cieplinski (COO of Pipe, a fintech-as-a-service firm), and others. Line is looking to close another round of $1 million as it expands its retail merchant network across the US, and rolls out in other global markets.

Founder-CEO Akshay says,

“We have 11,000 users on the waitlist, growing at 40 percent month-on-month their transactions will start happening now. Our partner Western Union has 60 million customers in the US, and 150 million globally. That gives us a wide network of users to tap into, many of whom have been struggling to send money home in the pandemic.”

Line is also piloting with Walmart, which is integrating the solution across its retail stores. Akshay believes that the India opportunity “will unfold” soon given “Walmart owns Flipkart”, one of the two big ecommerce platforms in the country.

Team Line

The startup employs eight people, who’ve strong connections and past experiences in India’s entrepreneurial ecosystem. “We also have Pine Labs’ Amrish Rau as an investor and advisor. The India growth channels already exist,” Akshay says.

Even though the global market for a niche product like Line isn’t quantifiable yet, the startup looks to target 100 million people with fluctuating incomes in the US.

Akshay shares,

“That number has gone up by 25 percent in the pandemic. People are doing odd jobs at warehouses or home deliveries or becoming baristas at Starbucks because those are the only jobs left. They are turning into micro entrepreneurs; somebody who was good at stitching is now a face mask entrepreneur.”

By powering essential transactions for these gig economy workers, Line’s opportunity to make an impact has also expanded. “COVID-19 has expedited the journey of a decade-and-a-half, and shrunk it to about five years,” says the founder.

Edited by Saheli Sen Gupta