Startup news and updates: daily roundup (October 12, 2022)

YourStory presents daily news roundups from the Indian startup ecosystem and beyond. Here's the roundup for Wednesday, October 12, 2022.

M2P Fintech partners with Tartan

API infrastructure company Fintech has announced its partnership with Tartan, a Payroll and Work Platform APIs Connectivity company, to become the first-of-its-kind player in India to provide consent-driven data of user’s current income and employment through Payroll APIs to lenders.

Through this, partnered banks and NBFCs will gain access to fully encrypted, comprehensive data directly from payroll systems to automate income and employment verification thereby enabling lenders to offer NTB customers instant, innovative, and customised lending products.

Through Tartan, once the verification and eligibility criteria are swiftly ascertained, partnered banks and NBFCs can leverage M2P Fintech’s Core Lending Stack (CLS) that seamlessly integrates RegTech, LendTech, and BankTech capabilities to offer customized lending solutions from onboarding to collections.

Amagi expands its operations to South Korea

, a cloud-based SaaS technology company for broadcast and connected TV, has announced that it has bolstered its presence in Northeast Asia, with a sales and customer support team in South Korea, to serve customers in the region.

The company has also signed a partnership with Digibase, a Seoul-based provider of professional media services for live video encoding and file-based transcoding. A partner of enterprise-grade cloud infrastructure providers such as Amazon Web Services and Google Cloud, Amagi enables broadcasters, content owners, and streaming platforms worldwide to create, distribute and monetise live linear channels effortlessly.

Amagi provides a complete suite of solutions for channel creation, distribution, and monetisation. Its clients include ABS-CBN, AccuWeather, A+E Networks UK, Cinedigm, Cox Media Group, Crackle Plus. Fremantle, Gannett, Gusto TV, NBCUniversal, Tastemade, The Roku Channel, and Vice Media, among others.

Droom partners with Turtlefin

Insurtech platform Turtlefin has announced its partnership with Technologies, an automobile ecommerce platform for buying and selling used and new vehicles, to provide motor vehicle insurance services. Through this strategic partnership, Turtlefin will be able to extend an option of availing comprehensive motor insurance products to Droom’s customers buying two wheeler and four wheeler vehicles online.

L-R - Amreesh Kher, Chief Partnership Distribution officer, Turtlefin, Sandeep Aggarwal, CEO & Founder Droom Technologies

With this partnership, Droom will leverage Turtlefin’s One API product and power its interface (consumer app and website) thus providing premiums from all the top insurers available in India to its customers and showcase the best possible vehicle insurance options in just a click. This way, Turtlefin will be able to assess risks more intelligently and provide real-time fact-checking and auto insurance quotations, providing a seamless customer experience. The partnership will be valid for three years and will be mutually beneficial for both the brands.

Turtlefin will offer Droom’s customers a specially curated offering, with a suite of benefits along with additional covers for vehicles from varied trustworthy insurance companies. Customers will get to experience a seamless single point online insurance service to compare and select an insurance cover, compare costs that meets their specific requirements.

RBL Bank and BookMyShow announce partnership to launch 'Play' credit card

and have announced a partnership to launch a new 'Play' credit card that will take the entertainment quotient for Indian audiences several notches higher.

Previously, in 2016, RBL Bank had successfully partnered with BookMyShow for the launch of Fun Plus Credit Card.

The ‘Play’ credit card will be available to select customers on BookMyShow and give them access to lucrative offers on transactions across movies, live entertainment offerings (online and offline), as also binge-watching movies and TV series on BookMyShow Stream by renting or buying a title, while enjoying benefits with every purchase made. While BookMyShow customers can purchase the ‘Play’ credit card for an annual fee of Rs 500/- the superlative offering will be available to entertainment loyalists on the platform, BookMyShow Superstars at zero cost.

Simplilearn partners with SP Jain Institute of Management and Research to launch new programme

, a digital skills training provider, announced its partnership with S.P. Jain Institute of Management and Research (SPJIMR), Mumbai, to launch Data Science for Business Decisions programme. The programme will enable professionals to harness data science and business analytics insights to make informed business decisions and enhance strategy, execution and effective leadership.

The programme is carefully designed for mid-senior level professionals with a work experience of 5+ years and is ideal for those who want to transform their careers in the data domain, and use Data Science to solve business challenges.

