The world’s a stage for India's bold, new D2C brands

It's not only at the Commonwealth Games that Indians are making noise at a global level. Homegrown direct-to-consumer brands barely a few years old, including Mensa Brands, are shifting multiple levers to fuel their international ambitions.

Getting an international audience excited about samosa, tea and handicrafts from India might be easy, but there is little by way of brands associated with these popular Indian exports.

But now, a growing list of digital-first, direct-to-consumer brands—including roll-up ecommerce player , beauty and personal care brand , and —is pushing for change.

These homegrown brands aren’t just targeting the Indian diaspora. They are making inroads into large retail chains and ecommerce marketplaces, while also selling through their own online platforms to a global audience.

“We want to make global brands of Indian origin so we will eventually try and take all our brands to the global markets,” Ananth Narayanan, CEO and Founder of Mensa Brands, tells YourStory. “To become a household name, having an international presence is very important.”

Mensa, the fastest startup from India to reach unicorn status, is betting big on targeting global audiences with its lifestyle portfolio—ethnic fashion brand Karagiri, fashion jewellery brand Priyaasi, decor label Folkulture, and fragrance brand Villain.

The year-old ‘house of brands’ startup is already selling some of its products in the US, the UK, the UAE, Canada, Germany, and Singapore. Ananth says that 20-30% of Mensa’s total revenue already comes from international sales.

“We are looking at a very different brand-building, and are doing it at a portfolio level and not as a single brand. This gives economies of scope and economies of scale,” says Ananth.

Cross-border sales expand the total addressable market for a brand, says Bala Sarda, CEO of speciality tea brand . And this gives investors confidence that a brand can scale and replicate its initial success in other markets.

D2C brands also see a higher order value to the tune of 20-30% in overseas markets, but the cost of customer acquisition is higher than in the domestic market. Building customer loyalty and repeat orders become key to maximising the return on customer acquisition costs.

Vahdam India, which has been targeting overseas markets since 2015, earns nearly 95% of its business from outside India. Indian snacks, too, are seeing demand, and samosas are popular enough in the US for retailers like Trader Joe’s to have their own private labels in the frozen food category.

Capitalising on that, quick-service restaurant brand Samosa Singh is planning an international expansion next year under the frozen foods category, to begin with. To begin with, the brand is exploring tie-ups with retailers in the North American markets.

“Indian food items like samosa, gulab jamun, and panipuri don’t need an introduction to the global audience. It is time that startups and brands create a market for themselves globally, which only a handful of snack companies from India have been able to do,” says Nidhi Singh, Co-founder of Samosa Singh.

An enabler ecosystem

What has essentially helped domestic D2C brands cash in-on the global search for niche products is an improving enabler framework, comprising distribution and logistics partners, payment services, and entities assisting with regulation and compliance.

Keren Levy, President and General Manager of merchant services at American financial services company Payoneer, says D2C brands from India are maturing now to reduce dependence on marketplaces to take them global.

The company works with nearly 400,000 merchants and small and medium businesses in India, helping them sell across 200 countries and trade in 150 different currencies.

“Once you figure out logistics and demand generation, you can market yourself to buyers in the US and Europe,” says Keren. “This is where you can really set your own business independently from marketplaces. That’s the biggest trend that we’re seeing… that’s what’s so unique in India and very different from other countries where Payoneer serves.”

Bharati Balakrishnan, Country Head and Director of Shopify India, says Indian D2C brands approach cross-border selling with an omnichannel approach.

Indian D2C brands powered by Shopify, including boAt lifestyle, Sugar Cosmetics, Wow Cosmetics, and Vahdam Teas, follow an omnichannel approach, selling their products on their own websites, at marketplaces, multi-brand stores, and physical outlets.

“Typically in India, D2C brands take the ‘own-website-first’ approach rather than ‘own-website only’, unlike in North America. D2C-first brands will start their journey on their own site, but quickly expand to other channels where their buyers are looking for them,” says Bharati.

Logistics player , too, announced its cross-border offering ShipRocket X earlier this year, offering documentation and tracking services to brands looking to ship overseas.

For categories that require certification and compliance with country-specific regulations, such as food and cosmetics, multiple Indian consultancies help brands get up-to-speed with the process.

“We started working with a consultancy for our global launch. They help you with requirements that are usually difficult for an entrepreneur to pay attention to, such as design of the manufacturing facility,” says Nidhi of Samosa Singh.

Beauty brand Plum Goodness opted to sell through Amazon for the same reason. “We started out with Amazon for the US as it takes care of taxation, regulations, distribution, and other processes,” says Founder Shankar Prasad.

The global opportunity

The North American market is a crucial one for D2C brands, accounting for a majority of the global opportunity. D2C ecommerce sales in the US tripled from $36.08 billion in 2016 to $128.33 billion in 2021, per a report by market research platform eMarketer.

In comparison, the global direct-selling market was valued at $189.71 billion in 2021, according to a report by Grand View Research, and is expected to grow at a compounded annual growth rate of 6.1% from 2022 to 2028.

