Indian online shoppers to outnumber US shoppers by 2022: report

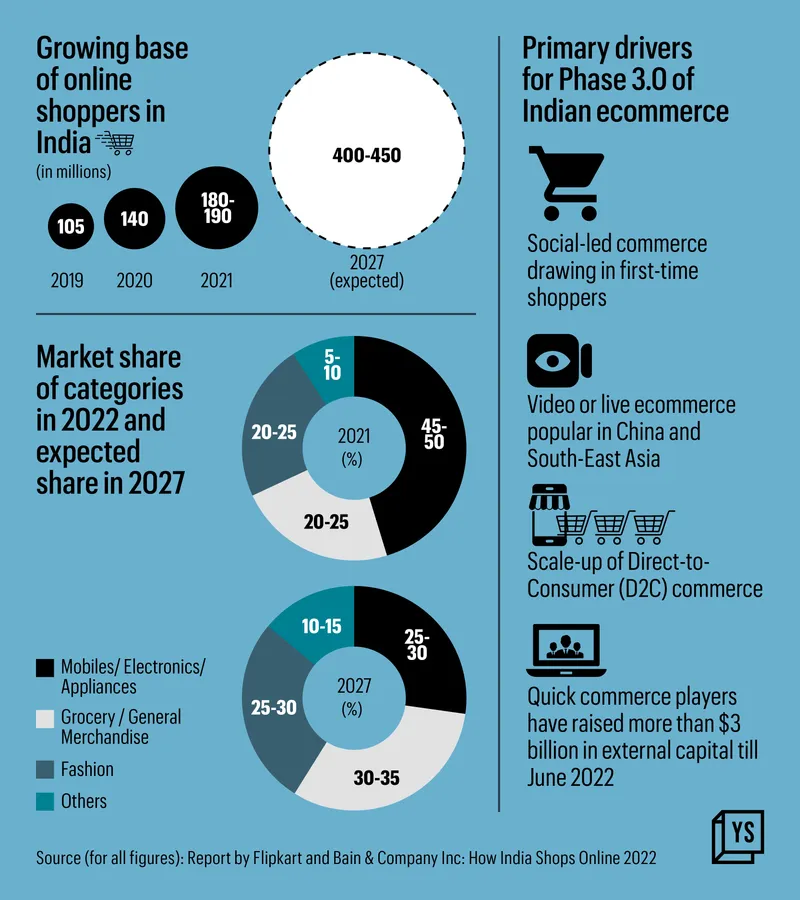

A report by Flipkart and Bain & Co, ‘How India Shops Online 2022’, says the number of shoppers in India is likely to grow to 400 million-450 million by 2027 from 180 million-190 million in 2021.

The Indian e-retail industry is expected to grow by 25-30% annually, reaching $150 billion-170 billion by 2027, according to a report titled How India Shops Online 2022. The ecommerce market, estimated to be $40 billion in 2021, is expected to reach $50 billion in 2022, said the report.

The report defines ‘e-retail’ as purchase of products online and does not include services, games and entertainment.

The report published by ecommerce company and management consulting firm Bain & Company Inc also says India might replace the US as the country with the second-largest online shopper base, after China, by 2022. According to the report, 180 million-190 million Indians shopped online in 2021; this number is estimated to grow to 400 million-450 million by 2027.

An estimated 40 million-50 million online shoppers were added in 2021 alone; of these, over 60% were from Tier III cities and beyond. Going forward, a growing segment of online shoppers will also come from digital-native individuals under 25 years of age, said the report.

The report divides the evolution of ecommerce in India into the following phases: pre-2015 as Phase 1.0, 2015-2020 as Phase 2.0 with massification of ecommerce, and the ongoing phase as Phase 3.0, characterised by shopper micro-segments, novel business models, and use of technology.

The recently concluded phase of online festive sales saw adoption of novel business models such as social-led commerce, ecommerce through video, or live streaming from horizontal platforms such as , and .

Executives from Bain & Co told YourStory that although these channels are in their early days, they will serve as platforms to onboard and retain consumers in the long run.

Key finds of the report

Social and live commerce

Social and video-led live commerce are yet to gain traction in India, though they are hugely popular in China and Southeast Asian markets. The number of monthly viewers for short-form videos in India is expected to grow to over 600 million by 2025.

“The experience has to be optimised and it is not a native experience yet,” says Manan Bhasin, Partner, Bain & Co. He says that reseller models using social commerce, similar to Flipkart-owned Shopsy’s interface, help bridge the trust gap for consumers from Tier II and III cities.

Resellers on Shopsy share select items from the catalogue and each share is accompanied by a unique code. The reseller gets a commission on each transaction, tracked through the code and based on the product category.

“The live commerce model is targeted at teenagers or the young demographic. Short-video apps will use the platform for early customer acquisition, hoping they will stay on. This will also reduce the cost of customer acquisition in the long run,” says Abhishek Raj, Associate Partner, Bain & Co.

Drivers of growth

The growth of direct-to-consumer brands, attractive quick commerce propositions, and use of advanced technology such as augmented reality, virtual reality, and Indic language-based search will propel the growth of the e-retail market in Phase 3.0.

The report says that fashion, beauty, and grocery or general merchandise, including personal care, will replace mobiles, electronics and large appliances as the leading categories by 2027. According to the report, the latter currently contributes to 45-50% of the ecommerce market share and will shrink to 25-30% by 2027.

Financial tools such as buy now pay later (BNPL) and equated monthly instalments (EMIs) are likely to contribute 15% to the gross merchandise value (total sales made by a platform during a specific period) by 2027. Currently their contribution is in low single digit.

Edited by Swetha Kannan