Bharat users on Made in India apps drive short-form video growth: RedSeer report

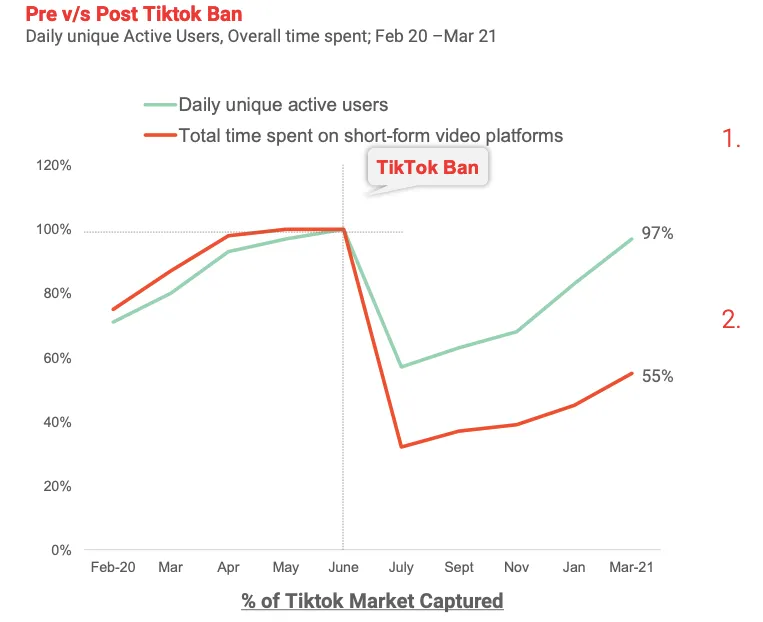

A RedSeer report titled 'The Rise of Made In India in Digital Content', has emphasised that the short-form video user base is back to nearly 100 percent of pre-TikTok ban, with strong loyalty to Indian apps.

Last June, the Indian government placed a ban on several Chinese apps, including the popular short video content platform TikTok — which had a large user base in India. In order to cater to the needs of the users who were left without a social media outlet post the ban, a slew of Made in India platforms like , Josh, , , and MX Takatak were born.

A report by RedSeer — 'The Rise of Made In India in Digital Content', has emphasised that the short-form video user base is back to nearly 100 percent of where it was before the TikTok ban.

It said, "Indian short form apps have been able to retain over 65-70 percent of TikTok users, adding 30-35 percent new users in the past year, essentially back to 97 percent of the TikTok user base. "

It added that the Daily Active Users (DAUs) on these apps reached close to 97 percent of where the numbers stood as of June 2020. This has primarily been because of aggressive marketing and user acquisition by the platforms. The report also stated that the time spent on the platforms have reached 55 percent to where it was in June 2020.

Data and Image: RedSeer Analysis, Consumer Surveys

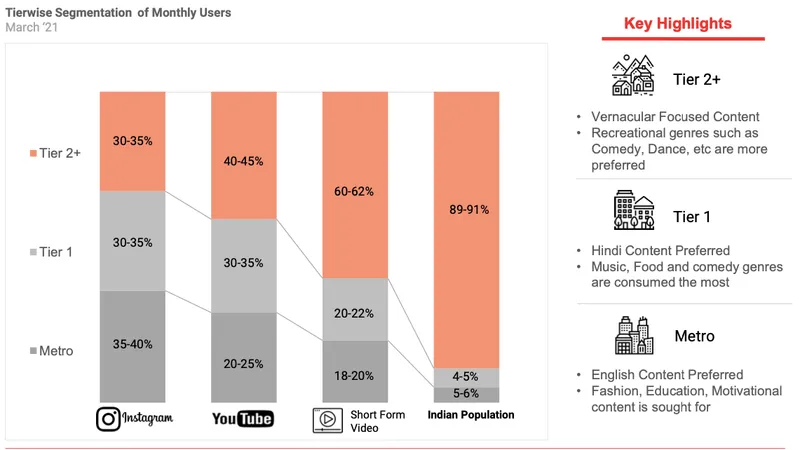

Push towards Bharat

More importantly, the report states that most of the new users (60-62 percent) who have onboarded the platforms largely hail from Tier-II cities and beyond. This trend is mostly driven by the platforms' strong focus on Indian content and ‘Bharat’ positioning.

