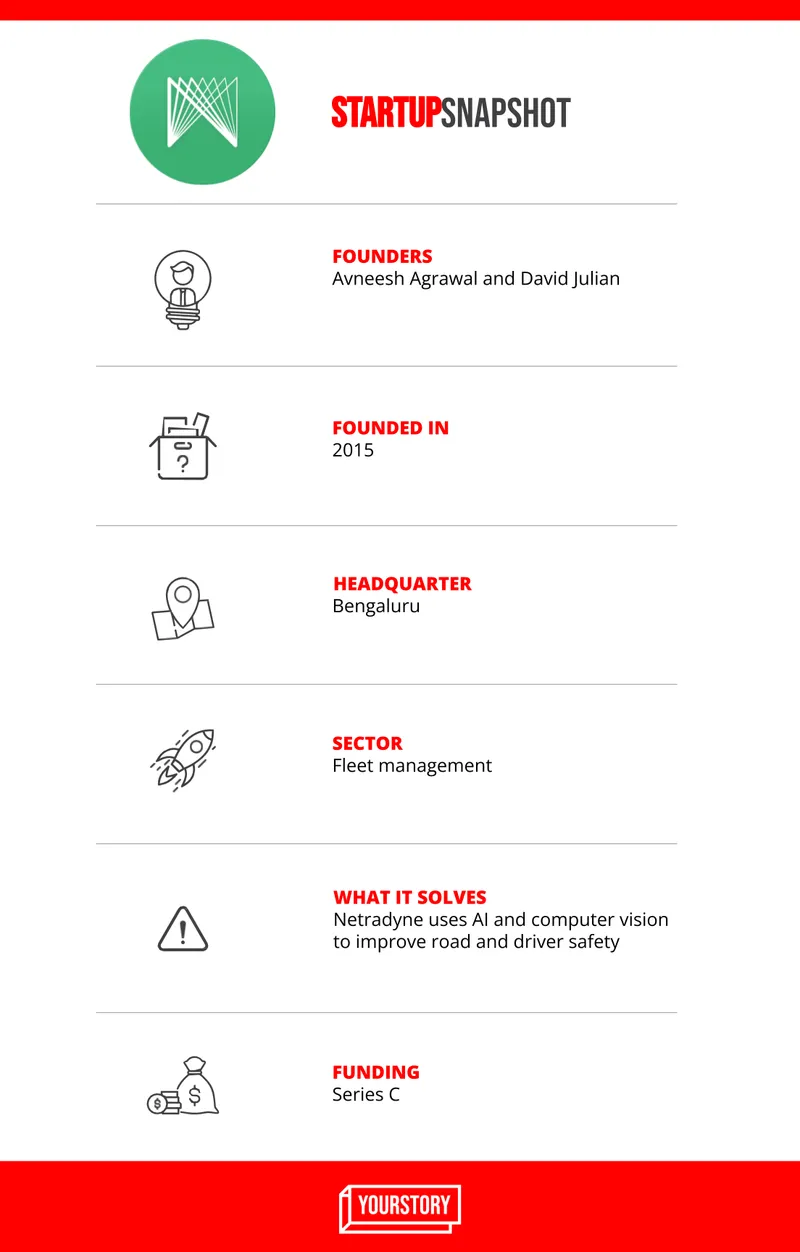

Fleet safety startup Netradyne expects to see 100 pc growth by 2024

The US and Bengaluru-based Netradyne uses artificial intelligence and computer vision to improve road and driver safety. It has developed a device that can be mounted on the windshield of a vehicle to monitor the road and driver simultaneously.

Avneesh Agrawal and David Julian started in 2015 to solve road and driver safety problems across the world by using their deep knowledge and vast experience in artificial intelligence and computer vision.

The San Diego, USA-headquartered startup, with its corporate office in Bengaluru, claims to have seen 300 percent growth year-on-year in the last two years.

“We have been fortunate to have seen a 52.9 percent CAGR in annual recurring revenue (ARR) since 2018. We grew 200 percent in 2021 as compared to 2020, and we expect to grow 100 percent year-on-year for the next two years,” says Co-founder and CEO Avneesh.

In 2019, Netradyne launched Driveri, an advanced vision-based fleet safety camera platform built to reinforce good driving behaviour. It can assess and alert drivers on factors such as speed, traffic sign compliance, and distracted driving, among other functions.

Most of the software and hardware for Driveri was developed in India. Till date, Driveri has captured, processed, and analysed 4 billion miles of driving, over 15 billion drive time of data, and continues to collect over one billion minutes every single month.

With a pan India presence, the startup says it will have almost 2,000 vehicles deployed with Driveri devices across Indian roads by the end of this quarter. While the US continues to be its biggest market, the company has launched the devices in Australia/New Zealand last month and will be launching in the US and EU this month.

The fleet safety startup has over 1,000 customers, with major clients are in the US. Indian clients include Zoomcar and Shell, among others.

