[Weekly funding roundup March 20-24] Venture debt emerges as a preferred avenue for startups

The increased reliance on venture debt by startups reveals the challenges of raising money through venture equity route.

Venture debt came back into prominence in the fourth week of March—a sign of the times as startups resort to this funding route as raising capital from equity channels proves to be challenging.

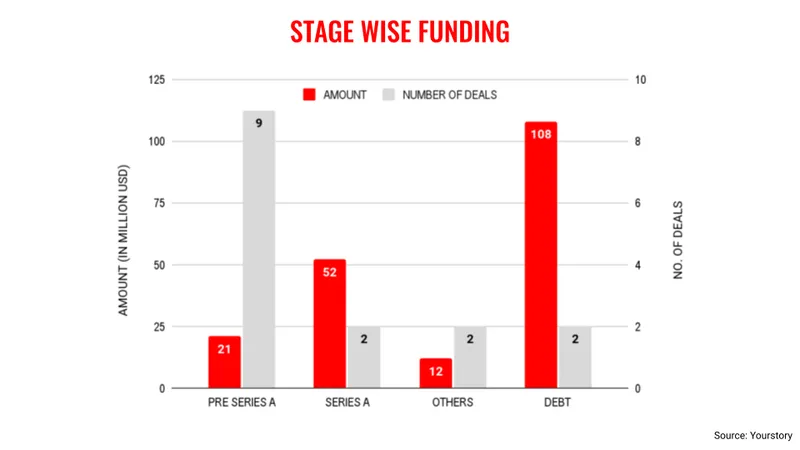

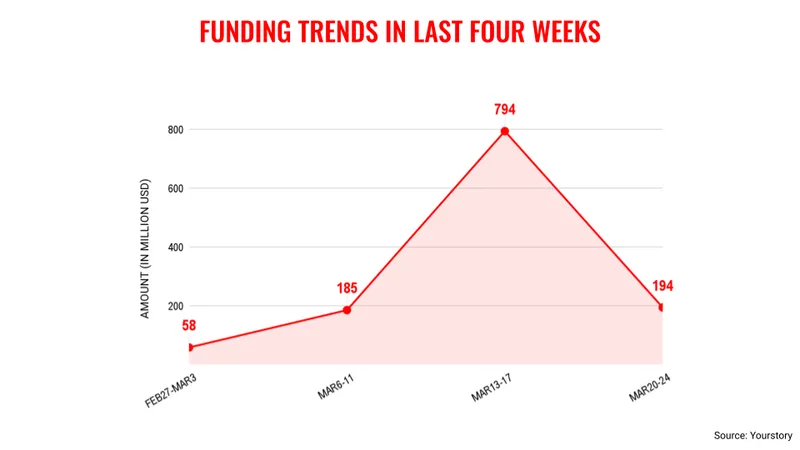

During this week, the total venture funding raised stood at $194 million and of this the contribution from debt was $108 million. In comparison, the total funds raised in the previous week stood at $794 million, which was primarily due to and .

Startups are increasingly relying on the debt route to raise capital as venture equity channels are more time consuming. Added to this, startups do not see any change in valuation while raising venture debt unlike equity capital.

These developments reveal the larger challenge of the venture funding ecosystem as the broad macro economic indicators seem less than encouraging. The banking crisis in the US and Western Europe are unlikely to end anytime soon and this would have a bearing on the capital flow into the startup ecosystem.

The expectation was that there would be an uptick in the funding momentum from the second half of this year but this hope is fading away.

However, the only bright spot in the present funding environment is for those startups with a strong artificial intelligence (AI) connection as such companies have a favourable view of the investors. An example of this would be Character.AI which recently closed a $150 million in a Series A round at a valuation of $1 billion.

Key deals

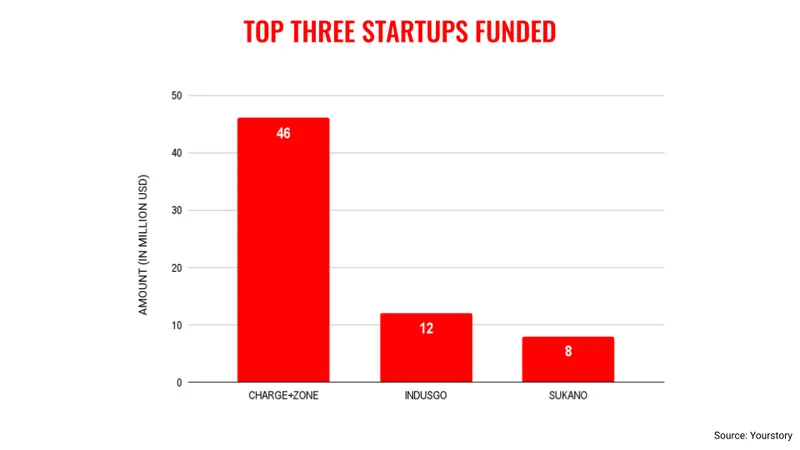

EV charging startup Charge+Zone raised $54 million led by BlueOrchard Finance in combination of debt and equity.

Sukino Healthcare Solutions raised Rs 50 crore ($6 million approx) from Stakeboat Capital.

Edited by Akanksha Sarma

![[Weekly funding roundup March 20-24] Venture debt emerges as a preferred avenue for startups](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-roundup-1670592545805.png?mode=crop&crop=faces&ar=16%3A9&format=auto&w=1920&q=75)