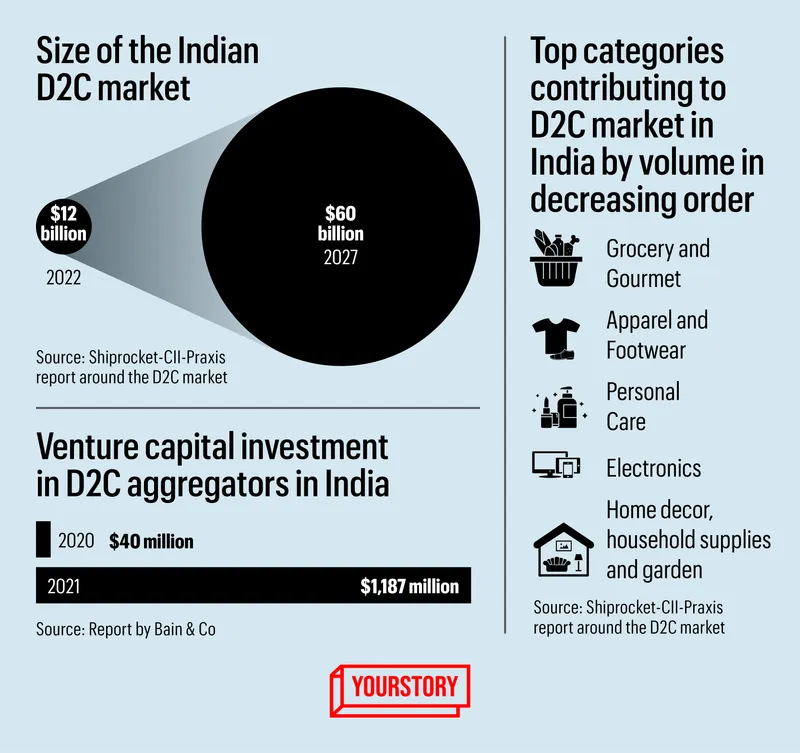

In India, the market for D2C brands is expected to grow to $60 billion by 2027, from $12 billion in 2022, as per the India D2C Report 2022 released by CII and Shiprocket.

Grand View Research added in its report that growth in the sector was primarily driven by rising consumer demand to validate a product as well as new business models, which, in turn, led to a rise in D2C distribution channels.

Asia-Pacific led the majority of total sales in 2021, accounting for nearly 45% of the market share. This opens up opportunities for domestic as well as cross-border sales for Indian D2C brands.

Omnichannel approach

Apart from individual pieces of the cross-border puzzle, roll-up ecommerce models such as Mensa Brands, , and make it easier for their portfolio brands to tap into the global market. It is easier for the roll-up models to negotiate rates with partner networks and marketplaces, translating to ease of scaling brands internationally.

“Mensa leverages a combination of aspects across product, pricing, marketing, distribution, and brand building, and works closely with partner brands to accelerate growth on both marketplaces and D2C channels in India and globally,” says Ananth. “We also use technology to enhance inventory management, warehousing, supply chain, demand, and growth-hacking by going global.”

The approach to taking the brands international differs, with ecommerce marketplaces easing the pain of shipping and duties. Website-based sales, however, help brands with data on who is buying, and with better margins.

Mensa’s portfolio brand Karagiri sells globally to the Indian diaspora only through its website, while fragrance brand Villain is largely available offline for buyers in the Middle East.

UpScalio took its suite of electronics and accessory brands Tizum, Aircase, Gizga, and Polestar, as well as office furniture maker Green Soul Ergonomics to the US and the Middle East earlier this year.

“We are currently promoting them through marketplace channels as we can build trust in the brand in association with the marketplace,” says Gautam Kshatriya, CEO and Co-founder. “Amazon is a trusted brand, both in the US and the Middle East, and we’re leveraging their reach to cater to customers abroad.”

Bala of Vahdam India has seen the omnichannel route work well for his company.

“The future for cross-border as well as domestic markets is omnichannel. It is specific to the category, stage, loan-to-value ratio of the product category, and other factors,” he says. “We started targeting the US market by selling on Amazon, our own website, and Walmart. Only 5% of grocery purchases in the US happen online,” he adds.

Hence, for D2C brands, an omnichannel approach, including partnerships with offline retailers, becomes critical to achieving scale in markets outside India.

Leverage and challenges

The biggest driver for targeting global markets continues to be increasing the average order value as well as higher margins, which brands can command selling overseas.

“The average order value goes up for a brand once they are selling in markets beyond India,” says Saahil Goel, CEO and Founder of Shiprocket. “The two parts to going cross-border are how to get it to the target geography, and where does the brand want to sell it—on Shopify, its own platform, or marketplaces like Amazon or Lazada.”

While the cross-border efforts of domestic D2C brands are expected to pick up, the sector in which they operate, however, becomes critical for international expansion.

“There is no dearth of beauty and personal care brands globally and it is a sectoral challenge. (But) an Ayurveda-driven brand has greater appeal and it is non-replicable globally,” says Shankar of Plum Goodness.

With market cues in place and interest in D2C brands at an all-time high, driven by social media and the pandemic, experts say Indian brands have never had such strong potential of making it big globally.

(Updated to correct US D2C ecommerce sales and global market numbers.)

Edited by Feroze Jamal