How fintech startup Ezeepay is enabling access to formal financial services in rural areas

Founded in 2018 by Shams Tabrej, Rashid Ali, and Dilkash Ara, Ezeepay is a fintech startup that aims to solve the underpenetration of financial services in rural India. It currently operates in UP, Bihar, Madhya Pradesh, and Jharkhand, and is exploring an expansion to South Indian markets.

In a queue one day, to exchange his old, demonetised notes back in 2016, Shams Tabrej noticed how most people around him were daily wage earners and day labourers. He struck up a conversation with a couple of folks and discerned that they had all been standing there since early morning, at the cost of earning a living that day.

This was nothing new though.

Shams, who hails from a rural village in Bihar, knew that for most people in his village, accessing financial services for the smallest of things took an entire day, or at least a majority of one’s working hours. Trudging all the way to the next village, often 20-30 kilometres away where the nearest bank is located is not unheard of in rural India - and that was the case with Shams as well.

After demonetisation, Shams decided this lack of access to banking in rural areas was not a problem he could live with, and got together with his childhood friends and family members, Rashid Ali and Dilkash Ara, to set up .

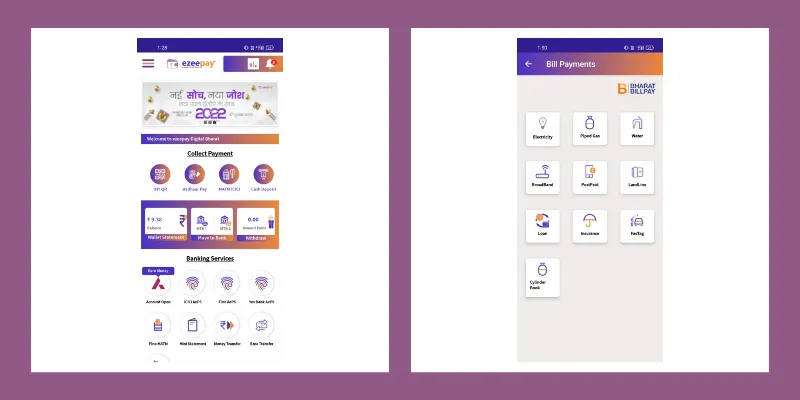

Ezeepay is a financial-technology startup that primarily serves the rural segment. The New Delhi-based venture provides digital banking services such as microloans, insurance, investment buying, AEPS, money transfer, and bank account opening; utility services such as bill payments, mobile recharge, hotel and travel booking; and compliance services such as ITR filing, GST registration, MSME registration, among others.

It provides all these services at its micro-ATMs and Ezeepay Touchpoint stores across the country, apart from its app. The Ezeepay stores not only enable people to conduct digital banking, but also help users renew their documentation and pay all sorts of bills without having to waste time travelling to different places.

“Our mission is to take banking to every rural household and solve the issue of banking in rural areas across the country. We offer convenience to our customers,” Shams tells YourStory.

The startup also offers doorstep digital services via a large network of on-ground agents. These agents not only help people access digital banking, but also help them conduct online transactions such as bill payments.

Revenue model and traction

One of the main issues Shams recalls running into in the initial days of setting up Ezeepay was adoption by its target audience, which was digitally illiterate. Low literacy levels and a lack of understanding of finances and financial technology made it hard for the startup to penetrate rural areas meaningfully.

“Working in smaller areas with comparatively lesser exposure and low literacy has some drawbacks. We had difficulty in building trust and familiarising people with digitalisation. Language also became a barrier in our journey sometimes,” Shams says.

The founders took on the responsibility of not only educating their target audience on financial matters, but also helped them understand how to use technology. The language barrier too was easy to overcome once they started offering multi-language support.

Ezeepay has built up a user base of about 2.7 lakh people since its inception in 2018. It has seen over one lakh downloads of its app, and its retail customer reach is nearly one crore.

The startup mainly earns its money from the banks it has tied up with, on every transaction it helps to conduct on its platform.

Shams says nearly 80 percent of its earnings are allocated to helping its customers by improving the company’s offering; only 20 percent is retained as profit. Users don’t bear any costs to use Ezeepay’s services.

The self-funded startup will be going for its first round of funding this year, capital from which it hopes to use to scale up. It also plans to deploy 2.5 lakh micro-ATMs in rural areas over the next three years to enable more transactions.

Its competitors in India include the likes of Spice Money (which enables rural banking by partnering with local kiranas and businesses), , JaiKisan, and , among others. Bigger startups like and are also making a bid to tap underserved users in rural India, where the next billion internet users are widely expected to hail from.

Valued at nearly $60 billion in FY20, the Indian fintech industry is expected to grow multifold to $150 billion by 2025, according to Invest India. Of this, rural fintech services are expected to account for a 30-40 percent share, especially as financial literacy improves. For startups like Ezeepay, this not only translates into a bigger TAM and more business, but also means better and improved access to formal financial services in rural areas.

Edited by Teja Lele