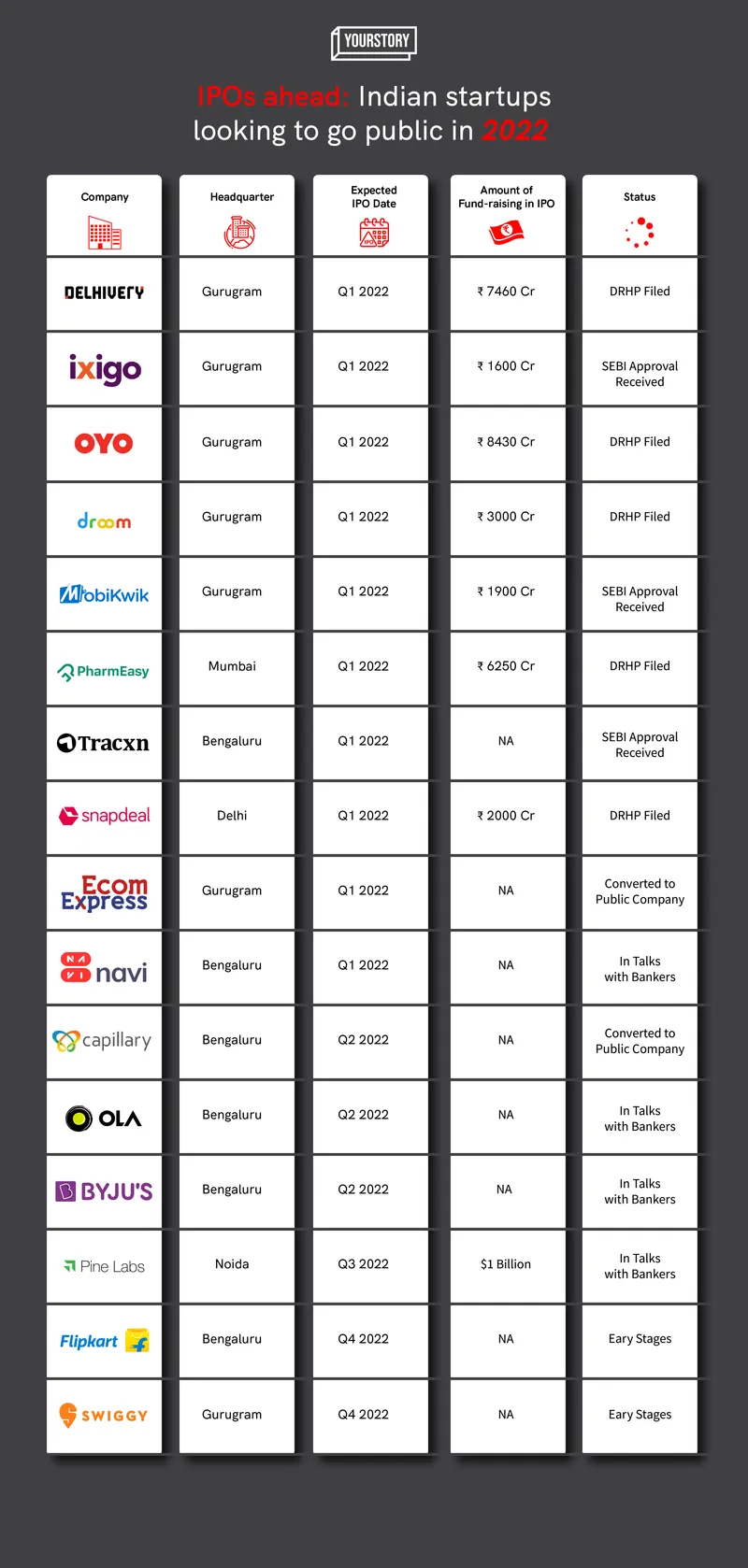

Here’s a list of Indian startups planning to go the IPO route in 2022

With several highly anticipated IPOs hitting the stock market this year, we can look forward to a very active IPO market in 2022 as well. Here’s a list of what’s in store for the year ahead…

The startup ecosystem has been one busy habitat in 2021.

Besides churning out over 40 unicorns (42 as of December 15, 2021, with a total valuation of $82.1 billion), 2021 has also been the year of Initial Public Offerings (IPOs), with , , , , , , , and getting listed.

