Personal taxes: Should you opt for the new 'new regime'?

Once again, individual taxpayers have to make a call on whether they should move to the new personal tax regime. Here’s a breakdown to help you decide.

The Union government in its Budget for 2020-21 introduced a new regime of tax at different (lower) slabs for salaried individuals. An assessee was free to opt between the new regime or the old depending on their preference. The catch was that none of the deductions hitherto available under the old regime could be claimed if an assessee opted for the new regime.

This option continues in this year’s Budget as well. But which regime should you opt for?

In this article, we look at the changes made in personal taxation in Budget 2023-24 together with the caveats.

The new proposals

Finance Minister Nirmala Sitharaman announced a slew of changes to personal income taxation, including:

a) Increase in the basic exemption limit to Rs 3 lakh (from Rs 2.5 lakh);

b) Increase in the limit on which tax rebate can be claimed, to Rs 7 lakh (from Rs 5 lakh);

c) Change in the slab rates; and

d) Change in surcharge for the highest rate, from 37% to 25%.

All these changes are applicable only if one chooses the new tax regime. It is pretty evident that the government’s impetus is on ensuring liquidity is made available for consumption-related activities.

A closer look, however, at what the tax amounts look like under the two regimes offer some food for thought.

[Disclaimer: We are yet to complete our analysis of the Finance Bill.]

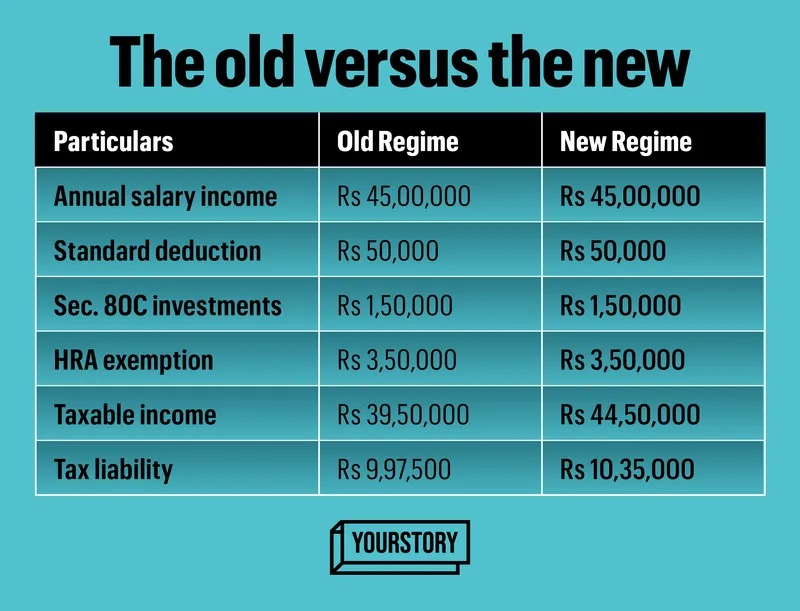

Say an individual earns an annual salary of Rs 45 lakh. Assuming they have qualifying investments under Section 80C worth Rs 1.5 lakh and claim HRA of Rs 3.5 lakh. Under both regimes, the assessee is eligible for a standard deduction of Rs 50,000.

In this example, an assessee saves about Rs 35,000 by opting for the old regime. This could change for an individual in the highest tax bracket given that the reduction in the rate of surcharge for the highest bracket is available only for an assessee opting for the new regime.

Let us take a simpler example. If an individual earns Rs 7.25 lakh per annum, under the old regime they would need to make qualifying investments to obtain an exemption under Section 80C (assuming Rs 1 lakh). Standard deduction of Rs 50,000 is available under both regimes.

In this instance, the new regime could be considered more beneficial given that the individual is eligible to claim a rebate on income lower than Rs 7 lakh. Moreover, the individual can arrive at this position without having to make any qualifying investment, thereby having more cash in their account.

While the government has clarified that there is no compulsion on individuals to move to the new tax regime, it is evident from the relief measures that it would prefer people opting for the new regime.

Moreover, the new regime is now going to be the default option while calculating taxes. If someone wants to opt for the old regime, they would have to specifically mention it.

The choice of the old regime versus the new regime can be changed only annually, and not in between a financial year.

The decision on which regime to opt for should be based not just on the tax liability but also on the cash flow impact this could have on your finances. Do not be driven by just the headlines—when you work out your finances, maybe you will end up with a different answer!

Rohan Arinaya and Chaitra Bharadwaj are part of Merican Consultants, a full-service finance and management consulting firm based in Bengaluru.

Disclaimer: The article is only informative in nature and not meant as nor should be construed as professional opinion. For specific queries, write to the authors at [email protected].

Edited by Feroze Jamal