[Startup Bharat] How India’s Tier II cities are emerging as new startup hubs buzzing with funding activity

We bring you a data led article on Tier II funding activity between 2015-2021, highlighting investor views on factors making these cities a preferred choice for entrepreneurs. Also, read which key cities made a mark, and have attracted investor attention recently.

Entrepreneurship is fast becoming the most pursued choice of career amongst youngsters today. And there are humongous opportunities to innovate for a large and diverse customer base in every sector.

Lately, we have seen that the geographical spread for startup funding has expanded from the Big 3 --Bengaluru, Delhi/NCR, Mumbai -- to the Big 8, including Chennai, Hyderabad, Pune, Ahmedabad and Jaipur.

Some early signs that emerge are – Chennai transforming into a software/deeptech hub, Jaipur leading as a fast growing Tier II startup hub while Pune enjoying its share of unicorns already (Firstcry, Druva, Icertis, MindTickle).

Overall, this augurs well for India as we need more than three cities to handle urbanisation, employment generation, and gender-income equality. And Tier II cities certainly offer a largely untapped opportunity here.

Padmaja Ruparel, Co-founder of Indian Angel Network and Founding Partner, IAN Fund, emphasises that Tier II & III cities are fertile grounds for innovative solutions to emerge.

“The growing internet penetration has made it easier for building propositions and scaling ventures. With the pandemic and lockdown, remote working helped to access customers and talent from these cities, and create many more innovative startups - building from Tier II cities, for the Tier II city problems/needs,” she adds.

Gopal Jain, Co-founder and Managing Partner, Gaja Capital, echoes these views.

“De-agglomeration could well be one of the legacy trends from COVID-19. And this trend is mainly driven by the digital economy where fresh growth is coming from Tier II cities.”

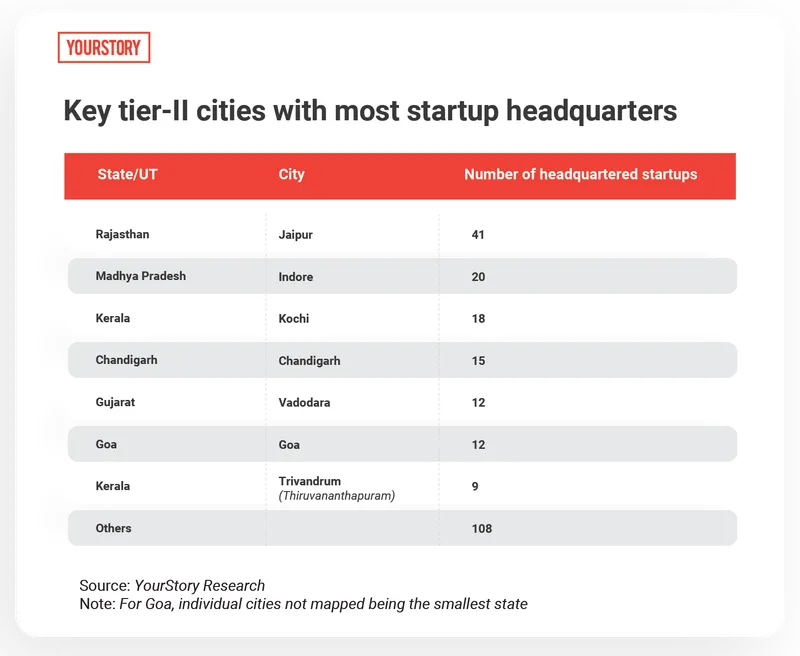

Tier II’s preferred headquarters

According to YourStory Research, Jaipur is turning out to be the most preferred headquarters among Tier II cities for startup founders as well as investors. More than 40 funded startups have their headquarters in Jaipur currently. Other popular hubs where startups are headquartered are Chandigarh (14), Goa (12), Indore (20), Kochi (18), and Vadodara (11).

