Decoding Tradingo’s strategy in a crowding market

The Indore-based discount brokerage firm is looking to make its mark in a busy market by focusing on retention of customers over acquisition.

A flurry of platforms has fired up massive competition in the online discount brokerage space. With fuss-free sign-ups, easy-to-use apps, and venture money, these platforms have been able to crack customer acquisition to a large extent. Retaining customers, though, remains a challenge.

"No one reports the number of customers (traders) they have retained," says Parth Nyati, Founder of online discount brokerage platform . “The average lifecycle of a trader on a platform is less than three months. An investor may probably stick for more time, but not a trader.”

The Indore-based startup has built a system around retention of traders (in-house proprietary tools and research-driven recommendations), as opposed to aggressive acquisition strategies adopted by several of its peers.

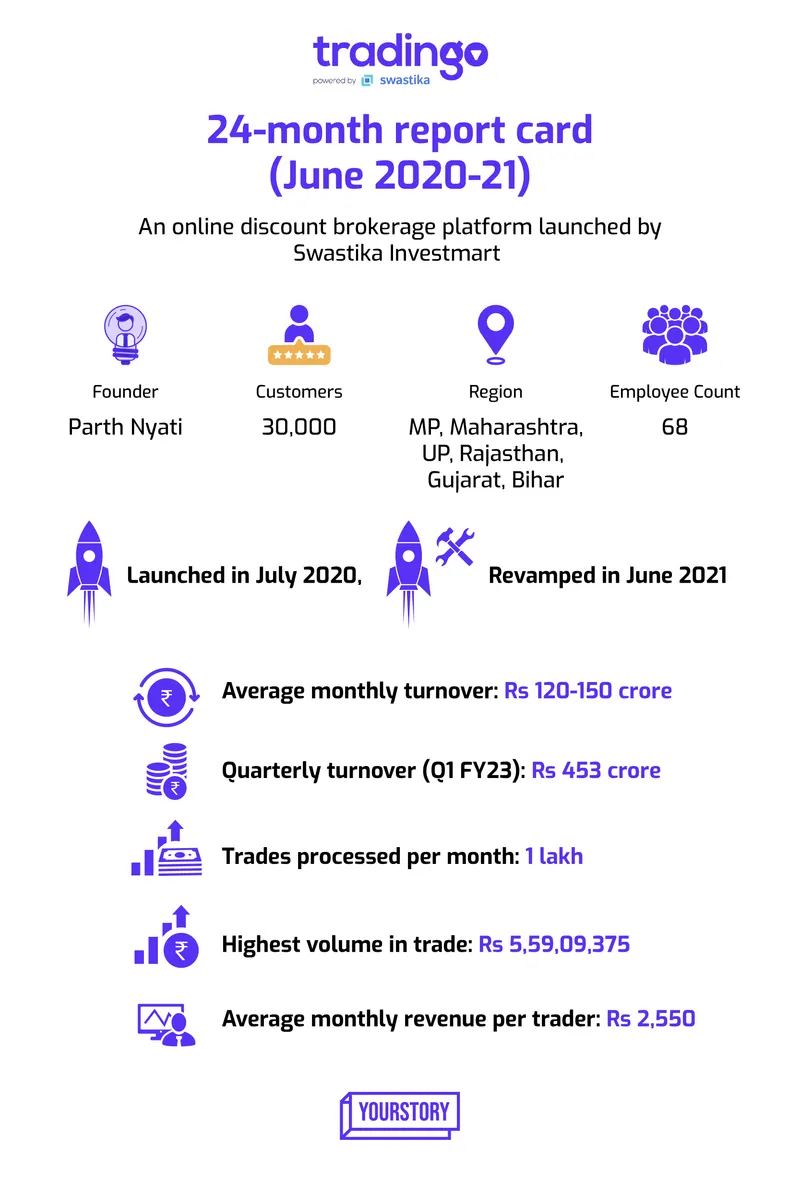

Tradingo entered the discount brokerage market—already teeming with established players including , , , , , and —during its inflection point in India in 2020. But the pandemic provided a boost for the new entrant, with strong accretion in clientele as well as volumes as more people took to trading during the lockdowns.

Following a revamp last year, the two-year-old startup added almost 85% of its customers (of a total 30,000) in the past few months, clocking a quarterly turnover of Rs 453 crore in Q1 FY23.

A spin out

Having worked with Mumbai-based financial services company Swastika Investmart for about eight years, Parth, an IIT-Delhi graduate, decided to spin out Tradingo out of the former by leveraging its brokerage licence and back-office operations.

“It didn’t make any sense to shell out that much capital to procure new licences unless there was a completely new thing that we were trying to do. So we decided to leverage Swastika’s licence. The strategies are different, but the back-office operations remain the same,” he adds.

The platform received seed capital from Swastika and commenced operation in July 2020.

This helped save on major costs such as on licence, operations, and infrastructure, besides drawing on referrals from Swastika’s network.

