Here’s how Flash helps ‘power shoppers’ manage online orders and grab rewards along the way

Flash—founded by former Flipkart executive Ranjith Boyanapalli—aims to simplify shoppers’ buying experience by aggregating all their orders on a single platform and rewarding them for their online purchases.

Manoj is an avid online shopper. Right from bread and clothes to smartphones and furniture, he buys everything online. He devotes an hour each day browsing through ecommerce sites and apps and spends more than Rs 2 lakh every year on online shopping.

But, being a power shopper, Manoj struggles to keep note of the various websites and apps he shops from in order to track his orders. He also finds it hard to look for information related to his orders.

(‘Power shoppers’ is an informal term for people who shop a lot online.)

"My inbox is cluttered and full. Most order-tracking emails are marked as spam, and it is tedious to search for important messages," he says.

This is where hopes to bail out shoppers like Manoj.

Flash—founded by Ranjith Boyanapalli, former senior vice president of Walmart-owned Flipkart—aims to simplify shoppers’ buying experience by aggregating all orders and order-related communication on a single platform, through a common email inbox.

Apart from this, shoppers can win rewards on placing frequent orders with brands Flash has partnered with. They can also obtain cashback, which can be transferred back to their bank account. One could say Boyanapalli is trying to create the of ecommerce with the Flash app, which went live last month.

CRED, founded by Kunal Shah and backed by Tiger Global, Sequoia Capital and Alpha Wave Global, has transformed the way credit card payments are made by rewarding users with cashback and offers for timely payment of dues. The CRED platform has nearly 16 million users.

Bengaluru-based Flash has raised $5.8 million in seed funding so far from investors such as Global Founders Capital, White Venture Capital, Soma Capital, and Emphasis Ventures. Interestingly, Kunal Shah is also an investor in Flash, along with a host of other angels, including Binny Bansal (Co-founder, ), Sujeet Kumar (Co-founder, ), and Rishi Vasudev (Co-founder, ).

Empowering power shoppers

Boyanapalli, Founder and CEO of Flash, tells YourStory that the idea for Flash came from his observations of the ecommerce market during his eight-year stint at Flipkart where he was in charge of fintech, payments, customer experience, and the marketplace business.

"There are several problems with the way ecommerce works today. Cluttered inboxes, lack of clarity on shopping patterns, and data-sharing concerns can make the online shopping experience unenjoyable," he points out.

Flash hopes to solve some of these problems and empower shoppers with the benefits they deserve.

There are nearly 25 million power shoppers in the country today, accounting for 70% of the total ecommerce revenue in India. Their number is expected to grow to 65 million by 2030, according to industry estimates.

"Shoppers that generate most of India’s ecommerce revenue deserve more. That’s why we created Flash to help users manage their ecommerce profiles and make the most of their shopping experience," says Boyanapalli.

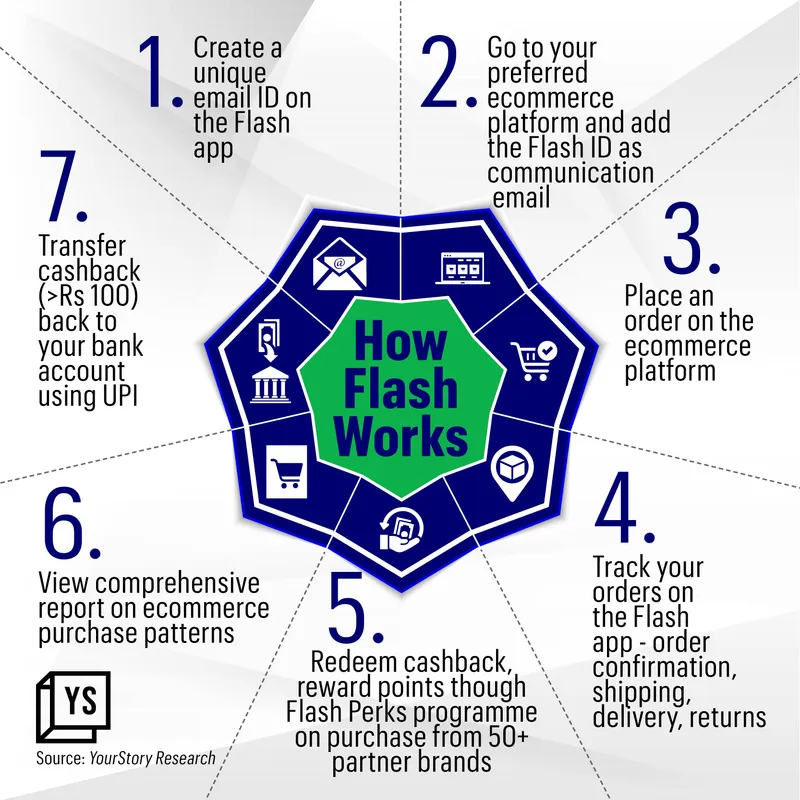

All order-related information, including confirmations, payment receipts, shipping updates, and product returns will be available in one inbox, linked to a Flash email ID.

