Axis Mutual Fund

View Brand PublisherAdd a ‘Silver Lining’ to your investment portfolio with Axis Silver ETF and Axis Silver Fund of Fund

Highly valued by investors, silver is often considered to be a ‘safe haven’ metal that has the potential to help investors create a hedge against inflation and also weather an economic downturn.

Often at the heart of multiple cultural practices and emotions, investing in precious metals like gold and silver has been a centuries-long practice in India. Historically, both these metals have demonstrated their prowess as an empirical choice against uncertain economic cycles. While investors have been exposed to Gold ETFs in the past, Silver ETFs have slowly but steadily started taking centre stage recently. However, most investors are yet to understand the importance of this metal and the purpose it serves in an investment portfolio. In addition to diversification, exposure to the metal has the ability to provide a hedge against inflation to the portfolio. Since the movement of silver tends to have minimal co-relation to the movement of Equity or Debt, the ability of the portfolio to compound over the long term is not impacted significantly even in the face of economic headwinds.

To help investors add the gleam of silver to their portfolio, Axis Mutual Fund has launched the Axis Silver ETF (an open ended scheme replicating/tracking domestic price of Silver) and Axis Silver Fund of Fund (an open ended fund of fund scheme investing in units of Axis Silver ETF). YourStory spoke with Ashwin Patni, Head Products and Alternatives, Axis AMC, to help investors understand the benefits of gaining exposure to silver and the unique value propositions of the newly launched funds. Here are the key takeaways from the conversation.

A potential hedge against inflation and economic downturn

In the beginning of 2022, the market witnessed Silver being used as an inflationary hedge. Explaining what differentiates physical assets from financial assets and why they should ideally be the preferred hedge against inflation over the long term, Ashwin said, “Historically, hard assets like land or silver have lower correlation with economic downturn.”

“Financial assets tend to get affected and hit harder by economic turmoil, and impacted by issues like inflation. Physical assets are known to be more resilient against these issues and some of the market volatility,”.

Why silver should be a preferred asset class for young or new investors

Ashwin contextualised how precious metals like Gold or Silver have historically demonstrated their ability as resilient investment avenues and should therefore, form a vital component of the investor’s portfolio. “A young or new investor tends to think about the next 10-40 years when they're making their portfolio. It's almost certain that in a 40-year timescale, you will have multiple shocks that could be macroeconomic, inflationary, or financial in nature. So when you're making your portfolio, you will need to have a very healthy balance between financial and physical assets. Historically, people who have held gold or silver in their portfolios, have witnessed their resilience during times of economic shocks,” he said.

What makes silver an attractive investment avenue

Silver is so much more than its popular use in jewellery. In fact, it is a key component for many industrial applications. The metal’s high demand is also a direct result of the fact that it is one of the best electrical and thermal energy conductor. Furthermore, the widespread usage of silver in sectors like renewable energy, electronics and jewellery, in addition to investments, has created a unique opportunity for investors to leverage. One of the key factors that make the economic outlook of silver promising is the expected rise in its demand going forward outpacing supply.

“While silver is obviously an important part of jewellery, or investments, there are also a lot of industrial use cases that have been created over the years. Allocating to a certain asset class like Silver with a long-term view is important,” said Ashwin, talking about the diversified demand for silver and its resilience to impacts of demand supply from any one segment.

Benefits of investing in Silver through an ETF or Fund of Fund

Ashwin spoke of two key benefits that came with investing in Silver through an ETF, namely convenience and security. “When it comes to assets like Silver, storage, quality check, finding a reliable counterparty to trade with, and safety are some of the key concerns,” he said. “An ETF can potentially act as a solution to these issues. The daily NAV (Net Asset Value) makes it easy to buy and sell and investors don’t have to worry about quality and storage. A lot of these things are automatically taken care of by the structure itself. And that's the beauty of this product,” he added.

When an investor wishes to buy a Silver ETF, there is an entity (registered on the NSE) at the backend that meticulously follows the latest market cost. NSE allows an ‘Authorised Participant or Member’, generally large companies/firms to handle the purchase and sale of Silver to generate ETFs. For a retail investor to invest in Silver ETF, all he/she needs to do is open a Demat/trading account online by submitting PAN, Aadhar, ID proof, and residential proof. Once that has been verified, he can buy a Silver ETF of his/her choosing and invest in it.