Enter Jarvis

The startup’s first area of focus was to build a tech product, i.e., the basic trading platform. Second came in the research recommendations, which is offered by other platforms. Tradingo has a joint team of analysts with Swastika to carry out these researches.

The third, and the most important, is decimation of that research, which according to Parth, is a big problem for all these platforms. This includes informing traders on when to enter or exit the market and how.

This led to the inception of Tradingo’s in-house proprietary CRM tool—Jarvis.

“We needed some kind of intelligence to give that support to our clients and also be able to scale the business,” explains Parth. Jarvis has more than 25 triggers based on the trading pattern of traders, their behaviour with the app, the market condition, and research.

“Coming from a traditional broking background, we understand exactly what a trader wants, and hence, build technology on top of that. It took us a year to build Jarvis,” he adds.

Jarvis operates via different channels to reach out to the traders, which could be as simple as a Telegram message.

The platform initially started out with 1,000 odd customers who were trading in high volumes (owing to bullish market conditions at that time). The revenue number, however, was not considerable. In July 2021, following its revamp and induction of Jarvis, it started seeing better onboarding and retaining numbers.

Since January 2022, the platform is clocking 10% month-on-month growth, and a monthly turnover in the range of Rs 120-150 crore.

“Discourage” clients from trading

A large number of clients stop trading after making a loss and then come back later after a few months, trade again, and repeat the cycle. That’s the physic of a common trader and hence the reason a platform loses clients. In such a case scenario, a winning strategy would be to educate the traders to do things in the right manner and exit or enter when they need to.

“A lot of brokers are revenue-driven. When you target revenue, the teams are incentivised (more brokerage) to make the customer trade more. They go beyond their capacities and end up losing more money. You have to educate traders to retain them instead of looking at short term benefits,” says Parth.

Parth adds that about 60% of traders are receptive to Tradingo’s recommendations.

The platform keeps the communication active even after a trader exits the platform.

“A brokerage has to provide some sort of education to its users. Otherwise, you'll get a spike of users, but eventually they will start losing money. But not many are willing to discourage clients from trading because it would be the right thing to do,” says a financial expert.

Besides Jarvis, Tradingo has a dedicated relationship building team of experts for its premium customers, which, as per the founder, helps in creating the stickiness. The platform also conducts engagement driven online and offline seminars with the traders.

Revenue model

Tradingo offers two types of pricing models. One is the usual discount brokerage model (where it charges zero fee on delivery-based orders and flat Rs 20 per order for intraday and other F&O trades). The other is premium services, which comes with a few subscription plans.

For the premium customers, the intraday charges vary based on the turnover/volumes of the traders.

About 80% of Tradingo’s revenue comes from premium businesses, which are built over the discount broking business as customers graduate to the former after sometime.

“A plain discount brokerage spending a heavy amount on acquiring customers using ads, influencer marketing, etc., is not sustainable. The cost is insanely high unless they have investors' money. It further makes no sense if the customer leaves after three months. You have to make them stay and a very few are focusing on that,” the founder says.

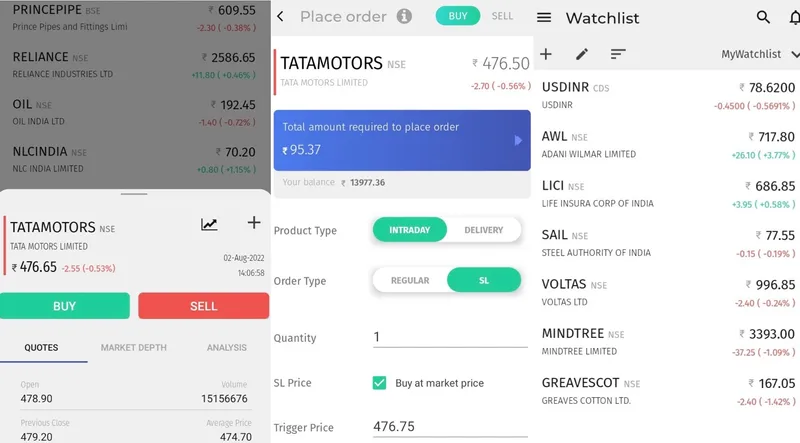

Snapshot of Tradingo app

Plans ahead

Tradingo is now exploring to scale up insurance as its next product, and would leverage Swastika’s licence for the same. Though it does offer margin funding to its clients, it is not looking to expand the same in the light of SEBI mandates, which makes it “difficult” for online brokerages to offer loans.

At present, Tradingo does US Stocks in partnership with Stockal, besides ETF and mutual funds on the same platform.

“Our APIs are public and we've integrated Algo Trading and stock basket platforms like TradeTron and Wealth Desk. Any startup can take APIs from us at no cost and build their platform on top of these APIs. We're working on a quant-based wealth management product for our HNI/Premium customers,” says Parth.

According to ICRA, given the increasing competition and cost of acquisition of clients, brokerage companies are focusing more on increasing the share of wallet. For instance, among the few retail-focused entities, the average revenue per active client increased by 25% to ~Rs 12,788 in FY21 from ~Rs 10,238 in FY20.

Edited by Megha Reddy