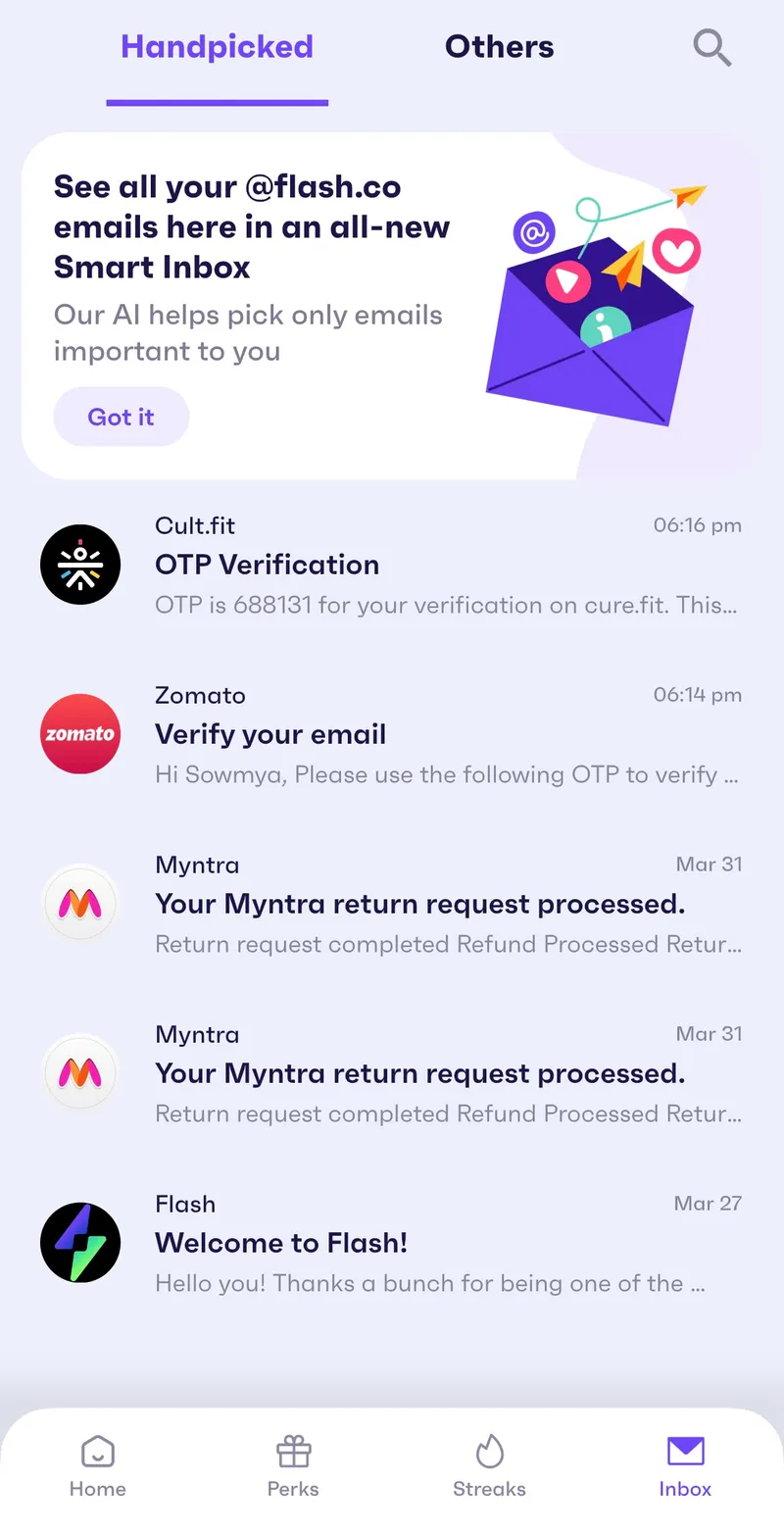

"It will be a mess-free inbox. There’s no chance a user will miss an important email," says Boyanapalli, demonstrating his own Flash inbox, which showed order updates from more than a dozen ecommerce platforms.

