Axis Mutual Fund

View Brand PublisherAxis Nifty 50 Index Fund packs a diversified portfolio for investors with efficient risk management

After trading in the red initially due to the COVID-19 crisis, the Indian stock market stunned investors with a remarkable recovery over the past year. Buoyed by factors like government-backed initiatives, rising vaccination rate, India’s IPO boom and economic recovery, key market indices like NSE Nifty 50 and BSE Sensex hit all-time highs during 2021.

The optimism in the market has led several investors to explore different mutual fund categories like index funds. Index funds are mutual funds that mirror the performance of a benchmark index like Sensex or Nifty 50.

As they are passively managed without the guidance of a fund manager, they represent a class of equity funds that are cost-effective and serve as a tool of capital appreciation over medium to long term.

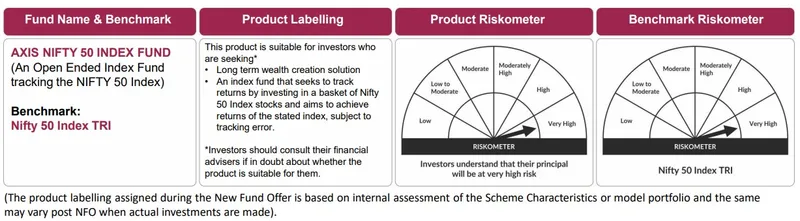

In tandem with consumer sentiment, Axis Mutual Fund is all set to launch a new index fund, Axis Nifty 50 Index Fund, which tracks returns by investing in a basket of Nifty 50 stocks. The open-ended fund is suitable for investors who are looking for a long-term wealth creation solution.

In an engaging fireside chat, Ashwin Patni, Head Products and Alternatives, Axis AMC spoke to YourStory about Axis Mutual Fund’s new scheme and what it has to offer investors.

Here are the key takeaways:

What’s driving the popularity of index funds in India

Ashwin said that the most important advantage of index funds was that they ensured transparency, thereby adding to the ease of understanding and investing in a scheme. “As is the case with popular indices like Nifty 50, the index constitution is in public knowledge. The index funds that track these indices offer investors a proportionate allocation of stocks making up the index. Moreover, the returns are also very stable," said Ashwin.

Talking about what set Axis Nifty 50 Index Fund apart from other schemes, he said that Axis Mutual Fund takes the effort to ensure that people understood the scheme and that its execution was efficient.

Nifty50: a benchmark index to track large-cap companies

Ashwin talked extensively about the fund house’s reasons while choosing Nifty 50 as a benchmark index for its new mutual fund scheme. He said that Nifty is among the most popular metrics that people refer to while trying to know what's happening in the stock markets.

“Nifty 50 features a basket of several well-performing companies that most investors have heard of. The biggest advantage that these companies have is that they generally perform well and the risk involved is relatively lower when compared to mid or small-sized companies,” he stated.

Axis Nifty 50 Index Fund: what’s in store for investors

Ashwin explained that from a risk perspective, every portfolio should be diversified. Irrespective of how a sector is performing, it can always suffer setbacks in future.

“These setbacks may be internal or external like the COVID-19 pandemic and can affect companies differently. For example, while COVID-19 hampered the growth of most sectors, others like IT and ITeS, healthcare or pharmaceuticals weren't affected as much. The Axis Nifty 50 Index Fund ensures that the investors get a good mix of stocks, rather than having to cherry-pick stocks,” he added.

Plus, it caters to the interests of both rookie and seasoned professionals with a diversified basket of stocks that captures favourable market trends efficiently.

Efficient risk management

One of the key USPs of the new mutual fund scheme was its efficiency in risk management and monitoring of stocks. Elaborating further, Ashwin said that in the case of a passively managed fund, the fund manager's job is to ensure that the scheme mimics the performance of a benchmark index efficiently. “It tends to be more about how he/she could make the fund more cost-effective. For an index fund, risk management is all about ensuring that the fund tracks an index as closely as possible," explained Ashwin.

Product Labelling:

Note: About FLEX - SYSTEMATIC INVESTMENT PLAN/ SYSTEMATIC TRANSFER PLAN ("Flex SIP”/ “Flex STP") Flex Systematic Investment Plan (“Flex SIP”) is a facility wherein an investor can opt to invest variable amount linked to the value of his investments in any of the existing open ended scheme(s) of Axis Mutual Fund (“Investee scheme”), on pre-determined date. This facility allows investors to take advantage of market movements by investing higher when the markets are low and vice-versa. Flex Systematic Transfer Plan (“Flex STP”) is a facility wherein an investor under any of the applicable open ended scheme(s) of Axis Mutual Fund can opt to transfer variable amount linked to value of his investments, on predetermined date from designated open-ended Scheme(s) of Axis Mutual Fund ("Transferor Scheme") to the Growth Option of designated open-ended Scheme(s) ("Transferee Scheme"). For more information, please refer to scheme information document of Axis Nifty 50 Index Fund available on our website www.axismf.com

NSE Indices Limited Disclaimer: The Axis Nifty 50 Index Fund (Products) are not sponsored, endorsed, sold or promoted by NSE INDICES LIMITED (formerly known as India Index Services & Products Limited ("IISL"). NSE INDICES LIMITED does not make any representation or warranty, express or implied, to the owners of the Axis Nifty 50 Index Fund or any member of the public regarding the advisability of investing in securities generally or in the Product(s) particularly or the ability of the NIFTY 50 Index to track general stock market performance in India. The relationship of NSE INDICES LIMITED to the Issuer is only in respect of the licensing of the Indices and certain trademarks and trade names associated with such Indices which is determined, composed and calculated by NSE INDICES LIMITED without regard to the Issuer or the Product(s). NSE INDICES LIMITED does not have any obligation to take the needs of the Issuer or the owners of the Product(s) into consideration in determining, composing or calculating the NIFTY 50 Index. NSE INDICES LIMITED is not responsible for or has participated in the determination of the timing of, prices at, or quantities of the Product(s) to be issued or in the determination or calculation of the equation by which the Product(s) is to be converted into cash. NSE INDICES LIMITED has no obligation or liability in connection with the administration, marketing or trading of the Product(s). NSE INDICES LIMITED do not guarantee the accuracy and/or the completeness of the NIFTY 50 Index or any data included therein and NSE INDICES LIMITED shall have not have any responsibility or liability for any errors, omissions, or interruptions therein. NSE INDICES LIMITED does not make any warranty, express or implied, as to results to be obtained by the Issuer, owners of the product(s), or any other person or entity from the use of the NIFTY 50 Index or any data included therein. NSE INDICES LIMITED makes no express or implied warranties, and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the index or any data included therein. Without limiting any of the foregoing, NSE INDICES LIMITED expressly disclaim any and all liability for any claims, damages or losses arising out of or related to the Products, including any and all direct, special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages. An investor, by subscribing or purchasing an interest in the Product(s), will be regarded as having acknowledged, understood and accepted the disclaimer referred to in Clauses above and will be bound by it.

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

The information set out above is included for general information purposes only and does not constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the Scheme. Income Tax benefits to the mutual fund & to the unit holder is in accordance with the prevailing tax laws as certified by the mutual funds consultant. Any action taken by you on the basis of the information contained herein is your responsibility alone. Axis Mutual Fund will not be liable in any manner for the consequences of such action taken by you. The information contained herein is not intended as an offer or solicitation for the purchase and sales of any schemes of Axis Mutual Fund.

Past performance may or may not be sustained in the future.

Stock(s) / Issuer(s)/ Top stocks mentioned above are for illustration purpose and should not be construed as recommendation.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.