First phase of festive ecommerce sales witnesses 5.4X growth in daily sales

The first phase of online festive sale season saw 5.4X growth in daily sales across platforms with 3X jump in volume of shipments.

As the first phase of ecommerce festive sales comes to an end, ecommerce platforms reported nearly 5.4X growth in their overall daily sales. Ecommerce shipment volumes also grew 3X over business-as-usual days during the sale period.

and its group companies, India, , and other ecommerce platforms, which conducted sales during September 22 to October 1, reported significant demand from Tier II and Tier III cities during the period.

In the runup to its The Big Billion Days sale, Flipkart recorded 35 million app downloads. The sale event brought four million first-time customers. Meesho recorded a nearly 68% jump in orders from 2021, with 3.4 crore orders being placed during its five-day Meesho Mega Blockbuster sale event from September 23 to 27.

“Ecommerce platforms have clocked sales of approximately Rs 24,500 crore (around $3 billion) in the first four days of festive sales, contributing to around 60% of the projected GMV (Gross Merchandise Value, a measure of total sales) for the first festive sale, and driving the overall Daily GMV to around 5.4X,” said Naveen Malpani, National Sector Leader–consumer and retail, Grant Thornton Bharat.

He added, “With around 48% of consumers shopping more during the festive season, roughly 50-55 million shoppers contributed to the GMV and growth in festive season sales.”

Similar to previous years, the festive sale season is likely to contribute a 30% increase in baseline sales from 2021, due to new buyers coming on board.

“From festive season sales in 2021 to this year, the growth in shipment volumes has been close to 55%. On business-as-usual days, the ecommerce industry was doing nine million shipments per day. On peak days of the sale this year, we have seen the volumes go up by nearly 3X,” said Dipanjan Banerjee, Chief Business Officer at logistics solutions provider Ecom Express.

According to industry estimates, total annual ecommerce shipments are expected to grow from nine to 11 billion by 2025.

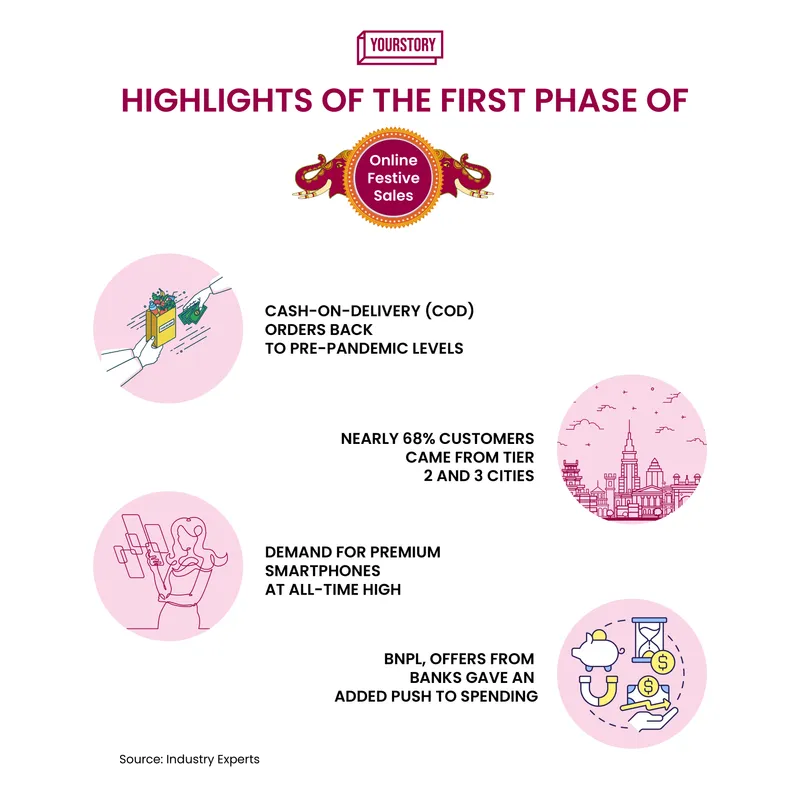

Key figures from the first phase of festive sales

Meesho records 60% growth in transacting users YoY during festive season sale

Share of smartphones marginally down

Mobile phones, which comprise the largest category for online sales, saw a slight dip as more consumers shopped offline in the first COVID-free sale event in the last two years.

