Founders expect strong funding environment in 2021 - InnoVen Capital Startup Outlook Report

Venture debt firm InnoVen Capital, in the sixth edition of its India Startup Outlook Report 2021, said the startup ecosystem is making a fast recovery post COVID-19, and pointed to a stronger funding environment.

The COVID-19 pandemic had not only disrupted businesses but also brought in a slowdown in funding. This year, can we hope to see a shift and change? The good news is, there is hope - at least as per the India Startup Outlook Report 2021 by InnoVen Capital, as it reveals that the scenario is changing for the better.

According to the report, despite the pandemic, over two-thirds of founders who tried to raise capital had a favourable experience in 2020, driven by a strong October to December quarter. Founders from sectors like enterprise/SaaS, logistics, ecommerce and fintech were most optimistic about the funding environment in 2021.

The report is based on insights gathered from startup founders across various sectors, from ecommerce to edtech, fintech to logistics, and more.

Commenting on the report, Ashish Sharma, CEO, India said in a statement, “The year 2020 was an eventful year for the venture ecosystem. The COVID-19 outbreak led to a perfect storm, with demand destruction, supply chain disruption and funding market dislocation. However, the resilience of entrepreneurs meant that startups navigated this crisis rather well and many companies have come out stronger.”

Data: InnoVen Capital

The key startup segments the report focussed on were:

Funding

In 2020, 54 percent of founders had a positive fundraising experience, while 24 percent claimed otherwise. Close to 23 percent of founders did not attempt to raise funds. The favourable fundraising experience was down from 75 percent in 2020 to 21 percent in 2021 and was driven by COVID-19 related disruptions.

An overwhelming 71 percent of founders believe that the fundraising environment will improve in 2021.

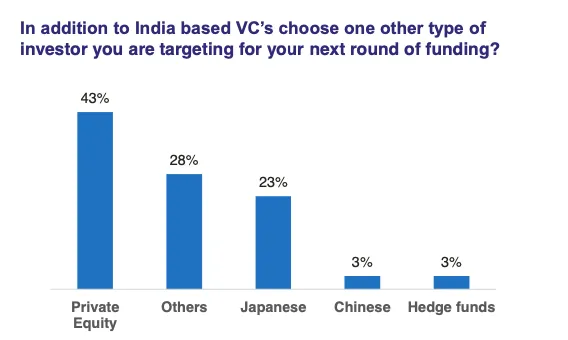

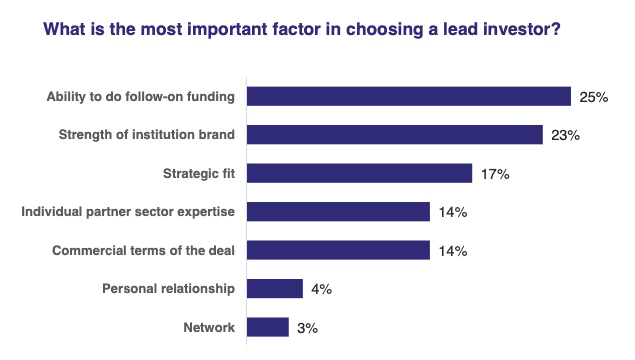

The report added that founders chose ‘ability to do follow-on funding’ and ‘strength of institutional brand’ as the top two factors while choosing a lead investor. The ‘ability to follow on funding’ factor gained in importance - it was up from 15 percent in 2020 to 25 percent in 2021. Only 14 percent of founders selected ‘commercial terms’ as most important.

Apart from this, the preference for Chinese investors went down significantly - from 29 percent in 2020 to just 3 percent 2021, due to regulatory and geo-political issues. The report mentioned that growth/late-stage founders were increasingly looking at private equity. There is also a noticeably higher interest in Japanese investors 23 percent - up from 13 percent in 2020.

Data: InnoVen

Growth vs profitability

While most companies had rationalised costs during the initial stages of COVID-19, the focus is back on growth as demand recovers.

Over 77 percent of founders ranked growth higher than profitability as a focus area for 2021, which is largely consistent with prior year. Close to 42 percent of startups aim to turn earnings before interest, taxes, depreciation, and amortization (EBITDA) profitable in two years, while 29 percent aim to reach there in two to four years.

On impact, the report revealed that the pandemic had a negative aftermath on most sectors, particularly in the initial stages of lockdowns. Only a few sectors like edtech and gaming experienced immediate tailwinds. However, we have witnessed a strong recovery in the second half of 2020, as per the report.

InnoVen

“Two thirds of surveyed founders mentioned that they were above the pre-COVID-19 revenue run-rate in December 2020. Ecommerce, logistics (express), B2B platforms, enterprise software, and D2C brands saw the strongest recovery,” the report stated.

However, close to 47 percent of founders believe that IPO is a likely mode of exit while 28 percent believe M&A as the likely exit option. Close to 70 percent of growth and late-stage founders have aspirations to go public in the future. Overall, the trend-line of IPO preference has gone up from 39 percent in 2019 to 43 percent in 2020, and is at 47 percent currently.

Improving unit economics was the topmost priority among respondents; particularly for retail, D2C brands, ecommerce, and B2B platforms. Close to 50 percent of early-stage startups cited ‘better product-market fit’ as top priority.

Hiring good talent and demand generation were the top two challenges underlined by the respondents, and this is consistent with the previous year’s InnoVen Startup Funding survey . However, growth-stage companies cited the regulatory environment as the second main challenge. Among international markets, respondents had the highest preference for the US, followed by Southeast Asia, and the Middle East.

Edited by Anju Narayanan