Starting with one store, how PVR-backed 4700BC Popcorn expanded to nine countries

Chirag Gupta, founder of premium gourmet popcorn brand 4700BC Popcorn, talks about building a premium snacking brand, fighting all odds, and taking the Indian brand international.

What’s the go-to snack to munch on at the movies? The answer, without a second thought, is popcorn! The default grub at multiplexes now, the humble popcorn has come a long way from being sold in plastic bags outside single-screen theatres. But with evolving times, consumers also started demanding a premium snacking experience. This is where Delhi-based Popcorn delivered.

Offering gourmet popcorns priced between Rs 10 and Rs 1,000, 4700BC expanded from a single store in the capital in 2013 to now having a presence in nine international markets.

The brand introduced new and never-tried-before popcorn flavours—a concept alien to India—with offerings including Cranberry White Chocolate, Mocha Walnut, Himalayan Salt Caramel, and Tiramisu Chocolate.

Its unique name piqued interest too. According to founder Chirag Gupta, as the first premium popcorn brand in India, 4700BC Popcorn made it a point to pay homage to popcorn’s history—with consumption dating back to 4700 BC.

In a conversation with YourStory, Chirag talks about building a premium snacking brand in India, fighting all odds, and taking the brand international.

The Himalayan Salt Caramel Popcorn by 4700BC Popcorn

Looking back

After returning home from a stint as a Senior Consultant with Deloitte Consulting in the US, Chirag teamed up with friend Ankur Gupta to launch an outlet of 4700BC in Delhi in 2013. “I think I wanted something that was present in the US but not available in India. Gourmet popcorn was one of those things,” Chirag told YourStory in an earlier conversation.

Over the next year, the single-store brand expanded to eight stores across Delhi and Punjab, selling popcorn in about 18 different flavours.

Initially, 4700BC competed with the likes of Lufthansa and PVR. Interestingly, in August 2015, PVR ended up buying a 70 percent stake in 4700BC by investing around Rs 5 crore. However, 4700BC continued to operate independently, while supplying its gourmet popcorn to PVR Cinemas.

“When PVR funded us, we were able to invest a decent amount in our backend. Once it was ready, we could supply to large clients like airlines and the railways,” says Chirag, adding that PVR Cinemas proved to be a good marketing channel in terms of sampling and reaching out to the right customers.

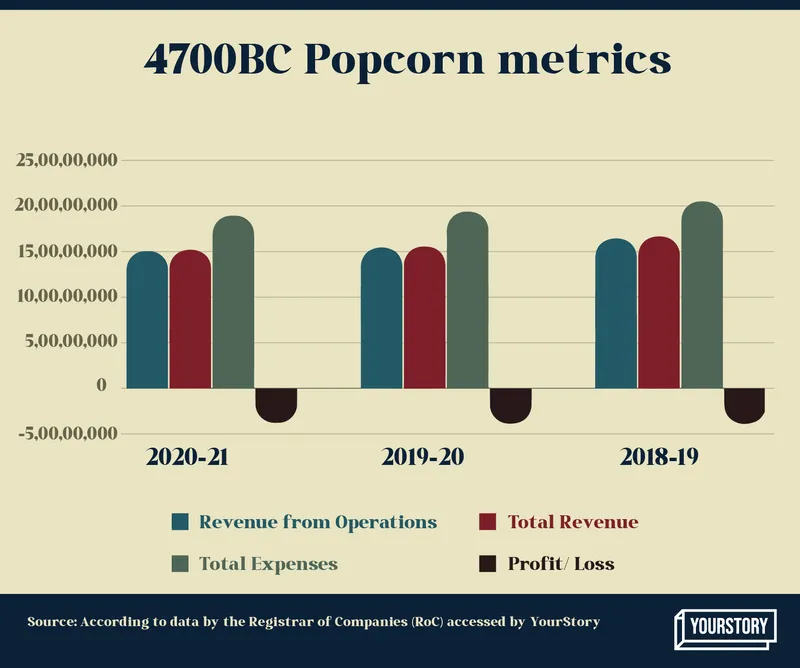

According to data by the Registrar of Companies (RoC) accessed by YourStory, in FY2018-19, 4700BC recorded total revenue of Rs 16.59 crore. Its sells through channels including ecommerce, D2C, cinemas, airlines, and railways. The founder claims that in FY2021-22, 4700BC Popcorn recorded Rs 33.66 crore in revenue.

