With 50K users, fintech startup muvin is helping children, young adults gain financial independence

Founded in 2020, muvin caters to kids between the ages of 10-24. Besides allowing parents to transfer money to their children digitally, muvin helps impart financial literacy to children and teenagers.

Teen-focussed pocket money, digital finance, and neobanking apps have been all the rage in the fintech sector over the last year. New companies are coming up every month to cater to this previously untapped target market, and the nucleus of their genesis seems to be singular: financial inclusion.

While many fintech companies are catering to the adult population, as well as geographically marginalised sections of India, there are very few avenues for teenagers to explore finance. Before the proliferation of teen-focussed financial platforms, most of the exposure teens had to finance was via banks that allowed them to open bank accounts run mostly by parents, or physical currency.

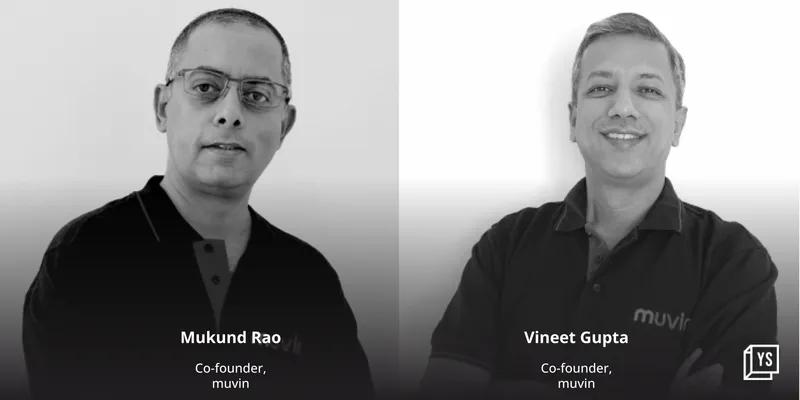

Vineet Gupta and Mukund Rao, who both have teenage children, grappled with the existing system.

“Our children’s minor bank accounts, through which we were giving them pocket money, had multiple challenges—from opening to enabling our children to use it freely, given the restrictions on bank ATM or debit cards,” Vineet tells YourStory.

When the duo assessed the on-ground situation, they realised that while the addressable market (TAM) was large, there were only a handful of platforms available that catered to teens.

They set up , a teen-focussed pocket money app for college students and teenagers, that aims to make students financially savvy, teach them money management skills, and remove the complexities from “finance”.

“muvin’s vision is to improve financial literacy across the 200 million youth in India while empowering them with financial products suited to their needs,” says Mukund.

The startup raised $3 million in a pre-Series A round led by WaterBridge Ventures in January this year, after raising a seed round of $1.5 million-plus from HNIs in the country.

While the youth-focussed fintech space hasn’t been fully valued yet because it’s still in its infancy and in the process of shaping up, the sub-sector has disrupted fintechs in India, capturing a market that very few cater to. The Indian fintech sector is expected to touch the $150-160 billion market size by 2025, according to a report by MAAS.

What it does

Bengaluru-based muvin is a downloadable app that can be used by both parents and children. Parents have to download the app, create profiles for their children, and then give them access to it.

Parents can use the app to transfer pocket money, set tasks, and pay upon completion of each task, and can also track their children’s spending.

Teens using the app, on the other hand, can spend money offline and online via a physical and virtual debit card. UPI and QR-based payments are available for those who do a full KYC. Users can also create savings goals for wishlist items and put money towards them every month.

The startup, like most in its sector, including and , provides educational bite-sized videos and written content to teach teens and children about finance and practices associated with managing money, like saving, investing, and taxes.

Vineet says that while muvin’s target audience is the 10-24 age group, anyone can use the platform.

“We believe that the educational content we offer is relevant not just for our immediate target audience, but for anyone looking to kick start their journey in understanding basic finance,” he says.

Business model

The startup does not currently charge users anything for accessing the platform; instead, it makes money from the interchange fees incurred by merchants for card transactions.

Fampay, arguably the biggest player in the space right now, has an ecommerce platform geared towards its target market—i.e., kids—which is also a revenue source for the startup, apart from interchange fees.

In terms of revenue, Mukund says, “We are meeting the planned numbers,” but did not further disclose the exact tallies. He added the app currently has three lakh installs, with 80,000 active wallets that have done their KYC.

In total, the app has 50,000 users. Fampay has crossed a million users, while Junio has over around half a million.

The startup says it is aiming to expand to one million users in the next 12 months and might raise additional capital this year to achieve scale.

Edited by Megha Reddy