Users can organise their email communication by categorising them by brands/sellers on the Flash app. The platform also generates a comprehensive shopping report that highlights the category and the apps/ecommerce sites on which users have spent the most money and what they have ordered the most.

The Flash interface is basic at the moment, but Boyanapalli says it will be tweaked over time by incorporating feedback.

Infographic by Chetan Singh

Screenshot of the Flash inbox

Incentivising customers as they shop

For rewards, the startup has partnered with more than 50 brands across categories, including fashion, food and grocery, beauty and wellness, and electronics, featuring big names such as , , , , and . The platform also hosts direct-to-consumer (D2C) brands such as Levi’s, Puma, , , and .

Shopping with partner brands will fetch users a fixed percentage of cashback, apart from coupon codes and card-affiliated discounts. For instance, shopping on Myntra using a Flash email ID will offer a 2% cashback, while D2C brands such as and St Botanica come with a cashback of 5%.

"Flash's reward system is what makes it unique. This is what will bring the user back," he emphasises.

Users are also engaged through the ‘Streak’ feature that incentivises them to achieve certain milestones for additional offers and cashback. For instance, the first milestone for users is to place 100 orders within a year to earn cashback of up to Rs 1,000 and avail themselves of exclusive discounts.

"Streak assures brand loyalty and retention of customers. Users are likely to shop more often in shorter periods to achieve these targets," says Flash's founder. "It’s like playing a game where you have to cross a level to win prizes," he adds.

Ensuring data privacy

At a time when cyberattacks and data leaks have become common in internet-led services, how will Flash tackle the issue of data privacy—given that its platform aggregates a customer’s entire shopping history?

Ashutosh Sharma, Head of Research at Forrester India, says Flash, just like CRED, will have access to shoppers’ data, including name, residential address, purchase patterns, and order history.

"We will have to wait to see how the data will be used. While users may not be too concerned about sharing private data if they derive value from the platform, whom Flash shares the data with is crucial."

Boyanapalli says all the data is encrypted and hence inaccessible.

"All the data we collect from users—shopping history and patterns—is deeply encrypted and stored in the cloud enabled by Amazon Web Services. It is not shared with third parties and is strictly inaccessible to anyone, including Flash’s employees," he promises.

Where the money comes from

The firm makes money through partnerships with brands, wherein it charges a fee for every order placed on partner brands through the Flash email ID. It also charges a commission for Streak achievements.

Flash’s revenue model is similar to that of CRED, which charges brands a listing fee in return for displaying their products and offers.

Flash is free of cost for users and will remain so for the near future, says Boyanapalli.

"We will consider new monetisation methods as we grow our user base and brand portfolio. For the next few months, we are focused on introducing Flash to power shoppers and committed to incorporating feedback."

Exploring an untapped area

Reward-based online shopping has become a common phenomenon today, with large players, including CRED, Google Pay, Paytm and Amazon offering large cashback and redeemable points on frequent usage of their platforms. Co-branded credit cards such as Amazon Pay ICICI card and Flipkart-Axis card offer additional benefits to users.

The rewards-based loyalty programmes market in India is worth $500 million-$600 million, with online retail accounting for half the value, according to Sharma of Forrester.

However, Flash—which combines rewards with order tracking—is venturing into an untapped market, says Boyanapalli.

While Flash derives inspiration from American players such as Route and Shop, which offer package tracking features for shoppers, Boyanapalli reiterates that there’s no like-to-like comparison as his startup offers both rewards and the ease of order tracking on a single platform.

Flash aims to onboard 2 million users and a total of 100 partner brands by the end of the year. Travel and entertainment will be the focal points over the next few months, says Boyanapalli.

Flash, which has a 25-member team, is looking to set foot in the United States later this year and eventually enter other markets over the next few years.

According to Sharma, Flash’s proposition to offer users convenience in terms of a clean and clutter-free inbox is a "decently large" opportunity.

But, for it to remain more than a flash in the pan, the startup will have to ensure it sustains user interest in the long term.

"Users will certainly be lured towards attractive rewards. However, the startup's scalability will depend on the variety of partner brands and the continuous appeal of cashback," says Sharma.

(Cover image and infographic by Chetan Singh)

Edited by Swetha Kannan