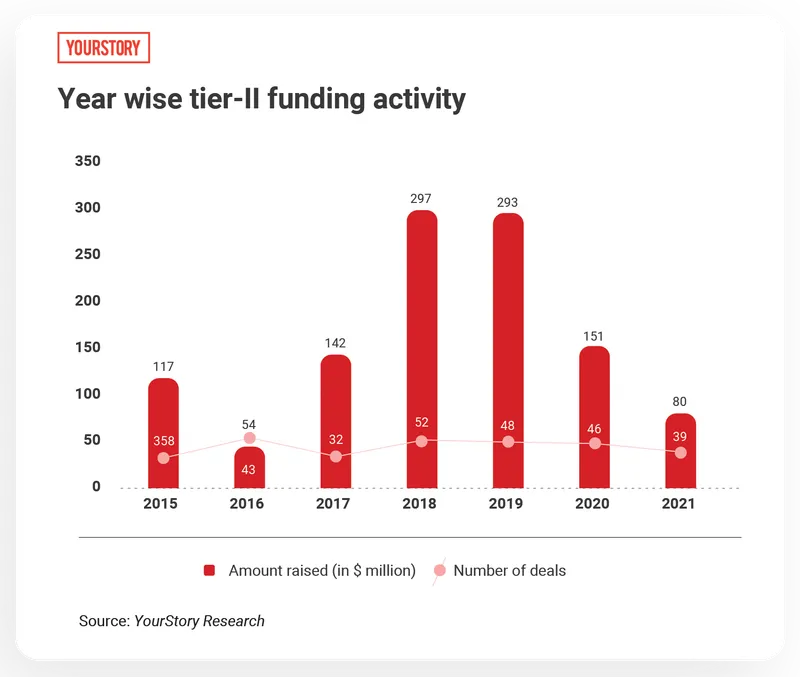

Tier II Y-o-Y funding activity

According to YourStory Research, between Jan 2015 - July 2021, Tier-II city startups in India raised approximately $1.12 billion in funding, across 305 deals. The graph below elucidates the impact of the COVID-19 pandemic, as the amount raised fell over 48.4 percent in 2020 as compared to the previous year.

Strikingly though, the total number of deals is almost the same. This indicates that investors have been continuously betting and exploring the Tier II potential in the country. Furthermore, in the first seven months of 2021, Tier II startups have already raised $80 million across 39 deals.

At this pace, the funding activity in Tier II cities could very well double in 2021, as compared to 2020.

Tier II’s top funded startups

The total funding raised by Tier II city startups between Jan 2015 - July 2021 is just 1.5 percent of the total $76.7 billion funding raised by the Indian startups during this period.

Yet, over this period, we have seen Indian investors reach out to more than 60 Tier II cities.

Faster adoption of technology and rising number of smartphone users are some of the reasons why startups are seeing exponential growth in these regions. That's perhaps because, small businesses need local solutions to survive, and startups originating from Tier II cities may be better equipped to offer these solutions in these geographies.

So, while national-level players address bigger issues, Tier II cities’ startups stand out for their concentrated efforts in building local solutions. And some of these solutions go on to work globally.

This pattern has increasingly encouraged the ecosystem to survive, scale and even build some of the most notable startups from some really small towns and cities in India.

A classic example here is Jaipur-based CarDekho. Founded in 2008, CarDekho operates in India and South East Asia. It has at least five auto portals and more than 70 CarDekho Gaadi stores, for buying and selling cars. It has raised approximately $327.5 million in funding with backing from investors such as Ratan Tata, Times Internet, Sequoia India, and Trifecta Capital, among others.

Here are some key Tier II startups that have raised a high amount of capital in the recent past.

