YourStory's 2020 Annual Funding Report: State of the Indian Startup Ecosystem

An in-depth view of the state of the Indian startup ecosystem in Jan-Dec 2020, comparison of trends with the 2015-2020 period, and outlook 2021.

Foreword by Shradha Sharma

The start of 2020 was unprecedented, with the uncertainty around enough to stir trepidation across the nation. But as they say, where there’s a will, there’s a way. As the Indian startup ecosystem battled the pandemic, what shone through was its desire to survive. Resilience and empathy were undoubtedly the two tenets of 2020.

From achieving greater maturity and better business models, Indian startups also streamlined revenues and innovations. Even as they deal with challenges, Indian startups are playing the role of a catalyst in reviving the country’s economy.

India’s growth story and its potential remain a strong bet, with a thriving innovation-led entrepreneurial ecosystem poised to contribute significantly to the move to an ‘Aatmanirbhar Bharat’, or self-reliant India. This was also reflected in the world of startups that still saw investments flowing in amid a cautious business environment.

In the Union Budget 2021 presented by Finance Minister Nirmala Sitharaman on February 1, the government’s thrust on boosting small and medium-scale startups, as well as encouraging the investor ecosystem, was clear. Initiatives such as revising the definition of small-scale startups, allocating more than Rs 15,700 crore for the uplift of MSMEs, as well as the introduction of an investor charter indicate the role this sector can play in achieving India’s mission to achieve $5 trillion in GDP by 2025.

The 2020 Annual Funding Report by YOURSTORY RESEARCH aims to highlight the growth of the Indian startup ecosystem through three phases: evolution (2015-2017), innovation (2018-2019), and democratisation (2020). The report offers an in-depth view of the state of funding activity and key trends in the Indian startup ecosystem in January-December 2020, comparison 2015-2020, and outlook 2021.

Moving towards 2021, there is a stronger focus on underlying business economics, both from founders and investors; and a thrust on monetisation, which earlier got pushed to the latter years of a startup's life. Companies that have purpose-built into their bottom line are most likely to remain viable.