The study shows that 75 percent of the current short-form video users will likely stick to these domestic apps, and are unlikely to switch back to Chinese apps even if the ban was lifted.

Ujjwal Chaudhry, Associate Partner at RedSeer Consulting, states,

“In less than one year post TikTok ban, Indian platforms have shown a strong V-shaped recovery, bouncing back to 100 percent of pre-ban daily user base. This shows how platforms were able to design the product, execute their plans, and market it aggressively in a very short period of time. This is a strong indicator of how the Indian digital ecosystem has matured in the last few years.”

The report nevertheless states that though the Indian platforms have come a long way, they have more scope to improve their content quality and product experience. The players still have to reach the global and cross-sector benchmarks on engagement and retention — which will further grow the monetisation potential for the entire ecosystem. Strong network effects and a fast-growing user base have been fuelling the ecosystem growth, leading to a large monetisation potential for both influencers and platforms.

Data: RedSeer

Apps that stood out

“Moj, has been a strong gainer across consumer and business metrics, as compared to the last quarter. The growth has been driven by regional language markets, especially in the southern states. On the other hand, Roposo has shown strong performance in Tier-I cities compared to the smaller ones. MX Takatak leads in the net promoter score (NPS) in the metro cities. The platform has held challenges and hashtag events similar to TikTok, to gain market share,” said the report.

According to the study, Josh leads both on influencer and user-end, driven by strong performance in the Hindi belt and Tier-II+ cities.

The report said:

- Josh – Fares higher on the NPS primarily on the back of increased satisfaction (47 percent) of Tier-II users, primarily emerging from the Hindi belt of India.

- Moj – Performs well in the Bharat region, leading to best satisfaction (51 percent) in Tier II+ cities, second-best (38 percent) in Tier I cities.

- MX Takatak – Secures the highest satisfaction (38 percent) across the competition in metro cities.

- Roposo – While Roposo does reasonably well in Tier I+ cities (garnering close to 30 percent NPS), the satisfaction among metro users is at 11 percent.

Data and image - RedSeer

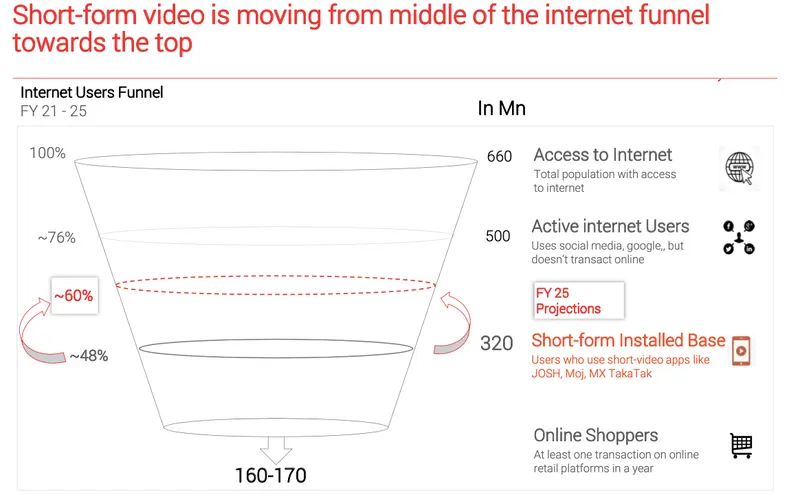

Monetisation

While monetisation still is a long way, Ujjwal explained that we can see the green shoots:

“In Tier-II and III cities, there is a significant growth in user base, bringing the brand attention to the segment”. Quoting the report, he adds, "Digital media is one of the fastest growing advertising channel with $2.37 billion annual spend."

The FMCG and media and entertainment verticals spend the largest share of digital media budget on online video, making them the biggest sector to advertise on short-form video platforms. Elite influencers with more than 10 million followers have a monthly earning of around $20,000 to $40,000.

Influencers with one million followers can earn up to $1,000 - $2,500, while budding creators with less than one million followers can earn $40 to $200.

“There is scope for light commerce to start soon in the platforms, maybe in a year or so,” says Ujjwal.

Edited by Kanishk Singh