The six month programme consists of 50+ hours of live online classes delivered by SPJIMR faculty, industry-aligned projects, academic master classes, and a certificate from the Institute. The participants will also be eligible for the Executive Alumni status from SPJIMR along with a chance to be a part of a two-day campus immersion programme.

LoanTap launches LTCash, an instant personal loan app

has launched a new app product called LTCash. It is a LoanTap-powered instant personal loan app that offers up to Rs 50,000 in cash without any manual intervention in the loan application and underwriting process, and in most cases without the necessity of any paperwork submission.

The online loan procedure takes less than 10 minutes to provide a smooth experience for customers. The company said it is one of the first NBFC to use RBI-approved Account Aggregators to facilitate a safe and seamless process for a credit eligibility check for the customer.

The new app employs cutting-edge technology and unique algorithms to let LTCash analyse each customer's profile faster and tailors the best offers to them. The benefits of this app include quick cash up to 50,000, 24% annual rate of interest, six months tenure, payments are made in less than 24 hours, no document uploads are required, and it is 100% digital procedure with a minimum income of 30,000. Also, there is no security deposit or collateral required.

KPMG and IBSFINtech announce strategic collaboration

KPMG and , a treasury-tech solution provider, have announced strategic collaboration to offer clients a holistic suite of corporate treasury automation solutions, thus helping them to accelerate the digital transformation of their treasury function.

KPMG & IBSFINtech Announces Strategic Collaboration To Provide Integrated Platform For Treasury, Risk And Trade Finance Management Functions

The partnership will empower organisations to harness treasury technology quickly, automate manual processes, reduce dependency on spreadsheets, and improve cost efficiency. The two companies will work together to deliver a seamless proposition, which is easy and quick to implement, and helps in reducing cost overheads across treasury, risk, and compliance.

IBSFINtech’s configurable decision-making platform caters to end-to-end digitisation of cashflow, liquidity, treasury, risk, trade finance, and supply chain finance management. Combined with KPMG in India’s rich expertise in implementing treasury transformation assignments, the solutions are expected to be a potent combination, offering organizations a wide range of possibilities for driving business performance.

Google Cloud empowers Indian public sector with MeitY empanelment

Cloud has announced its empanelment by the Ministry of Electronics and Information Technology (MeitY). This empanelment enables the Indian Public Sector, including government agencies at the Centre and State levels, and PSUs in sectors such as Power, BFSI, Transportation, Oil & Gas, Public Finance, and others, to deploy on Google Cloud.

Last year, Google Cloud announced the Delhi NCR Cloud Region in India to support customers and the public sector in India and across Asia Pacific. The cloud regions in India will provide cutting-edge tools and technology that will serve as a catalyst for this transition.

Google Cloud collaborates with the open-source community to develop technologies like Kubernetes and rolls these out as managed services. In doing so, organisations get maximum choice, increase the longevity and survivability of their IT investments, and gain access to the most innovative technologies—all while insulating themselves from managing open-source projects.