Top 10 Tier II cities and booming startup hubs

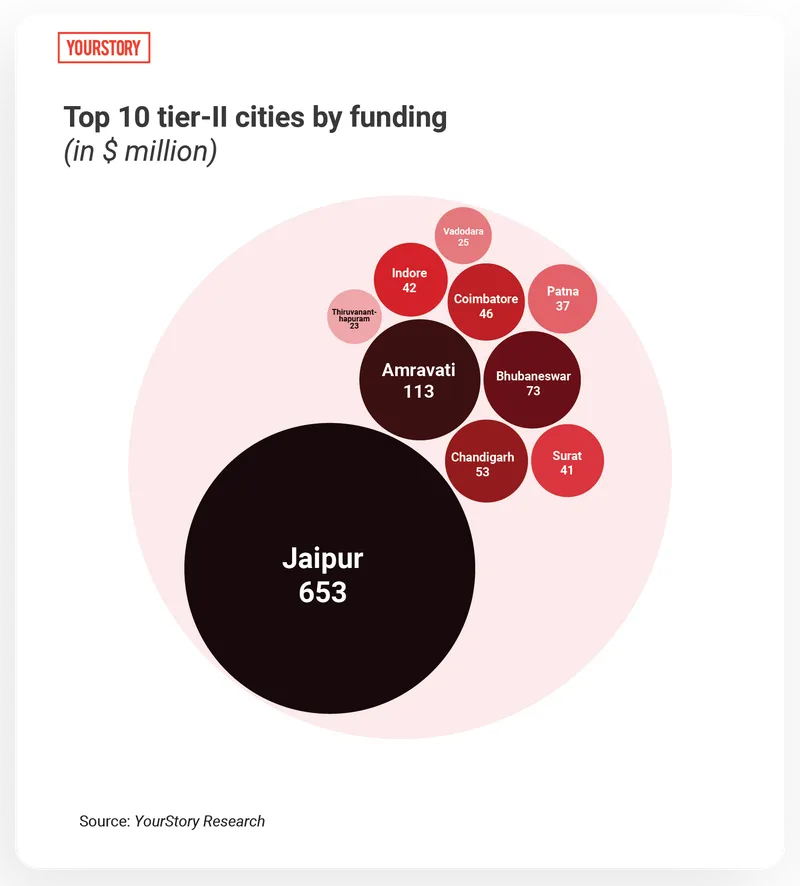

Interestingly, when it comes to funding, the dynamics differ. A look at the top 10 cities by funding activity between the period of Jan 2015 and July 2021 shows this -

Top 10 Tier II cities by funding [in $ million]

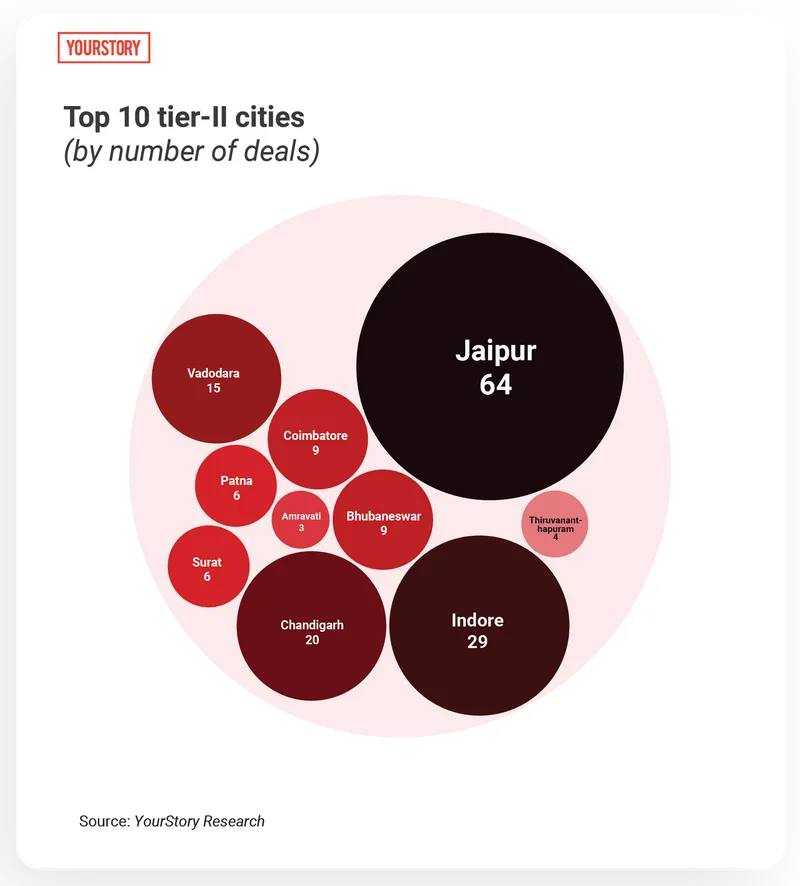

Top 10 Tier II cities [by number of deals]

