PPI-credit ban: EarlySalary, Jupiter, OlaMoney suspend some services; Paytm Postpaid hit

Following RBI's circular barring non-banks from loading credit in e-wallets, several fintech startups have temporality halted a few services.

Fintech startups and have suspended their credit-linked card services following the Reserve Bank of India's ban on non-banks loading credit into e-wallets, while other services including Paytm Postpaid and OlaMoney too have been affected.

Jupiter Edge, a unit of neobanking platform Jupiter, informed customers in a social media post on Thursday that it was "pausing" its services following RBI's recent guidelines. "Please be assured that we are in the process of evaluation, you'll be notified once we are back," the company said.

EarlySalary said it has put the brakes on its card services for now. “There was no preparation time given. We are also understanding (the RBI circular) and will come back with an answer,” Akshay Mehrotra, Co-founder and CEO of EarlySalary, told YourStory.

As for Paytm Postpaid, the 'buy now, pay later' arm of fintech giant has remained unavailable on third-party apps such as and since RBI's announcement on Tuesday.

Paytm, however, denied this and said its Postpaid services "continue to be fully operational for its users".

"For a very small percentage of users, where they had linked Paytm Postpaid to the Paytm Wallet for use, when the wallet balance is low, the service has been temporarily halted pending clarification," a company spokesperson said in an email reply to YourStory. "Moreover, Paytm wallet is issued by Paytm Payments Bank and hence is not covered under the guidelines as per our understanding."

The spokesperson added the move by Swiggy and Zomato "was taken before this issue on another RBI concern." It wasn't immediately clear what that concern was.

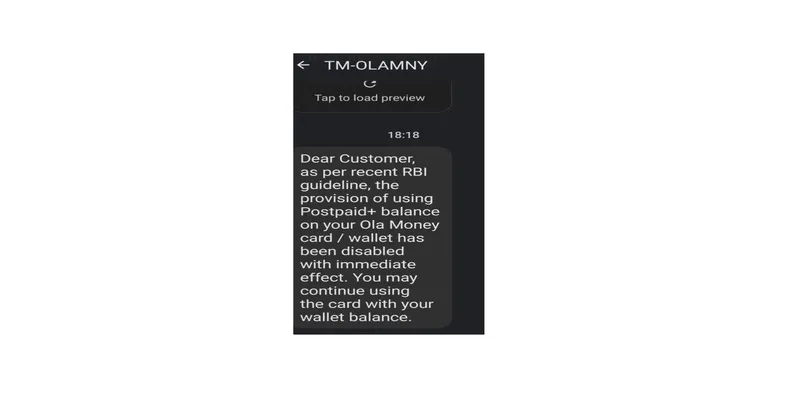

OlaMoney PostPaid, the digital credit payment service of cab aggregator , also informed users that it was disabling a provision allowing the use of its postpaid service along with a user's balance on Ola Money card or wallet. The company provides the product in partnership with affiliate financial partners, including non-banking financial companies.

Rajan Bajaj, Founder and CEO at Slice, said the company was working with its partner bank to comply with the regulation.

The issue at hand

RBI on Tuesday barred NBFCs from loading credit lines on to prepaid payment instruments (PPIs) such as e-wallets or prepaid cards.

While loading a wallet (for instance Gpay, PhonePe, Amazon Pay, or Paytm) using a bank debit card or credit card is allowed, taking a line of credit from an NBFC, or a non-bank, and then loading the wallet of the consumer is not allowed.

Several new-age fintechs such as , , , and , as well as neobanks have been taking a bank’s PPI (co-branded credit cards, for instance) and offering credit lines via their own NBFC or NBFC-partners to customers.

Essentially, players like Slice and Uni, primarily known as challenger credit cards, as well as post-paid services such as Paytm Postpaid, Ola Postpaid, and Flipkart Pay Later, will be impacted by the notification as most of these BNPL players source their credit from NBFCs, which do not have a direct affiliation with banks.

Tightening the noose

“NBFCs can't have accounts that allow you to pay using them. You can take the money into your bank account and pay from the bank. NBFCs aren't allowed to issue cards. Wallet providers aren't allowed to issue credit," said Deepak Shenoy, Founder and CEO at investor research and wealth management firm Capital Mind. "Maybe the idea is that NBFC lending should hit a bank account. Otherwise, the NBFC/wallet/mutual fund ecosystem can be used to bypass the banking system completely."

He added: "MF lends to NBFC, the NBFC loans money to wallet, and the wallet is used to pay. No need for bank at all?"

Consumer protection is touted to be another reason (other than to protect banks from shadow players taking over) for RBI's decision. Macquarie Capital Securities in a note said many customers were unknowingly taking a line of credit through their wallets at the point of check-out.

"Some of these practices have not gone down well with the regulator,” it added.

BharatPe co-founder Ashneer Grover also took to social media expressing his views, terming RBI's latest circular as a "flex move by banks".

"Not allowing loading of pre-paid instruments through credit is aimed at protecting bank’s lazy credit card business from Fintech’s potent BNPL business. It’s a flex move by banks - rent seeking. But market is market and regulation will eventually come around to what market needs," Ashneer said in a Tweet.

Next course of action

According to Sameer Singh Jani, founder and CEO of fintech consulting firm Digital Fifth, impacted fintech companies might have to acquire an NBFC licence as well as a credit card licence so they have regulatory support.

“They may move towards the classic BNPL model funded by equity instead of credit lines from NBFC. This segment also carries the risk of regulation, however, it is still available for building up," Sameer said. "They may also move towards short term individual loans, where payment would be made to the merchants and in the rare case to the customer. This essentially removes the card engagement layer.”

Startups might also look at partnering with banks for savings accounts with credit lines, which is within the RBI framework, or at least close to it, he added.

Evaluating the impact on customers, experts say that the challenger credit cards will shrink to just being prepaid cards.

“Many customers of these cards will potentially go back to 'no credit arena again', as they may not qualify bank’s credit approval criteria,” said Sameer.

These cards were a big boon from the inclusion perspective (students and young professionals) and the change would damage customer credit availability.

(Updated throughout with additional information, and to include clarification from Paytm that its "Postpaid service continues to be fully operational for its users." Also removed Onecard's name from the list of fintechs that are likely to be impacted.)

Edited by Megha Reddy, Rajiv Bhuva and Feroze Jamal