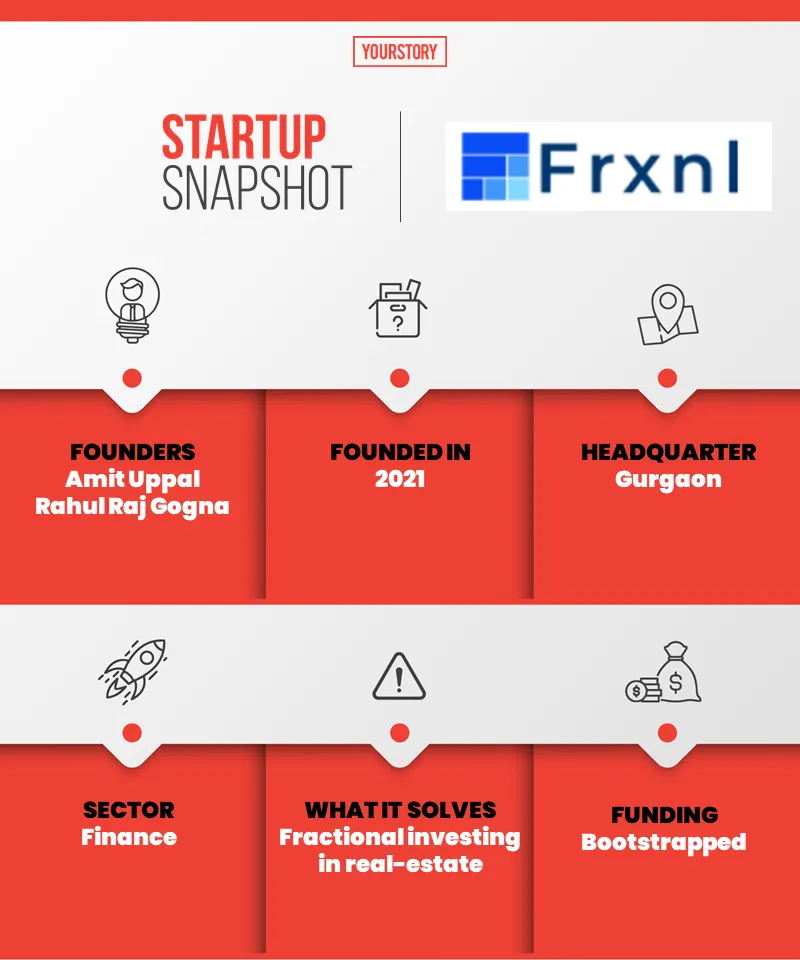

How proptech startup Frxnl makes it possible for the average Indian to invest in real estate

Fractional ownership is quickly becoming a new investor favourite, especially for costly investments such as real estate, in India.

With the investing world finally opening up to mom-and-pop investors thanks to platforms such as , , and , among several others, the demand for diversified investment opportunities has shot up. Increasingly, people are becoming more open to the idea of investing – not just in capital markets and treasuries, but also in IPOs, derivatives, forex, digital currencies, ETFs, and non-traditional vehicles such as environmentally sustainable projects and renewable energy.

Real estate has become an up and coming investment option in India, particularly for retail investors, thanks to platforms such as (read fractional). Founded by Amit Uppal and Rahul Raj Gogna in 2021, the startup allows people to invest nominal sums in real estate projects without having to grapple with the extensive paperwork and bureaucracy.

Unlike investing in stocks where one is allotted an entire share, and not a part of the share, Frxnl allows investors to make fractional investments in otherwise costly real estate projects. Traditionally, investment in high-yield real estate was limited only to institutional banks, asset management companies, and ultra-high net worth investors — but Frxnl makes it more affordable for middle-class retail investors to invest in real estate by offering opportunities starting from Rs 10 lakh.

“We wanted to correct the disparity in access to prime real estate, and a key problem to start with was how to make it affordable. Fractional ownership was the obvious solution,” Amit tells YourStory in an interview.

The Gurugram-based startup also helps solve the issue of trust when it comes to investing in real estate, where investments can go wrong, quickly.

“When it comes to real estate, there is way too much at stake for things to go wrong. A bad decision can terribly dent your financial goals, setting you back by years, if not decades,” Amit says.

It does that by using reputed third parties to evaluate properties for any encumbrances, escrow accounts to safeguard investors’ monies, and digital governance tools to allow investors to continuously monitor their investments.

“At Frxnl, we combine leading-edge technology with institutional expertise, hands-on property management, and a strong governance process to help users invest smarter and safer,” Amit says.

Investing in an asset Indians love

Given that nearly 80 percent of the average Indian household’s wealth is invested in real estate, the sector enjoys a position of trust that not even equities do. However, most Indians who buy property for investment purposes take the ‘buy-and-hold’ approach.

Frxnl eliminates that stagnancy by enabling people to put their money in rent-generating properties that are typically locked in by long-term leases, are professionally managed — hence don’t need any intervention from investors — and can generate steady and predictable returns.

“A fractional owner enjoys the same returns through lease rentals and capital appreciation as a sole owner would potentially do, minus a lot of troubles,” Amit quips.

Presently, the startup offers investment opportunities in commercial real estate, namely offices, warehouses, and retail spaces — all of which are pre-screened. As per its estimates, the listings on its platform so far can yield between 13 percent to 20 percent in returns over five to eight years.

It earns its revenue in three ways: distribution income from selling shares in a property; an annual property management fee; and a performance-linked incentive that aligns the interest of property managers with investors’ on its platform.

Co-founders of Frxnl

How it works

Rahul and Amit, both engineers and worked as colleagues at the same private equity firm which invested in real estate properties, founded Frxnl on the tenets of innovation, accessibility, and ease of use via a digital platform.

Users can start investing by simply signing up and browsing through offerings listed on the platform. Queries can be directed to the company’s in-house relationship manager.

Once the investment is finalised, a token amount is deducted from the user’s bank account to confirm their interest and commitment in a project — the remaining investment amount is debited once the listing is fully subscribed, ie once all fractions of the property are bought by various investors.

Users are invited to then monitor their investments through an in-built dashboard, as well as participate in making key decisions about the property, giving them full control over their investment. The startup is also currently developing a secondary market to enable users to sell their shareholdings.

“We imagine a future for the Indian real estate industry where ownership is truly democratic and hassle-free, and helps users realise their personal financial goals through an asset class they understand and love,” Amit says.

The bootstrapped, pre-revenue startup is currently in its beta-launch phase, and is present in Delhi-NCR and Bengaluru. Its audacious goal is to list a billion square feet of real estate on its platform by the end of 2025.

Frxnl’s main competitors include tech-enabled platforms such as AllSpace, RealX, FRACSN, , and hBits.

Fractional real-estate ownership is already a $5 billion market in India, and is slated to grow in the coming years, according to a post by Ankush Ahuja, ex-Corporate Director and Head of International Business at Investors Clinic, on CNBC. The idea of fractional ownership has already seen considerable success in the US and Singapore, and could become a dominant investment trend in India over the next three to four years, according to Riaz Maniyar, Co-founder, Real Estate Tech.

Edited by Kanishk Singh