Investors who do not have a Demat account can gain exposure by investing in Silver Fund of Fund. New-to-market investors with limited knowledge of the investing landscape who are looking for long-term diversified investment solutions at relatively lesser exposure to risk, should consider Fund of Funds.

Investing in Silver with Axis Mutual Fund

Keeping investor convenience in mind, Axis Mutual Fund has announced two schemes for investing in silver. “We have launched the Axis Silver ETF - an open ended scheme replicating or tracking domestic price of silver and Axis Silver Fund of Fund, an open ended Fund of Fund scheme investing in Axis Silver ETF for investors. We are aiming to seamlessly integrate available market opportunities with an investment strategy that allows investors to gain distinctive exposure to the metal,” explained Ashwin.

Other key attributes include:

1. Funds will invest in industry standard 30 kg Physical silver bullion of 999 parts per 1000 fineness

2. Purchase/sale of Silver done with reputed institutions and bullion traders to ensure minimal trading costs and quality

3. Hassle free ownership in Demat form*/MF Units**

4. Storage, transport and insurance hassles of Silver taken care by Axis AMC

5. Exchange liquidity – Investors can buy and sell ETF units on NSE at their convenience

For the Axis Silver ETF, the minimum application amount would be INR 500 per application and in multiples of INR 1/- thereafter. For the Axis Silver Fund of Fund, the minimum application amount be INR 500 and in multiples of Re 1/- per application in the ETF & INR 5,000 and in multiples of INR 1/- thereafter in the Fund of Fund. Both the funds will be benchmarked against the LBMA Silver daily spot AM fixing price.

“The beauty of these mutual funds is that you can accommodate the smallest of investors and the largest of investors in the same product in the same way consistently and everyone gets the same experience,” he said.

*Axis Sliver ETF units will be available in dematerialized unit form only

**Axis Silver Fund of Fund will invest a majority of its assets in Axis Silver ETF and investors will be allotted MF units that can be freely transacted directly with the AMC subject to applicable exit loads, levy’s and taxes as applicable. Units of Axis Silver Fund of Fund will not be listed on exchange platforms.

Sources: AMFI, Axis MF Research

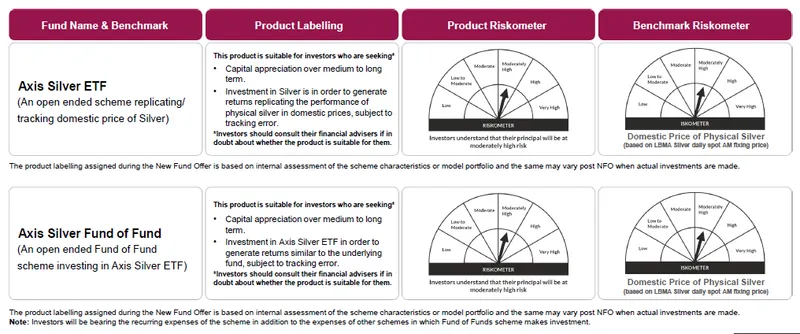

Product Labelling & Riskometer:

Note: Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or the model portfolio and the same may vary post NFO when actual investments are made.

Investors will be bearing the recurring expenses of the scheme in addition to the expenses of other schemes in which Fund of Funds scheme makes investment

About Axis AMC: Axis AMC is one of India`s fastest growing assets managers offering a comprehensive bouquet of asset management products across mutual funds, portfolio management services and alternative investments.

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

The information set out above is included for general information purposes only and does not constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the Scheme. Income Tax benefits to the mutual fund & to the unit holder is in accordance with the prevailing tax laws as certified by the mutual funds consultant. Any action taken by you on the basis of the information contained herein is your responsibility alone. Axis Mutual Fund will not be liable in any manner for the consequences of such action taken by you. The information contained herein is not intended as an offer or solicitation for the purchase and sales of any schemes of Axis Mutual Fund.

Past performance may or may not be sustained in the future.

Stock(s) / Issuer(s)/ Top stocks mentioned above are for illustration purpose and should not be construed as recommendation.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.