Clear acquires compliance risk management startup CimplyFive

This marks the second acquisition by Clear in 2022, following the acquisition of Xpedize earlier this year.

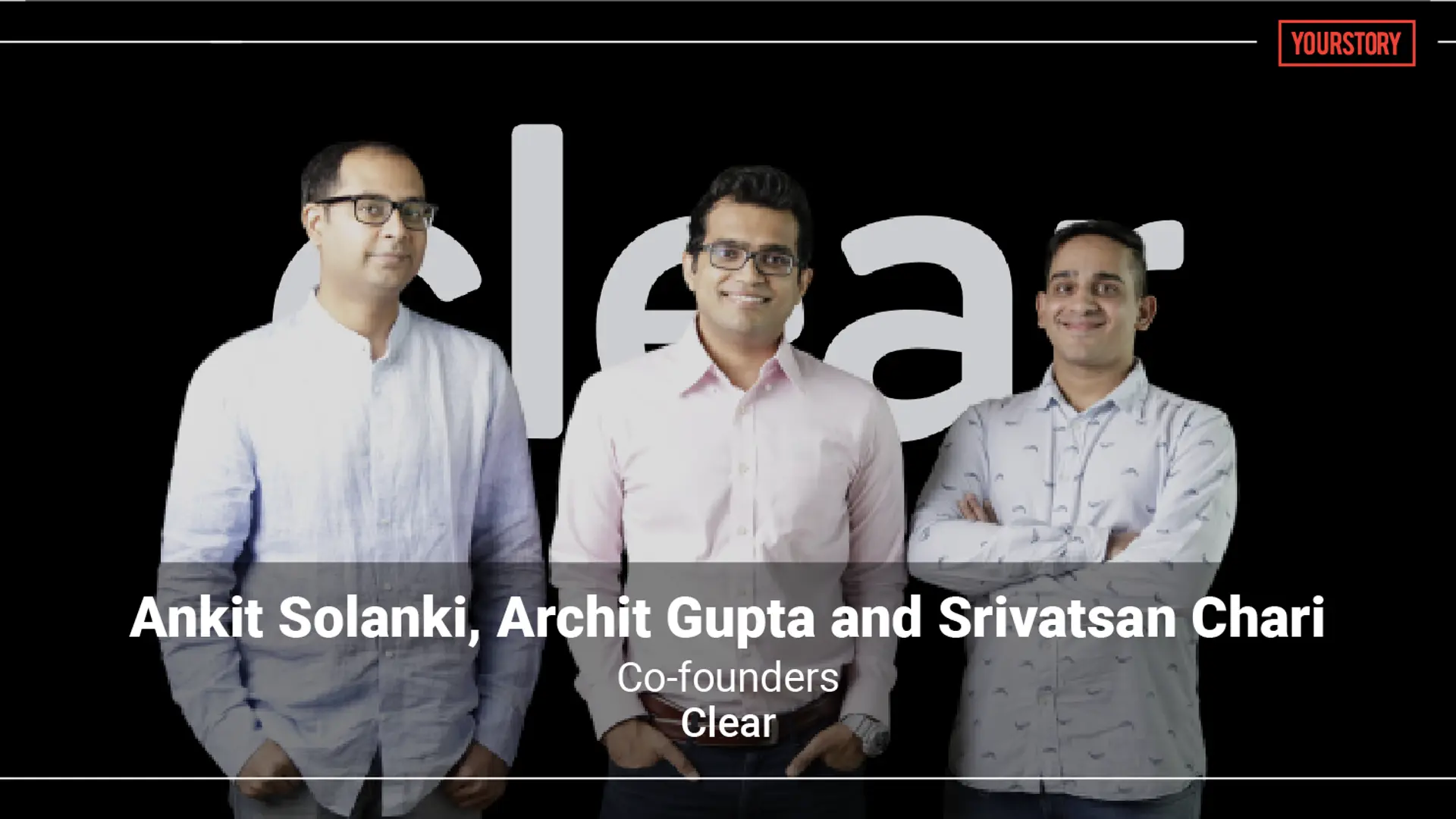

Bengaluru-headquartered fintech software-as-a-service (SaaS) startup Clear, formerly known as , has announced the acquisition of compliance risk management automation platform CimplyFive. The product will be a part of its suite of software targeted at CFOs.

According to sources, the deal is estimated to be valued at nearly Rs 75 crore, and Clear said in a statement that it was an all-cash deal. With the acquisition, the 20-member team at CimplyFive, including founder Shankar Jaganathan, will be onboarded by Clear. Shankar will continue to run CimplyFive, which was founded in 2014, as an independent platform.

This is the fintech company's second acquisition this year. In March 2022, Clear announced the acquisition of supply-chain financing company Xpedize for nearly Rs 100 crore. CimplyFive also marks Clear's fourth acquisition to date, which previously acquired YBANQ in 2021 and Karvy’s GST business in 2020.

“Serving the CFO’s office, we discovered that company secretaries are deeply under-served. These entities have to maintain multiple records, and in case of listed companies, they have to make LODR-related disclosures to SEBI, among others. These are happening in a broken system,” Archit Gupta, Founder and CEO of Clear, told YourStory.

In its second acquisition this year, Clear took over CimplyFive

He added that nearly 80 to 90 percent of Clear's revenues were coming from business-to-business (B2B) offerings, which included enterprise, and small and medium business entities. CimplyFive brings with it a customer base of 100-plus enterprises in addition to Clear's nearly 5,000 enterprise clients.

“For the last two and half years, we have been doubling down on the enterprise business. There is better retention and the needs are larger,” said Archit. The company also plans to build on its personal wealth management product over the years as the business vertical approaches EBITDA positivity.

He further added that the company was not looking to raise additional equity capital and might make acquisitions of early-stage companies or those led by good products with a strong customer base.

Clear had last raised $75 million in a Series C round in October 2021 led by Kora Capital, Stripe, Alua Capital, and Think Investments. In total, the company has raised $140 million in equity capital and is valued at between $700-$800 million, according to reports.

Edited by Kanishk Singh