In September, the Securities and Exchange Board of India (SEBI) Chairman Ajay Tyagi had said that thriving technology firms have raised Rs 15,000 crore in the last 18 months through initial share sales, and IPOs worth approximately Rs 30,000 crore are currently underway.

“Growing number of unicorns in the startup ecosystem is a testimony of the new-age tech companies coming of age in our economy. These companies often follow a unique business model focusing more on rapid growth than immediate profitability. Recent filings and successful public offerings of such companies is an important landmark in the further evolution of our equity markets,” said SEBI in its bulletin.

Thus, if 2021 was just a teaser for the IPO market, then 2022 can expect to be a blockbuster of a year, what with some big names waiting to go public.

We are talking unicorns like , , , , , , and that have spelt out their listing plans and filed their draft red herring prospectus (DRHP) with capital market regulator, SEBI.

Here’s a look at some of the notable names that are expected to make a debut in the next 12 months -

Delhivery

In November, Gurugram-based logistics unicorn Delhivery filed for an initial public offering (IPO) to raise up to Rs 7,460 crore, filings with the SEBI revealed.

The IPO of Delhivery will consist of a fresh issue of shares worth Rs 5,000 crore and an offer for sale (OFS) of Rs 2,460 crore from some of the existing investors. The IPO is expected to hit the market in the first quarter of 2022.

Investors Carlyle and SoftBank will reportedly be making a partial exit via the OFS. Private equity firm Carlyle Group, which first invested in the logistics startup in November 2017, will be selling shares worth Rs 920 crore in the OFS.

Last week, Delhivery acquired California-based platform for unmanned aerial system platforms, Transition Robotics Inc (TRI), for an undisclosed amount.

Ixigo

In August, Le Travenues Technology Ltd, which operates travel platform , filed preliminary papers with capital markets regulator SEBI to raise Rs 1,600 crore through an initial share sale.

The IPO comprises fresh issuance of shares worth Rs 750 crore and an offer of sale (OFS) of equity shares to the tune of Rs 850 crore by existing shareholders, according to their DRHP.

As a part of the OFS, Saif Partners India IV will offload shares worth Rs 550 crore, Micromax Informatics will sell shares for Rs 200 crore, and Aloke Bajpai and Rajnish Kumar will divest stakes worth Rs 50 crore each.

At present, SAIF Partners holds 23.97 percent in the company, Micromax 7.61 percent, Aloke Bajpai 9.18 percent, and Rajnish Kumar 8.79 percent stake in the firm.

The IPO of this Gurugram-based travel platform is likely to open in the first quarter of next year.

OYO

On October 1st, hospitality unicorn OYO filed its DRHP for an IPO to raise around $1.16 billion (Rs 8,430 crore) with market regulator SEBI.

According to the document seen by YourStory, OYO’s initial public offering consists of equity shares of face value of Re 1 each of Oravel Stays Limited aggregated up to Rs 8,430 cr ($1.16 billion).

As per the document, the offer comprises a fresh issuance up to Rs 7,000 crore and an offer for sale aggregating up to Rs 1,430 crore.

The IPO will consist of 83 percent fresh issue and 17 percent offer for sale. The IPO of this Gurugram-based startup is likely to open in the first quarter of next year.

Hospitality industry body The Federation of Hotel & Restaurant Associations of India (FHRAI) on December 16th again requested market regulator SEBI to suspend OYO's IPO process, citing non-disclosure of an investigation against the hotel chain for tax evasion, an allegation which the company has strongly denied.

Earlier in October, the FHRAI had urged SEBI to suspend OYO's IPO process, drawing attention to irregularities, such as being engaged in anti-competitive business practice and inadequate disclosures of critical court cases, among others, in its DRHP.

Droom

In November, unicorn and automobile ecommerce marketplace Droom filed its DRHP with markets regulator SEBI to raise upto Rs 3000 crore from an IPO.

The public offering will include fresh issue of shares aggregating Rs 2000 crore, and an offer for sale of shares upto Rs 1000 crore by Droom Pte, which is the sole promoter of Droom Technology.

Droom, founded in 2014 by Sandeep Aggarwal, will utilise Rs 1,150 crore for organic growth initiatives including expansion to Tier III and IV cities and international expansion, apart from acquisition and marketing and branding activities for sellers and buyers. Separately, Rs 400 crore will be utilised towards funding inorganic growth.