** Numbers in Rs

Surviving the pandemic

The pandemic posed a big threat to its business as almost 25-30 percent of its revenue disappeared with cinemas, airways and railways shut. Despite the gloom, the gourmet popcorn brand managed to generate Rs 15.12 crore in revenue in FY 2020-21, while reducing its losses by Rs 76.6 lakh.

The team decided to innovate and launch new products, foraying into the chips category with corn-based Chips+ and ready-to-eat corn.

“When the markets opened up, our revenue started coming from the new products as well,” Chirag Gupta, Founder of 4700BC Popcorn, tells YourStory.

He adds that while 2021 was uneventful, the brand saw about 2.5X growth in revenues in FY2022.

4700BC Popcorn offers 18 flavours

Snacking business

Popcorn remains a healthy alternative to fried snacks. According to Global Data, the Indian popcorn market was valued at Rs 8.74 billion in 2020, and is expected to grow at a CAGR (Compound Annual Growth Rate) of 14 percent between 2020 and 2025. Key players in the market include The Crunch Box, Popcorn & Co., Popcorn Fusion, and Planet Popcorn, among others.

So why is 4700BC so popular?

“India already has products for the masses but when it comes to premium snacking, apart from the likes of Doritos and Cornitos, there is a genuine absence of a brand with multiple product offerings,” Chirag explains, noting that the company’s advantage is a strong brand recall because of consistent presence in the market.

Today, 4700BC has expanded to nine international markets including the UAE, Qatar, Oman, Kuwait, and Sri Lanka—with Dubai and Qatar being the best-performing. In fact, Qatar Airways is one of 4700BC’s biggest clients. International sales contributed around 10 percent to the brand’s overall revenue in FY2022.

With Rishab Bhasin as the Head of Export, Corporate and Institutional Sales, the brand has carefully profiled consumers, giving it an edge in international markets—both product- and price-wise. “At some places, we are better priced than the European and American products,” Chirag adds.

Jumping over roadblocks

Although a prominent player today, Chirag says building the 4700BC brand was not a cakewalk. “Being a category-creator, I had to explain to consumers why 4700BC was more expensive,” he says, adding that conducting sampling to build consumer knowledge was the most challenging.

However, the distribution network for premium snacking in India continues to hinder the company’s growth as retail shelves are dominated by big FMCG companies.

“Digital is obviously the easy way. But when it comes to offline retail, how many counters have premium snacks available? Consumers living in the metros are still lucky, but that number is not big enough,” he suggests, adding, “Once there are enough brands in the premium segment, more retail shops will be open to stocking these options, helping us grow faster.”

Meanwhile, the company is focusing on generating revenues through international expansion.

“We are doing a lot of international exhibitions this year, including in Germany, London and Dubai,” Chirag says.

Market trends

Popcorn continues to remain a bestseller at 4700BC, with the caramelised flavour doing well in India, while cheese and chocolate popcorn more popular internationally.

Around 85 percent of 4700BC's revenue comes from popcorns—45 percent from gourmet and another 40 percent from microwave popcorns. The rest is generated from the newly launched products. The company now expects exports to generate 8-12 percent of the overall revenue.

The omnichannel business is equally distributed between online and offline channels—with D-Mart leading offline sales while Swiggy Instamart rules online sales. While Bengaluru tops 4700BC’s online sales, home base Delhi has the strongest offline presence. Interestingly, Amazon sales numbers are the highest in Mumbai.

“A decent chunk of our business also comes from Hyderabad, Chennai, Pune, Kolkata, Ahmedabad, and Jaipur,” Chirag adds.

The brand is now planning to raise another round of investments in the next three to six months. “To build a brand, patience is the key and we are building for the long term,” he concludes.\

(The story was updated with FY2021-22 numbers)

Edited by Kanishk Singh