The initial days

Avneesh says, “the biggest problem we saw when Netradyne was incepted was the lack of advanced AI and vision-based safe driving telematics system that could assist drivers in averting road accidents.”

By pioneering a data driven preventive and post-accident risk assessment mechanism for safe driving on roads, Netradyne emerged as a category defining leader for commercial fleet operators, he says.

“Though other companies are playing catch-up, we are far ahead in terms of capturing and analysing the driving data by our technology,” Avneesh adds.

How it works?

Netradyne claims to be the first commercial vehicle technology provider to combine Artificial Intelligence with video to detect, reason, and determine the causality of events, as it informs the way fleet drivers interact with the road around them.

The startup’s proprietary device Driveri has cameras that can simultaneously process all the signs, vehicles, and traffic lights in front of the vehicle, as well as keep track of the drivers’ activities to check if they are drowsy or distracted.

The device is mounted on the windshield of the vehicle to monitor the road and driver simultaneously. It has the capacity to not only alert the driver immediately but also record the incident and send a report to the fleet manager. Netradyne is using this technology not just to take control of the vehicle, but to assist drivers in reducing the number of accidents.

The system uses high-end processors and algorithms to essentially do two things - one is to assess the performance of the drivers and provide real-time alerts through audio messages. The second is to send this information along with the video for every single alert to the fleet managers, who use it for coaching or incentivising drivers.

The system then assigns a score based on the driving performance, which helps the manager decide the incentives.

According to the team, Netradyne is transforming the road transportation ecosystem by collecting and analysing more data points and meaningful information than any other fleet safety organisation so that customers can improve retention, increase profitability, enhance safety, and enable end-to-end transparency.

Netradyne's primary competitors are Nauto, Lytx, and Omnitracs.

The team

Since its inception, Netradyne has been building a world-class team to deliver industry-leading fleet safety solutions.

A technology veteran for 20 years, Avneesh has been passionate about converting research ideas into commercial reality. Avneesh holds a bachelor’s degree in computer systems engineering and a master’s of science and PhD in electrical engineering from Stanford University.

Prior to founding Netradyne, Avneesh was Senior Vice President of Technology and Business at Qualcomm for over 10 years. Avneesh has been granted over 150 US patents.

While working for Qualcomm, Avneesh met David Julian. David had worked at NASA’s Jet Propulsion Laboratory (JPL) on Galileo and Cassini deep space missions earlier. He was later a Principal Engineer in Qualcomm Research, where he was awarded over 100 US patents covering a wide range of technologies and started and led several R&D efforts, including the Qualcomm Zeroth Deep Learning Team.

David has a BSEE from New Mexico State University, and an MS and PhD in Electrical Engineering from Stanford.

Both Avneesh and David decided to start Netradyne inspired by a far-reaching vision to solve road and driver safety problems across the world in 2015.

Netradyne has a niche specialised team of over 350 employees globally.

The market and funding

According to a report by MarketsAndMarkets, the global fleet management market size is expected to grow from $20.6 billion in 2021 to $33.9 billion by 2026, at a compound annual growth rate (CAGR) of 10.5 percent.

“The market potential is huge because it affects all commercial vehicles and is also directly and dramatically affecting commercial auto insurance. The company has data from its customers that suggests that the accident rates have reduced to 30-40 percent, and distracted driving has gone down by about 80 percent,” says Avneesh.

The startup raised $150 million in Series C funding led by SoftBank Vision Fund, at a valuation of nearly $1 billion, in July 2021. Existing investors Point72 Ventures and M12 also participated in the round. This financing, along with earlier investments, brings Netradyne's total capital raised to over $197 million.

“The fact that SoftBank has invested $150 million in Netradyne reflects the potential of this technology to transform the road transportation and safety ecosystem,” states Avneesh.

Netradyne’s business that includes the suite of offerings including device as well as cloud-based services has been growing at 3X year-on-year globally, especially during the pandemic.

Challenges and future

The real challenge for the company today is to be able to scale up resourcing, especially in the technology area. Its operations in India are growing at a good pace and the startup is trying to ramp up hiring of team(s) accordingly.

As the skill sets needed for its line of work are niche in nature, Netradyne will be adopting various routes in hiring these specialists from top campuses such as IISC, IITs, and top engineering colleges such as RVCE and BMS in Bengaluru to name a few.

In the early years, the company had consciously focused on India and the US as key business markets to make technology available on a large scale. However, in line with its aspirations to become a global player, Netradyne continues to expand globally.

Within this year, the company expects to see its products being launched in the UK, Europe, Australia/New Zealand, Mexico, and other select markets. It will aggressively focus on the automobile, surface transport, and logistics segment such as commercial fleet management companies, hazardous and high value goods transporters, private car, trucks and bus manufacturers/operators to name a few.

Edited by Megha Reddy