The company was last valued at $1.2 billion during a $200 million pre-IPO funding round from new investors 57 Stars and Seven Train Ventures.

The IPO of the Gurugram-based startup is likely to happen during January-March 2022.

MobiKwik

In July, Gurugram-based digital payments unicorn MobiKwik filed for an initial public offering to raise Rs 1,900 crore, its DRHP showed.

The Rs 1,900 crore includes a fresh issue worth Rs 1,500 crore, and the remaining component - Rs 400 crore - will be secondary share sales where existing investors can sell their stakes in the startup.

Founded in 2009 by husband-wife duo Bipin Preet Singh and Upasana Taku, MobiKwik had recently raised around $20 million from the UAE's sovereign wealth fund, Abu Dhabi Investment Authority. The fundraise valued MobiKwik at around $700 million, according to a Registrar of Companies (RoC) filing by the startup.

This startup is also expected to hit the public markets in the first quarter of 2022.

PharmEasy

In November, the parent company of epharmacy unicorn Pharmeasy, API Holdings, filed its DRHP with markets regulator SEBI on Monday for a Rs 6,250 crore IPO through a primary share sale.

The company is also in talks with investment bankers to raise Rs 1,250 crore as part of a pre-IPO round, which will bring down the fresh issue size.

In October, Pharmeasy raised Rs 2,602 crore approximately ($350 million) in a pre-IPO round from Singapore-based Amansa Capital, US-based hedge fund Janus Henderson, global healthcare asset manager OrbiMed, and other investors including Steadview Capital, ADQ, Neuberger Berman, among others.

The round valued API Holdings at $5.4 billion. According to media reports, the round was a mix of both primary and secondary financing. The reports suggested that early investors also sold partial stakes to senior employees and founders.

The company will utilise an estimated Rs 1,929 crore from the public offering towards prepayment or repayment of outstanding debts.

The IPO of the Mumbai-based startup is expected to hit the markets during the first quarter of 2022.

Tracxn

In August, Bengaluru based Tracxn Technologies Ltd – the parent company of data intelligence platform – filed its DRHP with market regulator SEBI. In November, the company received the market regulator’s approval for its IPO. The platform’s offer solely comprises an offer of sale of up to 3,86,72,208 equity shares.

Out of the OFS of nearly 3.87 crore shares, Elevation Capital will offer 1.09 crore shares, Accel India will offer 40.2 lakh shares and SCI Investments will offer 21.81 lakh shares.

In addition, the 2 Flipkart founders, Binny Bansal and Sachin Bansal, will offer 12.63 lakh shares each. Promoters Neha Singh and Abhishek Goyal will sell 76.62 lakh shares each.

The market expects the offer to open during the first quarter of 2022.

Snapdeal

In a recent development, Delhi-based ecommerce retailer has filed its DRHP with SEBI to raise Rs 1,250 crore in fresh issue of shares through an IPO. In addition, existing investors in the company including SoftBank, Foxconn and Sequoia will be selling 3,07,69,600 equity shares in the company.

The company has appointed Axis Capital Limited, BofA Securities India Limited, CLSA India Private Limited and JM Financial Limited as the book running lead managers for the IPO.

The firm recently converted into a public company. As per a resolution passed by the company (dated December 5, 2021), its shareholders have approved the conversion of the ecommerce marketplace to Snapdeal Limited from Snapdeal Private Limited.

Snapdeal’s largest shareholder is SoftBank and holds 35.41 percent shares in the company, followed by B2 Professional Services LLP, whose directors are listed as Yashna Bahl and Parul Bansal, spouses of co-founders of the company, Kunal Bahl and Rohit Bansal respectively.

Ecom Express

Gurugram-based , a logistics and warehousing solutions provider for the ecommerce industry, has shortlisted four investment banks for its proposed IPO due to be launched in 2022, reported Moneycontrol on October 20 this year.

On October 22, the startup passed a resolution where the company’s shareholders approved the company’s conversion from Ecom Express Private Limited to Ecom Express Limited.

A recent report by VCCircle said the firm was eyeing a listing at a valuation above $2 billion.

Navi Technologies

Sachin Bansal's Navi Technologies is preparing for an IPO in 2022 and has appointed four banks, including Axis Capital and Credit Suisse, as advisors, Moneycontrol reported recently.

The Bengaluru-based company is expected to file its DRHP within the ongoing financial year (FY22).

