Tata 1MG’s growth prescription

Tata Group-owned online pharmacy Tata 1MG is stepping up its focus on high-margin growth areas like diagnostics and corporate tie-ups to drive progress.

A year after the Tata Group picked up a majority stake in healthcare platform , it is leveraging the group’s muscle to expand its presence in the lucrative diagnostics space, increasing its share of corporate tie-ups and bulking up e-pharmacy offerings.

“Our plan this year is to grow 80-85% year on year, and we’re well on track to achieve these numbers,” says Gaurav Agarwal, Co-founder and CTO, Tata 1MG, in an exclusive interview with YourStory Media.

In 2021, Tata Digital, a 100% subsidiary of Tata Sons, acquired a majority stake in digital health company 1MG Technologies. The aim of the group was to enter the $1 billion digital health market that is expected to grow at ~50% CAGR (Compounded Annual Growth Rate).

The Tatas are not the only ones to have sniffed this billion-dollar opportunity. A flurry of biggies - like Reliance via NetMeds and even Amazon through Amazon Pharmacy - into India’s e-health market points to the phenomenal opportunity that lies ahead.

E-pharmacy business

A full-blown battle is on in India’s e-pharmacy space. A deep dive into India’s e-health market shows that e-pharma constitutes 91% of India’s e-health GMV, or Gross Merchandise Value, and diagnostics only makes up the balance 9%, according to RedSeer Strategy Consulting.

“We have grown 30-40% over the last one year in the e-pharmacy business. One big focus area for us will be acute medicine delivery. We’re now looking to introduce orthopaedic support systems etc via the online platform. We’re also working on growing our private label portfolio and these could contribute about 6-8% of overall platform sales going forward,” says Gaurav from Tata 1MG, which recently concluded its Grand Savings Day sale. Over 2 lakh brands participated in this sale and the platform saw a 5X spike in daily revenue during the sale days.

Categories like Homeopathy and Ayurveda are doing well, and the platform is also seeing good demand in the chronic medicine segment.

“In a few cities, we have been piloting an IoT-enabled cold chain delivery supply chain, where we have a guaranteed temperature chart that can be monitored at the backend. This ensures that chronic medicines reach consumers at the right temperature,” Gaurav explains.

Tata 1MG has also been working on reducing the service delivery time and is seeing strong demand from Tier II and III cities, especially in UP and Bihar, owing to this. However, 35-40% of the orders are still coming from Tier I cities.

At present, Tata 1MG commands an approximate 18-20% market share in the e-pharmacy segment and has 40 million monthly unique users and 500 million monthly page views.

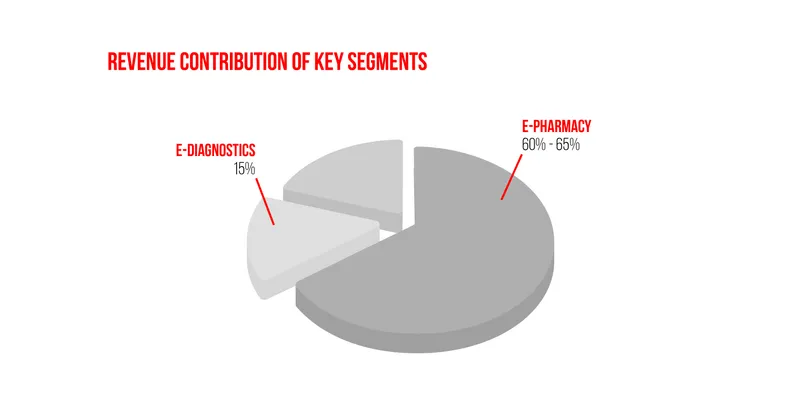

According to business intelligence platform Tofler, Tata 1MG's revenue from operations rose 65.7% to Rs 222.10 crore in FY22, while its net loss narrowed to Rs 146.30 crore. E-pharmacy contributes 60-65% of Tata 1MG’s overall revenue.