What’s interesting here is the fluctuation between the number of deals and the impact they have created in top rankings with their larger ticket sizes.

For instance, Amaravati, the legislative capital of Andhra Pradesh, happens to be the second-highest funding raker. However, this statistic is purely on the grounds of funding raised by two startups -- Pi Datacenters and Picxy. These startups raised a total of $113 million with only 3 deals between the period of 2016 and 2018. Post that, there has been no funding activity in this city.

On the contrary, we saw small ticket investments pouring into Jaipur, Indore, Chandigarh, Kochi, Goa, Vadodara, Bhubaneswar, Coimbatore, Lucknow, Patna and Surat through the years and even during the pandemic times.

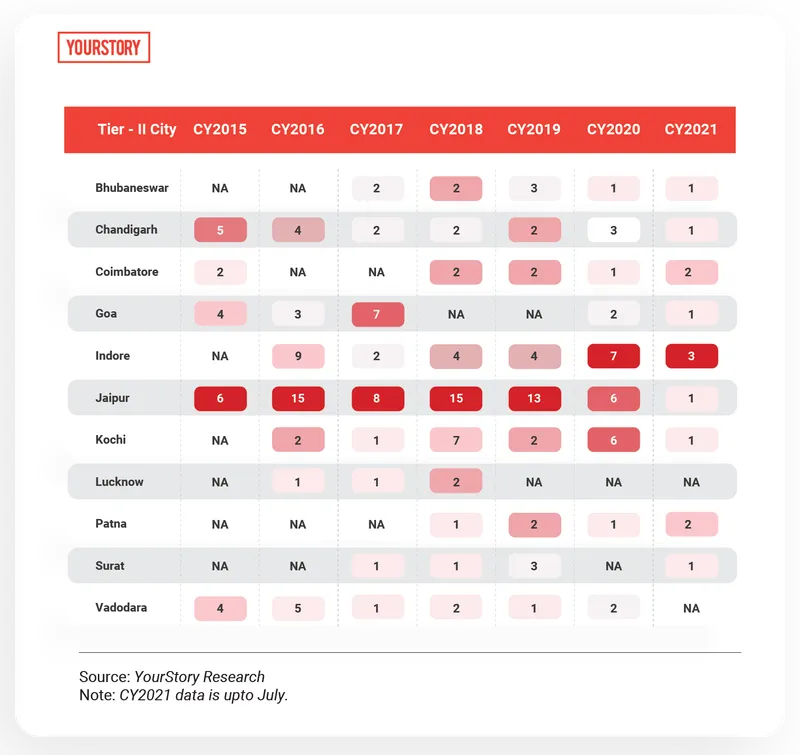

As seen in the graph below, although the number of deals are low, they are spread across the years, which positions these cities as attractive investment hubs rather than one-off large ticket size activity zones.