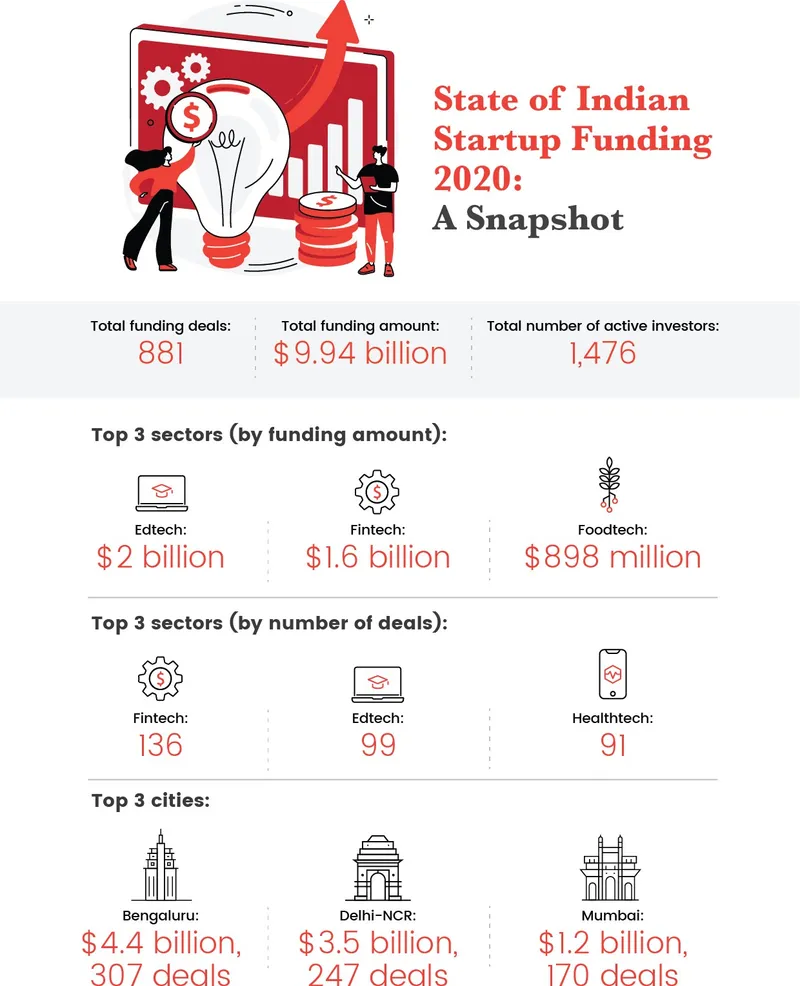

Key takeaways

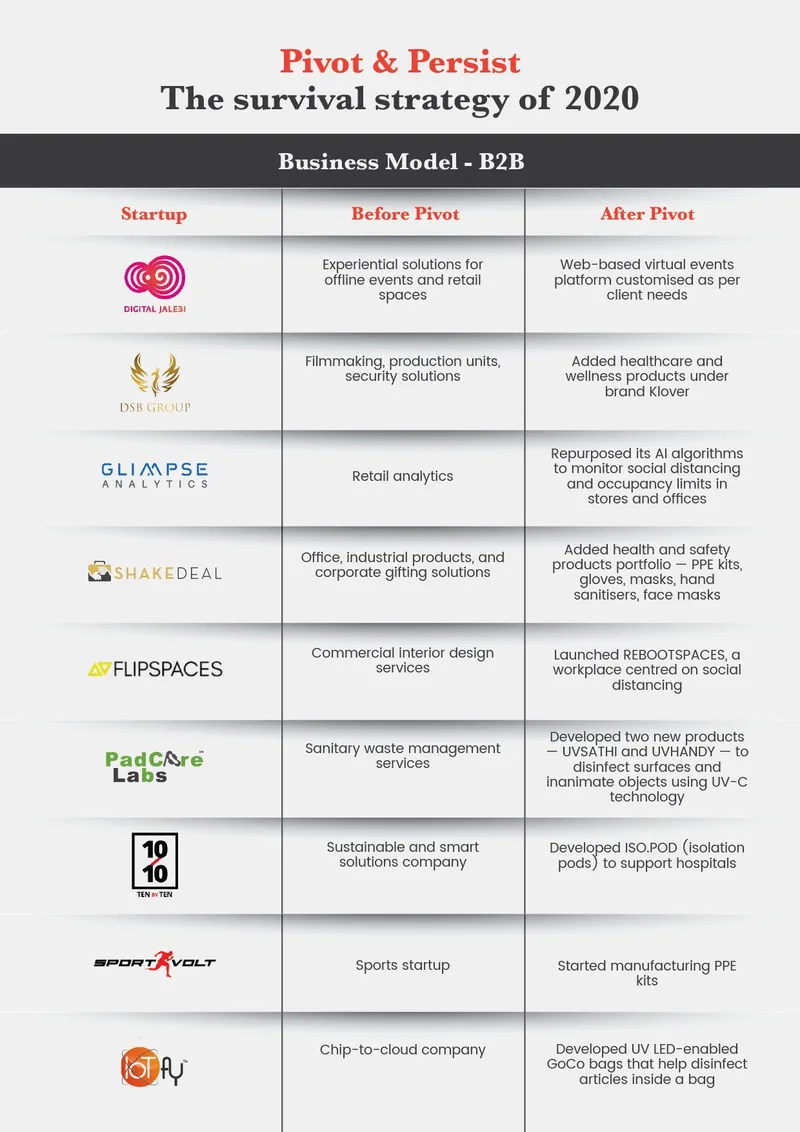

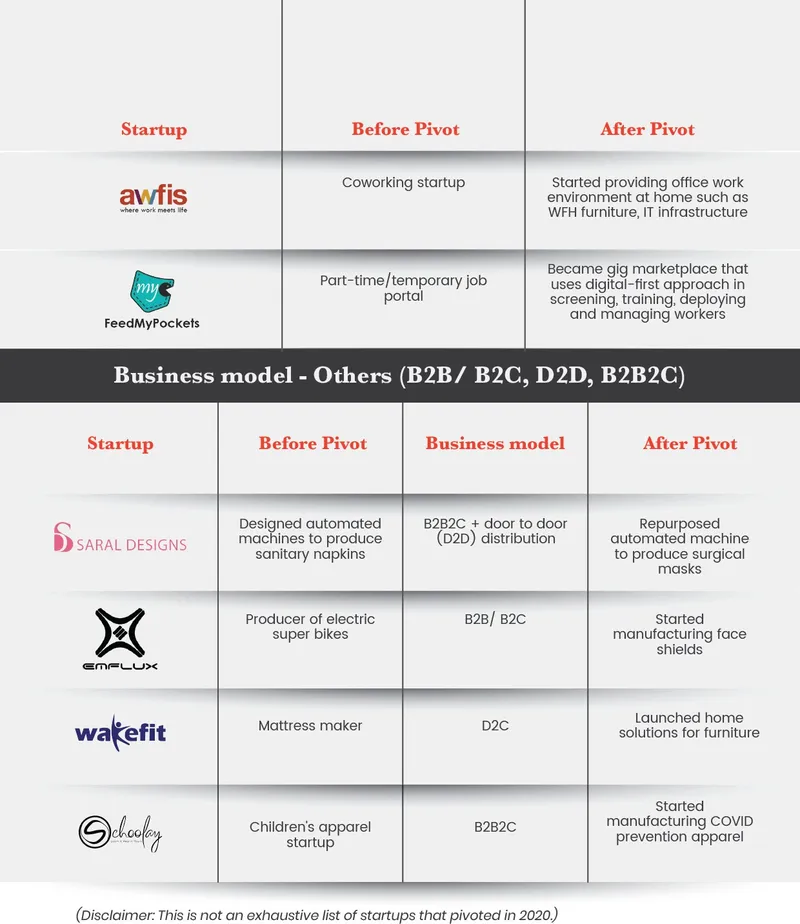

Pivot rather than shutdown was the sentiment for 2020

The years 2015 and 2016 are seen as the era of market correction in the history of the Indian startup ecosystem. These years together saw more than 360 startups shutting down. However, in 2020, we saw more startups adopting the pivot and rebranding route than shutdown. Exact data is not available for the number of pivots and rebrands. The analysis is made on the basis of public disclosures by startups on different media platforms.

Unique startup count for funding stays stable

It is observed that the count for unique startups receiving funding in 2019 (743) and 2020 (746) remained similar. Also, except 2016, when the unique startup count for funding grew by 17.5 percent, the subsequent years have shown a steady fall and rise in the number of unique startups that were funded.

Fall in funding but overall positive sentiment

In 2017, the Indian startup ecosystem received the maximum funding of $13.5 billion across 829 deals. Since then, there has been a continuous funding decline of 5.7 percent (2018), 6.37 percent (2019) and 17.07 percent (2020). Even from the deals perspective, 2018 (+4.22 percent), 2019 (+3.47 percent), 2020 (-1.45 percent) did not offer any extraordinary trend, thus indicating an overall positive momentum across the ecosystem.