Navi Technologies turned profitable in FY’21, posting a consolidated profit of Rs 71 crore, according to the startup’s regulatory filings. The company had posted a loss of Rs 8 crore in the previous financial year.

Founded by founder Bansal and his college friend Ankit Agarwal in 2018, the fintech’s businesses include lending, general insurance, mutual funds, and microfinance. It is also awaiting the Reserve Bank of India’s (RBI) nod for a universal banking license to build a bank from the ground up, utilising the technology stack built in-house.

Navi Mutual Fund recently submitted draft documents to the Securities and Exchange Board of India (SEBI) to launch its blockchain index fund of fund (FoF).

Capillary Technologies

Bengaluru and Singapore-based has reportedly roped in Kotak and ICICI Securities to manage its IPO.

The company has also converted into a public company, according to its regulatory filings.

As per media reports, the startup aims to list itself on the exchanges by the end of Q2 2022.

Founded in August 2008 by IIT Kharagpur alumni Aneesh Reddy and Krishna Mehra, Capillary Technologies is backed by Warburg Pincus, Sequoia Capital, Avataar Capital, and Filter Capital. It is an omnichannel engagement and commerce solution startup that claims to have a stronghold in India, Southeast Asia, MENA, and China among other countries.

Ola

Ola’s Chairman and group CEO Bhavish Aggarwal told CNBC in August that the Bengaluru-based ride-hailing unicorn has plans to go public next year — but, a final date for the initial public offering has yet to be decided.

Aggarwal said both and — the company’s electric-vehicle arm — have adequate capital and strong balance sheets.

“But, both companies in due course will go public. Ola will obviously go public sooner, it’s a more mature business — sometime next year, but we don’t have any final, final date to share with everybody,” he added.

BYJU’S

Bengaluru-based edtech unicorn is reportedly considering a public market listing in the United States through a special purpose acquisition company (SPAC).

It is also evaluating a domestic listing in the second half of calendar year 2022 and is in talks with bankers, according to media reports.

“Michael Klein’s Churchill Capital has made an offer of investing $4 billion at a valuation of more than $48 billion,” the source said. “Since a large part of the business is in the US, a listing in the market is being considered,” the person added.

Pine Labs

In September, Noida-headquartered point of sale (PoS) and merchant commerce solution provider converted into a public company, and is reportedly eyeing a public listing in the US. The fintech’s parent Pine Labs Pte is now Pine Labs Limited.

As per media reports, the company has hired investment banks Morgan Stanley and Goldman Sachs to manage the proposed IPO, and is looking to raise nearly $1 billion through a mix of primary and secondary stake sales.

Backed by marquee investors such as Sequoia Capital, Paypal, Lone Capital and others, Pine Labs is expected to go public by the third quarter of 2022.

Flipkart

Speaking at the Morgan Stanley Global Consumer & Retail Conference recently, Brett Biggs, executive vice president and chief financial officer of Walmart recently said that Bengaluru-based Flipkart’s IPO is on the cards but there is no timeline for it.

"The (Flipkart) business is performing almost exactly like we thought it would,” said Biggs. “It's the timing. Is the business exactly where you want? Is the market right? All those things (we) have to figure into (when) you do an IPO.”

In September, Flipkart launched ‘Flipkart Boost’, an integrated, service-fee based programme for D2C brands.

The company said it will provide end-to-end support covering planning, advertising, cataloguing, logistics, quality control and mentoring to homegrown brands.

Further, in June, the firm had forayed into the social commerce space with Shopsy, intending to capture a larger share of shoppers on the internet.

Swiggy

Bengaluru’s foodtech unicorn is also readying itself for an IPO and is expected to get listed in the October-December quarter next year.

Recently, the online food delivery startup has announced to invest $700 million in its express grocery delivery platform Instamart.

In July, Swiggy had closed a $1.25 billion round of funding led by SoftBank Vision Fund 2 and Prosus at a valuation of $5.5 billion. Founded in 2014, Swiggy in October announced plans to hold two ESOP liquidity events worth $35 million – $40 million at its current valuation in the next two years.

Apart from these, companies like Udaan, PhonePe, BigBasket, Cars 24, CarDekho, The Good Glamm, CSS Corp, Urban Company and more are also in the pipeline to go the IPO route in 2023.

Edited by Anju Narayanan