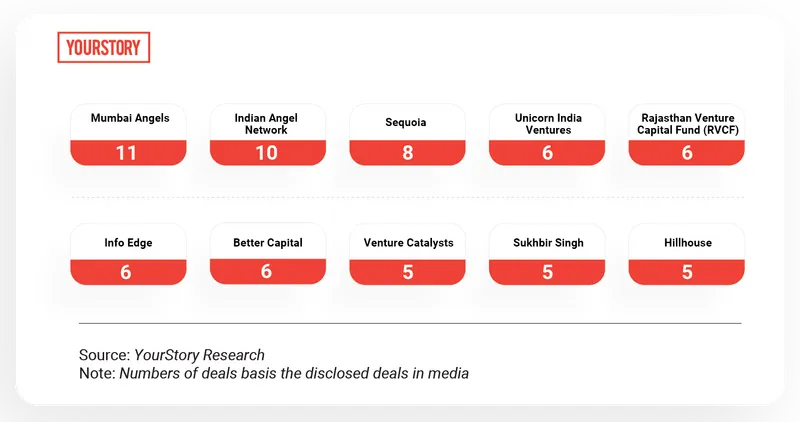

Top Tier II investors

Mumbai Angels is one the most active investors. Here is a glimpse of the top 10 investors in Tier II region.

Tier II deal flow in pandemic times

Predictably, the COVID-19 pandemic changed the dynamics for a lot of sectors. In a stark revelation of the extent of digitisation in the country, the number of active Internet users in India is expected to increase by 45 percent in the next five years, and touch 900 million by 2025 from around 622 million in 2020, according to the IAMAI-Kantar ICUBE 2020 report.

This increase will be driven by higher adoption in rural India and Tier II and Tier III cities, which has clocked a 13 percent growth to 299 million internet users over the past year, or 31 percent of India’s rural population.

Also, sectors like fintech, enterprisetech, retail/ consumer brands, direct-to-consumer (D2C) brands, agritech, edtech and foodtech among others, saw tailwinds post the pandemic outbreak, and saw scale at an aggravated rate.

Perhaps this is the reason we saw some Tier II city startups raising larger ticket size rounds even amid the pandemic period of 2020-2021.

Some of the notable startups here are Finova Capital ($55 million), LEAP India ($23 million), Milk Mantra ($10 million), Pushp Spices ($16.3 million), Zaara Biotech ($10 million), CareStack ($22.5 million).

The Way Ahead

As Rohini Prakash, Founder, Tomorrow Capital, mentions in an earlier interview with YourStory, the growing IT infrastructure and low cost of living are other factors which are increasingly making Tier II cities an attractive set up for entrepreneurs.

Also, one of the primary reasons for the growth of Tier IIcities is the increased availability of talent and the popularity of work-from-home. Most importantly, there has been a shift in mindset about big-city living.

According to Karthik Prabhakar, Executive Director at Chiratae Ventures, through the past 15+ months of working from remote locations, many founders and their teams have worked from Tier II cities. The mental fears of infrastructural challenges have all but vanished – robust internet and infrastructural connectivity has paved the way to consider other factors beyond proximity.

“Of course, there will be some course correction as companies scale but headquarters address may not matter in the medium to long term in a global world with remote operations,” he adds.

Further, given the decentralised nature of work post lockdown, there’s been a huge talent redistribution from a geographical standpoint. We now find amazing engineers and entrepreneurs working out of their home towns, and angel investing into their hometowns more frequently and more successfully.

“We think this will start creating a phenomenal cycle that will lead to more and more startup activities in areas that were previously remote from an Indian startup ecosystem point of view. This coupled with the fact that most VCs are now very comfortable making investments over Zoom, leads us to believe that the startup ecosystem in Tier II cities in India is set to grow highly exponentially in the next few years,” concludes Anurag Ramdasan, Principal – Investments, 3one4 Capital.

[Design: Manash Pratim]

YourStory’s flagship startup-tech and leadership conference will return virtually for its 13th edition on October 25-30, 2021. Sign up for updates on TechSparks or to express your interest in partnerships and speaker opportunities here.

For more on TechSparks 2021, click here.

Applications are now open for Tech30 2021, a list of 30 most promising tech startups from India. Apply or nominate an early-stage startup to become a Tech30 2021 startup here

Edited by Anju Narayanan

![[Startup Bharat] How India’s Tier II cities are emerging as new startup hubs buzzing with funding activity](https://images.yourstory.com/cs/2/77e43870d62911eaa8e9879653a67226/Tier2citystartups-08-1628873260718.png?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)