Flipkart’s B2B arm bets on new-age challenger brands for growth

Flipkart Wholesale, the B2B vertical of the ecommerce player, is betting big on distribution deals with challenger and new-age brands to grow its business in a competitive space.

Three years since inception, Group’s business-to-business (B2B) vertical, Flipkart Wholesale, is looking to leverage new-age challenger brands and local brands to spur growth.

Part of Flipkart India Private Limited, the wholesale vertical is reliant on growing the repeat orders from its kirana store customers for sustainable growth, Koteshwar LN, Business Head at Flipkart Wholesale, tells YourStory.

In 2020, Flipkart Group took over the Best Price cash-and-carry business from India Private Limited to set up its digital marketplace, Flipkart Wholesale. Since then, the vertical has taken an omnichannel approach with in-store, ecommerce, and reseller-led assisted format to sell to small retailers, institutional channels, as well as large accounts. The business claims to serve 1.2 million kiranas and MSMEs.

“We used to have private brands, but our reliance on them is minimal. There are enough and more local brands or challenger brands which we work with on the Flipkart Wholesale platform, which help us make better margins,” says Koteshwar.

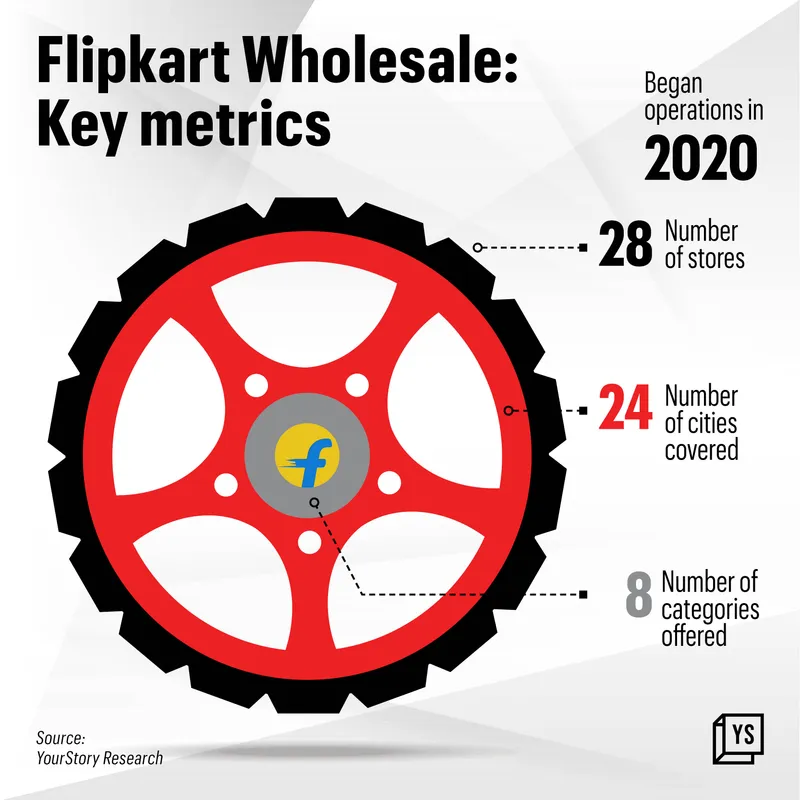

Flipkart Wholesale by the numbers

He adds that while traditional brands made up for the bulk of sales for the entity, the margins with new-age or challenger brands were nearly 1.5 times to 1.7 times higher, as it is not a pull category, requiring additional work from the network. A retailer mostly orders established brands to serve consumer demand, with 20% to 30% flexibility to showcase or push new brands.

Riding the wave of new-age brands

The platform also operates as a distributor for the new age brands through its alternate channel programme, helping them enter new geographies. “We have salesmen focusing on challenger brands and new-age companies to increase their presence across offline channels. They get to enter retail outlets, and working with us helps them get tremendous amounts of data on where the stock is going, how they can change pricing, etc.,” says Koteshwar.

He gives the example of a brand which was doing well in Southern India but started seeing demand in the Northern regions after entering the market through Flipkart’s distribution platform. “We are the first step where they realise the potential of the brand,” says Koteshwar.

