[YS Learn] Lead Advisory set to demystify merger and acquisition for startups in webinar

To understand the why, when, and how of mergers and acquisitions (M&As), YS Education, the learning arm of YourStory, is partnering with Lead Advisory, a division of Lead Angels, to bring together industry experts for a special webinar for startups.

Any startup that has raised funding knows that it has to give its investor one coveted prize – exit. They not only assure a significant return on investment, but also help build confidence in the startup ecosystem.

To better understand how merger and acquisitions (M&As) work, YS Education, the learning arm of YourStory, is partnering with Lead Advisory, a division of Lead Angels, to bring together industry experts for a special session for startups.

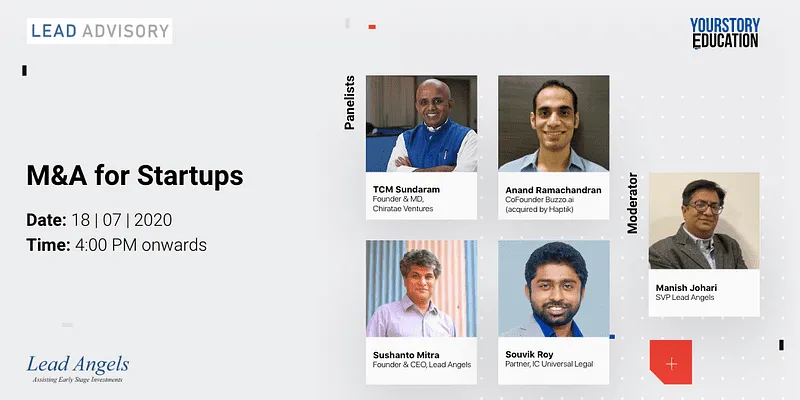

On July 18, in a panel discussion moderated by Manish Johari, SVP Lead Angels, with TCM Sundaram, Founder and MD Chiratae Ventures; Anand Ramachandran, Founder, Buzzo.ai (acquired by Haptik); Sushanto Mitra, Founder and CEO, Lead Angels; and Souvik Roy, Partner, IC Universal Legal will discuss:

- Relevance/purpose of M&A during the pandemic

- Different forms of M&A – cash-based, share swap, acqui-hire

- Handing legal, compliance, and taxation issues in the M&A process

Sushanto Mitra will give an angel investor viewpoint on M&A, while TCM Sundaram will provide the VC fund take. The founder perspective on M&A will be given by Anand, who has had two of his startups acquired in the NLP and AI domain, and Souvik will throw light on legal do's and don’ts.

While the current pandemic may have put a damper on several term sheets and investment deals, the session will focus on why M&As are still great options for startups. Although generally perceived as the last option for any startup, M&A is key for unlocking and enhancing value through finding synergies, especially in uncertain times such as COVID-19.

Several factors determine a good exit. One of the biggest and most important is that the acquirer needs to have deep pockets, and the company needs to add value for the acquirer. Great exits ensure more investor and investment euphoria.

While the initial public offering (IPO) remains by far with the highest value, there are other modes of exit, with mergers and acquisitions (M&As) playing an important role too. Some IPO examples of recent times include – Uber and IndiaMart. And the biggest example of an acquisition exit is the Flipkart and Walmart deal.

Register now

Edited by Kanishk Singh

![[YS Learn] Lead Advisory set to demystify merger and acquisition for startups in webinar](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/Imagejfjg-1594630569253.jpg?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)

![[YS Learn] 9 tenets from Vani Kola’s playbook for crisis management](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/800x4001-1594018393056.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)