Last date to link PAN to Aadhaar is March 31: Here’s all you need to know

The deadline for linking your PAN to Aadhaar is March 31, 2021. Failing to do so, defaulters may have to pay a fine of up to Rs 1,000.

The deadline for linking Aadhaar to your PAN (Permanent Account Number) is now March 31, 2021. Failing to link the two, defaulters may have to pay a fine of up to Rs 1,000 as per Section 272B of the Income Tax Act. Besides, the defaulter’s PAN will become inoperative after April 1, 2021.

In previous instances, the government has revised the deadline to link from June 30, 2020. However, there is no confirmation if the same will be done this time as well. Besides, any individual found to be using an invalid PAN can up to Rs 10,000.

With the Finance Bill 2021 passed last week, the government has added a new Section 234H, which talks about the penalty.

The bill says, "Without prejudice to the provisions of this Act, where a person is required to intimate his Aadhaar number under sub-section (2) of section 139AA and such person fails to do so on or before such date, as may be prescribed, he shall be liable to such fee, as may be prescribed, not exceeding one thousand rupees, at the time of making intimation under sub-section (2) of section 139AA after the said date."

With the deadline just around the corner, here is a step-by-step guide to link PAN to Aadhaar.

What is PAN?

PAN is one of the most important financial documents for an Indian national. It is issued by the Indian Income Tax department under the supervision of the Central Board for Direct Taxes (CBDT) and it also serves as an important proof of identification.

It is an essential document for filing income tax returns. It is also mandatory for filing tax deduction at source, or any other communication with the Income Tax Department.

Further, PAN is mandatory for opening a new bank account, a demat account, purchase of foreign currency, bank deposits above Rs 50,000, purchase and sale of immovable properties, and purchase of vehicles, among others.

How to link PAN to Aadhar via SMS

You can link your PAN to Aadhaar by sending an SMS to 567678 or 56161 from the registered mobile number of the user. The body of the SMS should include UIDPAN<SPACE><12-digit Aadhaar><Space><10-digit PAN> .

For example, if one’s PAN is PQRST4321Z and Aadhaar number (UIDAI) is 432198765000 then the person has to type — UIDPAN 432198765000 PQRST4321Z.

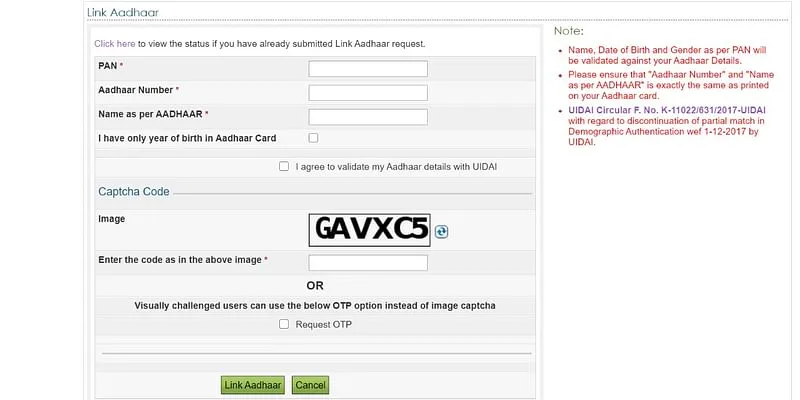

How to link PAN to Aadhaar via Income Tax website

- Visit the Income Tax Department e-filing portal — incometaxindiaefiling.gov.in.

- Log in by entering your User ID, password, and date of birth.

- Go to 'Profile Settings' on the Menu bar and click on 'Link Aadhaar'.

- Details such as name, date of birth, and gender will already be mentioned. Verify all the details given on the screen with the ones mentioned on your Aadhaar.

- Enter your Aadhaar number and click on the ‘Link now’ button.

Edited by Saheli Sen Gupta