The vertical is also clear about keeping an eye on sustainable growth. Flipkart Wholesale runs 28 stores and fulfilment centres across 24 cities, with no plans for offline expansion. “Our oldest stores see the maximum footfalls, but our assisted channel is growing,” says Koteshwar, adding that growing the large-format stores impacts the topline.

Market opportunity

According to Avendus B2B Marketplaces Report 2023, cash and carry outlets typically have a trade margin of 7% to 11% but are constrained by geographical reach. On the other hand, B2B marketplaces make margins of 3% to 6%, bundling credit and logistics services for retailers.

The report also says that Gross Merchandise Value (GMV or total sales by an ecommerce platform over a stipulated period of time) for retail distribution of B2B marketplaces is likely to grow to a $55 billion opportunity by 2027 from $11 billion in 2022.

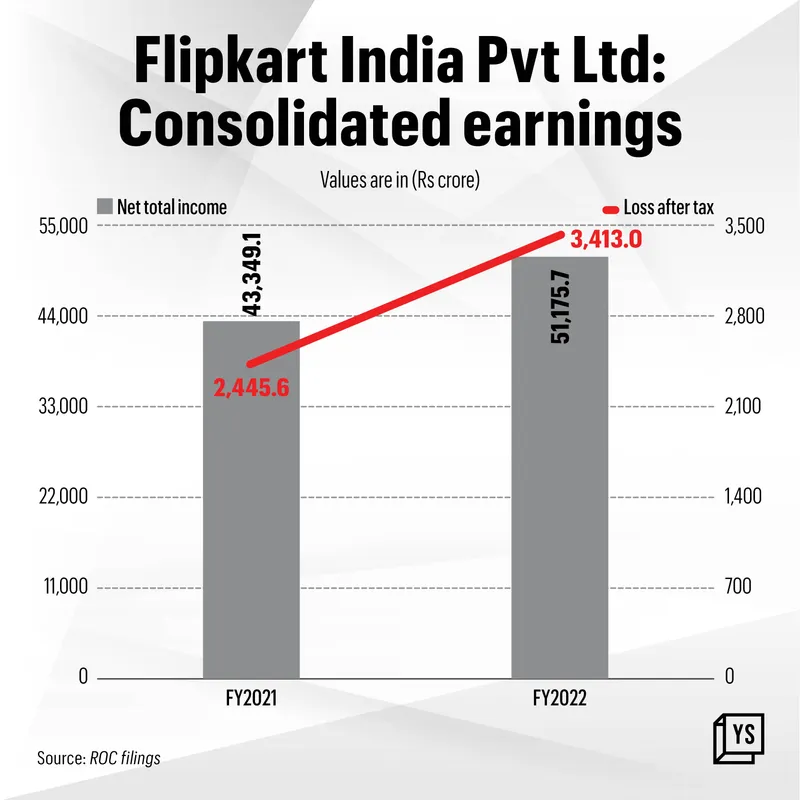

Earnings of Flipkart India Private Limited

Larger incumbents like and Reliance Jio Mart already command significant market share in the space, with the latter leveraging its store network. Others in the fray include the likes of ElasticRun, Jumbotail, and ShopKirana to name a few.

When it comes to competition, Flipkart Wholesale plans to differentiate itself by focusing on sustainable growth, staying away from investing in sourcing and growing private labels, and free logistics. “Private labels work well in B2C as the margins are better. Also, for logistics, we don’t charge additional amounts to the retailers but make up our cost of delivery, which is decided by distance covered, order value from the retailer and other metrics,” adds Koteshwar.

Flipkart India Private Limited, which houses both Flipkart Wholesale and wholesale distribution of mobile, television, laptop, tablet, mobile accessory, footwear, clothing, and grocery, registered a total net income of Rs 51,175.7 crore for FY 2022, up 18% from the previous year on a standalone basis. However, net losses for FY 2022 stood at Rs 3,362.4 crore, up 38% from the previous year.

With a massive opportunity and strong competition in the space, Flipkart Wholesale’s focus on sustainable growth will take time to be considered a significant player in the space.

(Infographics and cover image designed by Chetan Singh)

Edited by Megha Reddy