This ‘Made in India’ app aims to make bookkeeping easy for MSME sector

The winner of Aatmanirbhar Bharat App Challenge in the business category, GimBooks is helping micro, small, and medium enterprises keep a record of their business accounts and track their day-to-day office work.

According to Statista, India has nearly 700 million internet users across the country at present. Despite this, the digital adoption among small businesses is very low. While accounting software is a favourite for big businesses, most MSMEs in the country still do their accounts on paper.

Helping these companies move online is Raipur-based . Started in 2017, the startup was one of the winners of the government’s Aatmanirbhar Bharat App Innovation Challenge in the business category.

Founded by Yash Raj Agrawal, GimBooks is a cloud-based bookkeeping and business management platform that aims to make business easy for millions of small entrepreneurs by providing them a convenient mobile first, easy-to-use, and affordable solution.

Yash Raj Agrawal; Founder of GimBooks

“Winning the Aatmanirbhar challenge has helped us in a way where we are now being recognised in the industry, and are being approached from different partners in the ecosystem. We are now able to convince banks and NBFCs to work with us easily. Emerging as winners has validated our product and our existence in the industry,” Yash Raj tells YourStory.

Realising the need

Yash is a BBA graduate from Symbiosis Centre for Management Studies, Pune, and has done his MBA from Alliance University, Bengaluru. A technology enthusiast, he always wanted to bring in a modern approach to the widespread traditional businesses in India.

Yash worked as a business analyst with Target Corporation before he started his own venture of trading in Pyrolysis products. He got into the niche waste recycling industry with Pyrolysis as a trader of pyrolysis products. He pioneered in introducing pyrolysis products to many industries at a pan India level. This involved frequent transactions and invoice keeping with multiple vendors.

Yash says he often found it difficult to generate bills, especially when he was not in office and had to depend on other people. He then realised the need for a modern accounting platform for MSMEs.

With the launch of GST in July 2017, he believed it was the right opportunity to move in this direction, and GimBooks was launched in October 2017. The startup was started as an invoice maker app.

Team at GimBooks

“We had a customer driven approach. We got some very good feedback from our users who asked us to convert into a full-fledged bookkeeping platform by including features like banking inventory, expenses, ledgers, etc. Gradually we started incorporating these features and we are now a full-fledged book keeping company,” Yash says.

The startup has also tied up with banks and has introduced updates such as neo banking activities, lending, and insurance for its users.

How it helps?

Yash says that about 85 percent of MSME owners in India still do their day-to-day bookkeeping with pen and paper. Thus, there is a high demand for an easy-to-use and mobile-first bookkeeping solution.

GimBooks aims to help middlemen who buy, sell, and manage business by themselves. These include traders, wholesalers, distributors, and retailers.

“Ours is a do-it-yourself platform. There is no learning curve or prior training required to operate the platform unlike traditional softwares like Tally. Our users use the product by themselves, get familiar, and pay for it. Our core value has always been mobile first and easy-to-use approach,” Yash says.

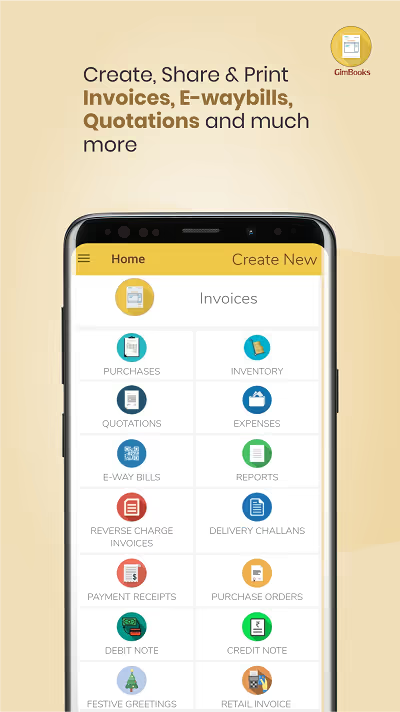

The startup helps its users to create documents like GST-compliant invoices, waybills, quotations, purchase orders, delivery challans, manage their inventory and expenses, keep a live track of various business reports, and send payment reminders to customers. The startup helps users simplify their regular bookkeeping with the help of their Android app named Easy Invoice Manager or their integrated website at the users convenience.

The users can also see their business reports and analytics, sale and purchase reports, ledgers, accounts in the app, and connect with other business owners.

Its flagship product is its mobile app. However, it also provides website platform for people who wants to do it from their computer or laptop. Yash claims that about 80 percent of its user base use the app.

Revenue model

GimBooks follows a subscription-based model that enables users to access a free trial period and renew the service thereafter. The subscription is priced in the range of Rs 1,800 - Rs 7,999, depending on the tenure the user selects.

Apart from this, the startup offers value addition services and fintech upgrades to users like GSTR filings, loans, insurances, etc.

Yash says: “We are doing close to 600 crore invoicing every month only from our paid customers. In order to take advantage of it, we are processing transactions where the users will be able to collect payments through our link. We are generating UPI links and will be soon launching net banking. We will be acting as a payment gateway for them where they can transact through us.”

The bootstrapped startup is relying on paying customers to grow as of now.

According to the team, it has three revenue models. First is a basic SaaS model which is meant for bookkeeping activity. The second one is SaaS++ for the value addition features it offers such as EWaybills, GSTR filings, registrations, cataloguing, etc. The users are charged depending on the services they opt for. The third is a fintech upgrade, which includes assisting customers in getting loans, insurance, and other transactions.

Domain specific

“One unique thing about us is that we offer domain specific book keeping solutions, where it is customised according to the industry the user is from. The software is adaptable to the ever-changing dynamic requirements of GST,” says the founder.

As soon as a new user selects a vertical, the user interface and features customised for that sector appear.

The app also backs up all transactions online automatically so that users don’t have to worry if they lose their smartphone.

According to Yash, the other similar products available in the market such as Vyapar, Kashflow, and Merrchant are either too expensive, not Indian MSME-centric, or too complex for a layman to understand by themselves.

"The advantage of using our platform is that as it is a do-it-yourself platform, we don’t require a sales team to show people demos every day,” Yash adds.

GimBooks is about to hit one million downloads soon. It has crossed 9.5 lakh downloads with 90,000 pay users (for SaaS model). Yash says the other revenue models are also gaining traction.

A team of 15 people, GimBooks will also be adding nine other languages to its platform soon.

The startup’s aim is to become the most preferred mobile-first business management platform of choice for Indian traders, retailers, wholesalers, and other small businesses.

Edited by Megha Reddy