Money no object: $4.5B fresh VC money waiting to be deployed in Indian startups

Global venture capital firms including Sequoia, Accel, and Lightspeed are showing increased confidence in the Indian startup ecosystem with bigger funds, waiting for an opportune time.

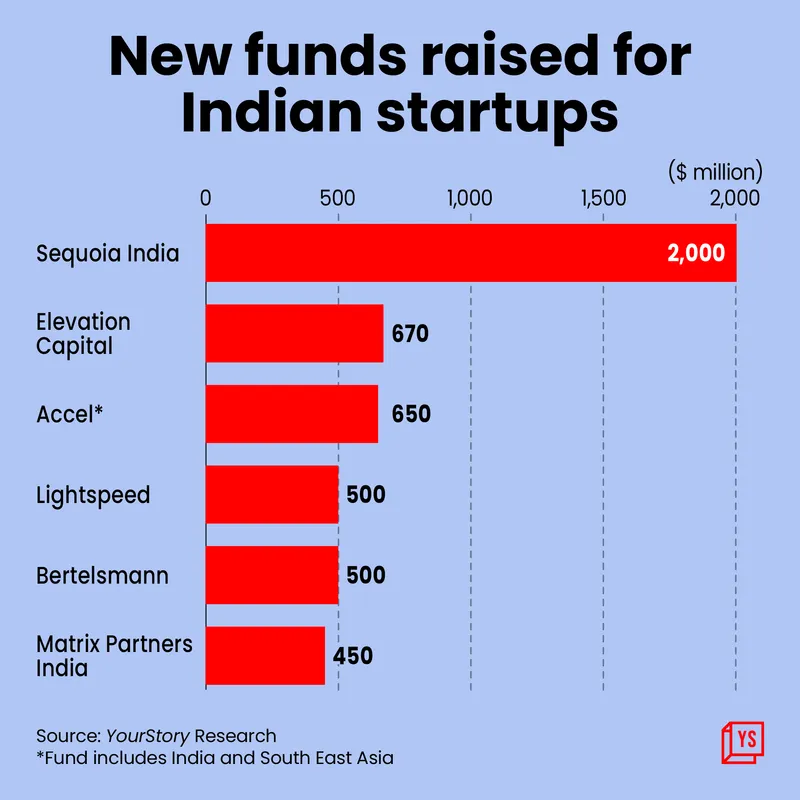

Even as venture funding shows signs of a slowdown in the Indian startup ecosystem, several global investment firms have made fresh commitments of over $4.5 billion for the sector—albeit for mostly early-stage deals.

In recent months, marquee venture capital firms—Sequoia, Accel, Matrix, and Lightspeed, among others—have announced raising new funds with a specific focus on early-stage investments in India, although it remains to be seen when this fresh capital will start to flow.

Besides these global firms, homegrown entities have raised or are in the process of raising new funds for early-stage investments.

In 2021, the Indian startup ecosystem raised a record $38.5 billion. But this year saw a shift in momentum, especially in the April-June quarter, largely driven by global factors, with May witnessing investments of $1.85 billion, the lowest in any month this year.

“Usually, when one goes through this environment, new sectors start to bubble and some of the green shoots emerge. This is what excites us," says Venky Harinarayan, Partner at Rocketship.vc, which earlier this month raised $125 million in the first close of its third fund.

The Silicon Valley-based venture capital firm, which has backed nearly two dozen domestic startups including NoBroker, Khatabook, and Jar, didn't disclose how much of the capital from its new fund it will deploy in India.

According to YourStory Research, Indian startups raised $17.1 billion across 891 deals between January and June, which is 82.8 percent more than in the first half of 2021. However, it is important to look at the numbers in continuity with the second half of 2021, when $22.7 billion were invested through 865 deals.

Additionally, most of the deals announced in the first half of this year were likely to have been formulated and acted upon at least a couple of months earlier, and the real slowdown would start to show in the second half of the year.

But the confidence level remains quite high among VCs that are keen to continue taking bets on Indian startups.

Sequoia accounts for a majority of the fresh capital raised for Indian startups this year. Sequoia India and Sequoia Southeast Asia collectively raised $2.85 billion across a set of funds, including India venture and growth funds, and an $850 million Southeast Asian fund.

“This fundraise, which comes at a time when markets are starting to cool after a very long bull run, signals our deep commitment to the region and the faith our Limited Partners have in the long-term story of India and Southeast Asia,” the VC firm said in its blog.

In addition to the new capital raised for India, several have increased the sizes of their funds. Accel announced a $650-million seventh fund in March. In comparison, its sixth fund was $550 million.

Also, the slowdown has not had a deep impact on early-stage startups.

As Rema Subramanian, Co-founder of Ankur Capital, told YourStory in an earlier interview, “There is greater slowdown in the growth stage rather than in the early category.”

She added that the possibility of returns from early-stage investments is quite high.

The bigger impact is on the later-stage investments, with larger private equity funds such as Tiger Global and SoftBank slowing down, bogged by losses incurred in the fiscal year ended March. These are typically in the Series C and beyond stages of funding.

Several reports, however, indicate that Tiger Global has started to invest in early-stage startups, especially in the Series A and B levels. In fact, earlier this year, the firm made its first seed-stage investment in Shopflo, a Software-as-a-Service, or SaaS, startup.

Amidst all this, other VC firms—both homegrown ventures as well as cross-border entities—have announced plans of raising separate funds for India. These include Eight Roads Ventures, IvyCap Ventures, Jungle Ventures, Athera Ventures, and Ganesha.

Global VCs have also dedicated more resources to India across segments such as fintech, edtech, B2B, SaaS, crypto, blockchain, and agritech.

Given the current environment, the focus will be to find new areas to invest in. As one VC puts it, “The secular trends around India are still very strong.”

Industry participants believe now is the right time to invest as there is less noise in the ecosystem and more clarity on which companies to put their money in.

“We are in a period of transition," says Venky of Rocketship, "though it is hard to say where it is going to settle.”

Edited by Saheli Sen Gupta