PLI schemes should focus on biz supporting pharma production: Bharat Biotech

Diagnostics: The game-changer

Even as e-pharmacy continues to dominate revenues in the e-health space at present, all eyes are on the e-diagnostics segment, which experts believe will be the real game-changer as margins in this segment are pretty high.

“Diagnostics is a high margin business and hence improving its share within the e-health pie would materially improve the overall gross margins,” according to a RedSeer report. The average gross margins earned by e-health platforms from e-pharmacy are in the range of 25-30% and from diagnostics as high as 45-50%.

“Last year we were offering 300 tests and doing 200 tests in-house. We are now offering 350-400 tests and most of these tests are done in-house via Tata 1MG labs,” says Gaurav, who is now looking to add genetic testing to the platform.

Tata 1MG is also working on improving service quality by increasing the number and duration of time slots for the home collection of samples and even quicker turnaround for test reports.

The big area of focus within diagnostics has been to increase the number of labs. “We have a total of 12 labs as of now and we will be increasing the number to 15 by the end of this financial year,” Gaurav says. This expansion of labs will help improve the report delivery timelines as samples will reach labs faster for testing.

“Most of the diagnostics industry has seen a degrowth post-COVID-19, but we've grown 61% over last year,” says Gaurav. Tata 1MG currently offers diagnostics in 42 cities and it is looking at scaling this up to 70 by the end of this financial year.

Tata 1MG is also piloting an omnichannel play for diagnostics. It is looking at setting up diagnostic centres at existing retail outlets and also standalone collection centres. Tata 1MG makes about 15% of its revenues from diagnostics at present and expects to grow 100% year on year for the next two years at least.

The rest of Tata 1MG’s revenue comes from corporate tie-ups and other outpatient programmes.

“The corporate business is a company priority. We think this can be a Rs 1,000 crore business in the next two years. This business is fundamentally lucrative as there is a fair bit of convenience and service revenue associated with it,” Gaurav says.

The healthcare platform generates about Rs 100 crore revenue from corporate tie-ups at present. Through its corporate health platform, Tata 1MG covers over eight lakh lives (including employees and dependents). Post the Tata deal, 1MG has been able to expand its reach to over 150 corporates this year from 20-25 last year.

With a focus on generic drugs, online pharmacy startup Truemeds helps slash medicine bills by 47 pc

Challenges in the e-health segment

Despite the rapid growth in the industry, profits are not very easy to come by in the e-pharmacy space. This is why experts believe the focus will shift to the diagnostics business, which has better margins.

“E-health players witnessed a huge boom in business during the COVID-19 period as demand for drugs was at an all-time high and deals were not required to drive sales. It is becoming difficult to make money now,” said an industry insider who did not wish to be named.

Channel checks have revealed that customer acquisition costs (CAC) have returned to pre-COVID levels and discounts have once again become important to retain consumers for e-pharmacy players.

“Discounting and CAC are the largest spend areas for India’s e-health platforms and they currently outweigh earned margins. Discounting spend is likely to remain at similar levels for the e-health players to stay competitive,” said Kushal Bhatnagar, Engagement Manager at RedSeer Strategy Consultants in a blog post.

Despite the competition in the market, Gaurav maintains that Tata 1MG has always been reasonably conservative when it comes to discounting and cash burn.

“We’re starting to get a positive reinforcement of our strategy. Our retail business is store-level EBIDTA profitable, patient support business is EBIDTA profitable, our corporate business is lean and efficient. Majority of competition is in e-pharmacy and now e-diagnostics,” Gaurav says.

However, Tata 1MG is not feeling the heat of competition.

“The thesis that winner takes all is not true anymore for the internet space. Players are finding their own niches and playing in them. We’re not too worried about competition but are focused on the quality of services and selection of products we can offer. Despite the competition, we have not seen much impact from the growth standpoint,” Gaurav says.

Edited by Teja Lele