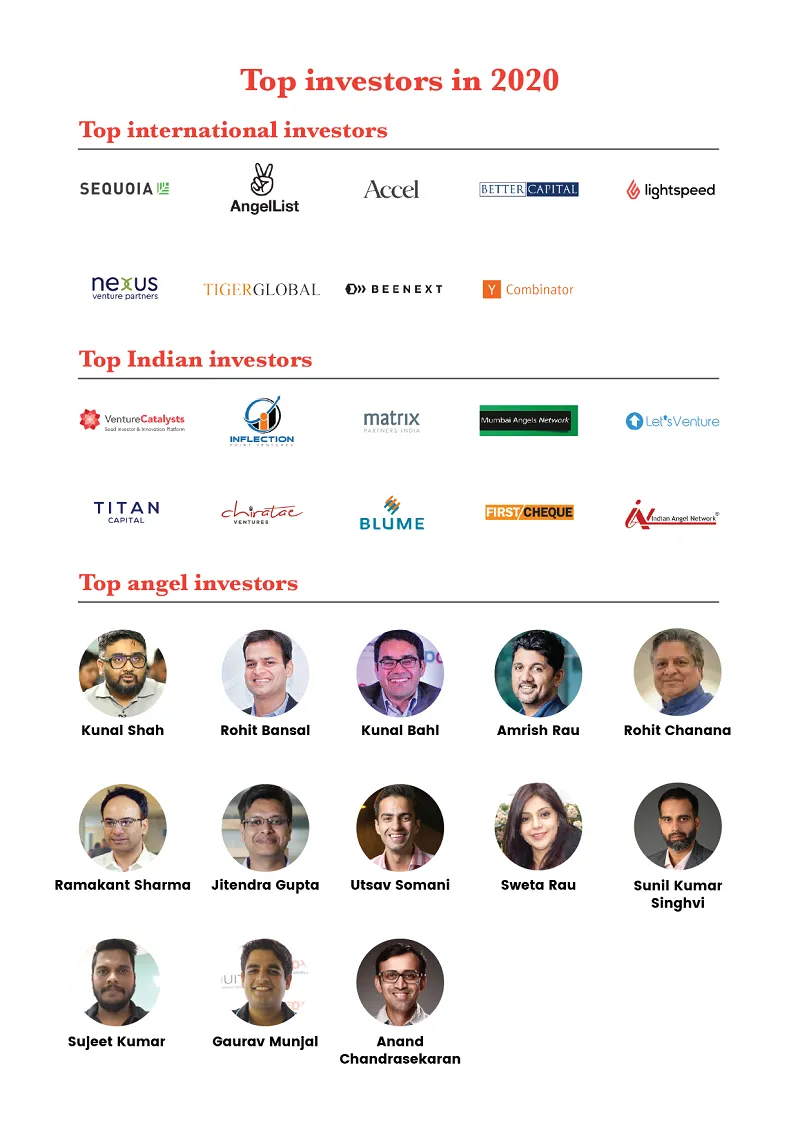

Investors focus on exploring new territories

It is observed that over the years, the number of deals with more than $100 million funding amount has reduced in the ecosystem. This only indicates how cautious the investor ecosystem has become, aiming for a diversified pool of investments as well as increased willingness to test the waters in uncharted territories. In 2020, investors maintained a diversified approach while testing waters in unchartered territories and even kept the sentiment high with seed-stage and follow-on funding rounds.

Expansion of sectoral landscape

The rise in technology adoption led to investor hopes riding high on sectors integrating new-age technologies such as deep tech, adtech, insurtech, media and entertainment tech, space tech, defence tech, and drone tech. Investors were also observed to show interest in a few offbeat areas such as celebrity commerce, gig services, sports tech, and security solutions providers.

Inclination towards Tier-II/III startups

During the period 2015-2020, investments in Tier-I and Tier-III startups increased at an average of 5 percent. After 2018, and even during the pandemic, a steady growth of near 6 percent in investments has been observed in Tier-II and Tier-III startups.

Inclination towards IPO route of exit

More internet and technology companies went public in 2020. There was a time when companies took 20 years to file for an IPO; that has now narrowed to just three-five years. Also, a number of tech IPOs are lined up for 2021. This is a significant shift from the earlier M&A route adopted by Indian tech companies.

11 startup trends that defined 2020

The upswing in telemedicine

Last year brought about the biggest health crisis known to humanity. The pace and scale of the COVID-19 outbreak led to a breakdown of traditional healthcare systems and brought about unstinted growth in telemedicine or online delivery of health services. Patients switched to video and audio doctor consultations, and began using fitness and wellness applications to track their health and pre-screen themselves. Online pharmacies also gained ground as the lockdown compelled people to stay indoors. This segment, in fact, saw some consolidation with the entry of large players like Reliance.

Penetration of tech and AI in healthcare

A sharper focus on the overall healthcare ecosystem helped expose its glaring inadequacies. In India, the heavily skewed patient-caregiver ratio is giving rise to the use of AI, ML, and other automation technologies in healthcare so as to reduce the need for human intervention. COVID-19 also led to a growth in ‘digital therapeutics’ or the use of smart healthcare devices, including mobile-based glucometers, oximeters, heart-rate trackers, and so on. The digitisation of personal medical records also got expedited.

Rise and rise of online learning

With offline education facing a crisis of continuity following the pandemic- induced lockdowns, edtech startups and e-learning platforms stepped in to help schools, coaching centres, private tutors, and higher educational institutions go online. They launched free live classes and ramped up their offerings to absorb the massive overnight demand for online learning post the lockdown.

The live coding boom

The Indian government’s National Education Policy 2020 mandated schools to initiate coding classes for students from Class VI onwards to help build analytical skills from a young age. The rollout of the new reforms in August and the event of BYJU’S acquiring WhiteHat Jr spawned an all-new wave of live coding startups. Coding became one of the buzzwords of the year and this segment of edtech is expected to be among the most sought-after by VCs in 2021.