“The share of online channels in smartphone sales is likely to go down marginally from 66% in 2021 to 61% in 2022. People are now stepping out to shop and offline stores are offering competitive discounts,” said Prachir Singh, Senior Analyst at global technology market research firm Counterpoint.

Nearly 50-60% of all smartphone sales during the online festive period happen in the first week of sale. According to Counterpoint’s estimates, the month-long festive sale season spanning September and October will see smartphones worth nearly $7.6 billion being sold.

“The Average Sale Price (ASP) of smartphones is also on the rise and expected to cross $240,” Prachir said. He added, “There is a surge in smartphones worth Rs 20,000 and upwards, while the sale of Rs 10,000 devices has been modest.”

Upgrades to 5G, preference for premium devices, and attractive schemes from financial companies driving BNPL (Buy Now Pay Later) have been key trends for the category.

Ad spends move to performance marketing

Apart from attractive financing offers from bank cards, financial companies, and platform tie-ups, overall discounts have been higher than 2021.

“There was a 5X surge in some categories. We saw discounts of up to 50% on hero products in categories such as mobiles, electronics, and large appliances. Beauty and personal care, as well as home appliances, saw better discounts over last year,” said Swati Bhargava, Co-founder of coupons and cashback site CashKaro.

She added that brands, including ecommerce platforms, have been spending a larger share of their marketing budget on performance marketing due to better outcomes.

“The customer acquisition cost on Facebook and Google has gone up. Direct-to-Consumer (D2C) brands, as well as ecommerce companies, are spending money on performance marketing, marketing through influencers, and other channels,” Swati said.

Growth in share of Tier II customers

Amazon India recorded a two-fold jump in its customer base from Tier II and Tier III cities during the first 36 hours of its festive season sale as they accounted for 75% of its total customer base during its 'Great Indian Festival.’ Flipkart too saw more than 60% of customers from Tier II and Tier III cities.

“All major ecommerce applications have topped Google Play charts this week, in terms of downloads and engagements. The sign-ups also witnessed a significant increase this year, with 65-68% coming in from Tier II and Tier III cities,” said Naveen of Grant Thornton.

He added, “Last year, Tier II and Tier III cities accounted for around 61% of total sales; this year, those numbers have increased. Geographically, around 70% of the sales across categories were seen from Tier II and Tier III cities.”

Apart from smartphones, people from non-metros also shopped largely for unbranded fashion and accessories, followed by beauty and personal care.

Alongside top ecommerce firms Amazon and Flipkart, which dominate over 60% of the Indian ecommerce space, new players including Meesho, AJIO by Reliance Retail, and Tata Neu have been making inroads during the sale season.

Key takeaways from festive sales

Upcoming festive season gives ecommerce players a reason to cheer, as they anticipate buoyant sales

D2C brands saw restricted growth depending on category

D2C brands saw slightly muted growth, with a CAGR of 20-25% as compared to other categories such as mobile and fashion.

“It depends on the category the brand operates in. A lot of D2C brands also have their own sales running on their platform, including weekly or monthly ones, which attract more consumers. Customers might not wait for a festive sale to order, say, personal care items,” said an industry expert, seeking anonymity.

However, Flipkart said that some D2C brands noticed 200% growth during the festive sale period.

“If you compare general ecommerce sales in any particular month, you will find an average of 20-25 % YoY growth. This showcases that people are now ordering online throughout the year. Emerging categories like beauty and personal care, FMCG, health and pharma are growing at a much faster pace as compared to mature segments like electronics and fashion,” said Kapil Makhija, CEO of ecommerce and retail enablement ecommerce platform, Unicommerce.

Unicommerce works with roll-up firms and D2C brands including , , , , , , , and others.

Kapil added that health and pharma reported 37% growth year on year in terms of shipment volumes during the sale period, followed by a 41% growth in the FMCG category.

While the first phase comprises nearly 60% of the ecommerce festive season sale, market strategy consultant Redseer feels the run-up to Dhanteras and Diwali is likely to throw up interesting trends in the sector.

Redseer says the first phase comprises 60% of ecommerce sales during the festive season. It’s likely that the run-up to Dhanteras and Diwali will showcase interesting trends.

Edited by Teja Lele