How NBFCs are innovating new-age financial products by using technology

NBFCs have kept pace with the rapid advancement of technology, leveraging AI, ML, and big data to develop credit products and processes that have brought formal lending to the masses.

If financial inclusion is a battle, then non banking financial companies (NBFCs) are its foot soldiers. Yes, banks power economic activity but without the active participation of non-banking financial entities, all that economic power shall go underutilised. For decades, Indian NBFCs have reached where banks couldn’t, accepted customers that banks won’t, and served use-cases that nobody else thought possible.

And now, these faithful participants of the financial system are turning to techies and building the next-generation of financial products, business models, and operational strategy.

Let’s first understand just how important NBFCs are. Here’s what the RBI says--“The world over, non-banking financial entities complement the mainstream banking system in the process of financial intermediation”.

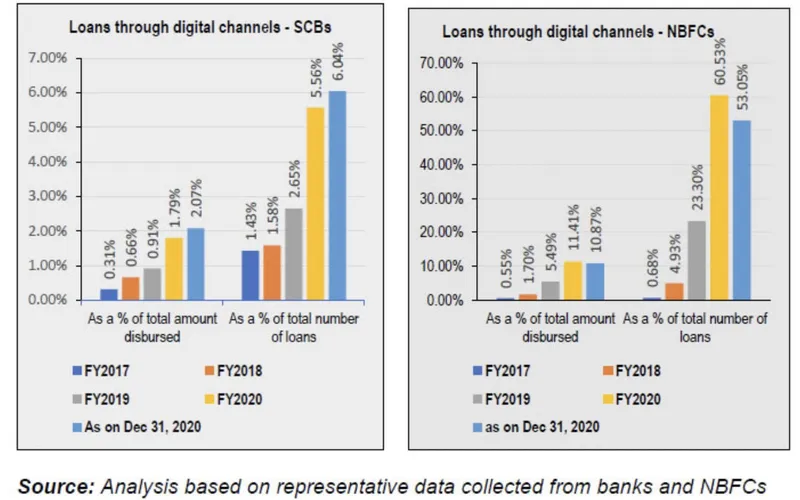

They’ve gained special significance in a country like India, characterised by limited penetration of banking services, traditional lending models, and a large population that doesn’t have access to formal lending. An RBI report released last year revealed that NBFCs accounted for the maximum number of loans (60%) sanctioned through digital platforms.

And while NBFCs in the country trace their roots all the way back to the 1960s, it’s only in the last decade or so that they have truly come into their own. Their meteoric rise can be attributed to several factors such as changing customer demands, increased digitisation, and the factor that we’re going to focus on in this piece--technology.

They have kept pace with the rapid advancement in technology, leveraging Artificial Intelligence (AI), Machine Learning (ML), and big data to develop groundbreaking credit products and processes that have brought formal lending to the masses (or at least, that are helping it get there).

Let’s take a look at how NBFCs make the most of new-age technology.

AI and ML

Risk assessment forms the very basis of every lending decision, and it has far-reaching implications on the lender’s (in this case the NBFC) business metrics.

AI and ML models help NBFCs simplify credit decisions by drawing on a varied set of alternate data (tax invoices, device data, transaction volumes etc.) to assess credit worthiness and reveal insights about delinquency risk and how to manage at-risk accounts. Research has shown that using alternative data and ML approved 27% more applications than a traditional lending model and yielded 16% lower average Annual Percentage Rates (APRs).

This is especially crucial in a B2B context, where underwriting is more complex with factors such as shareholder control, servicing capacity and industry risk. With a streamlined AI-driven pre-approval process, decline rates reduce and loan authorisation rates get optimised.

AI-driven intelligence also allows for deep personalisation of loans. Customers can be segmented on the basis of their repayment capability with the help of alternate data (device data, bill payments etc). NBFCs can leverage this segmentation to offer loan products with relevant amounts and repayment guidelines.

When the time comes for collections, ML can help identify borrowers that will potentially default by mining insights that were previously unidentified. This allows the lender to allocate resources optimally and employ the most effective strategy for each borrower group based on their default risk.

Robotic Process Automation (RPA)

NBFCs are known for the speed of their operations. In fact, it’s one of their main advantages over traditional banks. They ensure this speed by leveraging RPA to automate several repetitive processes. It helps NBFCs auto-capture data from application forms, verify KYCs instantly (in just 3-5 seconds), check eligibility, and quickly disburse loans in case of successful applications. While improving speed of operations, RPA also helps NBFCs cut costs, generate leads, and improve customer service.

Conclusion

While NBFCs have the option of building this tech stack themselves, they can also partner with fintech companies to leverage their technological capabilities. They can integrate the latter’s pre-built underwriting models and last-mile collection processes, and also work with them to improve onboarding and KYC processes.

The future of lending, therefore, isn’t going to lie in the hands of one or the other. Fintechs, NBFCs, and even banks must leverage their unique strengths, and bring them together in order to serve those who need it the most.

Edited by Megha Reddy

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)