SaaS and the remote-work routine

In 2020, SaaS platforms assumed critical importance in the ‘new normal’ of remote work. An increasing chunk of SaaS workers globally are now keen on continuing with remote work or ‘work-from-anywhere’ and staying close to their hometowns. As a result, the adoption of enterprise software is only going to grow in the future. The year also saw the increased penetration of vertical SaaS companies across sectors such as healthcare, B2B retail, ecommerce, and videoconferencing. SaaS startups that build plug-and-play API solutions for global customers also grew rapidly.

Grocery ecommerce gaining ground

Until 2020, the biggest verticals of India’s ecommerce sector were electronics and apparel. But the pandemic-induced urgency shifted the focus to essential categories like food and grocery. While incumbents in the segment ramped up their presence in the aftermath of the lockdown, the year also saw the entry of new, deep-pocketed grocery commerce platforms. The festive quarter was the cherry on the cake, with other categories also showing swift recovery and surpassing 2019 in terms of gross merchandise volumes.

Growth of B2B farmer marketplaces and e-mandis

With the pandemic causing disruptions across the agri-supply chain, leading to shutdown of physical markets, restricting travel from farm to mandis, and halting other on-ground operations, farmers were left with unsold produce and staring at huge losses. B2B agritech startups, which operate e-mandis and aggregator marketplaces to enable direct transactions between farmers, traders, and buyers, stepped in to fix this. Additionally, the procurement needs of food retailers and agribusinesses led to a sharp rise in demand for B2B farmer-focused agritech platforms.

Increased adoption of farm-to-consumer (F2C) brands

The pandemic-induced health uncertainty led to a rise in the demand for safe, hygienic, and farm-fresh food. From fresh fruits and vegetables to meat and dairy, online direct-to-consumer (D2C) platforms gained a significant edge over traditional food and grocery retail. The shift in business models and distribution channels and contactless doorstep deliveries of products also adhered to stringent social distancing norms. F2C startups recorded a 10X reduction in their customer acquisition costs and 3X growth in volumes during COVID-19, as per investor estimates.

Sensational growth of online brokerages

With more hours at their disposal and increasing uncertainty about long- term wealth prospects, millennial first-time retail investors (also known as Robinhood traders) flocked to online brokerages by the hordes. Besides existing discount trading apps, a bunch of generalist fintech players launched stock trading options on their platforms to leverage the trend. A SEBI report noted that 4.9 million new demat accounts were opened in 2020 — highest in at least a decade — with more participation from small towns.

UPI continued to be fintech’s crown jewel

Until 2020, small-ticket cash transactions that drive most of the cash in circulation, were the main deterrents to UPI’s growth in India. But with 2020, the urgent need for cashless/contactless payments turned out to be a watershed moment for UPI-led platforms. UPI transactions reached new highs every month, even surpassing card transactions at one point, with the adoption of digital payments cutting across demographic segments. As per NPCI, 2.23 billion UPI transactions worth Rs 4.16 lakh crore were recorded in December 2020, registering a 70 percent growth over 2019.

Online gaming’s meteoric rise

With all avenues of outdoor entertainment and recreation coming to a grinding halt, online gaming became the go-to option for an anxious population. Gaming startups witnessed good uptick in new users and hit record app engagements during the lockdown. Gaming gained not only because it became a safe ‘stay-at-home’ option across age groups, but also because it enabled human interaction and bonding in times of social distancing. From being a historically under-financed sector, gaming startups became the darling of local and global investors in 2020.

Inside the ecosystem (2015-2020)

In the wake of COVID-19, India’s current population, demographics, and economic situation might have put the country in a disadvantageous position compared to other Southeast Asian countries. However, due to the resilience and agility of Indian entrepreneurs, the investor ecosystem has not shied away from them in these tough times.

For instance, edtech led to a completely irreversible mindset shift for the Indian consumer, who had earlier never considered online education more than a value addition to the traditional institutional education system. In the last one year, not only has online learning become a mainstream sector, but also at the operational level, the digitisation has improved.

Next is ecommerce, where investors are now willing to test waters in different niches like reselling, social commerce, celebrity commerce, live video shopping, ecommerce SaaS, and more. Technology is reshaping Indian retail at an altogether different level, with local kiranas getting modernised layer by layer.