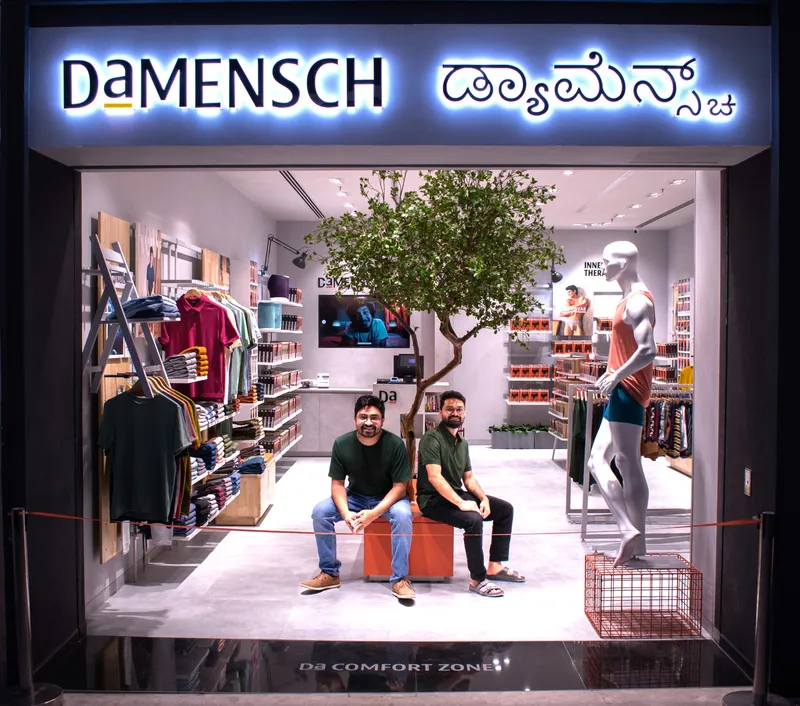

DaMENSCH kicks off offline expansion open store in Bengaluru

D2C men’s apparel brand has opened doors to its first ever exclusive offline store. The experience store at Mantri Square Mall, Bengaluru, allows customers to touch, feel, and learn about the fabric innovations the brand has created in its innerwear and outerwear collections.

DaMENSCH's experience store

With exclusive experience touch points, customers can understand the innovative and conscious practices that go into creating fabric from plastic PET bottles, thermoregulation, 4-way stretch, and more.

In line with its commitment to expanding omnichannel presence, DaMENSCH's first in-mall 1200 sq. ft. store is thematically designed with set-ups and fixtures in the brands’ signature colours. The store offers comfortable fitting zones, spacious changing rooms, an uncluttered shopping experience, and an extensive range of premium intimate clothing across various categories. The brand also aims to be available at 10,000 points of sale avenues across various formats in the next two years.

Carry My Pet opens new office in Mumbai

has opened a new office in Mumbai. This aligns with the company’s vision of building a robust national and international presence.

Carry My Pet has established an office outside the Delhi-NCR for the first time to meet the increased demand for pet relocation and transportation services across the country. In 2022, over 1,500 pet relocation queries were received from Mumbai, and since the inauguration of the Mumbai office on September 13, the company has received more inquiries from the city. In the coming year, it expects an increase in pet relocation services by 15-18%.

The Delhi-based company has completed more than 6,000 pet relocations, wherein over 7,200 pets were moved locally and globally to more than 30 countries. The company aims to set up offices worldwide, including Canada, Dubai, etc. The company is looking to expand globally by providing a complete door-to-door facility in all parts of the world.

Skinella announces tie-ups with Purplle, JioMart, and Netmeds

Superfood skincare brand is all set to expand its business to include Direct to Consumer (D2C) sales and further drive its growth with its newly launched ecommerce website. Aiming to expand its digital footprint, the brand has also collaborated with Purplle, JioMart, and Netmeds.

This move to associate with leading marketplaces is aligned with the brand’s vision of expanding in the digital space and enlarging its footprint. The products are available on these platforms and each of these digital platforms will offer excellent deals and discounts on Skinella’s products. With this strategic ecommerce expansion, the brand is looking to grow at 60%-70% in the initial phase.

Ghost Kitchens aims to expand its foodtech Program by investing Rs 50 Cr in the next year

Restaurant tech platform that helps restaurants and cloud kitchens having under-utilised capacities to earn incremental revenue without any investment, has announced the opening of its 100th fulfillment partner in Bharuch in Gujarat. It aims at further amplifying its brand footprint by investing Rs 50 crore in the next one year.

With the 100th outlet in Bharuch in Gujarat, Ghost Kitchens has taken the overall tally to 1200 internet restaurants in the last 10 months becoming one of the fastest-growing internet restaurant tech platforms in India. Currently, Ghost Kitchens is present across 35 cities including all major metropolitan centers. The brand operates at a pan-India level with over 40 partners in West India, 20 each in South, East, and North India, and has 50 more partners in the pipeline that will actualize in the next two months.

Curefoods adds Rolls and Wheels to its portfolio

Cloud Kitchen startup has announced that it as onboarded the popular kaati rolls and frankie brand, Rolls on Wheels into the Curefoods portfolio.

Started in 2011 by Yadu Nandan, the brand currently operates 13 outlets in Bengaluru. The addition of Rolls on Wheels to its portfolio expands its offering to the Tier 2 and 3 markets.

(This article will be updated with the latest news throughout the day.)

Edited by Megha Reddy