This financial literacy startup enables people to make a career in the stock market

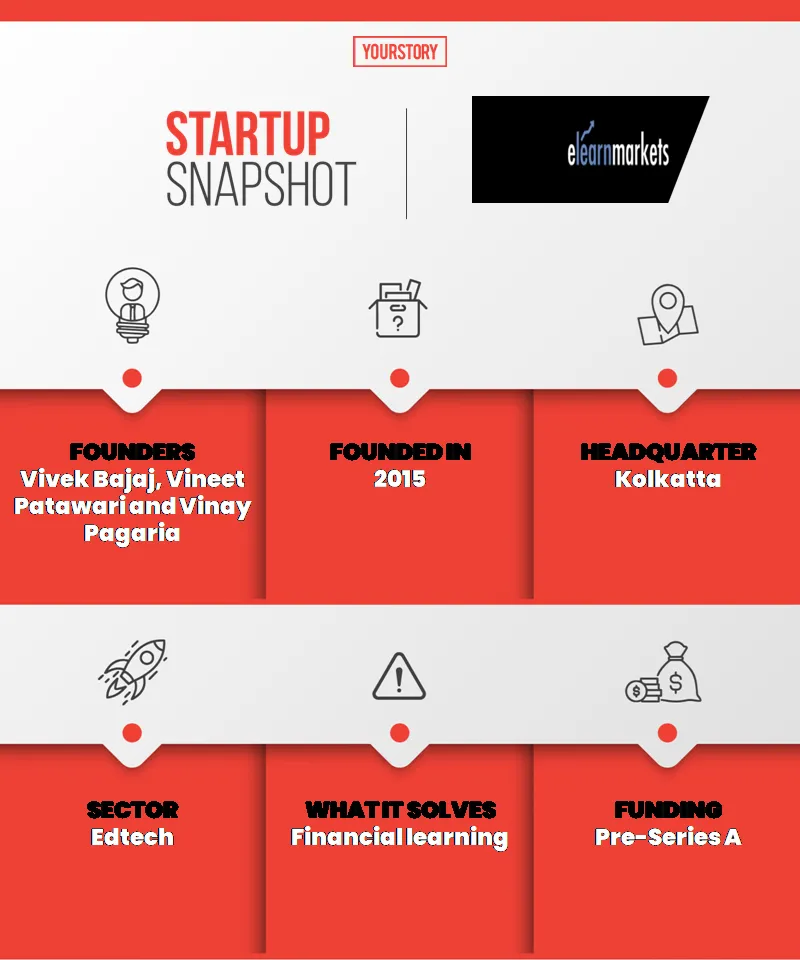

Online learning startup Elearnmarkets, founded by Vivek Bajaj, Vineet Patawari, and Vinay Pagaria, aims to spread financial literacy and saw a surge in users last year despite COVID-19.

When COVID-19 led to a three-month national lockdown in 2020, it became a true test of Elearnmarkets’ hypothesis on financial literacy in India.

Chartered accountants Vivek Bajaj, Vineet Patawari, and Vinay Pagaria founded in 2015 on the belief that interest in financial literacy will boom as Indians throng the stock markets. That passage arrived during the rollercoaster ride of 2020.

Stocks plunged at first—the BSE Sensex from a high of 41,932 points on January 16, 2020 to 25,981 points on March 23—before peaking at 52,104 points on February 16, 2021. A B2C app, Elearnmarkets clocked a 3X jump in new users per month compared to pre-COVID-19 levels.

snapshot

Their target user base comprises Indians seeking to invest and trade in stock markets, as well as fund managers in broking and wealth management firms. The Elearnmarkets app has been downloaded 3,29,000 times and has 730,000 registered users.

"The financial market remains deeply underpenetrated in India,” says Vivek, whose family owns one of the largest proprietary trading desks in Eastern India, with more than 150 full-time traders. He is a CA, company secretary and an MBA from the Indian Institute of Management (IIM) Indore.

“It is only in the past few years and during COVID-19 that we have seen a huge inflow of new participants in the ecosystem,” Vivek adds. According to a Global Financial Literacy Excellence Center study, only 24 percent of Indian adults is financially literate.

"Our company is becoming a catalyst to address this by facilitating first-time investors to learn the art and science behind the markets and become truly financially educated," says Vineet, who is a CA and also an MBA from IIM Indore.

Elearnmarkets’ revenue stands at Rs 15 crore. Of its 730,000 registered users, 41,000 users pay for the financial learning services. Its average revenue per user is around Rs 5,000.

It competes with Fintapp, , and Varsity.

Industry need

Vineet had the inspiration for building a scalable business on the internet. He shunned his IIM Indore campus job offer and started an eLearning venture that prepared users for MBA entrance exams. In 2015, he joined hands with Vivek to focus on financial education. Vinay, another chartered accountant, was a techie by profession, with 15 years of experience in software development.

Their cumulative experience and expertise spans understanding financial markets, learning management systems, and visualisation of learning tools. But most importantly, the trio shares a passion for making financial literacy widespread in India. They set up Elearnmarkets in 2015.

"The financial market education industry in India is very unstructured and fragmented,” Vinay says. “In this ecosystem, we have a lot of traders and investors who have vast hands-on experience and conduct their own training programmes. Then, there are well-renowned courses in finance, tax, audits such as CA, CFA and CS. However, there was no structured way of making a career in financial markets," he explains.

Towards this end, Elearnmarkets wanted to streamline and structure the journey for individuals who want to make a career in the financial markets. Its courses are certified by the National Stock Exchange (NSE), Multi Commodity Exchange (MCX), and National Commodity and Derivatives Exchange Limited (NCDEX). This gives credibility and helps individuals to achieve their career goals.

Further, the Elearnmarkets founders wanted to provide a platform to market experts, which would enable the sharing of practical experiences with learners. This would spawn a large pool of skilled learners who are well trained that can cater to industry needs.

Elearnmarkets founders

Experiential learning

As an online education platform. Elearnmarkets uses technology and an Interactive Learning Management System to spread investing knowledge. It works on a freemium model with courses being certified by NSE, MCX, and NCDEX.

It has more than 100 market experts who host courses and webinars on their app, for which the company gives them complete infrastructure support. (It charges a platform fee for providing such services.) The course topics range from fundamental and technical analysis of financial markets, to derivatives trading, financial modelling, currency, and commodity markets.

The founders have invested Rs 4.5 crore in Elearnmarkets to date. It has also got seed capital from a financial services firm in Kolkata, and a pre-Series A round in 2018 with investments from market experts like Ramesh Damani, Ajay Sharma, and Dinesh Agarwal, Founder and CEO of Indiamart.com. The external investments are close to Rs 3.5 crore.

The revenues more than doubled from Rs 7 crore in FY 2020 to Rs 15 crore in 2020-21.

The biggest challenge to making financial literacy ubiquitous is in Tier-II cities, according to the founders, where the regional language is the primary medium of communication, and where the propensity to pay for value-added learning content is less.

That is why Elearnmarkets has added courses and webinars in seven vernacular languages to make this transition easier, and kept product pricing very economical for this price-conscious customer base. This will be crucial for the internet venture that aims to grow its user base from 0.7 million learners to three million.

(Edited by Kunal Talgeri)

![[Startup Bharat] Chandigarh startup aims to make financial literacy mainstream in Bharat](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/startup-bharat-11-1599634822285.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)